As we hurtle through time towards September, I have a familiar sense of dread. Late summer and especially the fall, is historically a tough time for investors. I doubt this year will be an exception but the market’s “I don’t care about anything” mentality seems to be the only dominant trend. As such, it is clearly time to make a plan to capture some of the enormous gains generated since March with an eye towards the next set of developing opportunities. This is what we’re seeing and planning now.

COVID 19 – The Accelerator

I’ve been thinking about the lasting impacts of COVID. Without knowing the end of the story, it’s pretty obvious that the global pandemic has served as an accelerant to trends that were already in place socially, politically, economically, and in the financial markets. I’ll give you a few examples but you probably already feel these yourself just through observation.

Our entire education system, both public and private, was not providing quality workers and employees with the skills necessary for the modern workplace. Since 2012, “Quality of Labor” has consistently been the highest concern for businesses of all sizes in surveys. In fact, this concern has routinely been listed above taxes, poor sales, and regulation. In the last two years, “labor costs” were the only category to challenge Quality of labor as a top concern for employers. Without pointing the finger at any specific educators, we need to do better. COVID is shaking the tree of our education system. They are being forced to take a critical look at what is being taught, how it is delivered, and the affordability for all. We’re already seeing costs come down in private schools and that will continue as families struggle to justify spending huge tuitions for anything other than full-service, in-person education. Public schools are finally stepping fully into higher-tech learning modules after dabbling for the last decade or so. This is not a bad thing as they will ultimately provide a better, more relevant education at a lower cost per pupil. These trends are accelerating. Good!

Related to the economy we’re seeing some companies accelerate toward their own demise, while others accelerate toward their full and best selves. For years, I’ve wondered how some companies, even industries, continued to stay alive (big box retail in Malls, Coal, Airlines, and even Non-Lending Banks). COVID is forcing some out of business or fold in with more progressive peers. Others are having to reinvent themselves. Certain companies are taking enormous market share, as their business models are tailor-made for this environment (Zoom, Amazon, renewable energy, cybersecurity, etc.). COVID is an obvious accelerant for both death and birth within the business world.

