On January 20th, we will be hosting our annual Investment Themes Solution Series for clients and interested parties. Sadly, it will be a webcast via zoom but we do look forward to the summer when we hope to meet again in person in our office. Over the next week, you will hear and see investment forecasts from nearly every financial publication out there. This is not our forecast nor will you hear much of that in our webcast. Instead, we simply want to point to themes as they happen, trends as they unfold, and leadership as it becomes apparent. We will leave the highly sensational and regularly inaccurate forecasting to others.

The Big Three

Regular readers know the Big Three investment themes we have been talking about since 2018. These themes have been packaged in the context of developing opportunities, relative values, and now current trends. The Big Three are as follows:

- Internationals (esp. Emerging Markets) Outperforming the US stock market

- Commodities, Inflation Hedges and Gold (or dollar alternatives) establishing new bull markets

- Value styles outperforming Growth styles

We are going to talk in more depth about these themes, how we are positioned accordingly and some of the realities of owning this new mix of securities in terms of expected risk and return metrics, in our upcoming webcast. But for now, we thought we would close 2020 by announcing boldly that these new trends are now firmly in place. Investors who wish to continue making money in 2021, should be actively reallocating now. For today, we will give a little teaser of what we are seeing before the webcast.

Internationals Winning

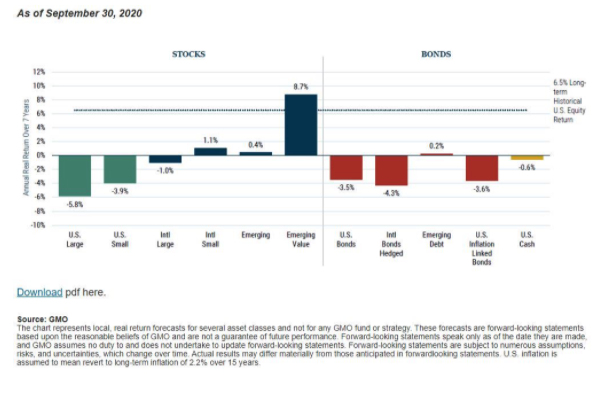

Let us be clear that investing out of the US is not an act of treason. We are a global financial ecosystem where all countries remain highly dependent on international trade and we should look for investment opportunities globally, always. Here’s a little fact; The percentage of revenue derived from non-US countries across all S&P 500 companies, still sits at 42% (down from 43% in 2016). Let’s call that no change. To some degree, our global financial markets have been moving more and more in sync with each other as central banks across the world tend to work in unison both in method, magnitude, and timing. The opportunity overseas from an investment perspective is based purely on valuation differences. Take a look at GMO Q3, 7- Year assessment of expected returns across the largest asset classes.

Two things should pop out to you. One is that almost every asset class has an expected negative return over the course of the next seven years. The traditional 60/40 (US stocks/ US bonds) is obviously in trouble looking forward. Second, you see the one standout as Emerging Value. We have spent a lot of time and research looking into this space and it is a bit complicated but an investible slice of the market. Our clients can look at their holdings and find those positions easily. Examples might be international producers of commodities, energy or raw materials, Emerging Market banks and financials, and International small caps and high dividend payers. These are not things found in your everyday investment portfolio. Today, All Season clients have anchor positions here and we will take them to overweight in the coming months. Also noteworthy is the large green negative bar on the left representing large-cap US stocks. This segment now offers the worst return prospects of any asset class in the world. Large-cap US stocks are where all investors have their money now on a scale and concentration that we have never seen before. What a great time to sell US large caps and buy Emerging Market Value! It won’t happen but now we can say we told you so down the road.

Commodities, Inflation Hedges and Gold

We come at this one with a little more hesitancy until we see more evidence but current trends are becoming more pronounced. For this theme, we generally need inflation or the threat of inflation to be real for this side of the market to really be productive. Much of what drives trends in inflation comes from Federal Reserve policies and the current position of interest rates. Specifically, if the Federal Reserve is maintaining a proper interest rate policy, then short term interest rates would roughly match the current rate of inflation in the system. Today, short-term interest rates are BELOW the rate of inflation which means that “Real interest rates” are negative. Gold loves this environment because it forces the value of the US dollar lower. The dollar made a 24-month new low this week. Commodities and other inflation hedges, including energy, commodity producers, and basic materials companies are all simply reflecting the current RISE in inflation. Yes, this is a fact. Inflation is on the rise now and has been since the summer. We believe the risk of high inflation is understated and misunderstood considering where we are in the pandemic cycle. Some think we are going to be trapped inside for years. We believe COVID-19 will be a bad memory by August and demand for goods and services will swamp supplies with “too many dollars chasing too few goods” (defn of inflation).

Next fall you will see the NFL playing in front of live fans in packed stadiums. You will also pay $27 for a hamburger at the stadium so sneak in some snacks. Again, All Season clients can look at their holdings and find entry-level positions in commodities, gold, and heavier exposure to basic materials. To be sure, owning commodities long term is not recommended. This is and always will be, a tactical allocation for us but one that we feel could be worth the trade in 2021.

Value > Growth

Investing in value is almost becoming a consensus view in the financial media now so that worries me. But in this case, I am not going contrarian because the value/ growth cycle is very, very long and we are just making the turn now. Today we are probably witnessing a peak in the relative strength of growth companies with new leadership emerging clearly and regularly from the value side of the market. We have seen this before, notably in 1999, just before the bear market and just before value took off to the upside for years. You can see the high point in late 1999 marked on the chart below, the same position today.

But since September, things have changed. Mega cap technology has dramatically underperformed. Facebook is down -8.5% since Sept, Netflix is down -4%, Microsoft down -3%, Amazon down nearly -6% for example. Meanwhile, the Dogs of the Dow (the worst performers of the last 12 months the deepest value components) are up handsomely with little to no price volatility. We own many of the “Dogs” in our Worldwide Sectors model. For example, since early September, Dow Inc (DOW) is up +12%, Goldman Sachs (GS) is up 23%, Walgreens Boots (WBA) is up 15%, JP Morgan (JPM) up 26%, GE (GE) up 76%, Boeing (BA) up 37%. We own all of these in full disclosure.

Investors struggle to let go of the past especially when the past has been so good to them. US large-cap growth has been good to all but now it is time to let go or at the very least, trim your position size and reinvest in value. These new regimes in value versus growth in the last years.

We will leave it there as our last Red Sky Report for 2020. It has been a wild ride but we are very pleased with year-end results across the board. We want to take this opportunity to also say thank you to all of our clients for allowing us to serve you. We know you have choices and we are always grateful for your continued trust and confidence in our firm. We look forward to working with you all in 2021 and introducing our newest Lead Advisor who is a Certified Financial Planner and Chartered Financial Analyst to our team of professionals.

Cheers, Happy New Year, and best of luck to us all in 2021

Sam Jones

President, All Season Financial Advisors