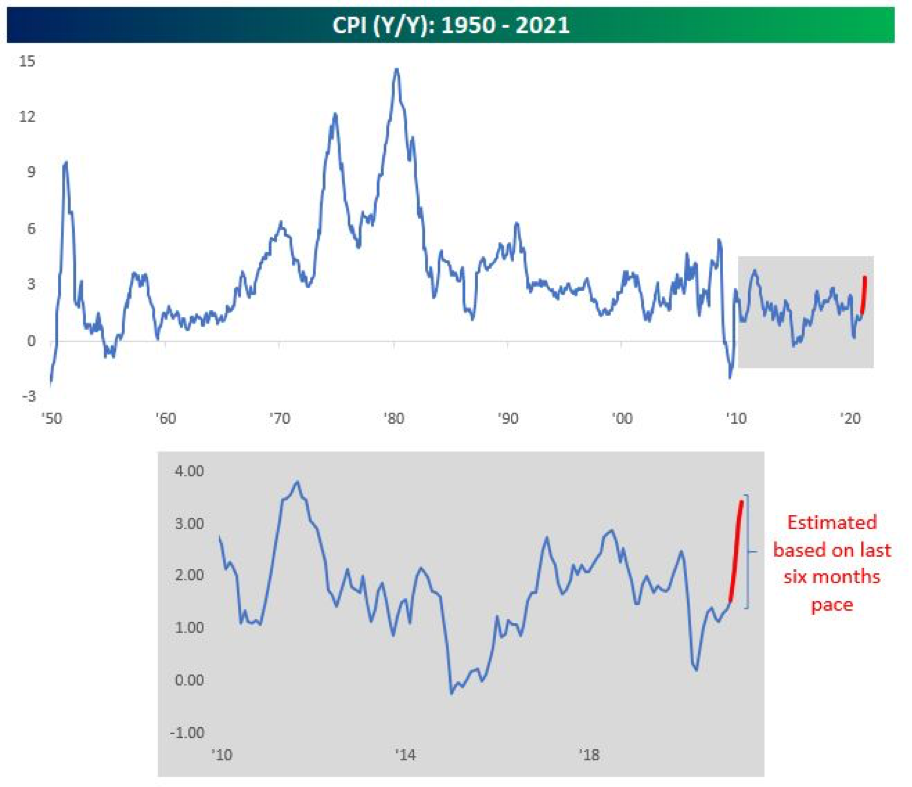

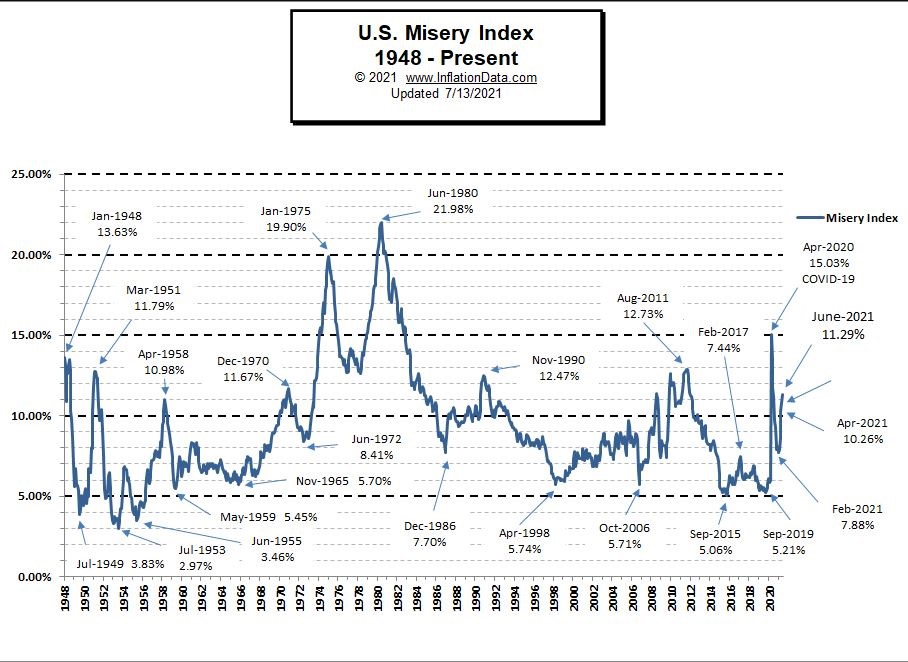

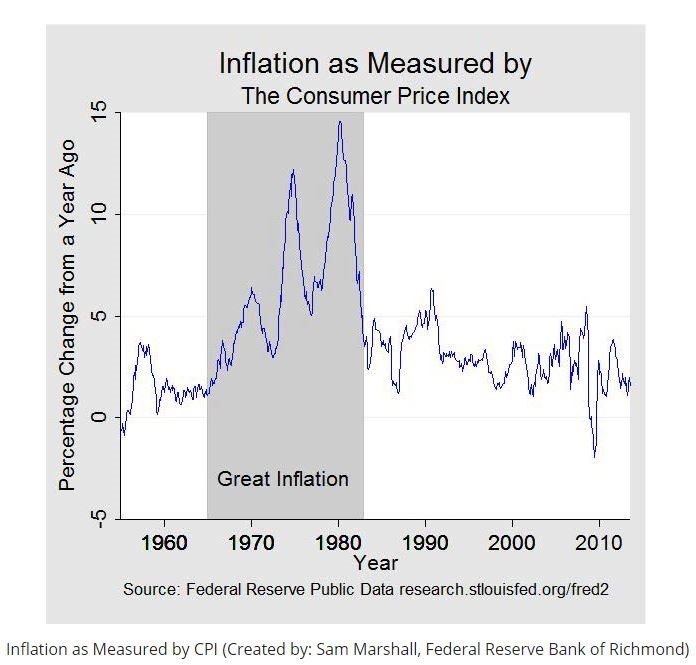

Today we’re going to reflect back to the days of presidents Nixon, Ford, and Carter from 1969 to 1981. Of course, this was an era of high inflation but also persistently high unemployment. I’m not sure who was responsible for the creation of the “Misery Index” (unemployment rate + Inflation Rate) but it’s becoming a subject of conversation again now for good reason. Those who choose to ignore the lessons of the past are doomed to repeat them.