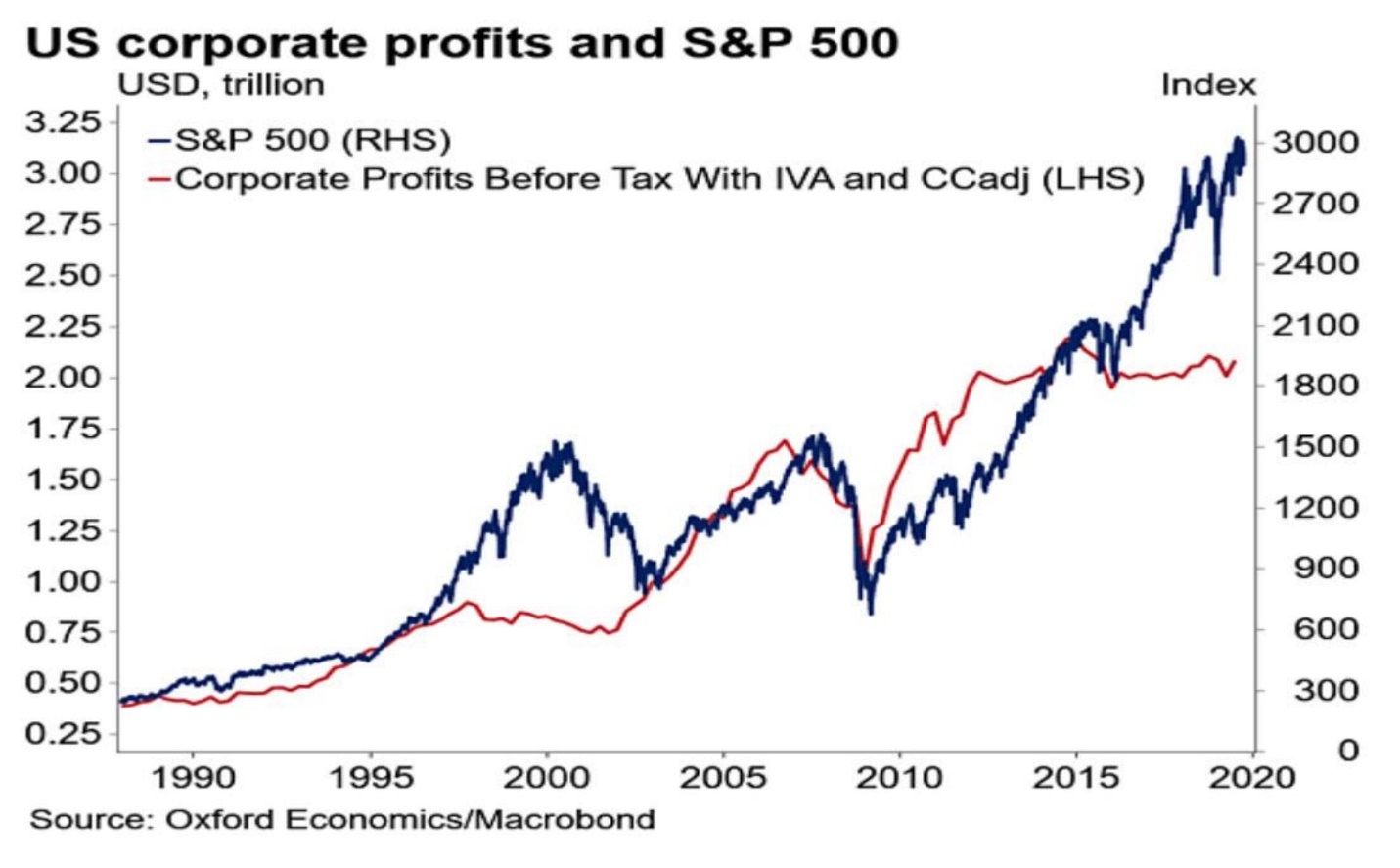

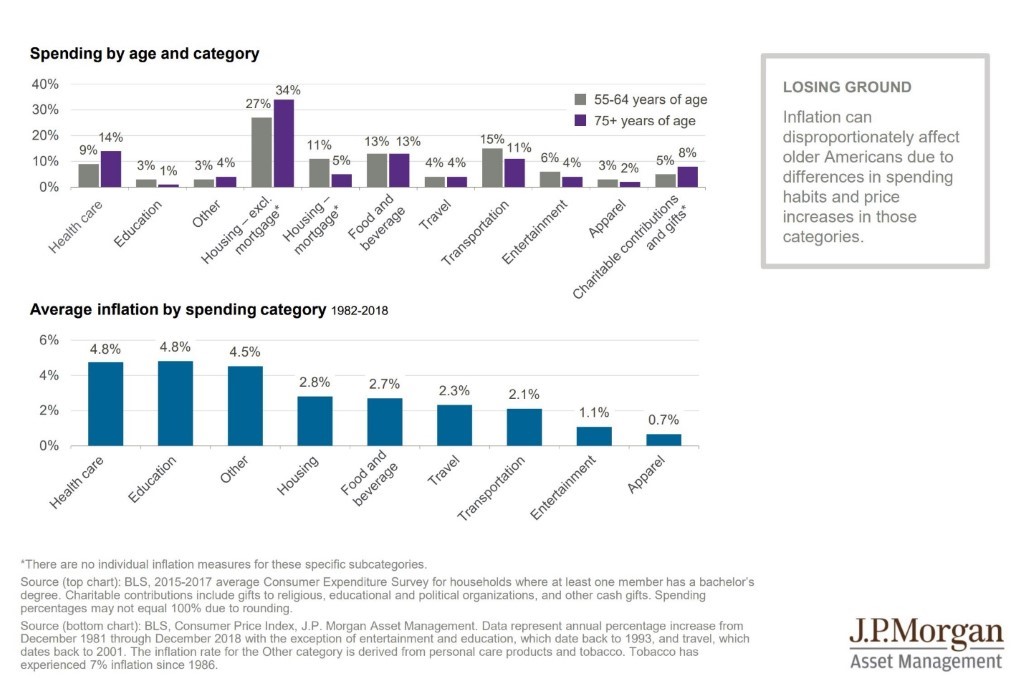

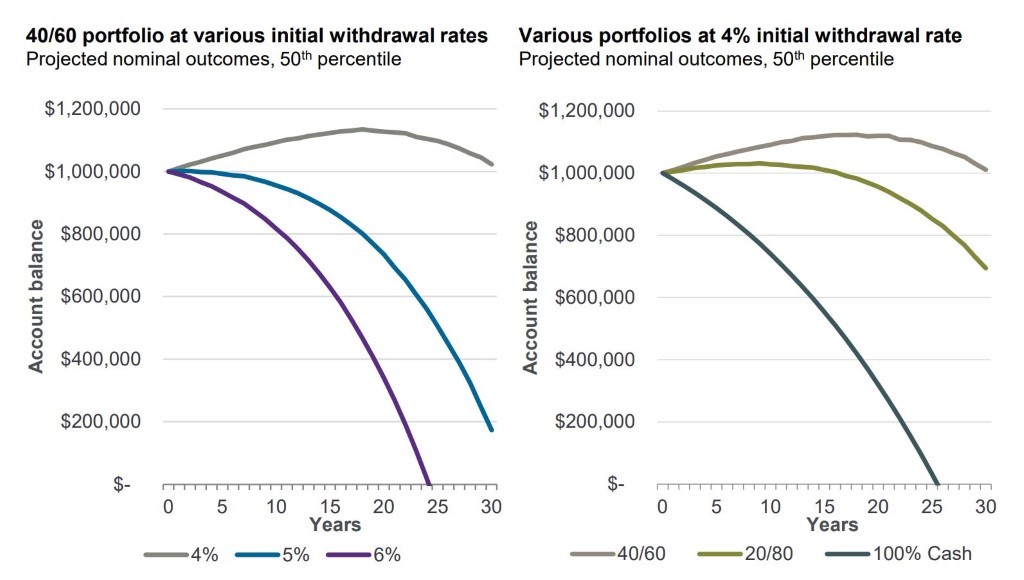

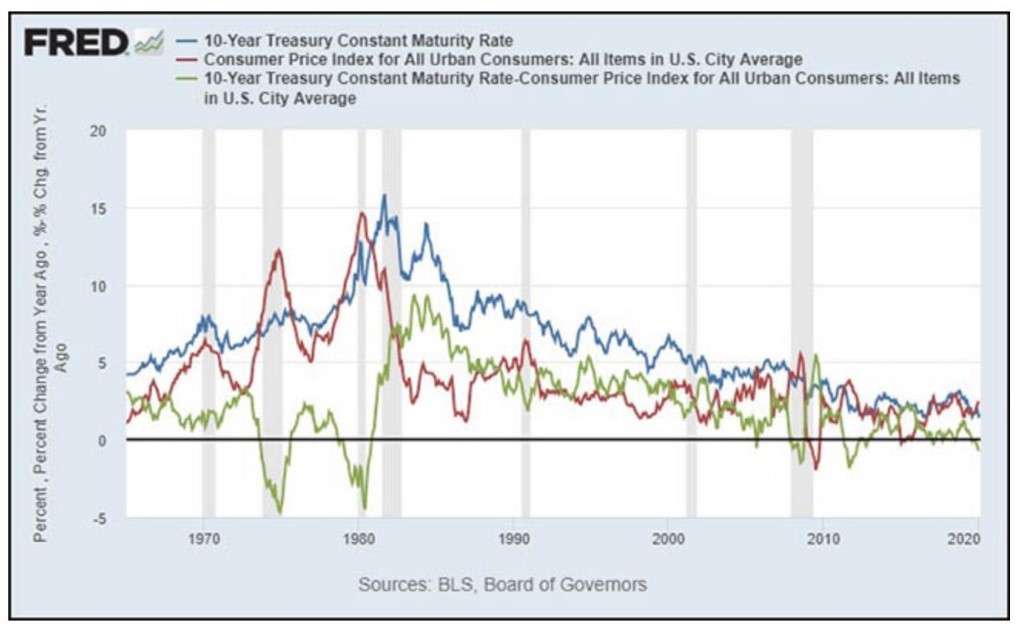

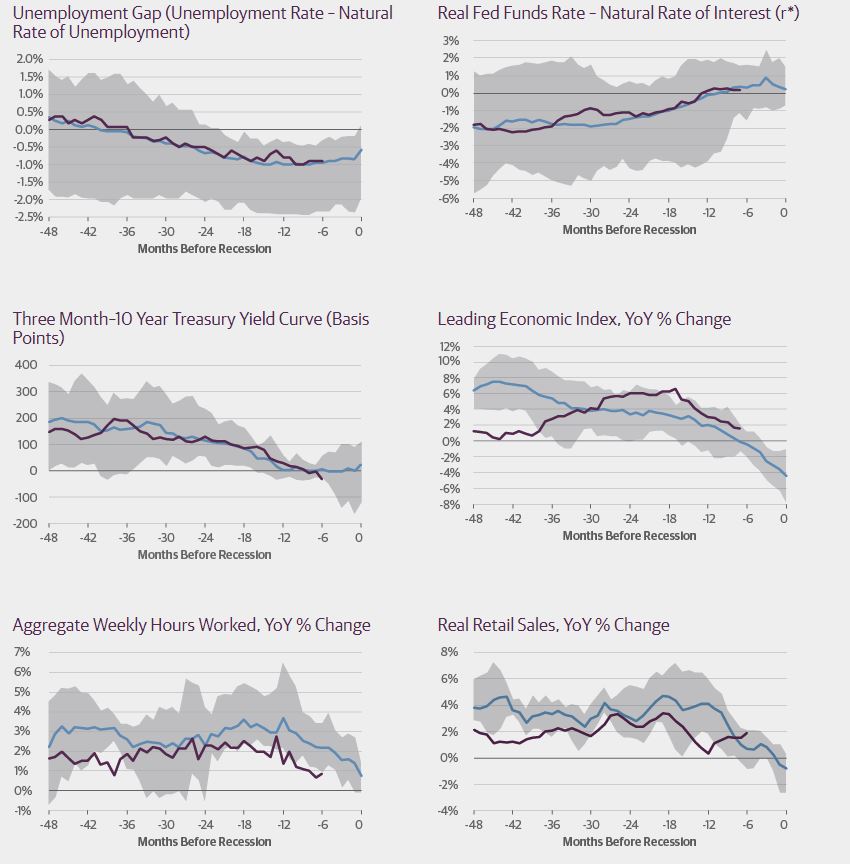

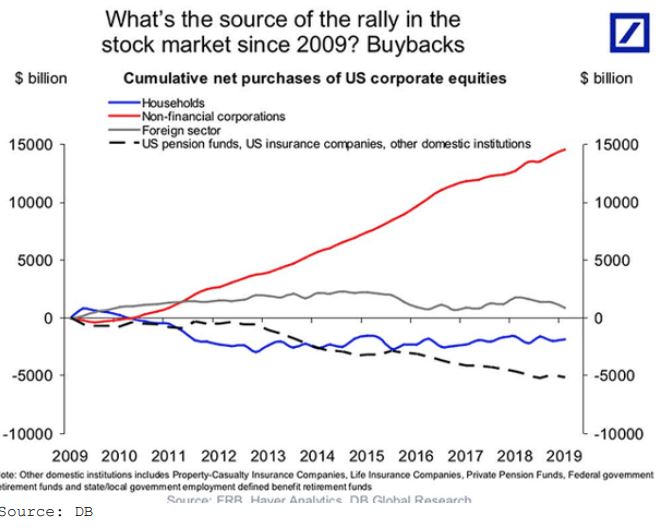

On the macro side of things, COVID is also accelerating the Fed’s response to the financial crisis in a way that is both unhealthy and unsustainable. The form of Federal stimulus during the economic crisis has evolved slowly since we left the gold standard in 1971 from a fiscal system that was supporting business and employment through public works, to a monetary form of injecting cash into the hands of investors, companies and bailing out those in debt. The printing press of US dollars has never really been idle since the late ’60s and now we consequently find that a basic home costs $500,000+ and interest rates have been pushed down to zero with the potential to go negative. Money is becoming worthless, thus the sharp rise in Gold, Silver, Bitcoin, hard assets, and other stores of wealth. Inflation is here (although wildly understated) and coming on strong. There is almost no way around it. Another $2 Trillion stimulus is coming as we accelerate toward some form of Debt Jubilee. I don’t have good feelings about the end of that story, but we’re getting there fast.

These are just a few examples. There are many others on the social and political side that are a little too hot to touch in a public blog.

