Someone important once said “Never Let a Crisis Go to Waste.” It seems to be especially appropriate now. Let’s dive into that subject looking from the perspective of how and when we might look for the end of this bear market in stocks and how life might change or pivot coming out of this crisis.

Loading Up on Stocks?

I’m sort of amazed at how so many sound so confident in their determination that a bottom is in for this 4-week-old bear market. In fact, it seems those who are hoping for some sort of “I told you so” notoriety in calling a bottom early, tend to be the loudest, youngest, and least experienced – or maybe just desperately hoping? Meanwhile, those who are battle-worn, having been through one or maybe two multi-year bear market cycles in the past, seem to be quietly shaking their heads.

I’m Shaking My Head

In my experience as a professional asset manager since the mid-’90s, I have never seen a bear market end with investors wanting to buy stocks. By the end, people are just emotionally and financially wiped out (we talked a lot about this in our webinar last week). The very last thing they want to do, near the final lows, is to buy stocks. At the bottom, we see capitulation and massive selling because it feels like there is no hope of higher prices. In this cycle, we have a lot of hot money, with an artificial sense of optimism that they can nail the low just in time for a rocket ship ride back up and out to new highs.

Wouldn’t That Be Something!

Others have lost significantly and are desperately hoping their accounts will recover immediately. They hope that if the markets put in a low right here, losses will go away quickly and this whole thing will just be a dark memory without any lasting impact on financial wellbeing.

From our camp, it feels a bit delusional to be willing to say that a bottom is in now (whatever your reasoning) with literally zero evidence and a pile of negative data directly ahead. Today, we have a near waterfall decline in stocks taking the market down 30{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} in four weeks. This has happened before but only in the worst of secular or structural bear markets like the Great Depression. Gold and Bonds are the only things in the world in established uptrends.

I will say that another way for emphasis. Every asset in the world is in a profound and obvious steep downtrend in price outside of gold and bonds. That is the condition of the financial markets, end of story.

Furthermore, today is the 5th of April. In 10 days, we will see the first earnings reports reflecting the 1st quarter. Obviously, the first half of the quarter will look good and the second half will look horrible. Is a 30{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} decline in stocks enough to say that all shocks to earnings are priced in? How about next July when we see the 2nd quarter (April – June) earnings? Has our express bear market of a mere 30{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} priced that in?

Wow, it seems reckless to even talk about a bottom now, let alone actually buying anything with more than a quick trade in mind.

Don’t get me wrong, there are some things that are trading at 15-year lows, that have been thrown out for dead, paying extraordinary dividends and may be showing some signs of bottoming now. We are aware of a few opportunities like these and may start to pick them up VERY slowly and only with more evidence that sellers are gone. But these opportunities are few and far between.

What we see today is that the problem areas of the financial markets are still a problem and may even be getting worse considering the price action last week. These are critically important cogs in the wheel of the financial markets. I’m talking about the credit markets where corporations have accumulated a generations’ worth of debt to fund buybacks and growth plans. This debt lives in the Investment Grade universe of BBB rated corporate bonds as well as junk bonds (High Yield) with lower ratings. Today, the rating agencies like S&P, Moody’s, and Fitch are reluctantly downgrading the bond issuers, forcing sales of corporate bonds, then margin calls, then selling of anything just to cover. Default rates are now on the rise in the High Yield space pushing prices down and yield up toward double digits. The stock market was down a little over 2{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} last week again, but high yield bonds were down almost 5{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}. No Bueno. The stock market will not bottom until I see an uptrend in high yield bonds. Others must be smarter than I am because I just don’t see an uptrend yet.

Another less known area of trouble in the markets lies in the world of Non-Agency Mortgage REITs. These represent the very large pool of lenders that are not backed by the Fed essentially. Agency mortgage REITs are in the bailout package already and those securities are already trading at all-time new highs. Today, we own MBB as an ETF that owns Agency mortgage-backed securities. But the real risk is in the Non-Agency mortgage securities which just made a new low last week like Invesco Mortgage Capital (IVR). The chart below shows an MBB bar chart versus IVR in Yellow. The 800 lb gorilla in the space, Annaly Capital Management (NLY), only has a small portion of their portfolio in Non-Agency mortgages and they are in a world of trouble (down another 12{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} on Friday alone). These are weapons of mass destruction if they are not controlled quickly. Once again, unless we see the Fed step in to backstop Non-Agency mortgage securities and REITS, we’re going to see some serious problems develop in our banking system and we’ve already been down that road in 2008, right?

