As many of you know, my wife and I have a four-month-old son at home. Today was a big day in our house—our little guy rolled over from his stomach to his back for the very first time. Yesterday he couldn’t, today he could, what an incredible development! In the next year we are certain to experience a number of these milestones—eating solid food, crawling, talking, walking. Each one will happen suddenly and, in some cases, without advanced notice. The changes he’s experiencing will be, exciting, happen rapidly, and be easily observable.

Contrast this with the adult world around us. Our environment, our economy, our lives, our careers, our relationships, our viewpoints. For most, these things grow or develop (sometimes devolve) from day to day, week to week, month to month, year to year with the changes remaining mostly hidden or unnoticed. The instant gratification, what-have-you-done-for-me-lately bent to our lives leads most of us to miss the small, incremental changes that will undoubtedly shape our futures in positive ways. Only when we inject time and look backwards can we realize the profound impact an innovation or new way of thinking has had on our lives. Hello, iPhone.

In the investing world, when you buy one share of Alphabet (Google) stock, you are inherently relying on the company’s almost 140,000 employees (crazy big number right?) to steward its existing business lines and to create new products and services that will ultimately generate revenue and in turn, earnings, in the future. How successful will Google’s employees be in this endeavor relative to the employees of other companies? Hard to say, but they are sure to try. In the process the company will grow and change at a glacial pace (at least from the outside looking in) while you and I continue to interact with the company’s browser, search engine and ads and track its stock price on a daily basis.

As of this writing, Alphabet’s stock (GOOGL) is down a hair over 10% in the first three weeks of 2022. I guess they should pack it up, call it a day and close up shop, right? What changed in the first 14 trading days of the year? Did someone pull the plug on the Google machine on December 31 as they left the building in a post-resignation blaze of glory? Hardly. Did something happen in the world that instantly made Alphabet a less valuable company? Is inflation or the prospect of interest rate hikes going to diminish the company’s ability to continue to grow its assets, revenue, and earnings in the successful manner they have in the past? Anyone’s guess. In any event, 140,000 employees are going to go to work today to try their hardest to deliver incremental value to you, the shareholder.

And Alphabet is only one company! Think about it this way: there are hundreds of millions of employees across the globe representing thousands of public companies and working for their stakeholders in the exact same way. And that doesn’t even begin to scratch the surface of private companies!

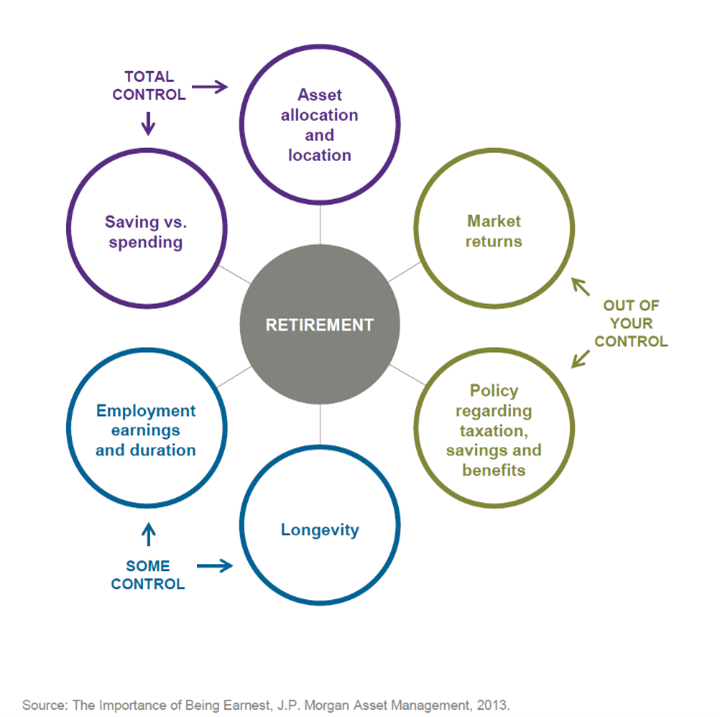

Weeks like the last one are not fun for anyone. Watching stocks (Alphabet included) sell off across the globe leaves most investors with a feeling of hopelessness and the sense that we are not in control of our respective financial destinies. Weeks like last are the reason why we work with you to build financial plans—to help refocus on the pieces of your financial lives that you ultimately control.

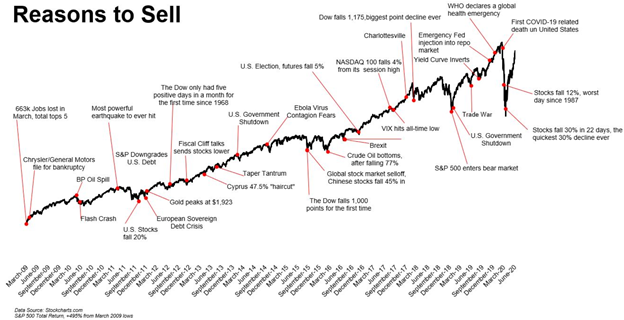

I hate to break it to you, but watching your portfolio decline never gets easier. Market volatility is a feature of our markets, not a flaw, and there will always be reasons to sell. The instant gratification of taking action today might feel good in the short term, but can have a major impact on your retirement as you give up on the seemingly small, glacial developments that are sure to drive returns in the future.

Source: Michael Batnick, The Irrelevant Investor

Having said that, if market movements over the last week have you feeling concerned or nervous or reconsidering the purpose of risk in your portfolio, now is a great time for us to get together to review (or build) your financial plan.

In closing, I want to share a quote Morgan Housel’s Psychology of Money: “Optimism is a belief that the odds of a good outcome are in your favor over time, even when there will be setbacks along the way…The short short sting of pessimism prevails while the powerful pull of optimism goes unnoticed.”

As we move forward in 2022 and beyond I know that there will be successes and setbacks in each and every one of our lives. The magnitude and rate of change in my son’s life will slow over time as he ages. There will be elections, market corrections, wars, inflation, diseases, recessions, deflation, politicians we don’t like and many other maladies. Despite how scary some of these things seem, I am optimistic that we can work together to build a plan that will help you and your family weather any and all storms that come ashore.

Will Brennan