The Plan

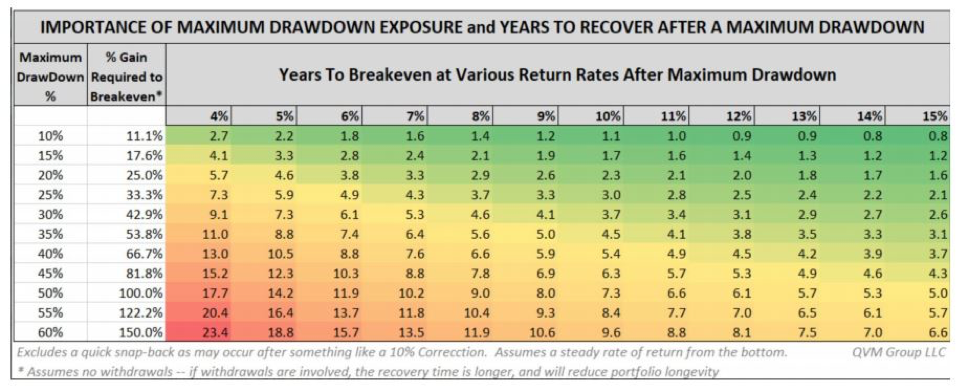

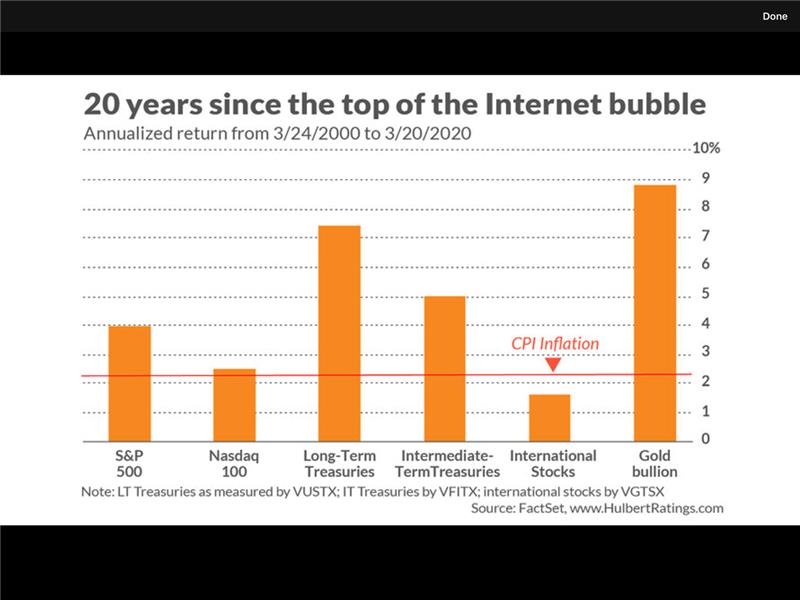

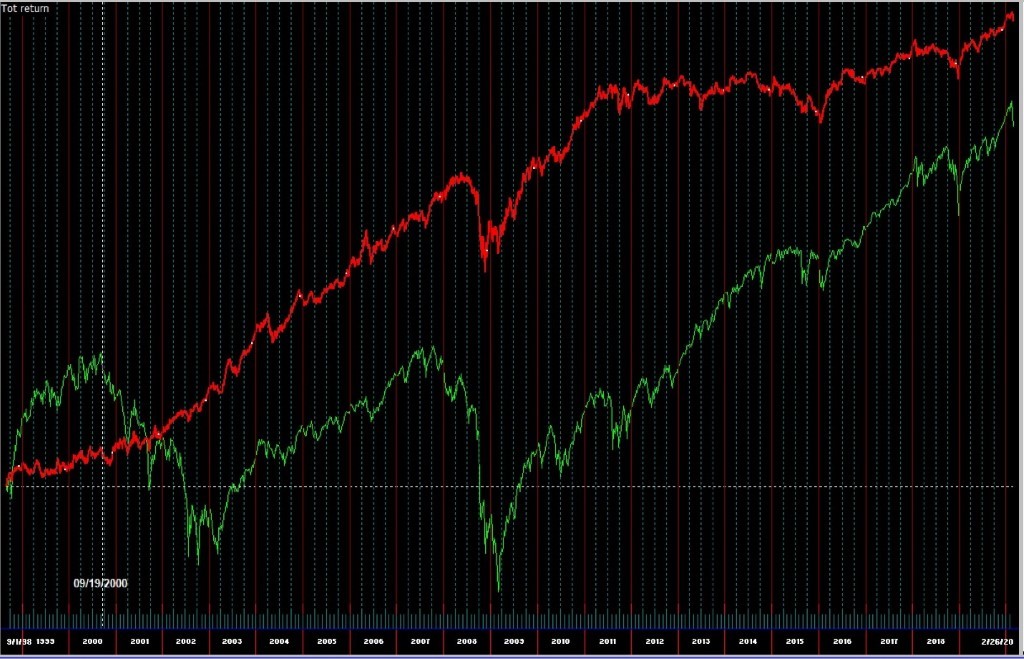

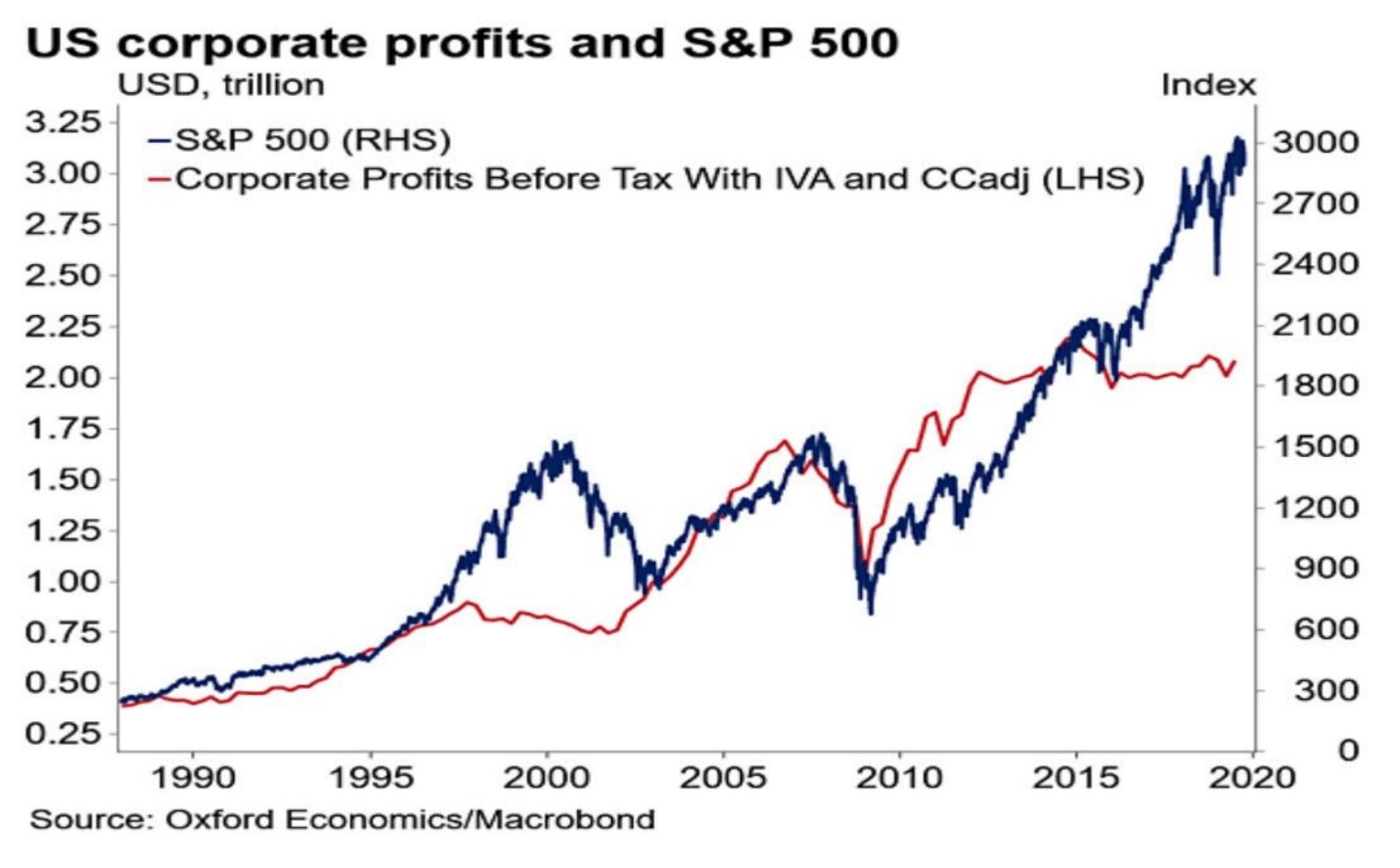

We’re having a good year and our investment strategies are in great shape YTD both in relative and absolute terms. As promised and ordained, the market has become more difficult starting in the first week of August, as it prepares itself for the fall, election madness, and the inevitable profit-taking that comes after a 50% meteoric rise in prices off the lows in March…. during a global pandemic…. with negative GDP ?!??. Technology and growth sectors have been the source of most gains but are now seeing some early profit-taking and increased volatility. We are actively cutting exposure here. Other gains have come from the safety trades like precious metals, bonds, high yield corporates, and recession sectors like healthcare and consumer staples. As the impact of the pandemic on economic activity has become “less bad” in August, the market has shied away from the defensive trades a bit but not so much that we have triggered hard sells yet. Most of our defensive positions had grown beyond their target allocations, so we simply pared them back to a normal allocation size. Some call this rebalancing, we call it prudent and timely asset management. Internationals, specifically positions in Asia and emerging markets, continue to impress us buoyed by price trends, fundamental valuations, and the tailwind of the falling US dollar. Europe not so much. So, we’re holding tight with our non-Europe international exposure for now. Most of what we’ve done in the last two weeks ahead of the September deadline is to take profits leaving us with a larger than normal cash position. So where are we looking to deploy this cash? Great question.

The Next Set of Opportunities