Back Then

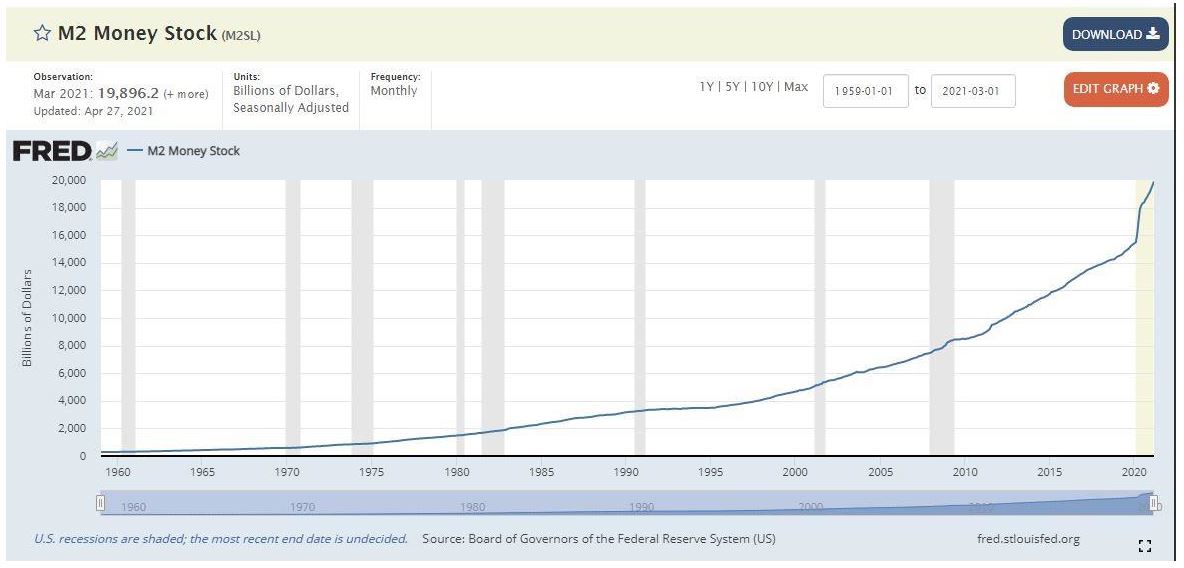

I am not a historian but strangely I found my early undergraduate course work on the economic history and financial markets to be fascinating. Nixon’s economic policies were largely responsible for inflation running very high and out of control through the 70’s and into the early 80’s. You can read all about it here https://www.thebalance.com/president-richard-m-nixon-s-economic-policies-3305562 . Clearly, he set the stage with his attempts at wage and price controls, adding a 10% tax (tariff) on all imports even while our country was moving deeply negative into the balance of payments with foreign countries (aka importing more than we export) and finally the economic atom bomb; removing the gold standard as a peg for the value of the US dollar. Flatly, Nixon the man, was responsible for very high inflation and unemployment culminating in his resignation in 1974 as our country spiraled into recession. An ugly time in America for sure but I was only 7 years old at the time and have no personal memory of events.

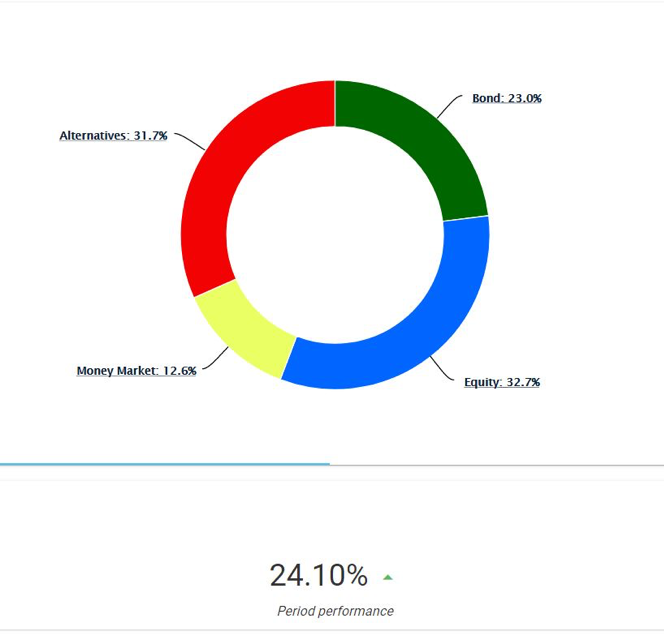

By the end of the recession in 1975, the Misery Index (shown above) rose to 19.90% with the unemployment + Inflation rates contributing equally. Then unemployment fell as the economy came off our recession during Ford’s time in office, but inflation continued to march even higher for another 5 years right into June of 1980 when the Misery index reached 21.98%. Poor Jimmy Carter inherited a near disaster of economic conditions and never had a chance to enjoy better times. In fact, the Smithsonian Museum in DC has enshrined President Carter’s sweater that he would wear when addressing the country on TV asking them to turn down their heat (and wear a sweater instead) to help cut living costs.

We can all imagine why the Misery Index earned its name. Inflation hurts those who are living hand to mouth, especially those who are out of work. This is miserable. Life becomes more and more expensive day in and day out as EVERYTHING costs more. Meanwhile, for the unemployed, resources dry up quickly and there is that primal concern that you’ll end up on the street or living a substandard life you never would have imagined.

…and Now

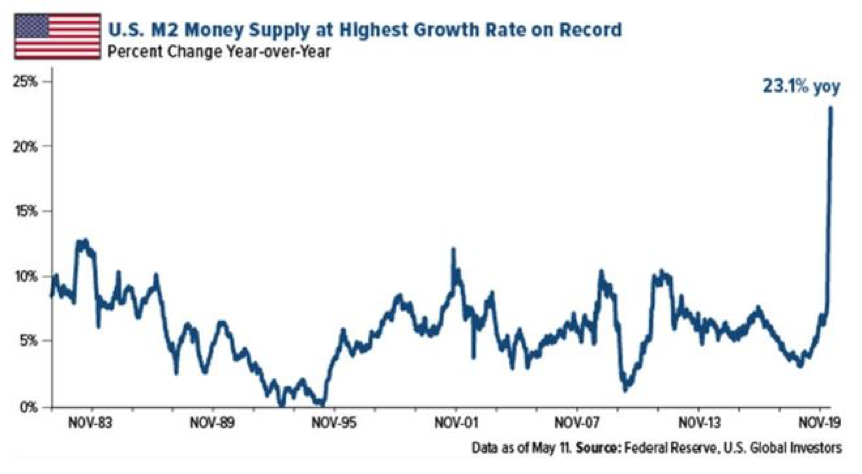

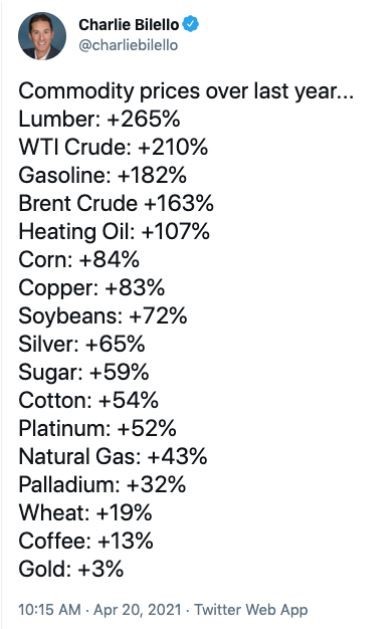

Looking at the same chart on the very right-hand edge, updated through last week, you can see the obvious; The Misery Index has started heading higher and is now approaching the highs set at the very worst part of Covid related unemployment in March of 2020. Specifically, the index in March hit a high of 15.03% (mostly due to Unemployment) and is now approaching 12% with inflation + unemployment contributing almost equally. Remember the economy has largely recovered but we’re still seeing unemployment remain stubbornly high, and inflation is now raging.

How is that possible?

I found a great article posted in the WSJ last week explaining why we are seeing unemployment remain stubbornly high. After reading, you will begin to understand that these are not likely temporary changes. https://www.wsj.com/articles/many-jobs-lost-during-the-coronavirus-pandemic-just-arent-coming-back-11626341401

A few highlights from the article

• “In industries ranging from hotels to aerospace to restaurants, businesses have reviewed their operations and discovered ways to save on labor costs for the long term.”

• “The company (Raytheon) said that most if not all of the 4,500 contract workers who were let go in 2020 wouldn’t be called back.”

• “Applebee’s is now using tablets to allow customers to pay at their tables without summoning a waiter.”

• “The U.S. tax code encourages investments in automation, particularly after the Trump administration’s tax cuts”

• “The company (Marriott) also reduced management staff by 30% in 2020 in its food and beverage department and said the changes would be permanent

• “not everyone can find a match for their skills, experience or location, creating a paradox of relatively high unemployment combined with record job openings”

• “The pandemic accelerated some of the company’s plans to automate factories and implement more digital technology”

So, IF we believe that labor and employment have seen some profound changes in the last 18 months leading to stubbornly high unemployment, THEN we should also recognize two things.

