Last month, we presented our Investment Themes for our 2021 Solution Series Webcast. Thus far, they are looking spot on as our themes continue to outperform the US stock market handily generating some very nice returns in our portfolios. For this update, I want to reframe the themes using the three “R’s” in the title to help our readers make sense of it all from an economic cycle perspective.

Reflation (Return to inflation)

The COVID economic disaster did something significant to the macroeconomic picture in our country. The event most likely put an end to the deflationary period that has dominated our economy since the mid-’80s. In the midst of the panic, we saw our interest rates drop to zero or negative real interest rates for the first time in almost 40 years. Simultaneously, we witnessed a federal infusion of dollars and open buying of securities in the $Trillions. We also saw entire industries literally shut down forcing supply constraints. Combined together, we most likely killed deflation as a dominant economic environment and opened the door to inflation, or reflation as some call it, for the first time since the early ’70s. It was not until October however, that the market began to recognize this change and gave the torch of leadership to all things inflationary. This should not be a new concept to our regular readers, but old habits are hard to break and many seem to remain stuck playing the game according to the old rules (of deflation). The old rules say that real-estate prices will rise because mortgages and lending rates continue to fall. The old rules say that growth (aka Technology) can maintain many higher-than-normal valuations – as long as interest rates (the discount rate) stay low and justify those valuations. The old rules say that companies can count on borrowing and refinancing their debt to do things like share buybacks and other financial engineering efforts to push prices higher. And most importantly, the old rules say that deflation generally offers investors a pleasant and smooth return using a simple 60% stocks and 40% bond portfolio.

But what happens when the old rules do not apply?

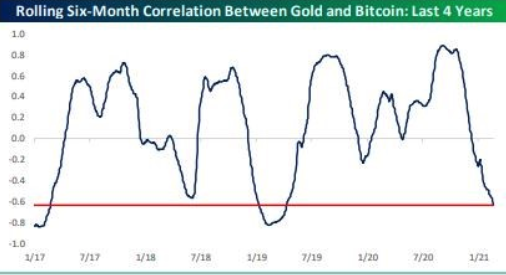

What happens is we see a market that rewards an entirely new set of securities like commodities, energy, basic materials, industrials, durable goods, and generally things that hurt when you drop them on your foot. This is happening now persistently, solidly, consistently, week after week after week. This is not a short-term thing but a significant change in the character of the markets reflecting the fact that inflation is happening. Jay Powell, the Fed Chief was grilled today and I heard more than once, pointy questions asking why the Fed was being so accommodative with fiscal policy and bond-buying when clearly the economy is recovering toward a post COVID world again and GDP might push up to 4-5% growth by year-end! My guess – Despite all the chatter to the contrary, the Fed will be forced to raise rates before the end of 2021. The new rules of reflation also favor Gold and currency alternatives like Bitcoin. Bespoke did some good work on the correlation between Gold and Bitcoin. Today, that correlation is stretched indicating that gold should take the leadership from Bitcoin any day as a currency alternative.

In other words, now would be the time for Gold to step up and Bitcoin to give up gains. That almost seems silly to say as I write and Bitcoin is already down 20% in just two days, while Gold has likely started a new bull trend higher.

But by far, the biggest threat to investors of all types under the new rules of reflation is the sudden and persistent rise in intermediate and long-term interest rates reflecting the new realities of inflation in the system. Bonds lose money when rates rise. As of yesterday’s close, the S&P 500 is still up a very healthy 3.21% while the 10-year Treasury Bond is down -2.94% on a total return basis. In the last week, we have seen both the S&P 500 and the bond market fall together while commodities of any sort including any broad-based commodity fund or ETF, are up 2-4%. It just does not get clearer than this folks. Stocks are in, Commodities are in, Gold is in, Bonds are out. Simple.

Reversion

In sync with the new reflationary rule set, we are also seeing a reversion of trends that have been in place for the better part of the last 8 years. Specifically, we are seeing value outperform growth dramatically and persistently. Growth is a code word for technology these days and here again, after speaking with many investors, I am hearing the same resistance to accept the new trends. Old habits die hard, especially when they have been so rewarding for so many years. I do not know of a Tesla investor who is considering selling their shares. The stock is only down 20% but still up 722% from the March lows of 2020 after the 5 for 1 split! I am not going to call a top in TSLA but I will say that if ever there was an iconic name that represents consolidated investor capital at a nosebleed valuation, this is the one.

