Good Americans are sitting on more cash right now than any time in the last several decades. It’s hard to get your head around this with unemployment sitting at 6.1%, wage increases flat, and the under reported cost of living rising now at 4-6-8% annually. But this is what happens when the US Gubermint sprays the economy with nearly $7 Trillion in cash and puts a delay on your required payments like mortgages, rents, and other costs. America is flush with cash. What a great moment to consider your alternatives.

Idle Cash

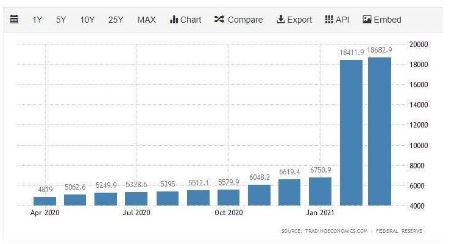

There are lots of measurements of cash in the economy. One of them is labeled M1 as the most liquid and common forms of cash. These include checking and savings accounts, ready deposits, and Travelers Cheques (I know, who has Travelers Cheques?). Look at what has happened thus far in 2021. M1 is now $18.6 Billion to be exact, up from $6.7B in January!

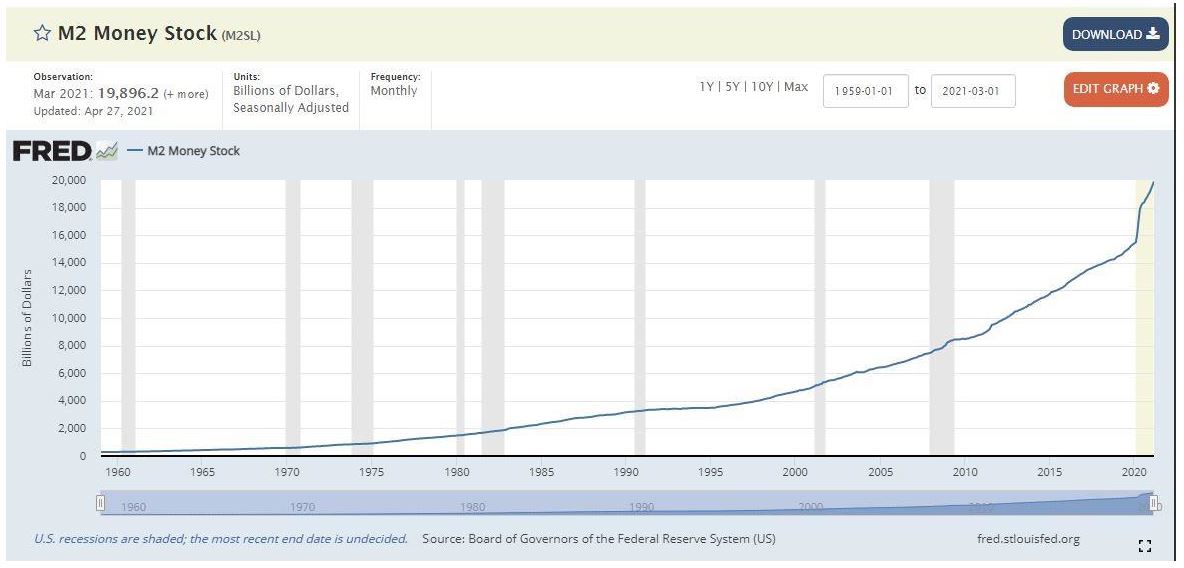

But that’s not even the big number. M2 adds to M1 by money market funds, CDs and other semi liquid forms of cash that are held in short time frames.

Wanna guess?

Did you guess $20 Trillion?

Notice the hockey stick type advance in the last 12 months associated with all the Federal Stimulus. Also notice the rising line since the 60’s.

Ok last one

This cash and assets held in money markets are simply not moving. There is something called the Velocity of money and it measures how often a dollar moves around the economy and circulates. It is a measure of economic activity, investment, and general commerce.

Notice the steady decline since the year 2000 and the near cliff in the last 12 months on the right side of the chart. All of this cash is not moving! I won’t go down the rabbit hole to far, but this is what happens when Federal stimulus effectively replaces economic activity as it has very clearly since the first days of QE in 2000. This cannot, should not, continue for many reasons. The primary reason is the unintended consequence of very high inflation which we’re seeing play out now. Inflation requires us to use more money for the same products and services. In the process, we’ll see the Velocity of Money turn up now, but not really in the good way. Hopefully, we’ll see real economic activity develop at the same time but so far, it’s nothing compared to the monetary influence of massive federal cash infusions…. But I digress.

The remainder of the update is devoted to those carrying great gobs of cash. I want you to consider the realities of sitting on cash for extended periods of time as well as the various options you might consider in the current environment.

Realities of Carrying a Lot of Cash

I have said that cash gives you options and that is true. Cash is an option. The option to buy anything at lower prices. Cash is also a risk control asset, meaning it’s there for you rain or shine to cover future expenses giving your investments time and space to rise and fall without worry. How much should you carry in cash? You’ll hear different answers but the rule of thumb is 6 months’ worth of your living expenses net things like social security or other secure forms of income (do not include your wages, investment income, rents or other things that are not secure).