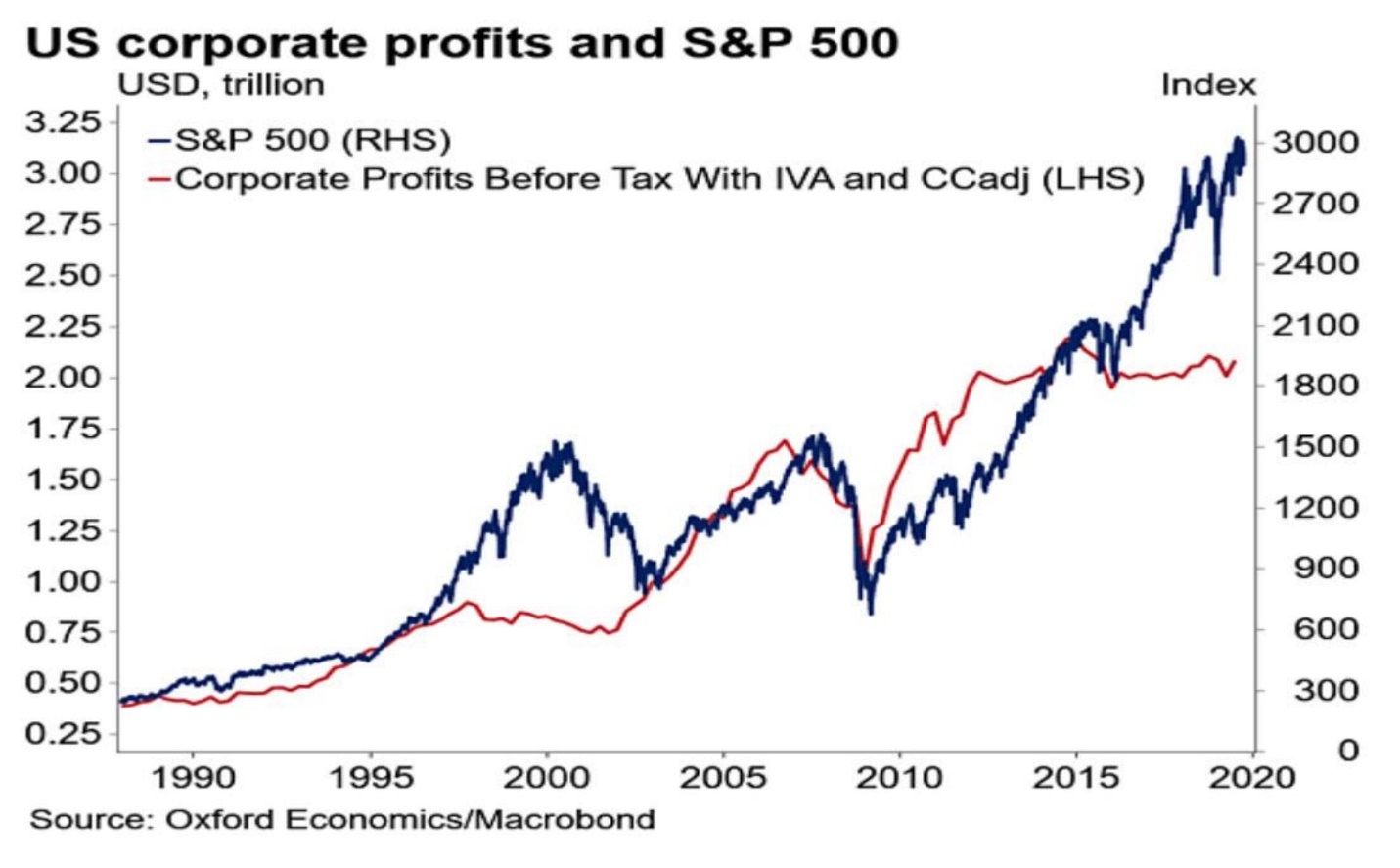

The good news is that this crisis will end, the bear market will end, prices will be at very attractive levels and we’ll have years of opportunity to make big double-digit gains in the markets. But that day will be in the future. Valuations have returned to “fair value” now if we assume that earnings are not going to be surprisingly bad. I suspect, like the jobless claims’ numbers, they are going to surprise us. During bear markets, prices normally overshoot “fair value” by 20-30{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} to the downside. Our estimates show that 1850 (ish) on the S&P 500 would satisfy a normal bear market decline. 1850 on the S&P 500, not coincidentally, marks the price level where current earnings and price will finally come back together after 5 years of share buyback nonsense (chart below). For now, 1850 seems to be a rational expectation for a final low but we’ll be pleasantly surprised, and remain open to possibility, if this bear market manages to bottom at a higher level. For all those who are saying a bottom is in, 1850 is -26{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} lower than the close on Friday. Not a forecast, just doing a little math.

Today, we are positioned well, with most household portfolios down 10{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} or less YTD. The markets are down more than twice that amount YTD (-22.97{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} as of Friday’s close). As we compile our own first-quarter results, we intend to share those in the coming weeks showing the relative performance of all strategies compared to the markets over several time periods. What you will see is that the market’s performance advantage over our risk-managed strategies over 1 and 3 years is now closing, or entirely gone. Passive indexing is giving ground to active, selection-oriented methodologies every day. If history repeats, our strategies will ultimately outperform the broad stock markets on a 5-7-year time frame before the market finds a final low. We see the developing opportunity and we’ll be there ready to be aggressively reinvested in stocks. But we also want to see more evidence, beyond a sensational guess, that prices are done falling and a new sustainable uptrend has emerged. There is no evidence of that condition now.

Can We Use This Crisis to Pivot?