1. The Misery Index is going to be looking a lot like the 60’s and 70’s.

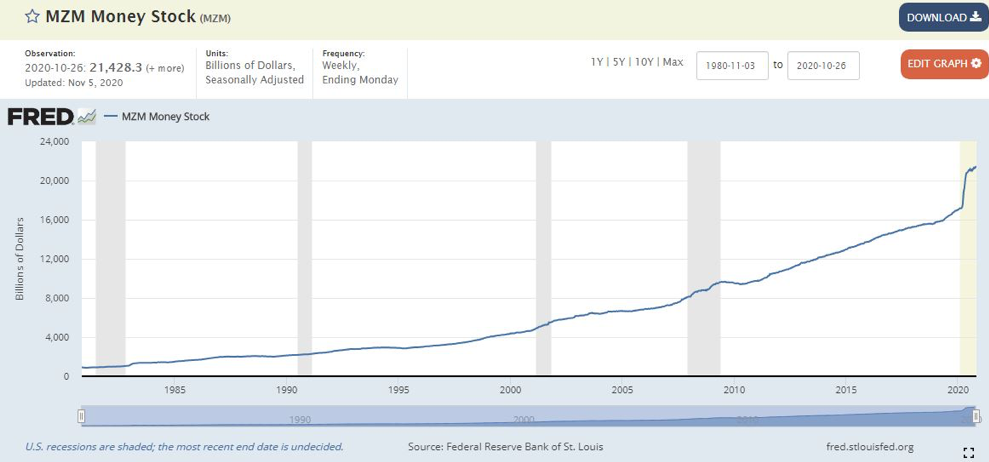

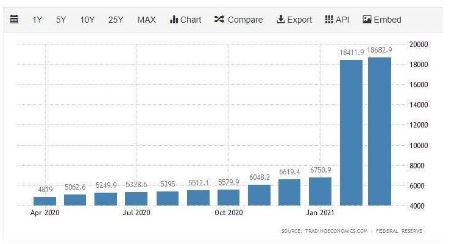

2. The Fed is going to be more accommodative than we might expect in order to support labor while allowing inflation to run hot.

Ok, ok, we can only handle so much macro stuff, so let’s bring it home now.

So What?

