New Power Positive YTD and Still Charging

For those who attended our webcast https://www.youtube.com/watch?v=9-7wG9SPjMM&t=1s on April 29th, you might recall our unbridled enthusiasm for the unrelenting wave of innovative companies that continue to push forward regardless of COVID-19. New Power is the home of game-changers, disruptors, innovators, pioneers, facilitators, and integrators. New Power just turned positive YTD and is tracking quickly to make another all-time new high. Please excuse us while we beat our chest and SHOW you the power of selection and risk management by way of our New Power Strategy. https://allseasonfunds.com/impact-investing/

Welcome to the New Market Environment – Selectivity

We have said this time was coming for several years but we were admittedly early. Now it’s here. Investors must realize and understand that you can no longer simply own a broad market index or a standard 60/40 (stocks/bond) portfolio and expect to make a reasonable return from this day forward. In our view, there is zero chance that the performance of the last 10 years generated by passive indexing will repeat in the next 10 years, perhaps not in our lifetimes. There are just too many headwinds including extreme valuations, index concentration in a handful of overbought technology names, bond returns approaching zero or worse, and the realities of a deep global recession(s). But smart investors deploying active, selective, and risk-managed strategies have the real potential to continue generating positive and consistent returns. This is what we do. We have entered the new market environment where selectivity is king. Winners and losers are pronounced so you can begin to understand that a portfolio that owns winners AND losers (all indexed securities) will simply tread water. This trend did not actually begin today, it began in early 2018 and is simply accelerating now as it becomes more and more obvious.

Our New Power strategy provides a classic case study. Going into 2020, our New Power strategy was almost fully invested. We owned many of the growth companies that were leading then, especially those in emerging tech and renewable energy. As the impact of COVID-19 began to shake the markets in February, a new group of “virus” trades quickly assumed leadership including gaming companies like Electronic Arts (EA), Activision (ATVI), and NVIDIA (NVDA). We bought them. We also saw select biotech companies like Gilead (GILD) and Regeneron (REGN) take the lead as they worked toward a vaccine. Finally, we found new leadership in household technology tools like Zoom (ZM), DocuSign (DOCU), and Spotify (SPOT) that get a lot of daily attention while we collectively evolved toward a more remote workplace. When the broad market was falling 5-8% a day, our New Power strategy did raise some cash but not more than 30% as we simply upgraded positions to the new leadership (aka selectivity). Now, as the market has bottomed, we have more things to buy than cash. We remain fully invested and have found even new leaders in companies like Beyond Meat (BYND), Fiverr International (FVRR), Twilio (TWLO), Redfin (RDFN) and Zillow (ZG). From the beginning of the year to the final lows in March, our New Power model lost -18.8% compared to the broad market losing -30% plus.

Today, from the lows on March 23rd, New Power has fully recovered losses (+22%), is positive YTD, and generating healthy gains daily and weekly. Comparatively, as of the close yesterday, the S&P 500 is still down -13% from the highs in February, down -9% YTD, and has only recovered only 60% of the loss incurred in the first quarter.

This is a story about how selectivity can serve as an excellent risk management tool. If we are willing to put up some volatility, we can work to remain fully invested in all markets, stick with leadership, and watch our money limit downside losses and recover faster. We don’t have to be market timers; we don’t have to make that call to sell all and subsequently wonder when it’s safe to get back in as so many try to do with repeat futility. I have been in a market once or twice when cash was king but it didn’t last more than a couple weeks. The financial markets are wonderful in the sense that something is always moving higher, we just need to find it.

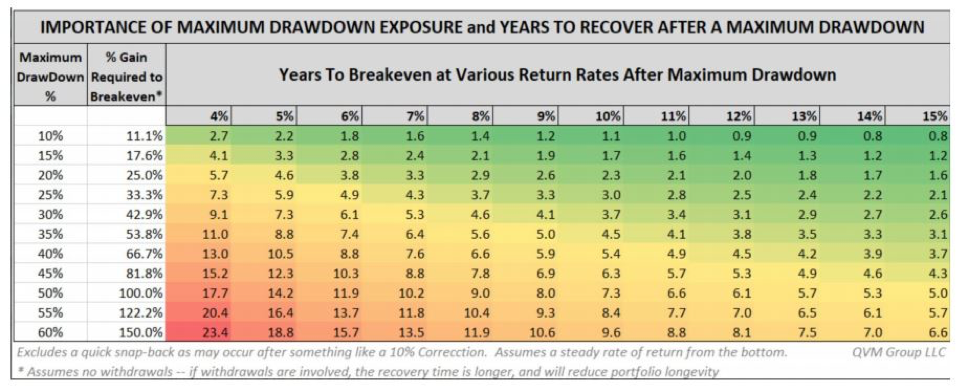

Last week we loaded our fresh new website thanks to the work of Sean Powers and Aidan Cameron in our office. www.allseasonfunds.com There you will find our library of Solution Series videos, links to our new and developing podcast “Create Wealth / Defend It” as well as downloadable research. Our current piece of research is called “The Hidden Costs of Investing https://allseasonfunds.com/ (located in the middle of the page titled “READ THE WHITE PAPER”). This paper is worth your time because we illustrate again the merciless math behind losses. I’ll provide a clip here.

Mitigating losses is obviously important because mathematically, we need to earn a higher return than our losses just to breakeven. For instance, the S&P 500 lost over 33% recently right? Find that number on the left-hand column. The return needed to break even is pretty close to 50%. If you lose 50%, you’ll need to make 100% just to break even. The S&P 500 has gained 32% from the lows but still remains 13% from breakeven (aka the highs). Case in point, it’s just math! Historically, losses in excess of 30% take 4-6 years to recover and no one has time in our short investing careers, to waste 4-6 years going through loss and recovery. Again, the point is that risk management serves a purpose however you do it. Tactical investing is tough but worth the effort. The selectivity method used in our New Power strategy is just a way that has a proven history but there are others. In fact, we have nine strategies that approach risk management differently in our offering to clients.

New Power is open to any and all with a minimum investment of $100,000. We would be happy to discuss the opportunity with you.

Onward

Sam Jones