For most of the last five years, I have been researching rental properties as a potential means of diversifying my own wealth and generating some passive income outside of the financial markets. I don’t really know why other than it sounded like a good idea and I have a lot of friends who do it. Honestly, I struggled to find anything that “penciled out” either in terms of income or total returns. I just couldn’t seem to make the numbers work given purchase prices, rental rates, upgrades, taxes, etc. In March of 2020, the financial markets provided a solution in the form of deeply discounted REIT investing. I am no longer looking for physical investment in real estate and find REIT investing far more attractive. Here’s why.

What is a REIT?

A REIT is a Real Estate Investment Trust that is effectively an entity that owns and operates hard asset real estate and is by law required to distribute to shareholders 90% of net income in the form of dividends. REITS come in many forms, shapes, and sizes covering all types of properties including residential, industrial, retail, commercial, infrastructure, mortgage REITs, malls, and so forth. Fortunately for us, investors can invest directly into REITs or through funds (Exchange Traded Funds and Closed-End Funds). This definition is enormously broad but let’s dive into the details so you can better understand what they are and more importantly, how they compare to owning an actual rental property as an alternative. Spoiler Alert! Our new Multi-Asset Income strategy is a REIT investment strategy and has just completed its first very successful 12 months.

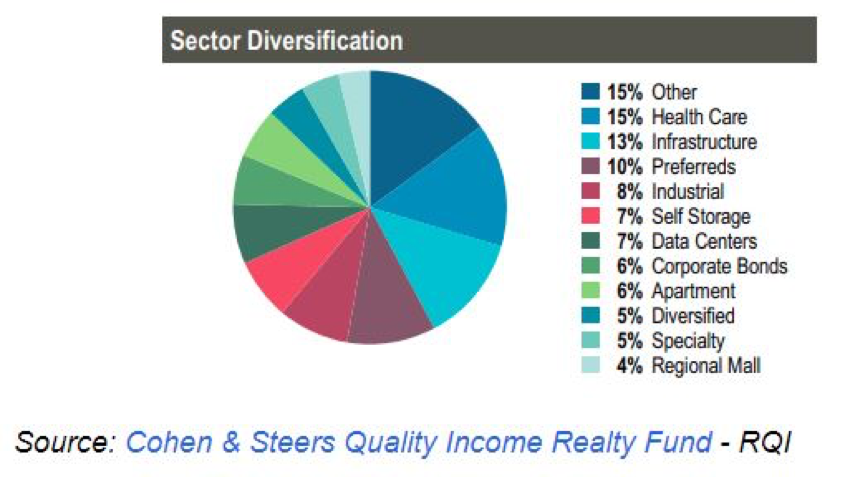

Here’s an example of one (of 33 securities we own) closed-end fund in our MASS income strategy, managed by the venerable and highly experienced folks at Cohen and Steers. Look no further for an all-in-one diversified REIT. This one pays 7.4% in annual dividend interest paid monthly. Wow. In the last 12 months through 3/30/21, RQI has generated a total return of over 60% and is still trading at a discount to Net Asset Value (more on this in a minute).

Size of Investment

If you’re like me, you don’t have unlimited capital to spend on real estate. Buying, owning, and managing rental properties is a deep pocket game requiring several $100,000’s just to get started even with a small residential rental. REITS can be purchased like any stock or fund as a shareholder with minimal investment commitment. You choose how much or as little as you want to invest in REITs. RQI above costs is around $14/ share. Simple, easy.

Sell When You Want To

In my long career of investing, I have come to appreciate the value of total liquidity. Said another way, there is no greater pain than being caught owning something that you can’t sell when you want to. Anyone who was forced to sell hard asset real estate between 2007 and 2010 knows that pain quite well as prices dropped 20-50% across the country with no buyers anywhere. REITS can be purchased like any other public security and SOLD with a push of a button. Note – Some REITS are only offered as private placements and have no liquidity (Avoid these like the dinosaurs that they are).

Steady Income Without Tenants

I rented out our office building on Sherman Street for a short period before moving our company into the space. Keeping the place occupied with tenants that suck the life out of you is nearly a full-time job. I think I had forgotten that pain when I was looking for another rental. I’ll never do it again. Assets held in a REIT or a fund of REITs, receive monthly or quarterly dividends created by the entire pool of properties. Vacancy rates in the entire portfolio might rise or fall a bit with economic cycles, but it would be extremely rare for a REIT to stop paying dividends entirely. Conversely, when your rental property goes vacant for a month or two, that might be your entire annual profit net of expenses and carrying costs. REITs pay regular and healthy dividends for as long as you own them and how nice that you don’t have to take that tenant call at 2:00 AM.

