Inflationary pressures are quacking. We’re going to talk about inflation today and what it means for investors and spending decisions. The ramifications of what is happening now are going to be profound in my opinion for the next 3-5 years. We all need to adjust our thinking, our investments, and our expectations if we are to keep this wild animal on a leash and avoid getting bit financially.

Bill Gross Retired in Feb. of 2019

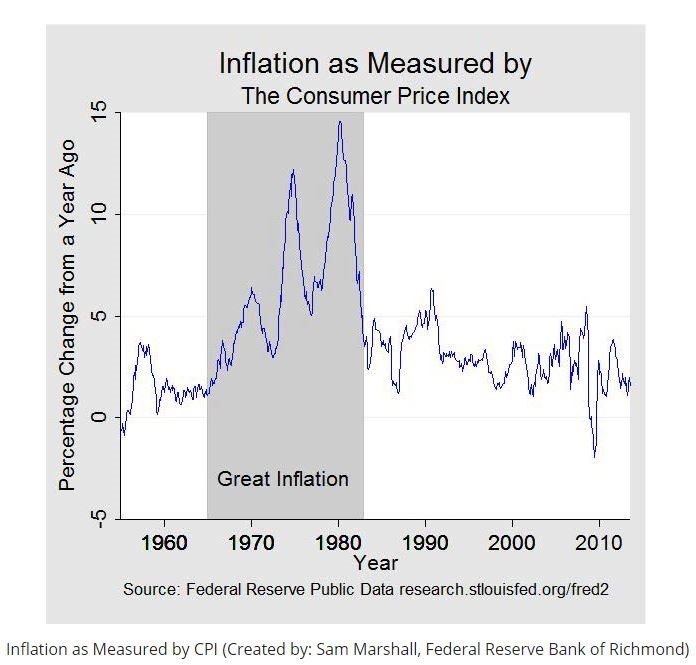

Jared Dillian of the Daily Dirtnap provided some great commentary in his daily column yesterday about the “Deflationist Cult”. He’s right, it is a cult. Cults in the investing world emerge after many years of a well-defined trend; in this case nearly four decades of falling interest rates. In fact, after this many years, there are many investors and professionals on Wall Street that weren’t alive to see and feel the last time we had any real inflation. Bill Gross, “The Bond King”, born in 1944, was a young adult, and aspiring bond investor in the 70’s and 80’s when inflation ran as high as 14% year over year.

In that time, you were absolutely nuts to own a Treasury bond of any sort as price losses just crushed your portfolio while inflation raged. Bill Gross took the other side of that consensus view and was probably buying Treasury bonds in the early 80’s, in bulk. 40 years later, Bill will be remembered as the greatest bond investor in history posting some of the most consistent and impressive returns ever seen via the PIMCO Total Return Fund. He literally rode the tsunami wave of falling interest rates from the highs in the early 80s all the way to his retirement in February of 2019 from the Janus Funds. I heard an interview with him once where he admitted that there was very little skill involved beyond recognizing the deflationary forces in the system (the Federal Reserve, central bank policy, politics, demographics, etc.) that benefited and supported Treasury Bonds as an asset class.

Bill retired 12 months before the final low in interest rates in March of 2020 . Out of nearly 40 years, I’m going to say that’s pretty impressive timing. Granted Bill is now 77 and deserves to retire with a few $Billion to his name but I would guess his retirement coincided with his own recognition that deflation (and falling rates) was coming to an end on a very long and very meaningful macro scale. At last check, in his own investments, Bill is now shorting the bond market – betting that rates are going to move meaningfully higher for longer than many think. In essence, Bill’s retirement coincided with the birth of real inflation and the high likelihood that associated interest rates will trend higher for the foreseeable future.

Consensus view in the financial services industry is very cult like regarding interest rates. There are assumptions in this view; The Fed can’t afford to raise rates, The Fed is going to keep rates low forever, The Fed is going to impose a cap on long term interest rates, etc. The Fed does not have as much control over inflation as everyone expects. Meanwhile the evidence supporting low rates and deflation is becoming weak and um….not convincing while the evidence that inflation is HERE is strong and compelling.

