Queue the Election Correction!

Well for everyone who is surprised by the market’s decline over the last month, I can only say, you’re probably not paying close enough attention to our communications. This is all following a script (ours) that was laid out this summer so no surprise from our end. Obviously, we’re not done yet as I watch the S&P 500 close down another -2.5% today. Rest assured, we have made defensive changes to our risk-managed strategies and we’re in great shape to take advantage of the next great buying opportunities with our emotional capital and your physical capital intact.

In our August 18th Red Sky Report “It’s Time” https://allseasonfunds.com/its-time/, we talked about the frenzied price gains in just a few names, artificially propping up the rest of the market which was already headed south. We said, “it’s time” to start taking profits, especially in those names that everyone knows and loves (FAANG stocks + Microsoft). Later, in September, we recorded a well-attended Solution Series webcast offering recommendations to those who owned big shares of large-cap tech, reviewing the various tax-efficient options for limiting downside risk and capturing some gains. You can watch that video here. https://allseasonfunds.com/do-you-have-enormous-gains-in-a-certain-stock-what-should-you-be-doing-now/

This is not one of those loathsome I-told-you-so blog posts. It is simply a note to our clients that we have been prepared for the current correction and getting defensive since mid-August. We are humbly giving you some peace of mind as the markets are in that place where accidents do happen. All is well on our end and these are some highlights of how we are positioned now.

- We have taken profits in nearly all growth-oriented and technology holdings.

- We are sitting on roughly 25% cash and money markets with recent sales.

- We added short positions last week to our strategies (these make money when the markets go down).

- We still own a small position in the VXX ETF which benefits from higher. market volatility. Plenty of that now and probably more to come.

- We have sold all high yield corporate bonds and emerging market bond positions in our diversified programs.

- We are holding our position in value, commodities, and emerging markets which continue to hold up well (more on this in a minute).

- We have taken a new position in the rising US dollar fund which tends to rise when stocks fall.

- We own no Treasury bonds outside of TIPS (Treasury Inflation-Protected Bonds) because Treasuries are dead money… for the next decade or two.

- We reduced our Gold and Silver positions today.

So that’s defensive for any investment portfolio without completely disengaging from the markets.

Let’s talk about elections for a minute before focusing this discussion on where we might look for the next giant return opportunities on the other side of this mess.

Election Correction – Open Your Mind

I don’t know of a rational (or healthy) person who would step in front of a fast-moving freight train. The pending presidential election is a freight train of chaos. Never has our country been so divided politically, economically, and socially. The last time we had this level of social unrest and anger in the streets, there was a bad guy that lived in Vietnam. You were either for the war or against it in the late ’60s. This time, we are at war with ourselves with the added drama of a global pandemic to keep us distracted. Whether you’re an investor, a company owner, or even just your everyday consumer, you are not likely to go out on a limb with anything that falls into the discretionary category. You are not going to buy stocks aggressively 40 days away from the most important election of modern life. Companies are not going to embark on new spending plans, or any M& A activity until they have some vision into the future. IPOs will be put on hold, same for big purchases at the consumer level until we see and feel some sense of calm. Today and for the next 40 days, there will be anything but calm. Buckle up and expect more volatility in every aspect of your life. On the other side, we’ll see how the markets and the economy reacts and then we can all make more educated decisions. With that said, we would strictly avoid any preconceived notions of what the markets will do after the elections depending on the outcome. Every investor who hated Donald Trump in 2016 probably struggled to watch the markets climb nearly 40% out of the election lows. Events just did not jive with their perception of what “should” happen. This round, we hear that if Biden is elected, we should expect stocks to fall into a deep depression. Smart investors will remove their political hats and show up as objective investors ready to follow trends as they unfold without hating or loving the reality. Open your mind to any outcome. If you are an emotional person by nature with strong convictions about politics, you’re probably not going to have a very pleasant investing experience looking forward.

Three Opportunities – Revisited

You know the big three, but I’m going to take this opportunity to say them again just for the record. In the next 24 months, it is highly likely that we will see the following three dramatic changes in the markets, creating both pain for those who don’t know what they are doing and reward for those who are aware. Regular readers know what I’m going to say but here they are again in brief with a few supporting graphics.

1. Inflation is coming

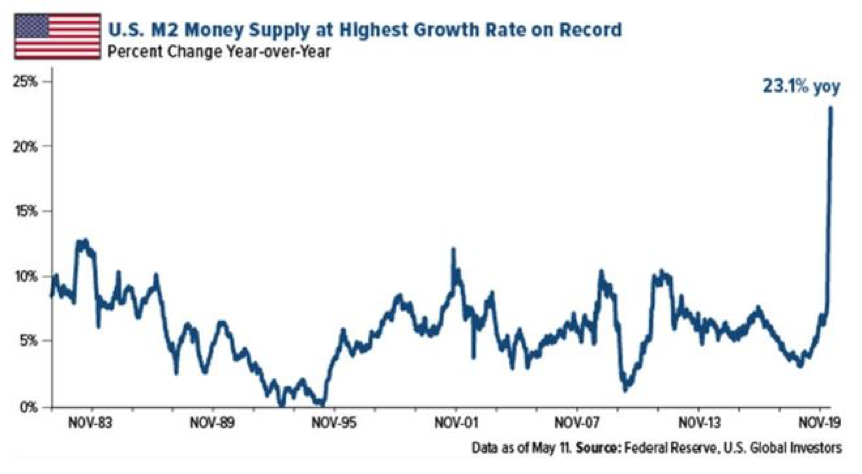

I know, I know everyone says it will never happen which is why it will happen this time. I’ll give you one chart that offers the most compelling reason why we should all expect some form of inflation, perhaps very high inflation in the next couple of years.

