Battleground

After a near-vertical rally in stocks since the lows on March 23rd, we have now entered the real battleground. This is the time and place where the ultimate “trend” of the markets will be determined.

Strongest Rallies Occur During Bear Markets

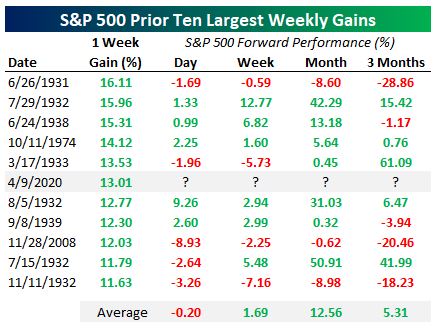

As a matter of simple fact and history, the strongest short-term rallies of all time occur during the worst secular bear markets in history. In the last week, we heard many times how last week’s gains were the strongest since 1974. This is true! To be specific, the strong week of 1974 occurred on October 11th near the end of a decade long bear market. I use the word “near” because the US stock market went on to lose another 20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} after that date to a final low on Dec 6th, 1974. Bespoke pulled this handy table together last week to show the 10 largest weekly gains in history which now includes the most recent event last week.

You’ll notice a few things. Of the 10 events, all occurred somewhere during deep, lengthy, and painful bear markets in stocks. For those of us who study market history, you might also know that 5 of these events occurred very close to the end of each bear market. However, in all but a couple of cases, prices made a new low after the BIG up week. You’ll also notice that 8 of the 10 events including last week, occurred during the Great Depression. Stats like these need to be taken within the context of the company they keep!

US Stock Market Retraced Exactly 50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of Previous Losses

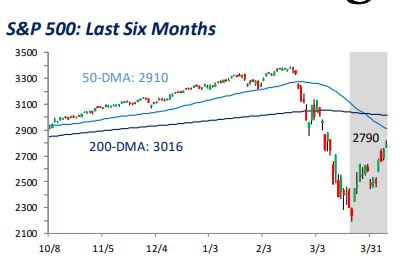

This is sort of a half-full/ half-empty thing. For market technicians who watch retracement patterns, there is some good news to take away from this. A 50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} retracement is pretty strong and could indicate that a bottom is in. A weak retracement of only 38{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} is more consistent with a standard rebound within a larger downtrend. But 50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} is just like it sounds, only 50{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. Now stocks are tired, buyers are getting a little thin and we have pushed prices right up to the bottom side of the falling 50 day moving average which is now around 2876. Yesterday the market tried hard to break above the average but couldn’t do it. Today, stocks closed lower by 2.13{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. This is obviously an important place and time for stocks. They will either blast higher and move back above the averages or see another round of selling and profit-taking as the headlines start focusing on the real possibility of a retest of the March lows.

