It seems that our last update regarding what to do in the event of a correction was pretty timely. Now, that we’re in a correction, the question on everyone’s mind is whether or not this is “that time” to add cash to investments, rebalance, realize losses and all the stuff we suggested in our update. Read on for a murky answer to that question.

A Little Context

First let’s back away from the moment and look at the big picture. The US stock market is now arguably the most overvalued in modern history. If one is looking for some relativity to that statement, we could say that stocks look relatively more attractive than bonds or real estate. We can also argue that stocks are relatively not that overvalued considering the very low interest rates. But let’s not kid ourselves into thinking that stocks are cheap by any stretch. They are either the most overvalued of all time or the second most overvalued of all time, one of the two.

Now think about a good sale or discount. What makes a good discount? Is it 10%? 20%? 30%? What number would compel you to act on a purchase of something you wanted in the retail world? 20% usually piques my interest, 10% not so much. Well for all the drama in the last couple weeks, the US stock market is barely off its high by 5%. Does 5% compel you to act? I am not compelled.

Finally, let’s look at what lies immediately ahead from several fronts. First, we have what has been called a mega mashup of political fights in congress for the next 30 days. They are fighting about rather large issues that will have a profound impact on the economy, possible default on Us Treasuries, natural disasters and Covid relief, tax policy and the big infrastructure spending bill. The House narrowly passed a bill yesterday to “suspend the debt limit and delay a government shutdown”.

This bill is unlikely to pass in the senate, but we’ll see. The debt ceiling issue is always an annual dog and pony show and we know how it will end. They will expand the debt ceiling but the “show” this year is going to a big one with competing powers on both sides of the aisle not wanting to budge. For now, they are trying to buy themselves time to have a good public fight.

Second, we have seasonality which is negative until the middle or late side of October. This factor is a blunt instrument for trading but the pattern over the years is pretty well worn with September and October being two of the worst months of the year historically (reasons unknown).

Third, we are entering a new earnings reporting cycle starting in mid-October. Earnings for the 3rd quarter will look back to earnings from the 3rd quarter of 2020 which will still compare well on a year over year basis but not nearly as BIG as what we saw in the year over year comparisons from the 2nd quarter of 2020. April, May and June of 2020 (the 2nd quarter) marked the very worst conditions for most companies in their histories. But the 3rd quarter showed a significant increase in earnings and activity. So long story short, it’s going to be tough for earnings to look as good as they did last quarter. Given how stocks are priced, we might be ready for some earnings disappointments in the weeks ahead.

And last, we have a bunch of other junk acting as unknowns and headwinds to stocks. They are China and their little real estate developer problem, COVID Delta variant, and whether or not this thing is contained, a slowing economy that is now measurable on many fronts, and very high Inflation (more on this in a minute).

If I pile up all this context in terms of timing and headwinds and compare it to a market that has corrected ONLY 5%, I have to wonder if we’re looking at a real discount at all? Is a 5% correction enough to create value, or discount the list of serious issues directly ahead? Probably not.

Get Ready…. Get Set

Think about our situation now as sitting at a traffic light that is showing red. Red means stop and wait for the green light. Red means, if you choose to move forward through the red light, you could get hammered by something moving fast. Red means wait. We know that the next light is green however, so this is a good time to “Get Ready and Get Set”. What does that mean in investment terms?

Getting ready to take advantage of any pullback requires action. Here are a few ideas for everyone out there including our clients and anyone trying to manage their own money:

- Add cash to your investment accounts but wait to deploy that cash. This might be your planned annual IRA contribution, funding a 529 plan, or just adding cash to a taxable account (assuming you have more cash in your bank than desired). Moving cash into your investment accounts is an action item, get er done. Do it today.

- Start making a shopping list of potential investments to buy. We have a systematic approach to finding our next investments based on relative strength, leadership, oversold, valuations and general asset allocation guidelines. We have cash ready to deploy but will let the market tell us where to deploy that cash with a special eye toward potential new leadership. Right now, I see no leadership…. Anywhere…. One more clue that it’s too early to deploy cash. But it is time to actively shop and explore.

- Take a second to look through your portfolio to identify which positions you hold at a loss. Given that over 30% of the market is now trading below a 200-daymoving average, I’ll bet you have more than a few. These might be candidates for sale in taxable accounts in an effort to “harvest your tax losses”. If you feel the need to raise cash, this might be a time and place to get that done. Selling securities held at a loss creates a capital loss that you can use against future gains in your year-end calculations of net realized gains. Remember, our goal is not to sell and sit in cash forever but rather to sell, capture the loss, and redeploy the proceeds into something more productive and promising. Again, this is only a relevant action item for securities held in taxable accounts.

Inflation and the Fed

I’m going to finish with a little macro-opinion because today is Fed day so I feel compelled. Jerome Powell had the hawk beaten out of him by Trump and Co. back in 2018 when he was personally and squarely blamed for the 20% market decline by tapering bond purchases and raising rates. Powell is not willing to be the nations’ punching bag again, probably not again in his career. Powell is therefore likely to talk down inflation (as temporary!) and come up with any and every reason why the Fed needs to continue to support the economy (weak employment, weak economy, etc.).

We also know that practically every public measure of inflation is understated, almost to an absurd level. The Fed is broadcasting the Personal Consumption Expenditure (PCE) index as their measuring stick which is now less than the Consumer Price Index (CPI) which is WAY less than the Producer Price Index (PPI). My best guess for real inflation in our country is that the cost of living is currently increasing close to 6%. I pull that number from the average annual change in wages in the private sector which is just under 6% for the last 12 months. I suspect employers are trying to keep wages in line with the real cost of living for their employees in order to retain them. Anyway, the point is that the Fed needs to show a different number than reality in order to avoid embarrassment in not doing their job (Fed mandate is price stability and full employment). Prices are not stable and we are not at full employment.