But cash is also an unproductive asset. It earns nearly nothing and actually loses value relative to inflation. Today, we heard that inflation is now 4.1% with the change in PPI and other measures hitting levels we have not seen since the 80’s. It’s sort of ironic that we’re also hearing stories of gas lines and empty filling stations. Inflation will push up closer to reality in the next couple years. I’d guess we’ll land somewhere close to 7-8% as an annual rate of inflation by 2023 and the Fed will be in full panic. Cash earning zero minus a 4% inflation rate = negative 4%. You are losing 4% of your wealth on all cash assets annually at this point in time. The same argument can be made for those carrying cash and large debt at the same time. Debt is an expense and cash can reduce that debt. If you have nothing better to do with your cash, by all means, pay down your debt! Some find comfort in looking at a big bank balance. Personally, I hate it, makes me uncomfortable knowing that I’m hurting myself, my family, and my purchasing power later in life. My students in High School finance would know this as negative compounding and something to avoid.

So, let’s keep that 6 months snug in the bank and seriously consider options for all the rest.

The Obvious Choice – Invest Your Cash

I talk to different households every single day. My sense is that there is a lot of mistrust out there now about the financial markets. This is what I hear in various forms of commentary.

- The stock market is just gambling

- The market is rigged against investors and only benefits Wall Street

- The market is going to crash, why would I buy now at these valuations?

Ok, let me pick this apart by stating a few facts.

- There is risk in everything, everywhere, always.

- We avoid things we don’t understand or don’t control directly.

- Investing is only gambling if you invest like a gambler. I’m a terrible gambler.

- Financial markets are actually more predictable than you think.

- Investing costs have never been lower in history.

- There is more investible value in today’s market than any time since the 70’s.

- The globe is recovering from a pandemic and about to start spending.

- You can build a portfolio of securities that pays dividends and interest above the rate of inflation (~7%) right now.

- Market declines are opportunities to invest cash – We’re in our first correction of 2021 now.

- You will be alive for a long time.

- Inflation is going to be higher and more persistent than you think looking forward.

- The stock markets of the world will be higher 10 years, 20 years, and 50 years from now.

Seriously, it is high time to stop making excuses for sitting on piles of cash.

If I were sitting on a lot of cash (which I am not and never have), I would consider two approaches to getting invested in the markets here.

- I would give myself permission to invest some portion of my cash every month. That way, I’m not just picking a day or time and plowing it all into the markets. You will buy monthly and maybe your investment options will be available at a better price over time. You can try to game entry points for individual securities doing it this way.

- I would spend time building a complete portfolio of investments across non-correlated securities with an appropriate mix of growth, income, risk controls, passive strategies and active strategies. I would deploy all of my excess cash all at once to this mix. This is my strong preference.

We can help with all of this of course.

Buying real things like land, real estate?

I just got my appraisals from the tax assessor’s offices for our real estate holdings. Oh my, taxes are going up, up and up. The costs of owning and operating real estate are sharply on the rise (replacing broken stuff, taxes, new roof, insurance, Utilities…). No one talks about this in the real estate world. Instead, we focus only on recent sales (high!) , Inventory (low!) and the historically low interest rates (affordable!).

Let’s remember a few things. Homes are a place to live. Think about spending your money on things that cut your living expenses. How about solar, how about Xeriscape? How about smaller home? Want to buy a rental property or commercial building? Fine, just make sure it’s generating enough free cash flow after all expenses to beat inflation (let’s call it 6% annually). Land, same thing. It must be income producing enough to beat inflation plus taxes. Ready to buy a farm? Inflation forces our assets to either grow or earn interest. Real estate prices do tend to grow over time looking backwards at least. Rental property can also produce income annually if you have good tenants always. Both are positive and could be considered as a productive use of cash but there is now a larger hurdle for that growth and income and don’t forget to include all carrying costs over time in your calculations.

Investing in a small business?

Maybe, I like this idea but know that these deals rarely work out for the “angel investor”. How many times have I heard, “My buddy is starting a business and wants me to invest”? Uh no. Mostly because this little venture will possibly destroy your relationship – and your capital, most likely.

Private equity and venture capital done right can be productive but this is the domain of investors with very deep pockets, giant risk capacity and very long periods of time without the need for income or returns. Is that you? This is also the part of the economic cycle where you might be exposed to that new start up company that is “talking about going public” outside of a private equity firm. You might have heard about this from your successful friend who does this sort of thing. Indeed, there is a wide spectrum of companies looking for private funding, showing fabulous proforma spreadsheets with 300% growth rates and sky-high valuations. You’ll be asked to invest six figures for 1% of the company value which they will dilute with additional share classes in the years to come. Again, you might consider taking a position here but only with an amount of money that you simply don’t need for 10-20 years and have no expectations for growth, income or returns in that time frame. The goal is to own a part of the next Amazon at the ground floor. Maybe it will work! But with lots of experience here, I would suggest using taxable dollars for these investments. At least you can write off the loss if you never see your money again.

Fund the Future

Something that isn’t discussed often are the priorities of using your discretionary dollars. Cash should first be used to fund three things that will definitely happen in the future. These are your own retirement, college costs for young children, and Healthcare expenses as you age. All of these things are tax deductible to you today through retirement plan contributions, 529 college savings plans or Health Savings Accounts (HSA). Funding these provides for you and your family in the future and saves on taxes today. I scratch my head when I see a household sitting on piles of cash with no assets in these three groups when you know with 100% confidence that you’re going to need them. You’re really going to have to do some hard explaining to me to justify why these three are not fully funded each year if you have the cash to do it. Need help building a retirement plan for your small business? Call us. You can put away nearly $58k/ year of income for your retirement and reduce your income tax bill. I would do all of these things first before entertaining other taxable options in or out of the financial markets. Again, we can help…. If you ask.

Thanks for reading!

Sam Jones

President, All Season Financial Advisors