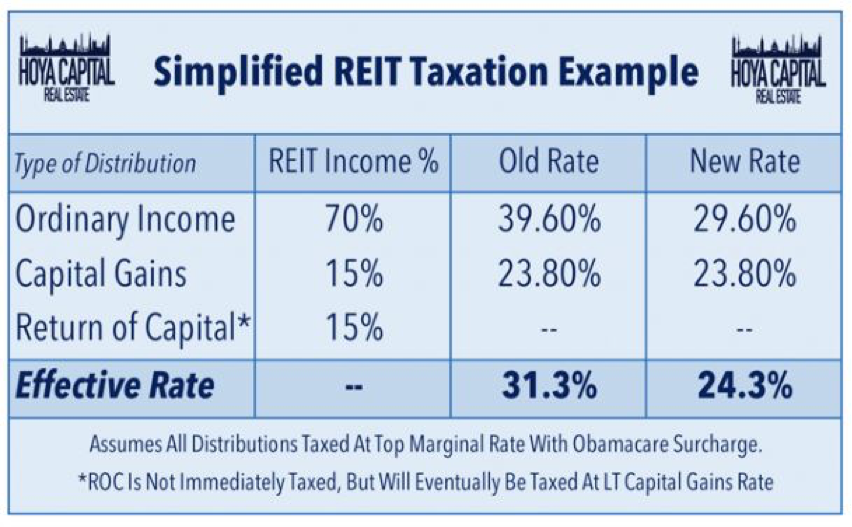

REITS Are Now Tax Efficient

There is a bit of misinformation out there about the taxes and REITS so let’s get it straight. First, read this https://seekingalpha.com/article/4322753-taxman-cometh-reit-tax-myths. The executive brief is that dividend income generated from REITS (direct or in fund form) is eligible for the Qualified Business Income (QBI) 20% tax deduction as part of the Tax Act of 2018. The “yield” from a REIT comes to you in one of three forms; Ordinary Income, Capital Gains, or Return of Capital. Most of the income is “ordinary income” normally which again is reduced by 20% when filing your tax return due to QBI status. Cap gains are taxed at normal rates. So, for high-income earners, the dividends that you receive as income are taxed much closer to long-term capital gain rates after the discount – see the illustration below. This is tax efficient (not tax-deferred to be clear). You can also invest in a REIT with a taxable account or any tax-deferred account like an IRA. Conversely, if you want to own a rental property in an IRA, you’ll need to find a trust company to provide custody services and establish a self-directed IRA with plenty of additional costs to do so. And then there are property taxes, and short-term lodging taxes, and city taxes, and taxes on taxes when owning rental property. Yikes.