Do you see anything strange on the right side of the chart? Yes, the money supply means everything as one of the key drivers of future inflation. This is terrifying. Gold and Silver tend to lead inflation and they have been the best performing asset class for the last two years. Now leadership in Gold and Silver may be coming to an end as actual inflation finds its way into the economy leading us to invest more in broad-based commodities. It’s still early but take a look at the price of wood, copper, food, etc. When energy bottoms on the other side of elections and COVID, inflation will really become pronounced. Unfortunately, the Fed has now verbally boxed themselves into not fighting inflation until it’s really out of control. There are lots of ways to make money during inflationary times. Our next Webcast Solution Series will cover the topic of Inflation and how to position yourself on October 7th. Please RSVP soon on our Solution Series page https://allseasonfunds.com/videos/

2. Value will Outperform Growth

Usually, this happens after bear markets have begun in the global markets and it’s hard to say if we’re in a bear market yet or not. Sometimes Value outperforms growth by simply losing less. Sometimes, Value actually makes money while growth loses money as it did for the first three years of the 2000s. Today, I’m shaking my head at the craziness in the growth side of the markets. Companies with triple-digit P/E ratios were raging higher (until two weeks ago). Now they are very suddenly down 20-30%. Tesla lost almost 11% today for instance. We have no hatred for Tesla; It is a great company with extraordinary vision and promise. But we don’t like Tesla at this price and will buy it back lower, maybe much lower. Meanwhile, the likes of Caterpillar, 3M, Dow Inc, Intel, Verizon, Honeywell, are starting to attract really buy-side interest for the first time in years and are trading well below the broad market valuations found in the S&P 500. Interestingly, 20 of the 30 stocks found in the Dow Jones Industrial Average are now outperforming the tech-heavy S&P 500 over the last 30 days. One could simply own the Dow Jones 30 index as we do to get easy exposure to Value. Investors who have been at this longer than the last 10 years know that growth and value often change roles as market leaders. Might we be on the cusp of the 10-year rotation?

3. Emerging Markets Will Outperform the US markets.

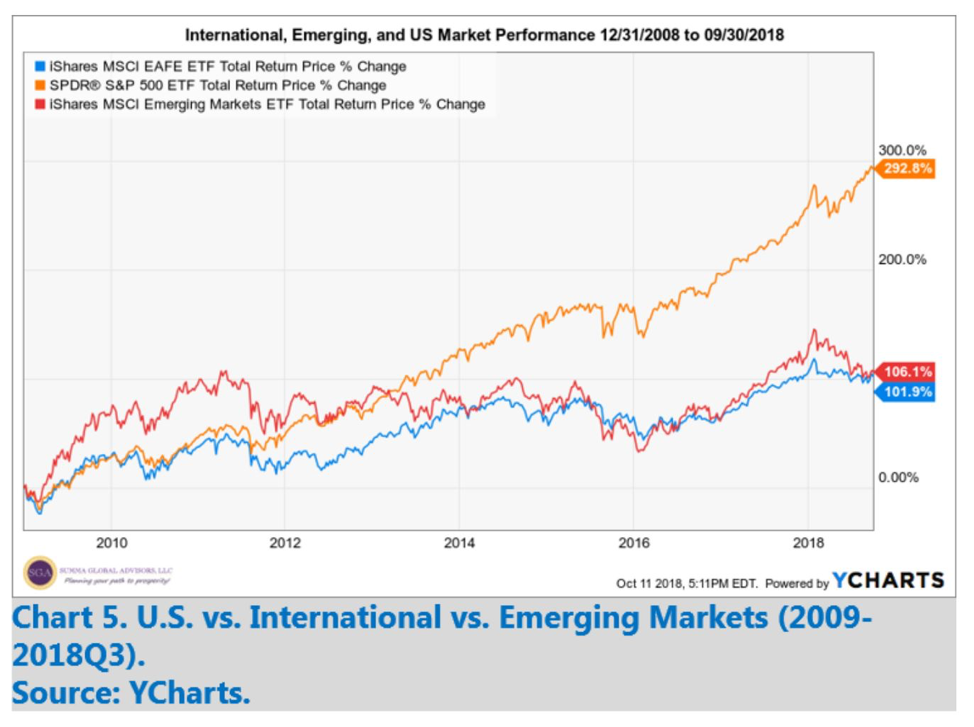

The valuation argument is undeniable regardless of how much you might love the US. Emerging markets might be the last place on earth with attractive valuations in aggregate. They have lagged for the last several years at the index level as you can see from the chart below but I will say that we’re seeing select managers in the ancient, left for dead, mutual fund space, doing incredibly well. We have taken a few positions in the Fidelity Emerging Markets, Southeast Asia, and Small Cap Japan funds in our “Worldwide Sectors” strategy. All three are crushing their index benchmarks and we hope to hold these outperformers for years.

Again, once uncertainty regarding elections and COVID begins to subside, there is a very good chance that emerging markets will dramatically lead the US markets.

I’ll leave things there for now. The message for today is that we are in a good spot managing downside risks in all strategies and will be ready to jump on the next set of opportunities as they unfold over the course of the next 12-24 months. Stay tuned to our communications in all forms and thanks for listening. Feel free to share any of our content with friends, family, or workmates at your discretion.

Sam Jones