The Next 24 Months Will Make AND Break Investors

With few exceptions, almost every asset manager on earth has struggled to keep up with the S&P 500 over the last 5-6 years. But the tide has turned. Index strategies are now lagging, active managers are putting up some very nice returns and we’re thrilled to be back in the driver’s seat. This is happening as it does historically, during recessions and when bull markets come to an end.

The Big Picture – Still in Recession with Stocks Carving Out a Long-Term Top

Regular readers know that we are still operating on the thesis that the US stock market is carving out a significant bull market top. This process, and it’s always a long and painful process, began in January of 2018. The growth rate of the US economy peaked in the fourth quarter of 2018 at 3.2%, fell to 2.3% by the end of 2019 and finally went negative in the spring of 2020 (recession). Today the US economy is still in recession on a year over year basis (-2.3%)! From the stock market’s perspective MOST of the conditions that precede major tops have also been developing since 2018, including the absurd concentration of gains among a few tech stocks (FAANG) pushing the technology weighting in the S&P 500 to an extreme of 26%. We have also witnessed two mini bear markets in 2018 and again in March of 2020 illustrating clearly that prices are not secure while gains are hard earned. The Fed and the US Treasury department have been working overtime to support a paper economy built on short term stimulus via corporate tax cuts, and unprecedented monetary and fiscal stimulus. The stock market has thus far, avoided a longer, more protracted bear market as a result. From our technical perspective, one of the key conditions that has been missing in the topping process, until now, is unbridled speculation and frenzied buying of stocks. Now we can add that to the pile of evidence. More than a few times this week, I read or heard, that earnings and fundamentals don’t matter anymore. After all, what value is a Price to Earnings ratio (P/E) when many stocks are trading over 1000 x 12-month trailing earnings (like Tesla which was unfortunately just added to the S&P 500). Rampant speculation is probably the most pronounced hallmark of every major top in stocks. Prices can continue higher but much depends on trends in COVID and the associate response from the Fed to reup their support for the economy. Ultimately, like gravity, the current level of the US stock market and the current state of the US economy (earnings and fundamentals) need to reconcile as the gap between the two remains at an extreme.

As 2020 comes to a close, it seems somewhat obvious to us that trends are going to strongly favor those who can still make money away from the winners of the last several years. We’re ready, willing and able. We have provided our Game Plan for the Remainder of 2020 https://allseasonfunds.com/game-plan-for-the-remainder-of-2020/ to regular readers who are trying to do this themselves. Have at it, but you’ve got to have the discipline to stick to the plan from here on out. The next two years will have far fewer opportunities to make money but they do exist. In the Bear market of 2000-2003, the S&P 500 lost a cumulative total of 46%. Our strategies made money in each and every year of that bear market. We see the same set up and believe we have the same potential with a clear path of what to own and what to avoid. Here’s a chart of that bear market period (2000-2003) with the S&P 500 shown in Green and results of our flagship “All Season” Strategy, net of all fees, shown in Red (please review our composite performance disclosures).

Economy Getting Weaker Again

In the last several weeks, we have seen a slew of economic reports indicating that the US economy is getting weaker again after recovering nicely over the spring and summer. Double Dip Recession headlines should not be confused with the reality that we never emerged from recession. We are simply bouncing down a flight of stairs economically speaking.

So, the obvious question and cause for concern is this. If we are in recession and economic conditions are now getting soft again, what in the heck is the stock market doing trading at all time new highs?

Great question!

Answer: The stock market will likely retrace back to reflect actual economic conditions. “Fair Value” on the S&P 500 is shockingly -42% lower than the close on Wednesday. When does that start is anyone’s guess but January of 2021, would fit the historical pattern.

