The stock market has officially entered a bi-polar state. To those who haven’t been paying attention, there are newly established bear markets happening right now and there are new bull markets beginning right now. A tale of two markets. None of this should be a surprise to regular readers. Now that technology has been taken out to the woodshed and Treasury bonds are losing value faster than any time since the ’80s, we have to ask the question of what’s next? Is it ok to buy back technology now? Have interest rates gone up enough? Is this value and inflation thing almost done? Let’s look at the big picture and hopefully you’ll see which are primary long-term TRENDs and which we might consider for a short-term TRADE.

Growth versus Value

I will jump to the big reveal early. Value is now the primary trend of the US stock market. Growth is now a trade. By that, I mean that investors should remain focused and invested on the value side of the market. Periodically, we might get an opportunity (one that is fast approaching) to TRADE on the Growth side. Let me give you a little context for that idea. Value has been long forgotten for most of the last decade. Instead, investors have leaned on growth as they usually do during long strong bull markets. But that changed in 2018. Since then, Investors have taken the growth thing too far, favoring high-priced and overvalued speculative companies with negative balance sheets and zero revenue. You’ve heard me complain since 2018 about market conditions, but I am done now. Value is back, investors have come to their senses and are leaning hard into companies with real and repeatable earnings and dividends with strong balance sheets. They are even digging deep in the post COVID sectors that now present incredible opportunities. So, growth is out and technology is the poster boy of growth. Last week, we talked about “Reversion”. Look at the table below.

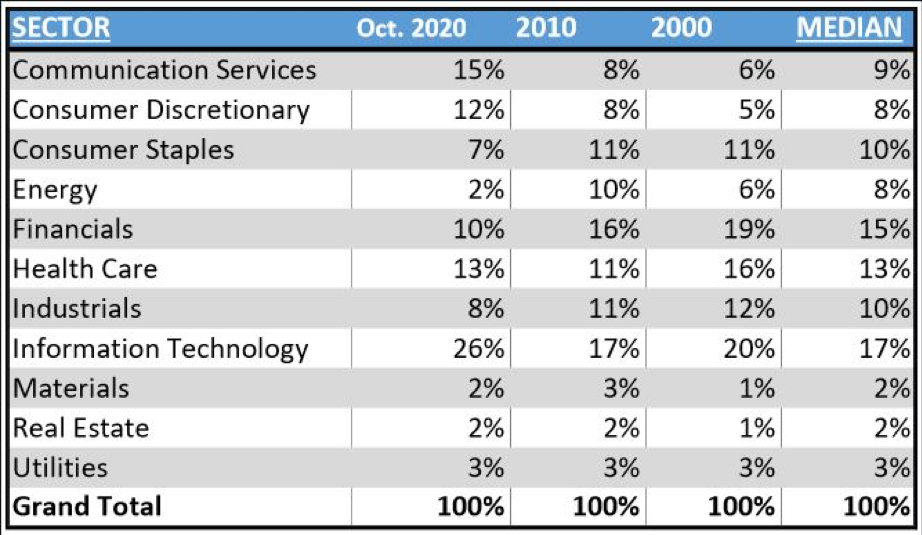

You will see a sector breakdown of the weightings in the S&P 500 as of last October against the historical median. Now focus on Technology which even in October represented 26% of the S&P 500. What you don’t know is that an additional 10% of that number was moved to the Communication Services sector in 2018 (mostly Amazon and Netflix). The real number for technology is therefore 36% of the S&P 500 because all technology trades together. We are in never ever land. The median weighting for technology is about 17. So, could technology get cut in half just to get back to median? Certainly. Now, look at Energy sitting at 2% of the S&P 500 with a median weighting of 8%. Could Energy rise 4-fold just to get back to median. Yes! Mean reversion takes a long, long time, not measured in days or weeks but quarters and years. Communication Services, Consumer discretionary are probably also reverting and should probably be held with a critical eye. These trends have just begun.