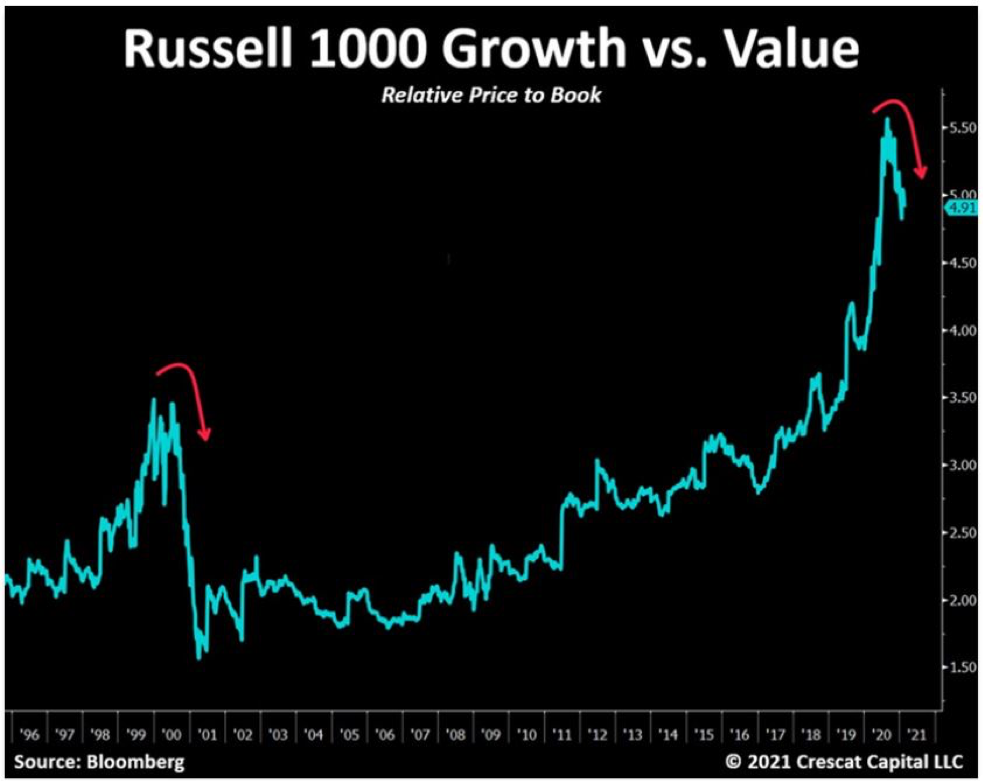

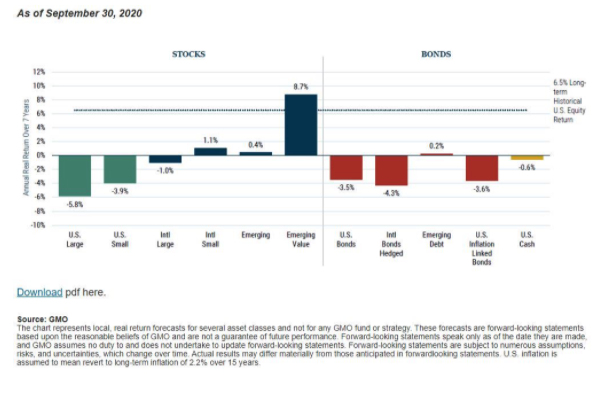

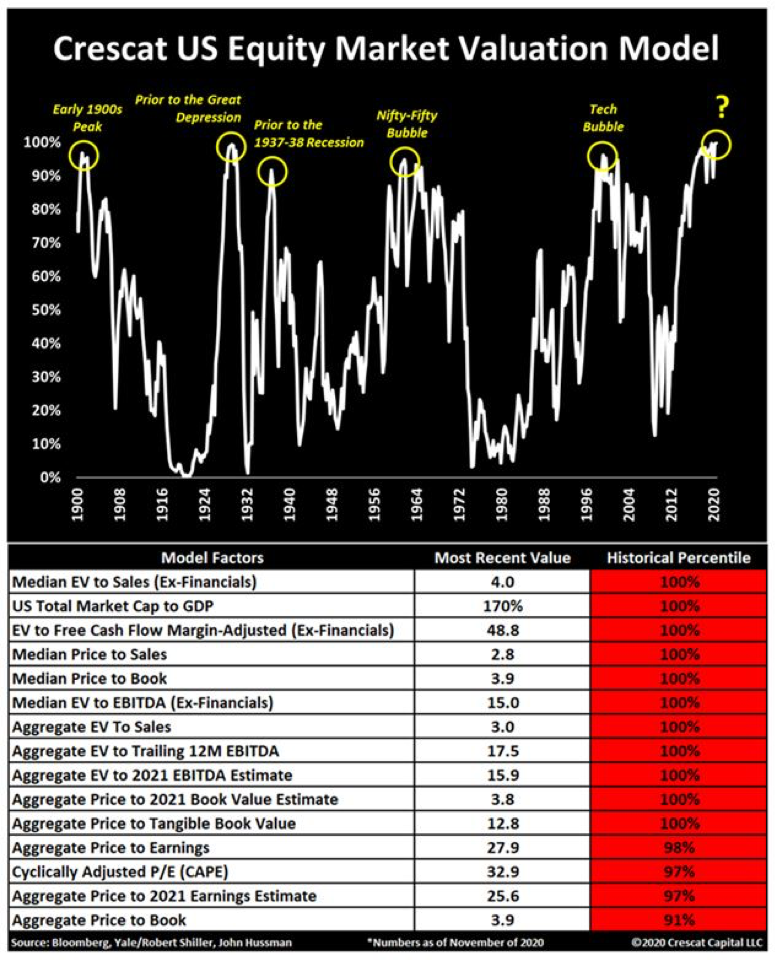

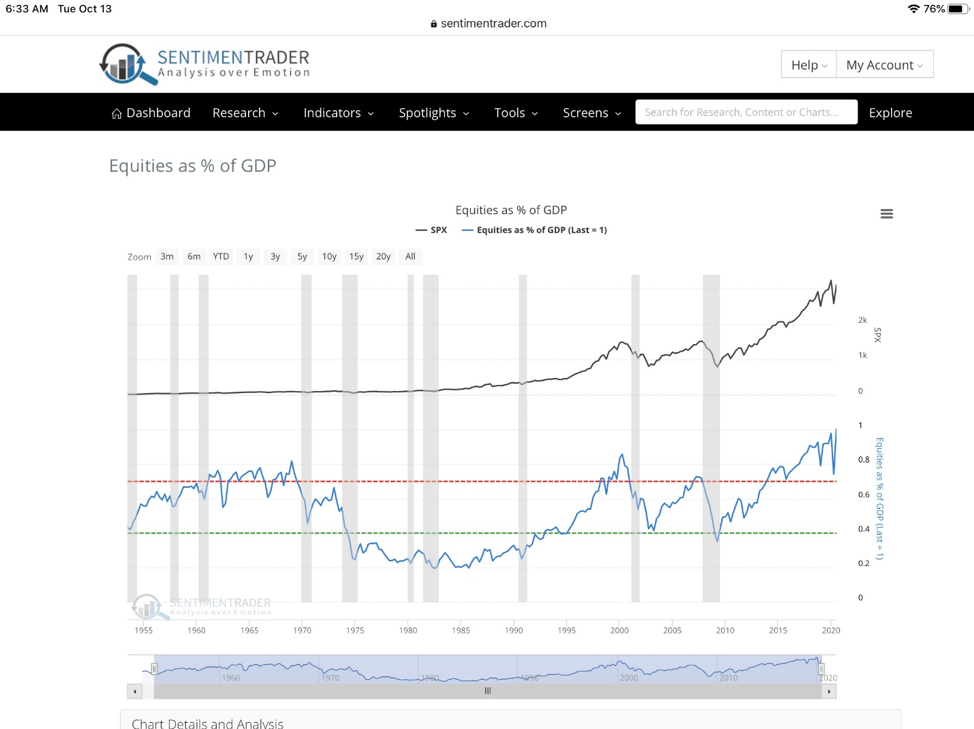

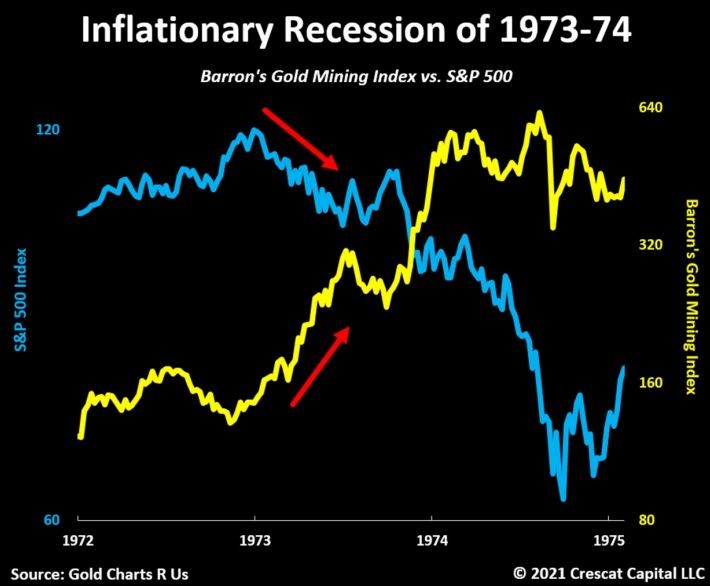

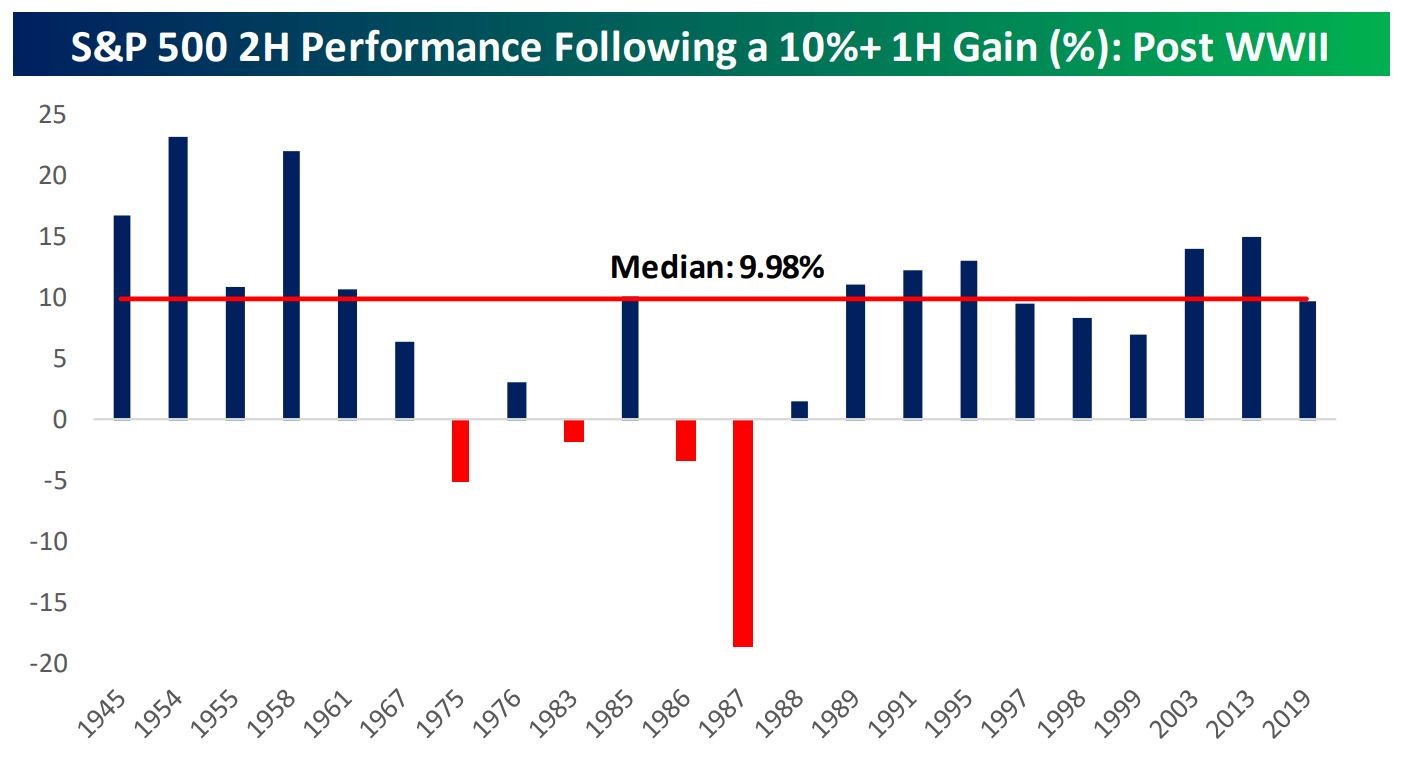

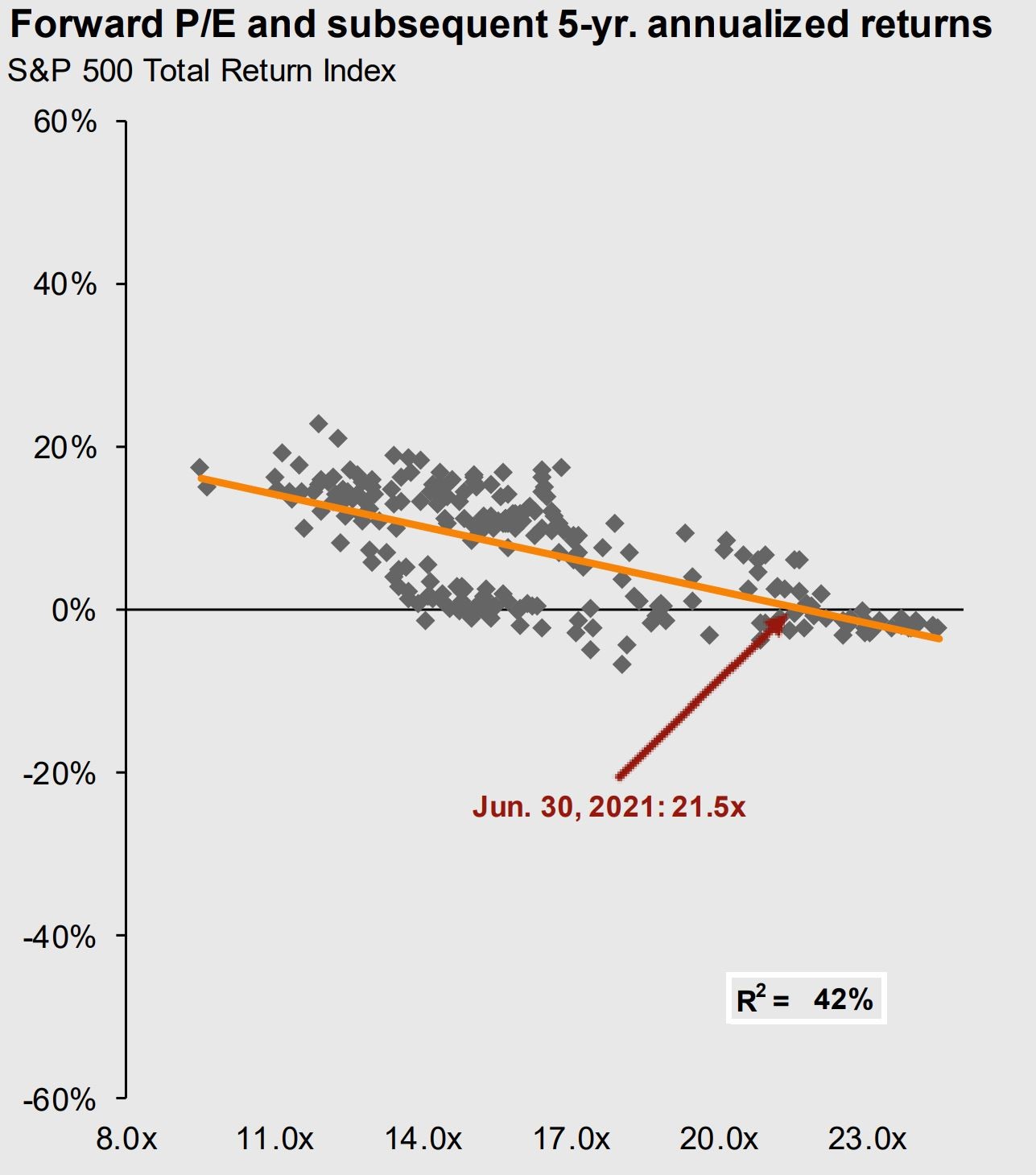

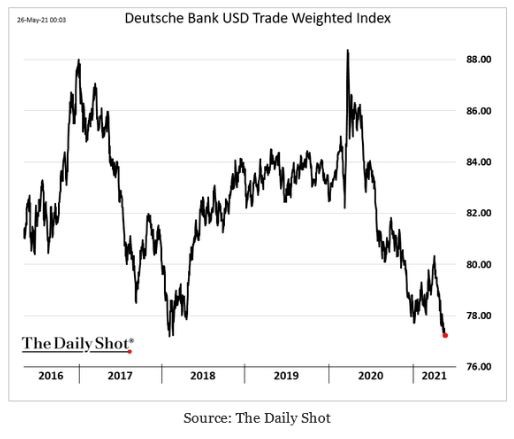

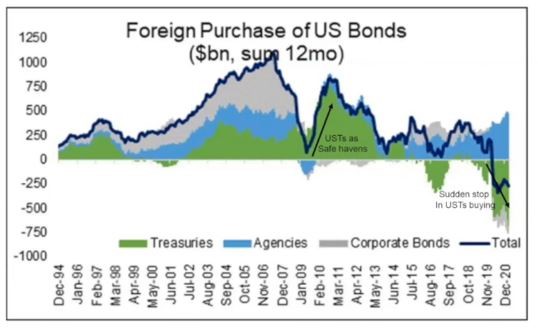

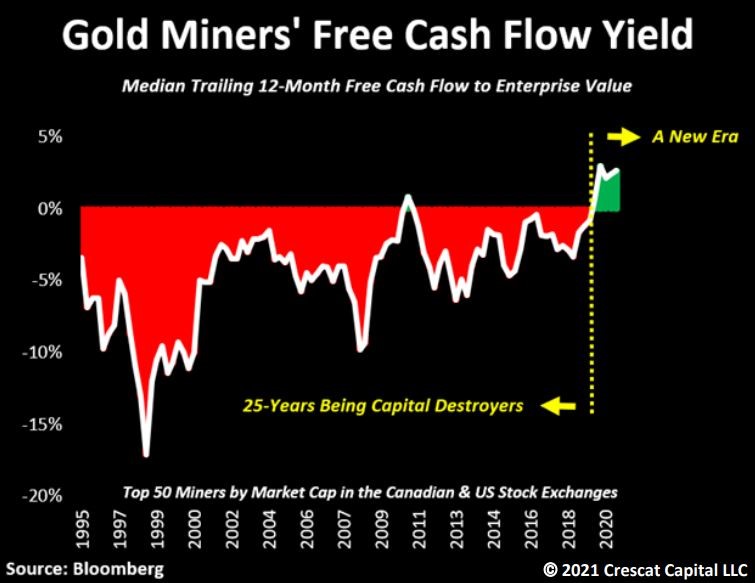

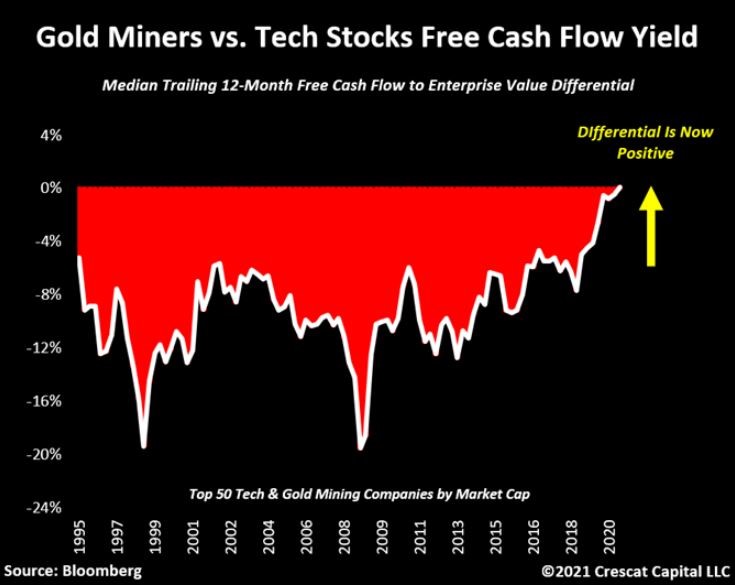

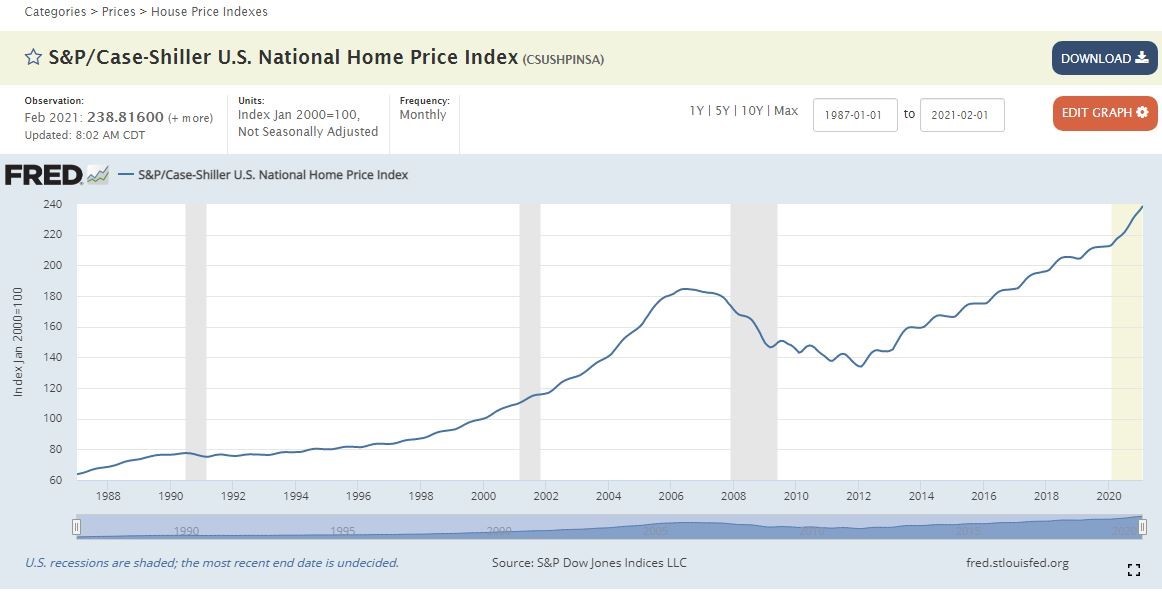