As usual, I’m going to get myself into trouble forecasting but we’ll do some now anyway because the set up seems obvious (Ha!).

There are three main opportunistic themes that we have discussed in the last several years:

- The resurgence of “value” over “growth”

- International stocks over domestic stocks

- Going long inflation hedges like gold, silver, and commodities.

Today, trends in 2 of the 3 are already in place. They are the international trade and the inflation trade. Precious metals and inflation trades are in new bull markets– buy pullbacks! Internationals, especially emerging markets are a lower conviction trade for us, but the valuation and price trends are healthy. We are buying pullbacks and reaching for full exposure here after years of very light allocations. The Value trade remains elusive, but I think we’re getting close. Where do we find value you ask? Well, this is tricky. Everything that is still trading at its lows of the last 12 years might look like a “valuable” investment. You must look at this space with a very critical eye because some names, sectors, and industries are just on their way to zero (a.k.a. value traps). Others are truly undervalued, overlooked by a market that just can’t get enough Tesla at $1700/ share. There are some sectors that are starting to look attractive. One such sector is the REIT space. Mortgage, residential, and even some industrial REITS that own the telecom infrastructure needed to transition to 5G networking all look like good value here. We’re also seeing some bargains in select energy companies in the natural gas and midstream markets space paying 8-10% yields. Finally, there are quite a few traditional high yielding stocks like the wireless carriers and insurance companies, who are not going away anytime soon. These holdings dominate our fully invested and newest strategy called Multi-Asset Income (MASS income) which is yielding over 7% annually. Pretty attractive in a zero interest rate world.

