There is a sickness in the market that is becoming more evident by the day. The relentless selling since mid-November has come as a surprise to many. We all look at our investments with a raised eyebrow and more questions than answers. For this update, I’m going to try to clarify what we see happening in the context of some very notable and recent changes in leadership in the markets. This may prove to be one of the most important moments in recent history for those wishing to (re)position themselves appropriately for 2022.

What is Going On?

Well to put it bluntly, what’s happening in the markets today is nothing that any veteran of a full market cycle hasn’t seen before. Personally, I’m a little surprised to see it manifest right now given all the current data but quite often the most persistent and lasting trend changes in the markets happen when no one expects them to occur. What trend changes am I talking about?

At a very high level, the market is now adjusting to the fact that the Federal Reserve is beginning their long overdue process of removing liquidity from the markets. Nothing much has happened yet and is not likely to happen anytime soon in terms of the Fed Raising interest rates, but they are starting the process of becoming less accommodative to the markets. Why? Well because they now understand clearly that inflation is not transitory beyond a mild loosening of supply chain restrictions in 2022. They are feeling pressure to “do something!!” knowing quite well that raising rates won’t do anything to curb this form of inflation. In fact, any action on their part to remove liquidity is likely to increase inflation as the rising cost of borrowing will be added to the pile of higher input costs. So, they reach into their box of tricks and begin tapering bond purchases as well as pursuing reverse REPOs with their banking partners to create the perception that they will control inflation.

As a result, we’re seeing the economic cycle clock turn quickly toward full recovery/ early recession environment.

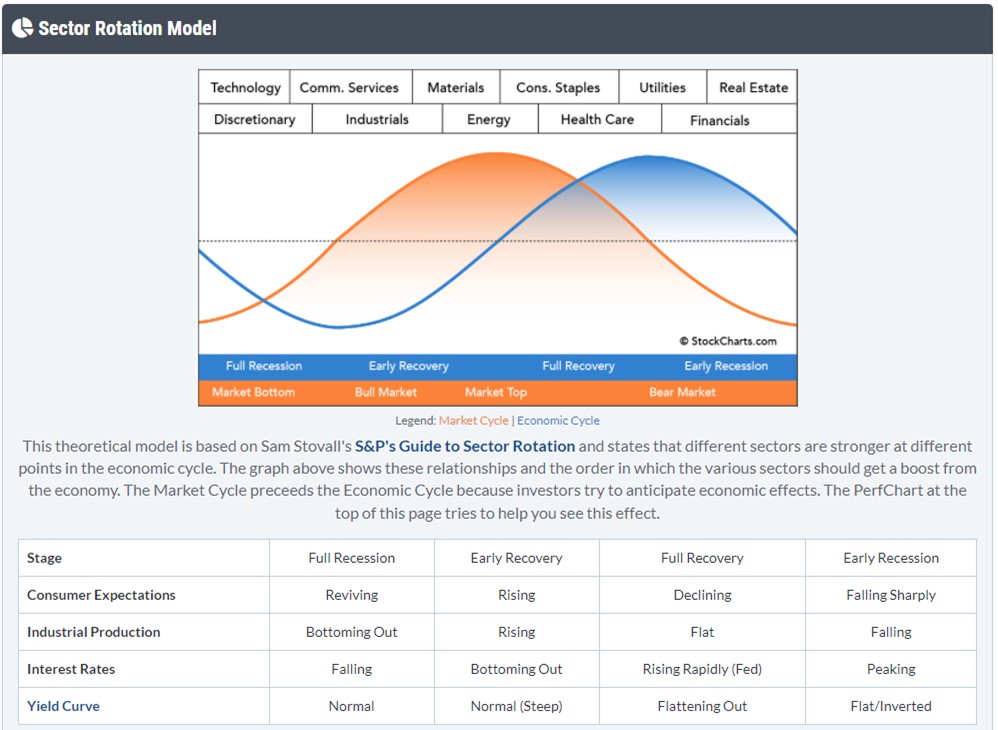

Let’s take a minute to review what that means from a leadership standpoint in order to help us understand where we should be cutting exposure and where we might add exposure in our investment portfolios. The chart and illustration below are provided by Stockcharts.com

Look to the right side two columns marked as Full Recovery and Early Recession. Right now, I would peg our current environment as closest to Full Recovery mode.