The Misery Index today is tracking the Misery Index of the 60’s and 70’s. We can argue all day that conditions are the same or different, but it is what it is. During that long period of high Misery Index (10-22) in the 60’s and 70’s, the stock market experienced several bear markets which actually understated the recessionary pressures of the time. Nevertheless, stocks literally went flat from 1965 – 1982 interrupted by 3 rapid fire declines of 20-50% each. Treasury bonds lost money consistently throughout the entire period (1965 – 1981). Gold went straight up as did other inflation hedges.

This was not a great time for most investors who relied exclusively on stocks and bonds in their portfolios as both asset classes generated losses net of inflation. I am NOT forecasting that specific outcome, however there are several important lessons from that time period that will likely playout in today’s markets.

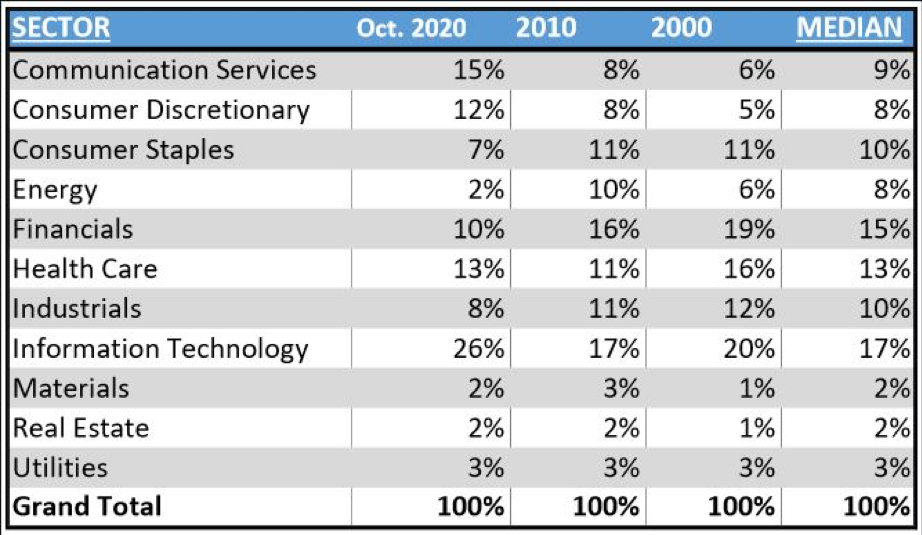

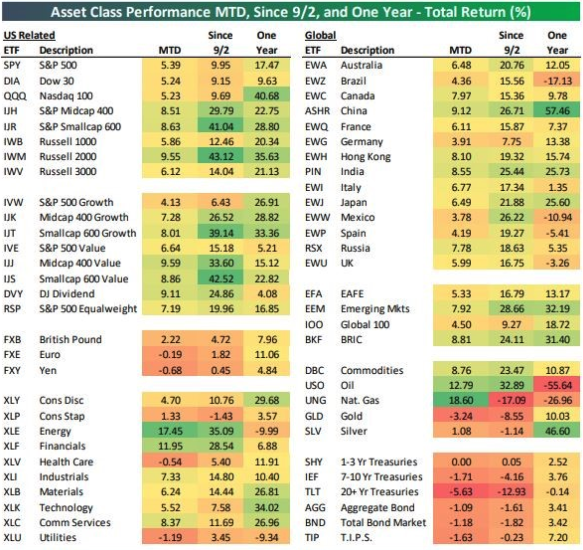

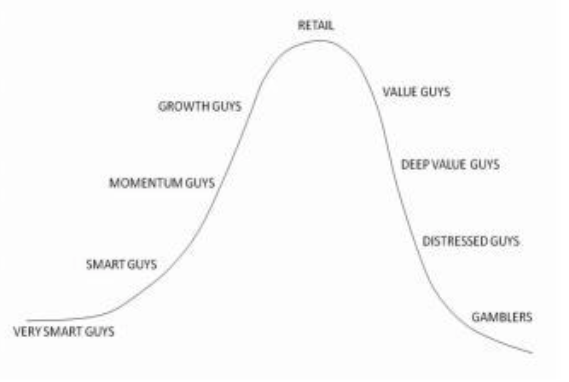

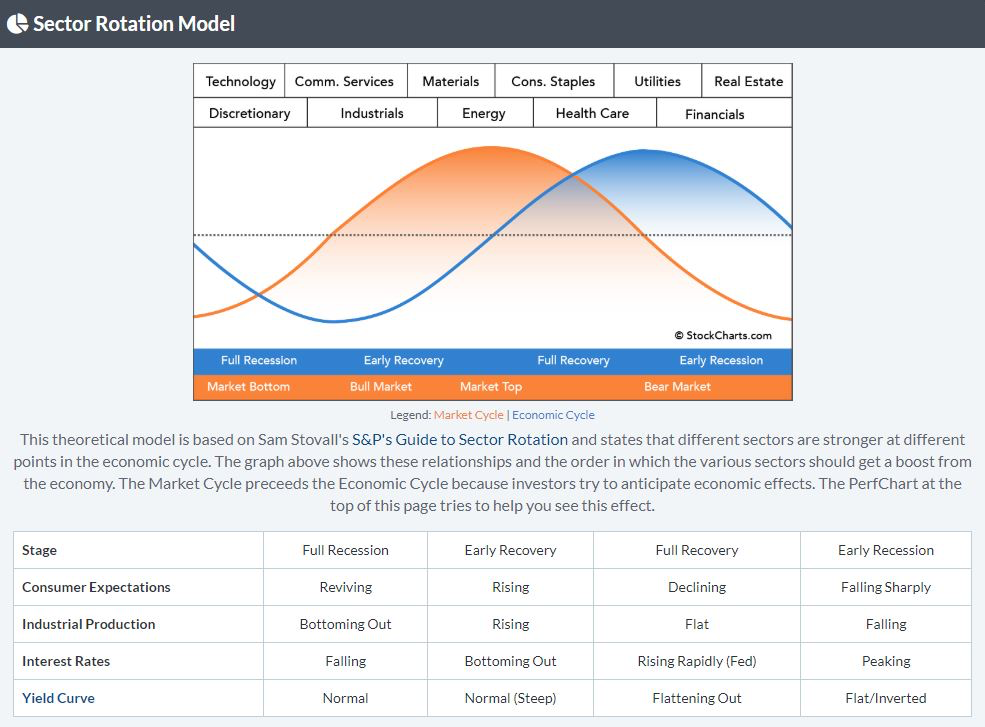

• Selectivity (owning very specific things rather than broad market indices and funds) will be critically important to your financial success.

