Every new year, I find some quiet time and space to just think, observe and research the current condition of all things financial. My intention with these personal sessions is to shed my emotions and assumptions from the recent past and just observe what “IS”. Often, I find that I’ve gotten caught up in the moment, especially when it comes to making investments or financial decisions. At the top of my notes page, I write “What’s Next” forcing myself to move beyond the moment and establish some guides for financial decision making in the year ahead. Please enjoy my notes for this 2022 New Year update.

Notable Quotes

“Success is 50% luck, 50% timing and the rest is your talent” – Scott Galloway (Pivot Podcast)

But

“Luck is the residue of design and hard work” – Branch Rickey

And

“Trust is the union of intelligence and integrity” – my Yogi Tea bag

So

Please trust my thoughts below and know that I have no specific talent beyond a keen sense of observation and 30 years of experience. Hopefully we’ll all be lucky enough to make smart decisions when the timing is right in the days ahead.

Thoughts on Stocks

Stocks across the globe should begin adjusting to a reversal, and eventual removal, of central bank monetary support. In simple terms, here in the US, that means, the Fed is now embarking on their long overdue process of removing liquidity from the markets in hopes of containing very high and persistent inflation. Given current valuations and the new shift in monetary policies globally, my expectation is that broad market stock indices will generate below average returns for the next 1-3 years with above average volatility. Earnings per share in the US stock market in aggregate since 2015, are running 209% above actual profits due to share buybacks (companies buying their own stock to boost earnings in the absence of real profits). And corporate profit margins are just starting to compress now as input costs are moving strongly higher. Speculation is rampant (SPACs, NFTs, IPO wave of companies with zero income, etc.). Finally, way too much money is still concentrated in just a few mega cap technology names making this a top-heavy market. Market indices will go the way of Mega cap tech for the foreseeable future until Mega cap tech no longer carries such a high weighting in the index – specifically the S&P 500.

I know that doesn’t sound great but at the same time…..

Stock pickers and value investors still have an opportunity to perform very well with outsized positive returns in the next few years.

Roughly 40% of the current market of US stocks are already very deeply discounted, trading at 12-year lows, spinning off high dividends and just now turning up in price. Stock pickers and value investors still have an opportunity to perform very well with outsized positive returns in the next few years.

The market and economic cycle guys that I respect are ALL pointing to the end of 2023 as the next significant low in equity markets and potential best zone to load up on stocks again. Seems pretty plausible actually. Between now and then, risk management and selectivity among one’s personal assets, is going to be critical.

Thoughts on Bonds

Bonds are unattractive now but could be worth a trade in the second half of 2022, especially long-term bonds. For as long as the Federal reserve is posturing to fight inflation with the potential to hike rates, bonds won’t provide positive returns. Allocations to bonds should be kept to a minimum until inflation ultimately drives the economy into recession – later in 2022 or 2023.

Investors should NOT depend on bonds to provide much diversification benefit until inflation finally tops out – again, maybe second half of 2022. This condition has been the case since early 2020, no change for now.

Thoughts on Commodities

Commodities and commodity producers are behaving well, as we would expect. They are rising consistently with the constraints in raw materials and high demand. They are making new highs regularly and now energy is back on board this train after consolidating prices for the last 6 months. Commodities, including gold at these levels, are now one of the only true sources of portfolio diversification as bonds are no longer serving this purpose. However, we all need to accept that commodities have much higher volatility than bonds. Therefore, investors who want lower portfolio volatility in general are going to have to get more comfortable carrying higher cash or investing in securities (funds) that are explicitly designed to control volatility.

Commodities, as an asset class, are historically under-owned by institutions and retail investors alike. Valuations are still very attractive relative to stocks and bonds, and I would expect the commodity bull market that began in the Fall of 2020 to continue for longer than most would consider reasonable. As a new secular bull market in commodities unfolds, it will take several more years of growth and higher prices to attract a representative amount of investor capital. If inflation goes away in 2022 (not my expectation), then the commodity bull market will end quickly.

Thoughts on Real Estate

It’s hard to have any conversation with anyone about real estate without using the word “crazy”. Indeed. It is what it is – crazy. A reasonable person should expect prices to stop moving higher from here. A reasonable person could also make the case that prices don’t need to fall much considering demand, supply and affordability based on still rock-bottom mortgage rates. So, we can make a reasonable assumption that real estate prices are probably going to be flat at best for the next several years. Timing is everything and you must have some pretty evidence-based arguments to convince me to buy real estate now. Strangely, I’m still seeing people load up on real estate as if it’s a good deal, as if they had better get in now before prices go even higher. I think that’s foolish, wishful and backward thinking. I said the same thing back in 2019 before the Covid induced gold rush in real estate. Nothing has changed in my mind. Real estate prices will follow the direction of the stock market just as they did in 2008. They are now partners in the Wealth Effect game.