Evidence

First, ignore the Consumer Price Index – It has become perhaps the most deceptive measure of inflation out there, created, massaged, managed, edited, reformulated, and manufactured to sell the idea that the change in the cost of living in our country (and associate pension payments indexed to inflation) is just 1-2%. Laughable! Does that even feel close? If we only had to spend our money on things at Walmart and the Dollar Store then that might be true, but unfortunately, we all must pay for food, energy, housing, and healthcare that form the lion’s share of our daily expenses. CPI does not accurately reflect the true costs of living anymore. I’m not a conspiracy guy but it would be worth your time to visit Shadow Stats.com http://www.shadowstats.com/ . You’re going to see a lot of hard data and begin to understand exactly how and why our “Core” CPI index has been manipulated. Shadow Stats suggests that the real year over year cost of living increase is now 9.4% as of the end of February. That feels about right actually. Don’t shoot the messenger.

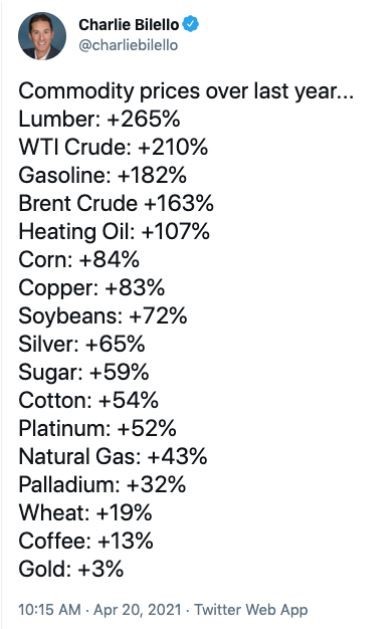

Let’s look at a few other inflationary things quacking! How about Commodities in the last year? Clipped this from Twitter.

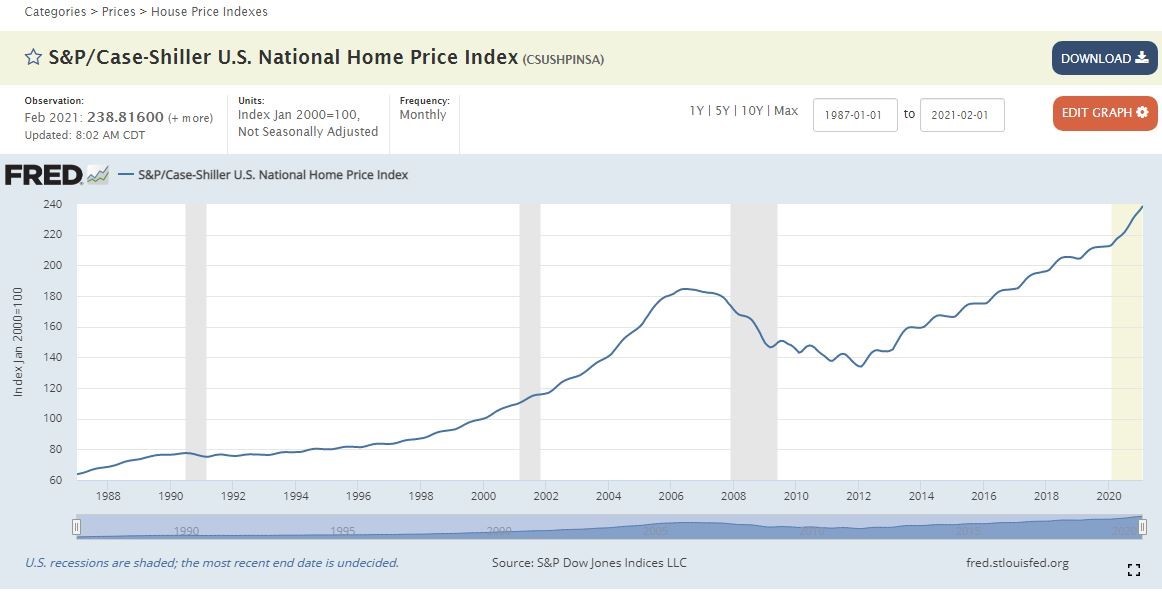

How about Home Prices?