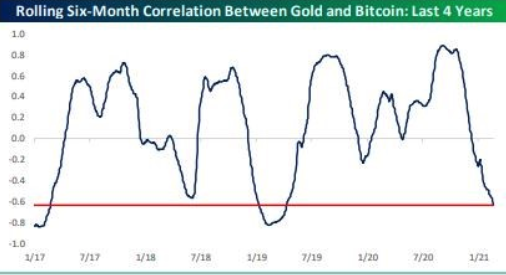

• Gold and other inflation trades should be given a long leash as core holdings during this cycle. There will be times, like now, when the market tests your conviction. Gold went up 5-fold from 1972 to 1975 while the S&P 500 lost 50%.

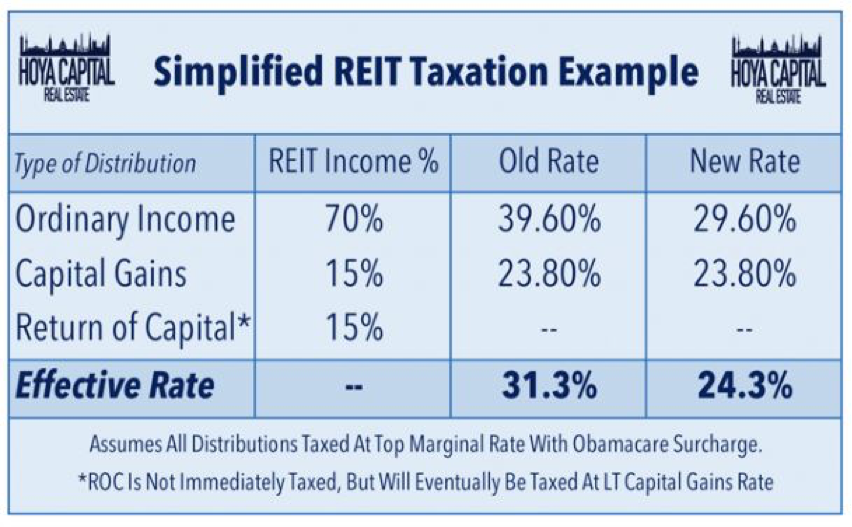

• There were very healthy return opportunities for investors to trade stocks and bonds with emphasis on buying discounts aggressively when they present themselves. Please remember to trade retirement accounts only, if possible, to avoid the heavy tax bite.