The Critical Takeaway

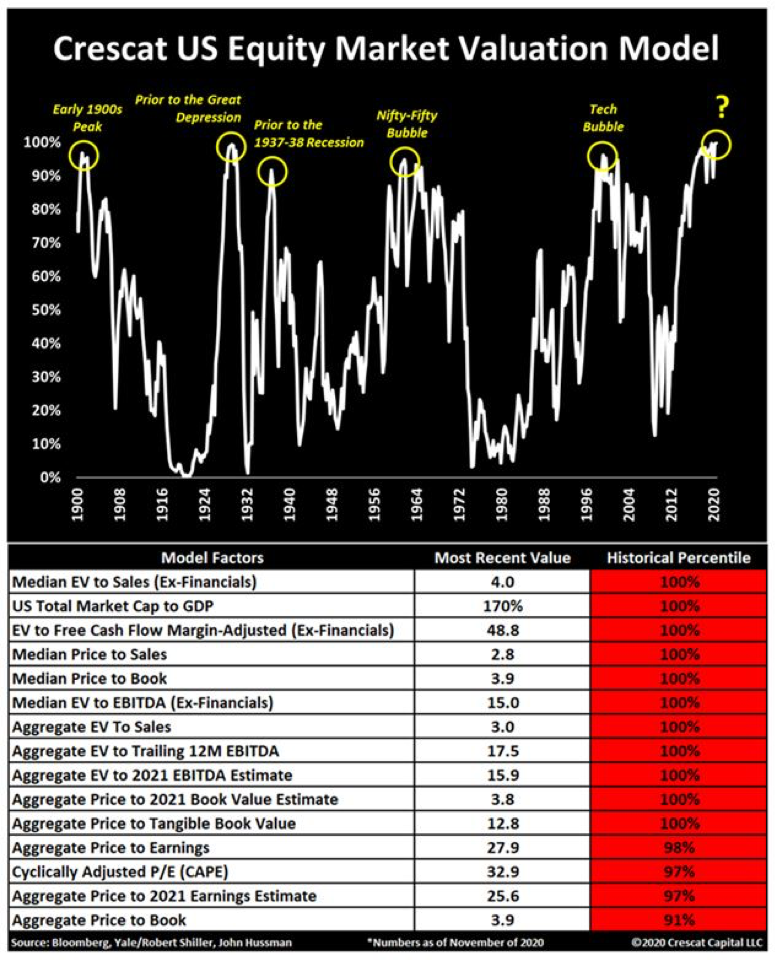

The US stock market in aggregate is very suddenly in an unstable condition both in place and time. Prices and valuations have reached 100% on practically every measure. Crescat Capital provided this very clear picture using their Equity Market Valuation model to illustrate how market valuations are literally at their fullest from a historical perspective looking back over 120 years. Prices have almost never gone higher from here without a dramatic improvement in earnings or the economy.

Lots of Red on the right-hand column. Last time we were here were the previous major bull market tops marked by the yellow circles.

Many Opportunities to Continue Making Positive Returns

To finish on a positive note, we are wildly bullish on our own strategies. We think our method, process, experience with bear markets and recognition of where risk and return live looking forward, present us with an incredible opportunity to outperform. As we move into 2021, active, risk managers like All Season, are positions well to find new leadership, invest in non-traditional asset classes and continue making positive returns. At the same time, we would strongly caution decision making based on past returns, especially those of the last 5 years. We invest today for the future, not for what has happened in the past. The next few years will look nothing like the last decade. We’re glad you’re with us. Please feel free to reach out to us if you have questions about any unmanaged, outside accounts, 401k plans, etc. If you’re approaching retirement, I cannot think a better time to evaluate what you own and potentially reposition for the next cycle. Please let us help you.

Limiting Our Total Households served to 250

After careful consideration, we have made the corporate decision to limit our total number of households that we serve to 250. There are many reasons for this decision. But most importantly, we want to stick with our business model of being a smaller, specialized wealth management firm serving higher net worth families with sophisticated asset management offering and cost-effective team of professionals in tax, estate and financial planning. We are choosing to stay at a size that does not compromise our service offering or our ability to know you and your situation in detail. This is who we are. Today we serve 207 households and we want to serve the friends and family of our existing clients by preference. If you have friends, associates or family who are need help and are interested in our joining our firm, our door is open, for now.

I hope everyone had a wonderful Thanksgiving in whatever form it happened!

Cheers

Sam Jones

President, All Season Financial Advisors, Inc.