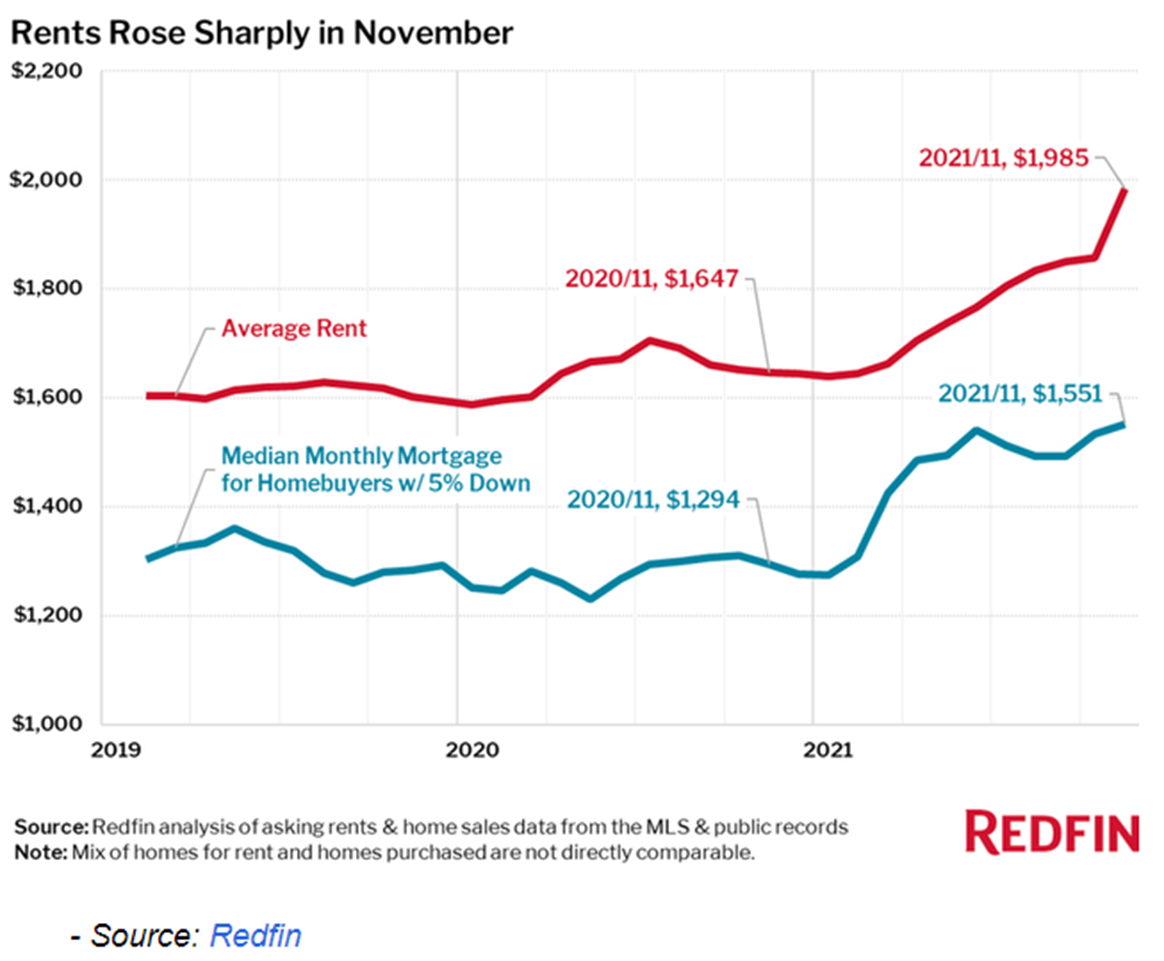

Like stocks, there are still some pockets of opportunity. Income generating rental and commercial properties could be attractive IF you can buy them at a reasonable price (tough!) and can generate positive free cash flow. Rents are going up and will continue to go up for at least the next 8 months to match prices paid for real estate. Given that OER (Owners Equivalent Rent) accounts for 39% of Core CPI (consumer price index), it’s pretty safe to say that higher rents are going to push core inflation higher well into 2022.

On the other hand, office property could easily be the source of a nationwide problem. Let me explain. We as a country are not going to return to commuting, paying for transportation and parking, just to sit in a cube farm in an 85 story “office” building. Apple has lost almost 20% of it’s engineering talent to Meta in the last 6 months following Apple’s back-to-the-office mandate. They say it costs $28,000 per employee to provide office space. Companies are more than willing to jettison this expense. This is a structural, seismic shift in how we work that is never going back to the way it was. How many millions of square feet of office space are collecting dust right now? How many owners of office property know that once the current lease expires, there will be no tenant to replace those who have left? What will our cities look like in the absence of “office workers”? How will we find a mate outside of the office? (1 in 3 marriages come from office introductions). Big changes are coming.