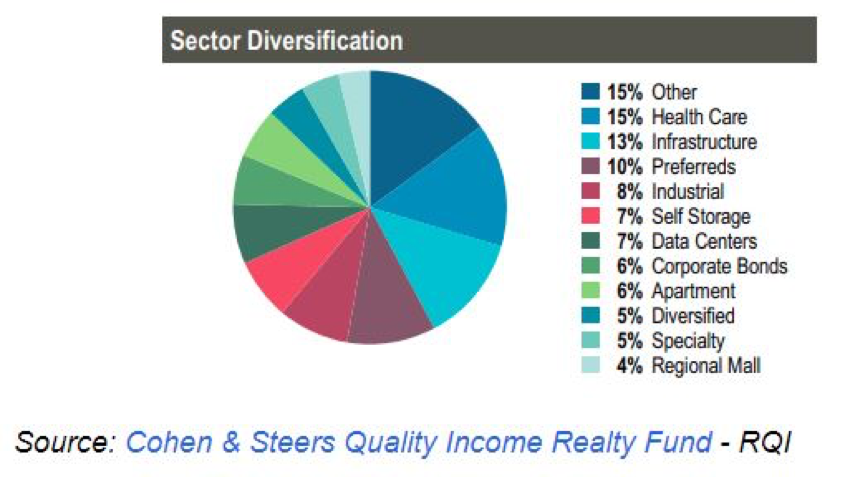

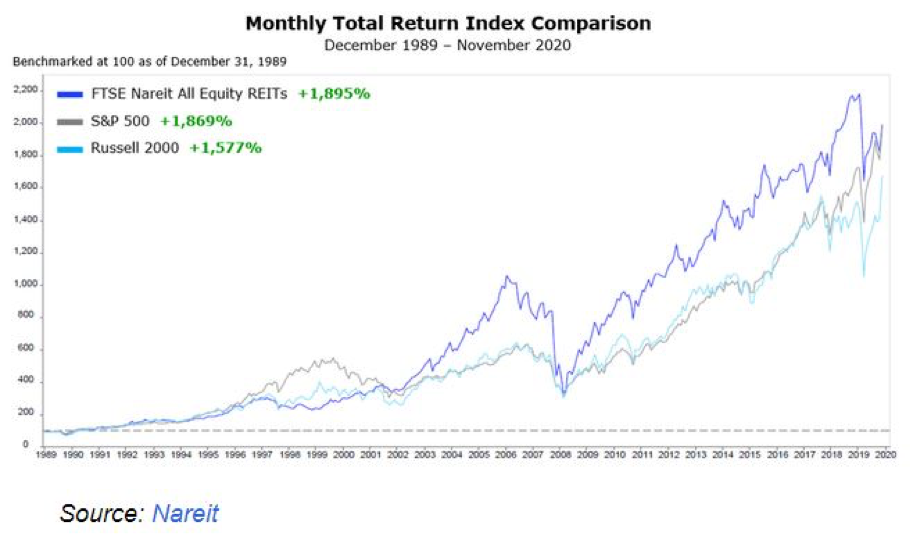

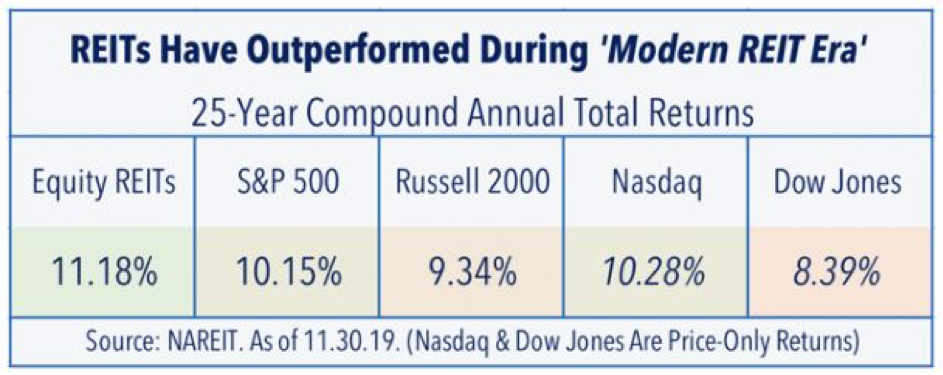

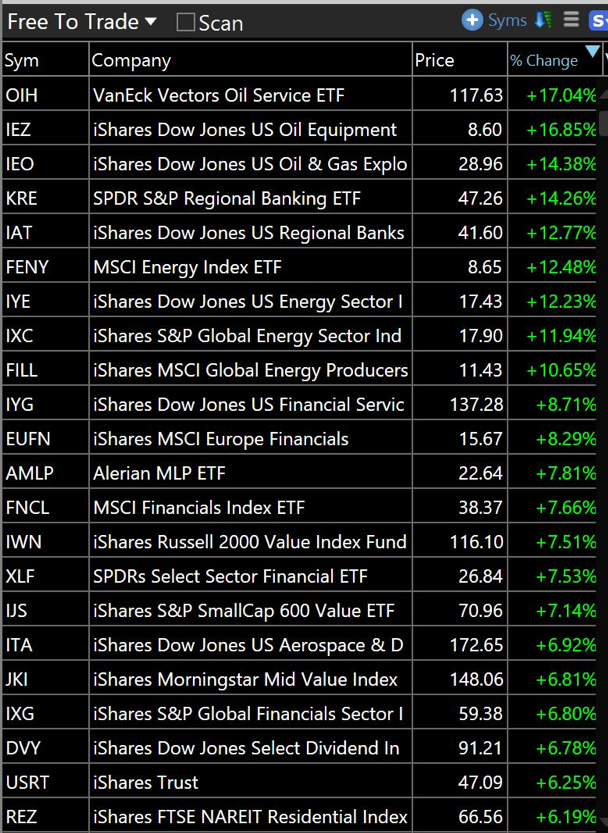

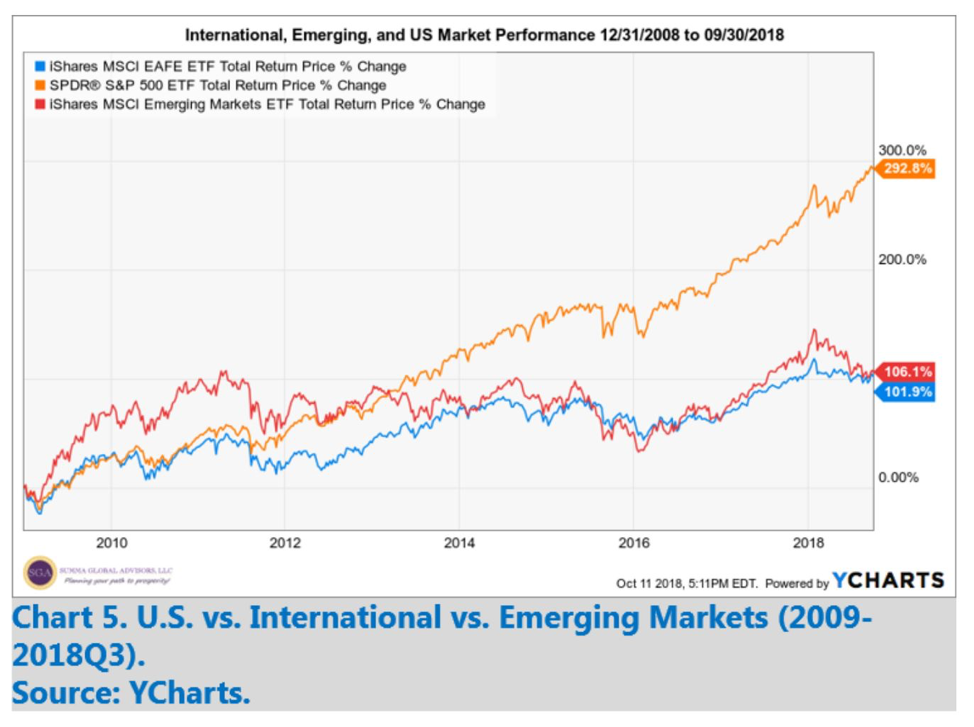

• There were many sectors and opportunities to make money in the 60’s and 70’s, including deep value, internationals, real estate, TIPS, hard assets, select small caps, financials, materials, industrials, precious metals, alternatives, high dividend payers, etc. Most of the winners of that time are barely owned today by investors.

• Sitting in cash or short-term bonds, earning zero while inflation runs at 6, 7 – 10% hurts your net worth as the purchasing power of your cash erodes every day. You’ve got to try to generate a return beyond inflation with your investment dollars!

Let’s keep our eyes on the Misery Index as an indicator that should put the 70’s playbook on the top of our desk. History is an incredible teacher if we’re willing to listen.

Markets at a Critical Juncture

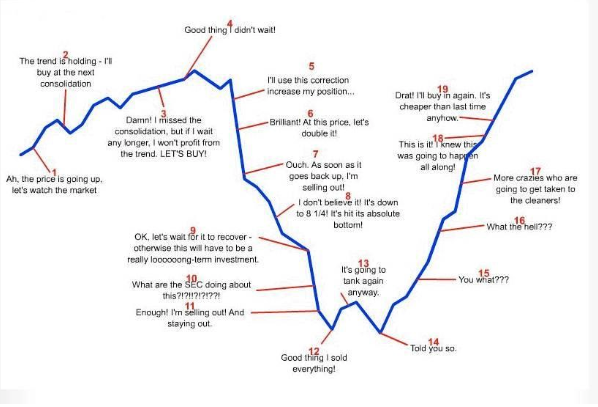

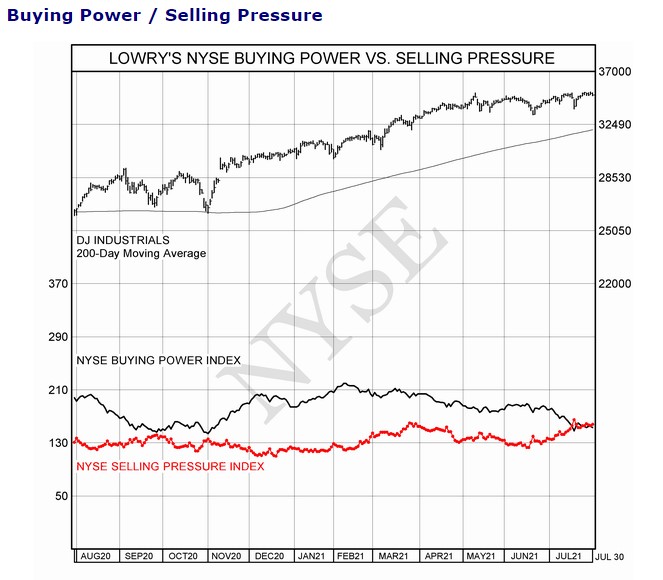

For those who have been paying attention, the headline market indexes like the S&P 500 have moved out to all time new highs in July. But this strength has masked a lot of weakness and broad-based selling which has been accelerating since June. Lowry’s Research does some good work on Buying and Selling pressure and sounded a warning alarm last week when the selling pressure rose above the buying pressure for the first time since the COVID crisis was first recognized by the market in February of 2020.

Miser

Needless to say, this is a very important moment in time for the markets to stabilize and see some buying enthusiasm. Given all the liquidity and cash on the sidelines plus support from the Fed and potential new $1 Trillion infrastructure bill, we would all expect this situation to resolve to the upside as we move beyond the seasonally weak period of August and Sept. But let’s not get complacent. I’ve been doing this long enough to witness two major bull markets come to a surprising end in Sept and October while consensus view held for a strong fourth quarter. Remember, the markets reflect expectations for the future, not the past. August begins the time when investors begin looking into 2022 and adjust accordingly, and thus, this is an important time to observe price trends closely without clinging to our assumptions and judgements.

More than anything, we would advise you to enjoy the remainder of the summer with friends and family. This is that time of year. Let us worry about the markets and how your investments are positioned. Take a load off and do something that makes you happy.

Cheers

Sam Jones

This was a headline following the earnings report from Intel last week:

This was a headline following the earnings report from Intel last week: