Game On!

Thankfully, as the summer comes to close, it seems we are getting back into the game established around this same time last year. Much of what happened this summer falls in the category of “Trades” against the dominant “Trends”. For this Change of Seasons update, let’s review those Trends and offer some detailed notes plus actionable opportunities that recently developed.

Stick With the Dominant Trends

First, for those who have no idea what I’m talking about, feel free to catch up by reading these specific posts from earlier this year. They all tell a similar story but from different perspectives.

The Big Three

Reflation, Reversion, Recovery

Trends versus Trade

Miserable conditions and Opportunities

Dominant Trend #1 – Inflation

The Inflation subject is almost moving into the dead horse category in terms of investor awareness, but the evidence surrounding rising and troublesome inflation is everywhere.

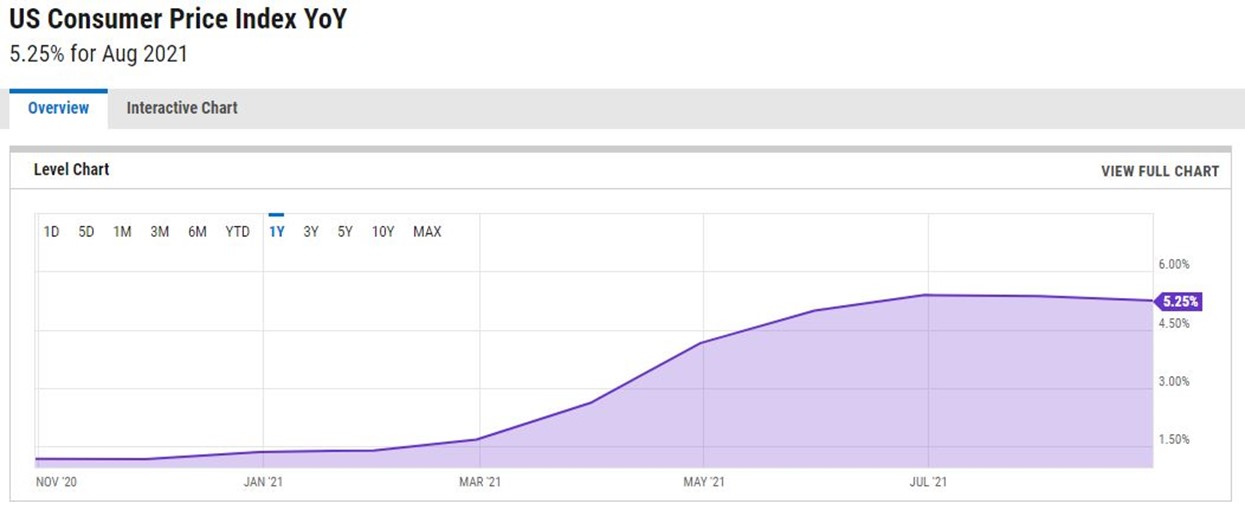

Remember that CPI grossly underrepresents the real cost of living changes in the US, but now 5.25% is the last number. One year ago, that number was 0.60%.

And as we would expect during a period of sharp inflation, interest rates have been rising over the last year (with a brief counter trend “trade” of lower rates over the summer). Despite the Fed spending Billions to support the bond market monthly, the 10-year Treasury bond interest rate is up 120% (.75% – 1.61%). Yes, these are still low numbers for now but we’re just getting started as interest rates will work hard to catch up to real inflation.

10-year Treasury Bond Interest Rate – 12 months ending 10/8/2021.

Other evidence is that aggregate commodities are rising sharply, outperforming all other asset classes year to date. Inside commodities, energy is the top performing sector with oil probably headed to $100. They said oil would peak at $70, today it’s trading at $81.

Housing costs are through the roof as well as food, transportation, and now services which are starting to build in higher labor costs!

Supply constraints, blocked fulfillment, lack of labor and materials as well as the after-effects of Trumps’ Nationalism have left our country unable to fulfill demand domestically or through our international vendors. Too much money chasing too few good = inflation.

As we said in May, we will use any pullback in the “inflation trades” to add to positions and we did just that in September following a summer of consolidation.

Personal Opinion – inflation is not price gouging as I have recently heard.

How dare you charge me that much!

That is crazy, I won’t pay that much!

How about water and electricity and trash and food and gas and housing, even Uber. You will pay whatever the market says for things you need. When supply of what you need is tight, prices go up, that’s just economics. The answer? Need less.

On the actionable opportunity side, this is the time and place when we should see gold and gold miners rise from the ashes of a 12-month consolidation in price. Crypto currencies and Gold have been moving inversely for the last year. From a technical standpoint, Crypto should run out of steam here while Gold would likely take the lead again. We’ll see. Some of the metals like iron and copper have also pulled back nicely this summer. Any blended commodity ETF made new highs last week again while no other asset class, can claim the same but there is still more growth ahead. Hold commodities!