Consumer Expectations Declining… check

Industrial Production Flat…. check

Interest rates Rising Rapidly…. check (but may be “peaking”)

Yield Curve Flattening Out…. Check

Looking above to the chart, in a Full Recovery environment, we should expect the following:

- The stock market should be topping out broadly with continued leadership in energy, materials, consumer staples, utilities, healthcare and financials. This is a time when investors must be very selective about what they own and keep risk management protocols firmly in place. The worst performers should be technology, consumer discretionary, and communication services sectors from here forward.

- During this time commodities can continue to do exceptionally well but investors shouldn’t expect the same high growth rates as the last two years. In fact, in some economic cycles, especially those dominated by inflation, commodities become the only productive asset class. There is real potential for that outcome now.

- Long term bonds should start to perform better as the Fed threatens to push up short term rates. Today the 30-yearTreasury bond broke out to a new 8 month high. Still, expectations for bonds to be a highly productive piece of any portfolio should be kept in check. Bonds at this stage are just a safe haven offering a little volatility control in your portfolio.

Getting (Re) positioned for 2022

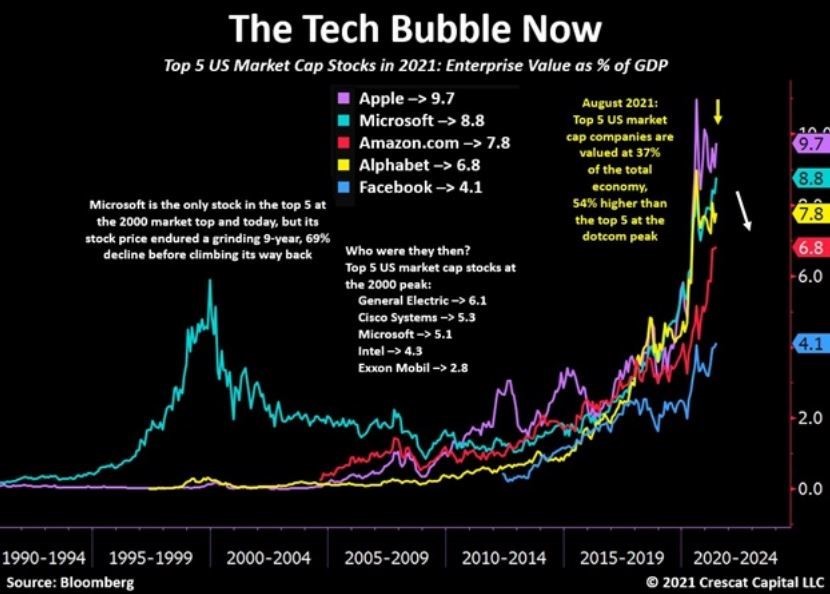

I’m going to say this again as a final warning as we head into 2022. The greatest risks I see in today’s market is the very high concentration of wealth among a few mega cap technology names. You know the names. Apple, Amazon, Google, Facebook (Meta), Microsoft. These names have become an enormous piece of our country’s annual GDP in terms of their enterprise value (see below courtesy of Crescat Capital LLC) – 37% to be exact. Similarly, these same names collectively represent a weighting of over 30% in the entire stock market. I always like to ask, what could go wrong?

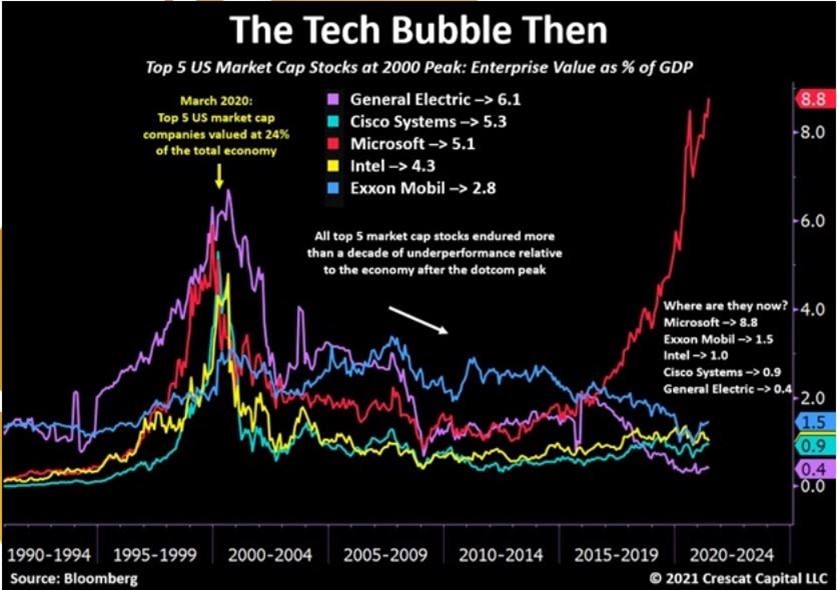

I’m not going to be the guy that tries to explain why, how, or when any of these behemoths could see their stock prices fall. I can only say that once a set group of names climbs to this type of dominance in the economy and the financial markets, the results looking forward have not been great. Crescat also showed the last time we had a concentration of financial wealth in just a few names. That time was the year 2000 when our markets were dominated by GE, Cisco, Exxon Mobile, Intel and Microsoft. Of those five, only Microsoft has generated a reasonable return on an average annual basis over the last 21 years.