Now, on a more philosophical level, I am wondering about a lot of things. I am wondering how this crisis may alter how we live, our standards, our preparedness for future pandemics. I’m wondering if we might use this crisis to pivot culturally to literally avoid returning to the status quo. What was so bad about yesterday? Well, there was a lot of good, but there is still that massive wealth inequality thing that seems to be shaping our politics and ripping our country into two warring camps of haves and have nots. Consumerism and excess driven by social media reached levels that some would consider grotesque. We are hearing with a little bird song of joy how China’s air and the world’s pollution content are now the best we have seen in decades with the literal shutdown of the world’s business activity. I’m seeing families gather, bond, and almost get to know each other again. There have been more laughter in our house in the last three weeks than any time in the last decade, and I think we’re not alone.

I’m also hoping that we might recognize this global pandemic as a strong reminder that we cannot exist alone in the world. We need other countries to move gracefully forward through good times and bad, including shared knowledge, shared resources and maybe even shared aid. No country is an island on this globe and now we have a global purpose that can unify our goals, rather than building walls.

I’m thinking about climate change and wondering if COVID-19 might pave the way for all countries to finally pivot away from a carbon fossil fuel world to a clean energy world? The next main event for our government will be a New Deal type package that gets America back to work. Today we are keeping the economy and financial markets on life support by spraying the system with cash. But this does not, will not, solve sustained unemployment, bankruptcies, and foreclosures that inevitably come out of every deep recession. We will need serious and massive jobs to act from Congress, a real one, not a corporate tax cut called a jobs act. I hope we can recognize that the Green economy is shovel ready with $Trillions of projects sitting on the shelf waiting for the right leadership and will of the people to emerge. I remain hopeful.

Finally, we can safely say that life will be different after this crisis and maybe in good ways. I see remote working and learning sticking to some degree. Do we really need so much office space? I suspect the bubble in higher education costs has probably burst, thankfully. I see a world that will be better ready to act, earlier and more strictly when future pandemics become known. Life is never the same after a crisis of this magnitude. Let’s not let this opportunity go to waste.

Keep Calm and Carry On… cause we’re not done yet.

Sam Jones