Dominant Trend #2 – Value over Growth The rally cry of all growth, speculative investor bulls is that valuations don’t matter because rates are so low. First, valuations always matter, that’s just delusional. Rates have gone up 120% in the last year and will continue higher until Inflation throws our economy into recession as it has done repeatedly in the past. Overvalued growth investments will continue to struggle in this environment.

Note – There is no problem sitting with your growth investments like Facebook, Netflix, Microsoft, Tesla, Apple, and Amazon as these companies are almost consumer staples now. Furthermore, selling highly appreciated shares might create some unwanted tax bills and should be considered carefully with your super smart financial advisors (us). But do check your “growth” expectations regarding their stock prices looking forward. Higher returns will come from the value side of the market for the remainder of this economic cycle. Allocate cash to new investments accordingly.

Opportunities for new investments can now be found in value/ cyclical sectors like:

Banking, materials, select industrials, financials including select brokers, and the leisure space including airlines, hotels, and restaurants which got hammered over the summer. I went to see the new James Bond movie at our local Theater this weekend. First time in nearly two years. While the movie was unremarkable, the theater was packed! Scan the movie theater public companies as a value play? Only see CNK as a potential. Stock dividend payers, REITS and other non-bond securities paying more than inflation rates (~5%) should be held and accumulated now. Our MultiAsset Income strategy with a dividend yield of 6.72% will push over 20% YTD return net of fees today and will likely continue to outperform the markets for as long as the “trends” persist.

Dominant Trend #3 – Internationals over Domestic This trend is not working thus far in 2021 and has been a bit of a frustration. I think the Trend is still there but we’re going to have to be patient. The same valuation story in the US should drive all investors to consider the value story available in overseas stocks. The US stock market is the most overvalued of any market in the world but as we’ve seen, valuations don’t matter for long periods of time… until they do. International investments have additional headwinds of currency differences and some non-western, communist type leadership practices like we’re seeing in China with President Xi Jinping working hard to defang their own version of FAANG stocks.

Personal opinion – We can’t really waggle our fingers at President Xi. We have clearly seen what happens to small companies when they are forced out of business by the likes of Amazon and Walmart. Eventually we too will consider limiting our monopolies but not yet. We did it with AT&T and others in the past and will do so again. President Xi is watching the western world and taking steps to limit the concentration of power in their own mega cap technology companies like Alibaba, Tencent, Baidu, JD.com and China Mobile. I listened to a great podcast from Crazy Genius this weekend discussing the merits of breaking up Amazon. It’s worth your time to understand how damaging Amazon has been to competition and small businesses but there is a surprise ending to the story.

I also took this picture of a Mall Entrance sign in Maine this summer. Notice anything? Last man standing, Walmart! Not a single other business survived in this mega mall.

But I digress….

The valuation opportunities in Europe and Emerging Markets are compelling and we are choosing to keep our core exposure here. In fact, last week, there was some evidence that Chinese technology stocks bottomed which should offer some support and rising prices for most emerging markets funds that are heavy in those names. We added back some exposure to emerging markets across the board in our active strategies and will plan to add to these as evidence of a new uptrend unfolds.

Dominant Trend #4 (Bonus Trend) – Cash, Liquidity and Market Pullbacks

Last week, on Monday, we finally saw a washout. Investors sold in mass just as the market was approaching the most oversold condition of the year. If there is one dependable indicator in the world over all time, it is the fact that retail investors sell at the lows. The smart money watches for panic selling and then begins to accumulate and add exposure. Last week, we removed all hedges and short positions and added exposure as we should.

There is solid evidence that the low for the summer correction is in but I would describe the return opportunity ahead as thin. I won’t be surprised to see marginal new highs in the broad market by year end, but very marginal. Why? Well, that’s a long story, but in short corporate earnings have significant headwinds now coming from the potential of higher corporate taxes and the reality of higher labor and input costs. While stock prices have largely discounted some Fed tapering, they have not yet begun to factor in these impending challenges.

With that said, the final Trend that all investors need to recognize is that liquidity drives prices and there is a lot of liquidity (cash) still sitting on the sidelines and not invested ($trillions actually). Historically, it’s very hard for the markets to experience significant declines beyond 7% under these conditions. Someday, liquidity will dry up or be inflated away, but for now, we need to remain invested focusing our investments on the things we just talked about and working hard to make sure our net worth is rising at or above the rate of inflation. Everyone recognizes now that sitting on a pile of cash while prices for everything rises at 5-10% annually is a bad equation.

So, it is Game On, as we are approach the very beginning of the strongest 6 months for the markets. Hopefully, I gave you some good ideas of where you can deploy your cash and invest with the primary Trends. Of course, we do all of this for our clients in our managed accounts.

A huge thank you to all our clients for your continuing trust and confidence in our firm. And a big welcome to all our new clients in the last 6 months. Wow! We must be doing something right.

Cheers

Sam Jones

President, All Season Financial Advisors