Follow the Money

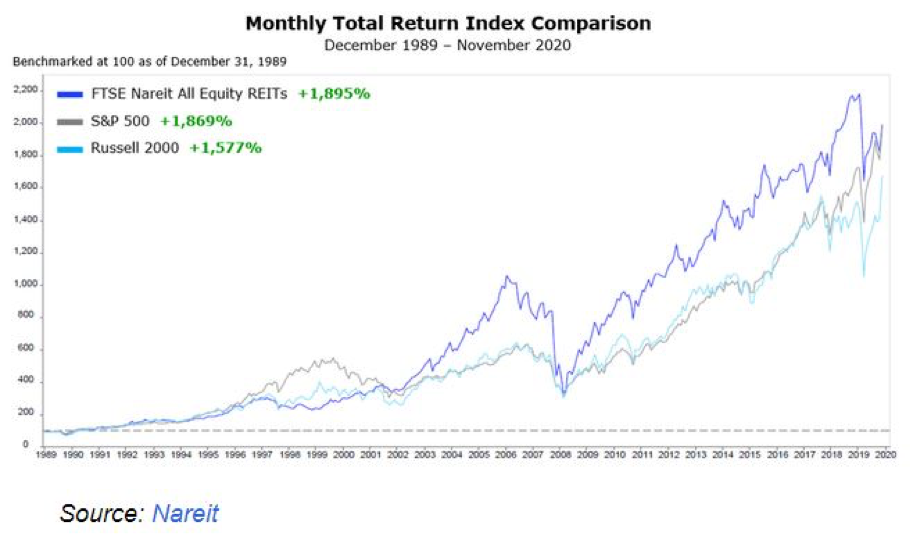

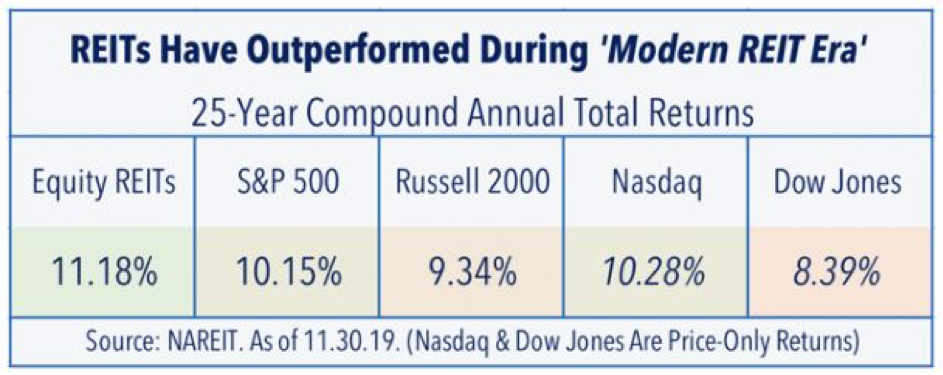

I don’t know how I didn’t know this but REITS, as an asset class, are actually one of the best performers out there for long-term investors. Like any asset class, they are not without periods of decline and loss but over 10, 15, and 25 years, REITs have done better than stocks, bonds, and commodities. Here’s a quick chart from NAREIT showing the index performance versus the S&P 500 and the Russell 2000. For all the lovers of big tech, you should also know that this very basic REIT index has also outperformed the Nasdaq 100 even after internal REIT fund expenses.

I can hear the rebuttal. Yes, this period of 25 years has been dominated by falling interest rates which provide a tailwind to both stocks and all forms of real estate. To that I would reply; One more reason to own Real Estate in REIT form rather than rental property which is subject to just as much risk of rising interest rates but with near-zero liquidity. For what it is worth, industry statistics say that rental properties generate between 2-5% net of all expenses on average. I’ve heard people talk about bigger numbers and seen smaller numbers. All things considered; I think I’d reach for the potential return found in REITS.

REITS Still Trading at a Discount

I saved the best for last. Physical real estate is in short supply for a lot of reasons. We have seen people snap up second homes during Covid. We have seen some buy real estate as a form of wealth preservation fearing the end of the US dollar. We have seen a new generation of first-time home buyers enter the market and most importantly, we have seen interest rates to borrow money go to near zero. The perfect storm for crazy price appreciation! Now, it would be hard for me to say with a straight face that you are going to find a deal of any sort in rental real estate even if you could find something to buy. Prices are elevated, hyperbolic, overpriced in real estate to the extent that I wish I could short my own house. Conversely, REITS are now trading at the second most undervalued condition since March of 2009 – happy to provide the data upon request. Many closed-end funds in the REIT space are still trading at a discount to Net Asset Value, meaning the price of the shares is lower than the value of the underlying holdings in the portfolio. This is the situation now even after prices have recovered substantially from the lows in March of 2020. REITS are relatively inexpensive compared to physical real estate because the market prices of these securities were decimated during Covid, down 70-80% from their highs. Hard real estate only paused and then exploded higher with little to no price damage along the way. I will say this plainly. There is still significant opportunity left in REITS and very little price potential left in physical real estate despite the arguments of short supply. Investing in a REIT is a post-COVID opportunity, especially as we all get back to work in commercial space, fire up industrial space, and go shopping at the mall. I think we’ll look back in time and recognize that Investing in hard real estate was probably a better bet pre-COVID.

Multi-Asset Income is Our Solution

We created the MASS income strategy for our clients in March of 2020 when it became obvious that REITs were going to present one of the best investment opportunities of the decade after COVID. The strategy does not invest exclusively in REITS but a combination of REITS, preferred securities, high dividend-paying stocks, high yield mortgage, and credit bonds. We have 33 positions with an aggregate annual dividend yield of 6.82%. As we approach the end of its first year, MASS income has generated an impressive total return. Numbers will be available in the next few weeks after calculations are complete from our third-party provider.

This program is not a bond strategy but a fully diversified, k-1 free, completely liquid, Multi-Asset growth and income strategy. Yes, it’s all that! Finally, we are also recognizing that the return stream generated from MASS Income on a weekly and monthly basis has one of the lowest correlations to the return pattern of the markets and many of our internal investment strategies. This program is a true diversifier to your portfolio! Assets in the strategy have ballooned to $10M in very short order. My conviction is high that this will be one of our best performers for the next 3-5 years and would invite a conversation with any and all regarding a potential investment within your portfolio. We’d be happy to provide detailed information about holdings, performance, and the asset allocation to any upon request. The door is open, welcome to our house 😊.

Thanks for reading

Sam Jones