I’m not going to be the guy that tries to explain why, how, or when any of these behemoths could see their stock prices fall. I can only say that once a set group of names climbs to this type of dominance in the economy and the financial markets, the results looking forward have not been great. Crescat also showed the last time we had a concentration of financial wealth in just a few names. That time was the year 2000 when our markets were dominated by GE, Cisco, Exxon Mobile, Intel and Microsoft. Of those five, only Microsoft has generated a reasonable return on an average annual basis over the last 21 years.

Average annual returns (including dividends) since the highs in the year 2000 through yesterday:

GE -4.62%

Cisco -0.08%

Exxon +4.68%

Intel +0.31%

Microsoft +10.52%

Back to the script. If I were a betting man looking into 2022, I would consider (re) positioning my portfolio to have a more reasonable weighting in these names or any others with clearly ridiculous valuations (TSLA, NFLX, NVDA).

At the same time, we investors should all acknowledge that if these companies run into trouble for whatever reason, they will take the market with them by the shear fact that of their market capitalization weighting in the stock market index, notably the S&P 500.

In just the last few days, we have started to see some real unbridled selling in technology names with stock prices that simply don’t reflect current earnings growth in any way. Today, we heard about Docusign (DOCU) which is down -40% as I write after missing earnings by a mere $26M last quarter on earnings of $574M! That’s not a big miss but it is a very big reaction to the news! Pay attention to these things. Salesforce (CRM) and Adobe (ADBE) lost over 9% in single day reactions as well. Tesla is down 6% today on no news at all. (Re) positioning for 2022 and profit taking appears to be happening now among names that are wildly overvalued. I fear for the future of Cathie Woods and her infamous Ark ETFS (Next gen technology funds) that are moving quickly toward losses in excess of -20% YTD.

Where Should We Look to Buy?

Always a great question. Regular readers know the answer, but I’ll spell it out clearly for any DIY investors out there. Stock purchases should be in the value side of the market where prices are low relative to earnings growth. We have been accumulating these names in the last three weeks. Take a look at this Market map provided by FinViz.

To understand what you’re looking at you don’t have to do much more than squint your eyes and look for green spots. This is a market map showing the Price to Earnings Growth (PEG) of the components of the market index. A number higher than 1 shows a stock that is generally overpriced relative to its current earnings growth.

To understand what you’re looking at you don’t have to do much more than squint your eyes and look for green spots. This is a market map showing the Price to Earnings Growth (PEG) of the components of the market index. A number higher than 1 shows a stock that is generally overpriced relative to its current earnings growth.

Note a name like Salesforce (CRM) that is showing a PEG ratio of 9.29. Salesforce got slammed by investors this week. Tesla at 4.86 is no deal. While not as overvalued, the same goes for MSFT, AAPL and AMZN. If the current price action is any indication about where gains will be had in 2022, we would recommend selectively looking for lower PEG ratio stocks aka the value sector. Note- PEG ratios should not be anyone’s sole evaluation metric.

As mentioned above, Commodities can also be held or accumulated on pull backs like the one we are seeing now. There is higher risk in commodities today than 12 months ago, but the trend is still our friend here and the cycle says hold commodities for now.

It’s also not a bad time to add back some bond exposure just to control volatility as we move into 2022. Longer term bonds (TLT) are showing the best price action as the market is betting the Fed controls future inflation. I’m not so sure but I would avoid short term bonds in the coming months as you will be fighting the Fed while they try to manage inflation.

All in, these are slight but potentially significant changes that investors should consider as we move toward 2022. We are making these changes to our clients’ portfolios now. I read somewhere that past performance is no indication of future results. I would modify that statement to the following. Past performance rarely, if ever, indicates future results.

What a great time to consider (re) positioning for 2022.

Stay tuned for more ideas on year-end financial planning and tax strategy coming soon.

Cheers

Sam Jones