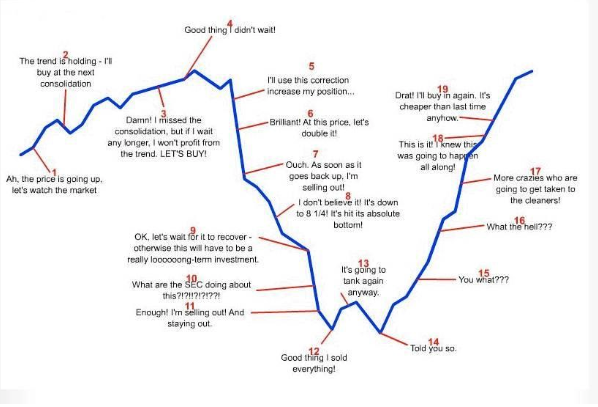

Given recent history, investors would be inclined to blow off the recent weakness in the name and might even consider buying more. And that would be a great strategy if we were operating under the old rules of deflation, falling interest rates, and acceptance of bubble-type valuations. But we are under a new set of rules now so we should not be surprised to see Tesla and other mega-cap growth names really disappoint investors in the weeks and months to come. Do not forget, Investor sentiment matters more than just about anything including fundamentals, innovations, and great leaders like Elon Musk.

Here again, my fav Behavioral Econ chart. Tesla (TSLA) is approaching #5-#6 in my opinion.

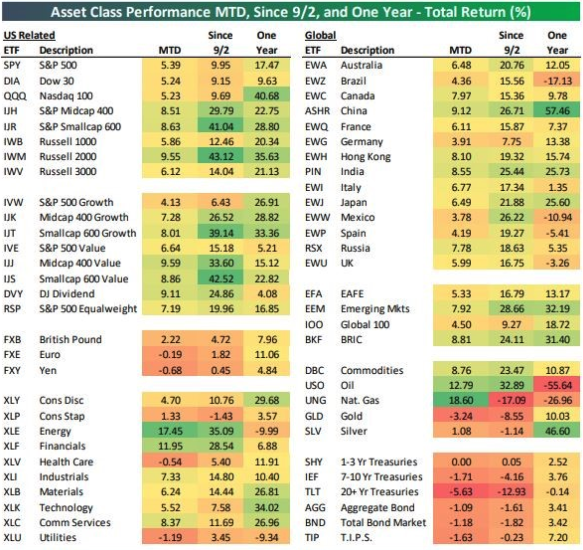

Also, in the reversion camp, we continue to see strength in Internationals and Emerging markets. Non-US has been outperforming domestic indexes since we switched to the new rules in March-May of last year. This has been especially pronounced since early September of last year. Again, this matrix from Bespoke. Internationals are up almost 2:1 since last September outside of US small caps.

Recovery

It would seem obvious to say that global economies are now in full recovery mode. By itself that is inflationary but this a time to focus on the cyclical sectors that respond well to an economic expansion. This is the well-forecasted recovery trade and we have a ton of things to buy and own here. Thankfully, most of these cyclical types of securities are now value trades after being beaten to death by a year of a global pandemic. These are sectors and stocks trading at historic rock bottom valuations like banking, finance, metals, materials, and traditional energy. Beyond that, it is probably okay to start incrementally buying into the post-COVID side of the markets like hotels, airlines, travel, leisure. Have you looked at Disney recently (DIS)? How about Hilton Worldwide (HLT). We own a great newer ETF from Invesco – PEJ (Invesco Dynamic Leisure and Entertainment). It holds equal thirds of restaurants, hotels/ gaming, and Leisure sectors. It is a rocket that will make every Bitcoin/ Elon Musk cult fan jealous. It is game on for the post-COVID sectors and a global economic recovery. When you see an earnings report that is down -90% year over year in earnings and the stock of that company goes up 5% on the day, you know the bad news is fully priced in. We have seen more than a few of those in the last month. Do not overthink things, play the recovery by digging deep into value and cyclicals.

This is a great time for investors who know where to look for deals and opportunities while avoiding yesterday’s winners like growth and technology.

Thanks for reading!

Cheers

Sam Jones