Rising home prices are a good thing for economic growth and personal wealth, but when prices are this high and rates start to rise as they are, affordability drops dramatically. Looking forward, anyone considering buying a home now is naturally a deflationist. You are literally short inflation because you are banking heavily that rates will fall below zero, allowing home prices to rise even more. As a side note, building a home now is probably going to be a shocking experience from an unexpected cost perspective. Revisit the change in commodity prices above for things like copper and lumber. We already have short supply in homes but that fact does not justify building something that is going to cost 30, 40, 50% ? more than you expected. We were entertaining a kitchen remodel in our home last year. That project is not happening anymore.

Headlines Quacking

There is no shortage of headlines talking about the rising prices of everything including the cost of goods sold (COGS). In economic terms, when COGS, goes up, you need to raise the price of your end product in order to keep your profitability stable. In a deflationary environment, demand is the only thing that matters as the costs of everything are either stable or falling with quick and easy fulfillment. In an inflationary environment, supply, availability, and the costs to produce anything becomes the denominator of profits even while demand remains high.

This was a headline following the earnings report from Intel last week:

This was a headline following the earnings report from Intel last week:

Ok enough with the evidence- there is a lot, we’ll leave it at that.

Ramifications for Investors

Wow, I’m running out of space and your patience, so I’ll keep this brief. Investors need to own inflation beneficiaries and limit or minimize exposure to the deflation side of the markets, notably Treasury bonds. That is not an absolute statement or a recommendation to sell all Bonds! But it would certainly make sense to own very short-term Treasury bonds, TIPS, Floating rate funds, mortgage bonds or other areas of the bond market that do not suffer as badly during inflationary periods. Total bond and income positions can also be reduced as an asset class decision here. Many investors are just sliding from bonds to owning more stocks. That may not be the wisest choice longer term as you’re really just expanding your exposure to risk assets while valuations are at historic extremes.

Other options to consider with a portion of your bond money are non-correlated assets like commodities, gold, silver, metals, inflation hedges, currencies, alternative funds, hedges, REITS, etc. We’ve talked about a lot of these options in recent posts and are actively engaged in all of these in our portfolios now. Today, for instance, we increased (again) our allocation to Gold/ Commodities/ Inflation holdings from 15% to 20% of total assets in our flagship All Season model. The extra 5% was pulled from our “Income” holdings reducing that allocation from 20% down to 15%. These are conscious, incremental, evidence based, trend following decisions and part of our internal process. For the record, our “Income” allocation was as high as 50% this time last year.

Every investor situation is different and we’re here to help you figure out how to rework your outside investments for the new environment. It’s not too late.

Ramification for Spending Decisions

This one is tough, but there is a bit of an old and dusty operating manual for spending habits during inflation.

First, remember that things tomorrow will be more expensive than things today (except housing and a few others). Cost will become a bigger part of daily decision making and you’re going to have to spend more time hunting for what you want at an affordable price. Appliances are already crazy expensive for instance but there will be deals if you’re patient. Find the deal and buy it when it’s cheap if you can.

Second, get out of the mind frame that you can get what you want, when you want it at a reasonable price. It’s just not going to happen. Supply is constrained globally and that may not be as temporary as some might suggest. Plan ahead, way ahead, and think about what you’re going to need in 6 months. Winter is coming, do you need to order snow tires in August? Maybe.

Third, wean yourself from a life of disposable consumption. This is the classic situation where it costs more to fix or clean something than to just throw it away and buy a new one. That moment in time is gone. This sounds like a comment from the Grapes of Wrath, but the best investment you might make now is a sewing machine and a complete set of home tools. You Tube is your friend for all things related to basic car or home maintenance. We all need to relearn how to preserve and add life to our “stuff”.

Finally, reduce overall consumption. Make no mistake, for many in our country, these are the Great Gatsby days of massive consumption. Many more are already there by circumstance and living hand to mouth. But for those who love to spend, its time to start measuring your spending, identify where your money goes each month and look for ways to reduce excessive or unnecessary recurring expenses. Life is going to get expensive; you’re going to need a lot more money just to cover your same expenses as inflation rises over time. We are doing a lot of cash flow analysis for our clients now through a robust financial process, thanks to our new lead advisor, Will Brennan, CFP. Let’s have the conversation and make sure you’re covered.

That’s it for this episode of Inflation, but there will be more, I promise.

Sam Jones