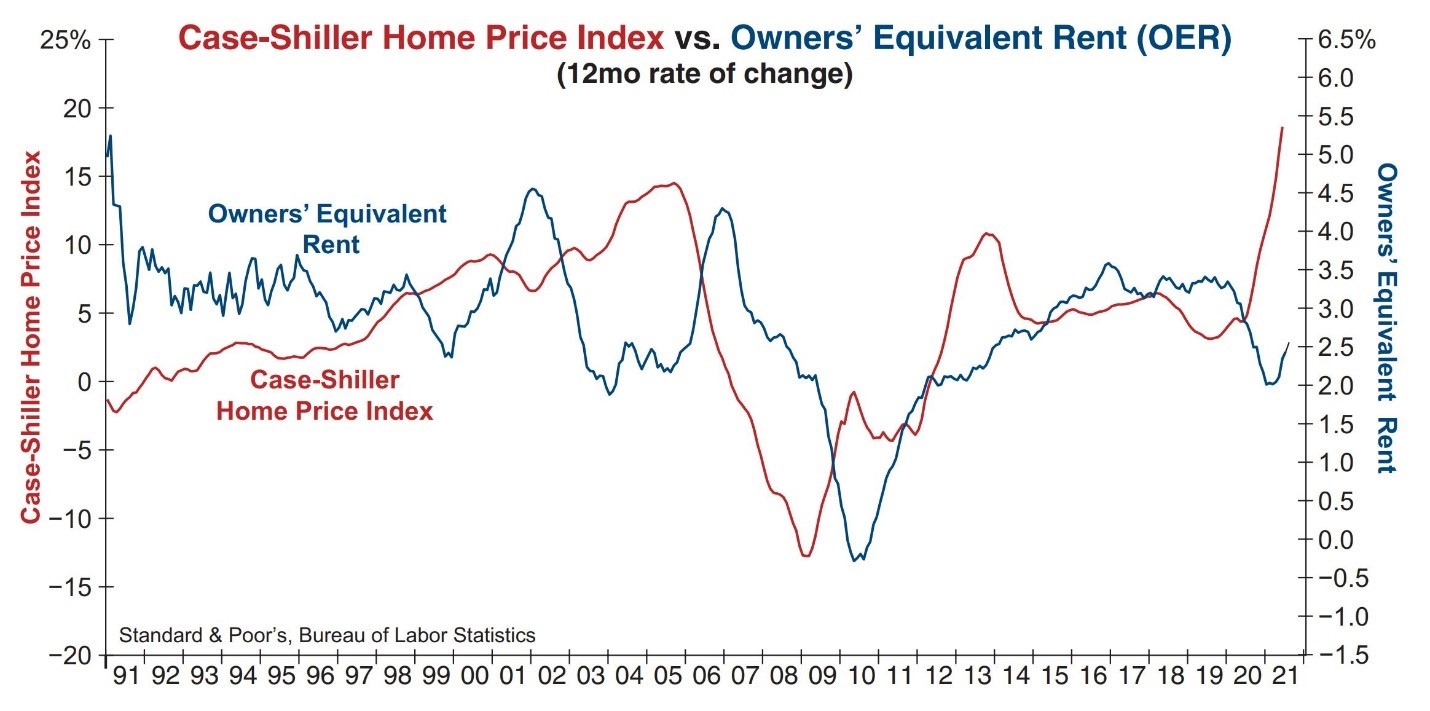

The problem for the Fed as we move forward in time is that their arguments surrounding the temporary nature of inflation are going to become thin and hard to defend. I want to highlight one of the biggest contributors to the Consumer Price Index which is housing costs represented in the index as a combination of “Rent of Primary Residence” and “Owners Equivalent Rent”. Note that neither variable includes the real prices of homes sold but rather the rental equivalencies. What we’re about to see is that rents in our country are going to go up, straight up. Rents follow home prices with a lag of about 13 months. Look at the chart below from the BLS that is circulating everywhere.

You can see that rents (shown in blue) are experiencing an historical divergence with actual home prices (shown in Red). We are also approaching the 13-month time and place when we would expect rents to chase prices. Furthermore, the rent moratorium is now over, not extended by the courts, so landlords are free to raise rents or evict. It’s a sad moment for many who are renting as they are about to get some harsh notices from the property owner. This is always what happens when we try to control prices in anything. Once the price control is lifted, they race hard and fast to get where they want to go. Rents are about to go as sharply as what we have seen in home prices over the last year.

Here’s the critical takeaway. 31% of the CPI index is comprised of these housing rental costs. If rental costs are going sharply higher, CPI will go sharply higher and the Fed is going to be embarrassed into acting swiftly (tapering bond purchases, raising interest and admitting that inflation is not temporary). From a timing perspective, we’re looking at early 2022.

I wanted to include this macro commentary because Federal policy has a direct impact on the financial markets. Today they are our friend; they will say nothing today that disturbs the market. We might even get a brief relief rally in prices. But the trend of Fed policy is not so benign looking forward as conditions out of their control, impact their stance. Clearly, we want to be aware of the context of timing and the environment in terms of what we buy, how much and when. As such, I believe we are quickly entering a new regime in which the typical “buy the dip” strategy becomes more challenging and we might consciously wait to buy bigger dips and deeper discounts.

Enjoy the Fed Commentary today… or take a nap, you won’t miss anything

Sam Jones