Anecdotally, we are in the permit process to convert the second floor of our Denver Office building into a fun residential loft for personal use or short-term rental. The downstairs will remain as a conference room for meetings with clients. Mixed use will become all the rage. If I ran the zoo, I would consider converting many office buildings into residential apartments and condos asap.

Thoughts on Labor

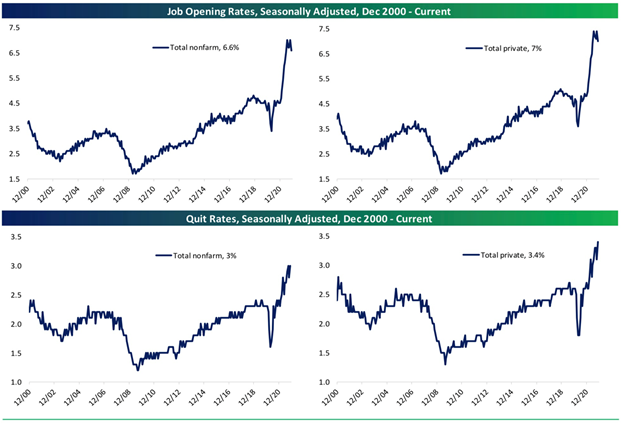

This issue is one for the textbooks. Talk about unintended consequences. Our labor shortage problem is not a short-term phenomenon either. Labor participation rates (meaning among the total number of eligible working population, what percentage are employed?), are still stuck hovering close to the historic lows set in March of 2020. Quit rates (the number of employed who have recently quit) are also on a parabolic rise consistent with the parabolic rise in job openings.

What’s going on? I observe a generation of baby boomers who are choosing to retire earlier than expected. Make no mistake, monetary and fiscal stimulus always finds its way into the hands of asset owners and the Baby boomers are the current owners of assets in bulk. With a big thanks to the Fed, they can now retire early! Gen Xers and Millennials are not ready, willing or able to fill those empty seats. In addition, burn out, health concerns, needs to cover childcare, and interest in starting a new company are all contributing to The Great Resignation thing. I don’t know where this trend goes from here honestly. What I do know is that wages are not going to revert to the sub-standard levels of pre-Covid, in the foreseeable future. Higher wages and salaries that match the real cost of living are now the new standard. Why is this relevant? It comes back to the argument of why inflation is not transitory. The economy and earnings will adjust to a permanently higher wage base putting a new higher floor on costs of goods and services. As I like to tell friends; We have moved beyond a system that provides what you want, when you want, at the price you want. Now, you’re lucky if you get to choose one. Decisions of when to buy, when to build, whether to buy or repair, will become more important than in the past.

Thoughts on Control

I see a lot of bad behavior out there these days. Too many newer investors chasing things they don’t understand, trying to get rich quick, concentrating assets in just a few of last years’ winning stocks. For all the market talk and attention, I want to remind everyone that the most impactful thing you can do to Create and Defend Your Wealth is to focus on your own spending and saving patterns. These are the areas where you have control, rather than the markets where you have little to no control and have a relatively low probability of getting rich quick with some great idea or another. We hear only the stories of that women who is buying a $200M beach house with her recent winnings in Ethereum. But we don’t hear about the other 99.9% of crypto investors and Meme stock traders who are sitting on massive losses, reluctant to sell and admit error. We work hard to help our clients understand the purpose of money and to what degree they need to generate returns to cover their real living expenses net of incomes. Pay close attention to how your taxable money is invested such that it doesn’t generate a lot of short-term capital gains. Pay attention to your asset allocation mix making sure that you have an adequate amount of cash to cover any expense shortfalls in your house for the next 1-2 years, so you are not forced to sell stock holdings at a bad time. Consider using a free spending and budgeting app like Mint.com or YNAB.com (You need a budget) for a few months to discover where you are really spending your money. You might be surprised! Are you putting money into a 529 plan for your kids’ education and saving on State income taxes? How about funding your Health Savings Account for $8300 this year as a deduction against Federal Income tax? Can you really afford a second home? Is this the right time for a kitchen remodel? How can you make sure that your income is stable and growing for the next 5,7 or 10 years?

These are the things I wish more people would focus on. Those who do tend to worry less and find true financial independence much earlier than the gamblers out there. Focus on the things you can control, and your wealth will follow! Yes, it’s messy, but that’s why we’re in business.

Best to all in the new year.

Sam Jones