Bear Markets are Deceptive

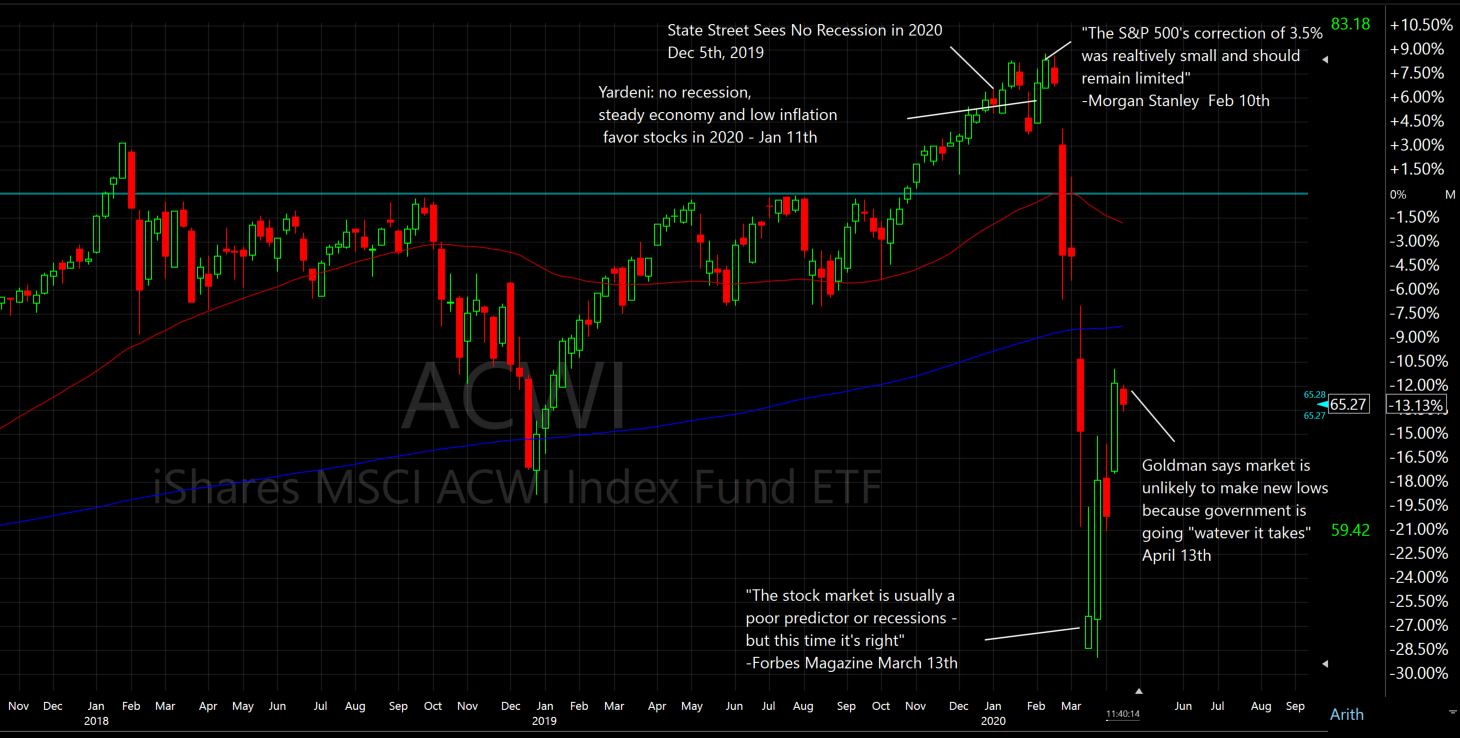

One of the hardest parts of being a DIY investor is that the headlines tend to lead you to believe in a future outcome, only to find that reality does just the opposite. I pulled a few recent headlines from the last 6 months below just to give you an idea.

Before the top in February, you couldn’t find a headline that wasn’t talking about the good times ahead, the enormous gains from the likes of Tesla, or Beyond Meat or any of the other glamour stocks. All headlines spoke of NO SIGNS OF RECESSION. We were scratching our heads as far back as last fall with our many videos and Solution Series broadcasts showing the growing and prolific evidence that the US economy was tracking toward recession well before the Corona Virus hit. The markets were doing a nearly perfect job of forecasting the recession with the inverted yield curve, etc. months and months before the virus was even a thing. Remember the headlines saying the Inverted Yield Curve doesn’t matter this time. Well, apparently Forbes Magazine decided that it did matter after all with their headline on March 13th. The market (stocks, bonds, and commodities) are very good predictors of recession if you just care to understand and believe what you are seeing. On Monday, Goldman Sachs released a big headline stating that the market is unlikely to make a new low because the Government is going to save us. I have no confidence in that reasoning. When was the last time we had a global pandemic and economic coma? Never? 1800’s? I suspect the Fed and Treasury will need to do two or three more $Trillion infusions to keep the life support going. Nevertheless, they could be right. Again, this will be the battleground on which the US stock market will either experience a mild pullback that sets up a very strong move back to the old highs. Or, this will be the top of the first rebound in a long bear market that takes us to new lows. The headlines will drive you to drink, so it’s important to tune into your own system and process for guidance.

Stay Tuned, important days directly ahead.

These graphics are part of our Solution Series webcast which will be delivered in a few minutes and recorded for all. Please join us in two weeks for our next update as new risks and opportunities are developing.

Good luck to us all

Sam Jones