Other areas that fall into the value camp are industrials, materials, and financials. These are typical go-to sectors coming out of a recession, but it seems too early to really embrace this trade despite some recent strength in August. We’ll keep an eye on these but not ready to hit the buy button just yet.

Note to ALL DIY investors

This is not an easy market anymore. The easy money is behind us as the market has pushed prices up beyond full valuation for current earning and economic activity. As we climb the wall of worry, the market effectively forces you to either step aside and wait, or continue to embrace the risk-on world of the stock market. You really need to make a choice now. I’ve heard those frustrations, as you want your money to be invested productively, but don’t want to do it with stocks. I would strongly caution against piling into the technology winners of the last 6 months. There is a high chance of pain here for the late arrivals. I also wouldn’t give up on your bond and gold yet despite the recent correction in both. In fact, we added a small Silver position yesterday. I would suggest you pick through the REIT world and take a few positions in your favorites here. We’re happy to help our clients with their own DIY accounts if you have specific questions, but be aware that the environment for profitable investments is getting thin and selective so set your expectations accordingly.

That’s it for now – I hope everyone is enjoying the back end of Summer with friends and family. We’re firing up our communications again with Red Sky Reports, new webcasts, and podcasts after a bit of a break as our readers and viewers went on vacation. Please tune in!

Cheers

Sam Jones