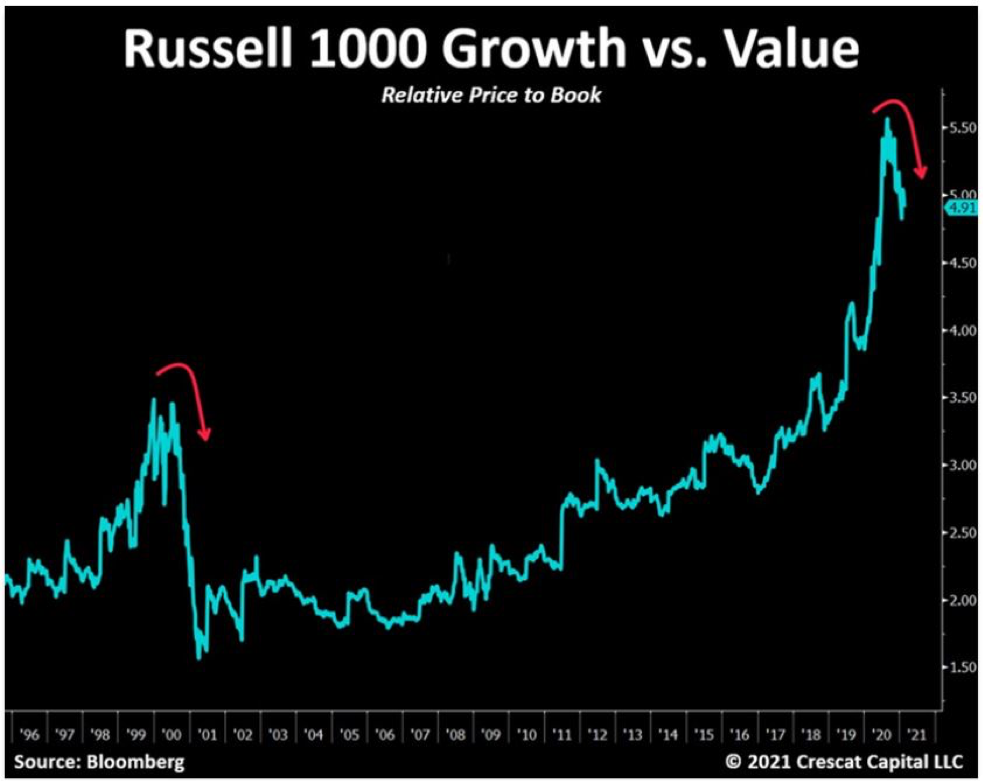

Meanwhile, Value is in and there are many sector investments to choose from. This trend is probably 4 months old if I had to put a timeline on it but it is just getting started and often lasts 2-3 years. Look at this long-term chart provided by Crescat Capital last week. Given the extreme in this relative relationship, it would be a good bet to assume that Value will continue to outperform growth for the foreseeable future. From the last peak in 1999/2000, it took almost 11 years for growth to retake its leadership overvalue. I witnessed all of it.

But even within primary trends, we will see counter-trend TRADES develop. That moment is probably coming soon. Technology companies have been slaughtered in recent weeks with many of the darlings down 30-40 and 50%! Some growth-oriented investors will start to pick up discounted shares in here and we should see a counter-trend rally develop soon. But this is my advice. Be nimble and be quick because growth is a trade from here on out. You are going to have to buy technology on hard down days which is tough, and you are going to have to sell technology when it’s up big which is even tougher. Finally, you are going to have to be earlier than the big guys who know more than you and have faster computers. For those who still own too much technology and “Growth” in their portfolios, I would conversely be patient, wait for a bounce and sell right into it. Proceeds can go to your favorite value stocks or funds on the same day. Write this on a sticky note and pin it to your desktop – Value is the Trend; Growth is a Trade.

Inflation Here to Stay

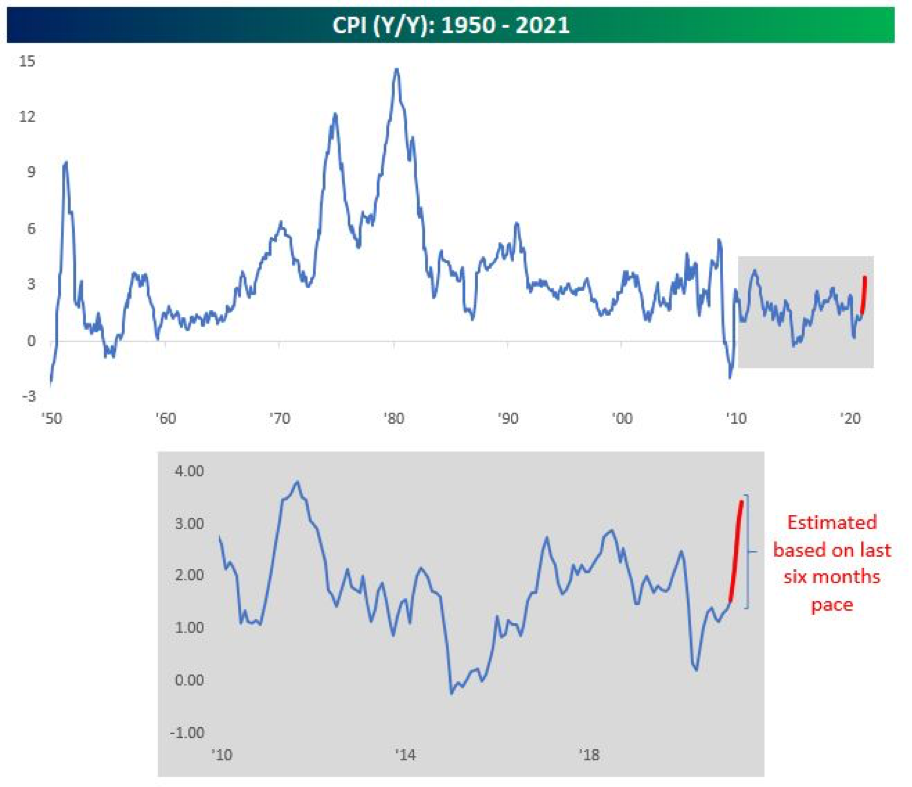

Here is the other highly controversial idea. Inflation is no longer a temporary trade but a new dominant TREND. I am sure the hate mail will fill my inbox on that statement. But the data is becoming pretty clear and prevalent. What is not clear is the mental mess that this fact creates in our minds. We have been told that inflation is dead. We have witnessed the Federal Reserve come to the rescue time and time again. We have even heard the Fed beg for inflation. That will be viewed as crazy talk down the road when they recognize the monster they have created by their own handiwork. The numbers are likely showing real inflation, with producer prices paid and the services sector, and soon, the highly manipulated Consumer Price Index shown below (thanks to Bespoke). I might even go as far as saying the Federal Reserve is on the cusp of losing control here. Inflation is like toothpaste: hard to get back in the tube once it’s out.

The Treasury Bond market has been screaming inflation for over 4 months now. Bond prices have fallen dramatically, and interest rates have officially spiked even while the Fed is cheering for more! Readers know that inflation trades are working quite well. Those are Banks and Financials, energy, materials, metals and hard assets. Gold is not participating for now, but we are still hopeful. Deflation trades like speculative growth stocks and highly leveraged companies living on debt are under severe selling pressure.

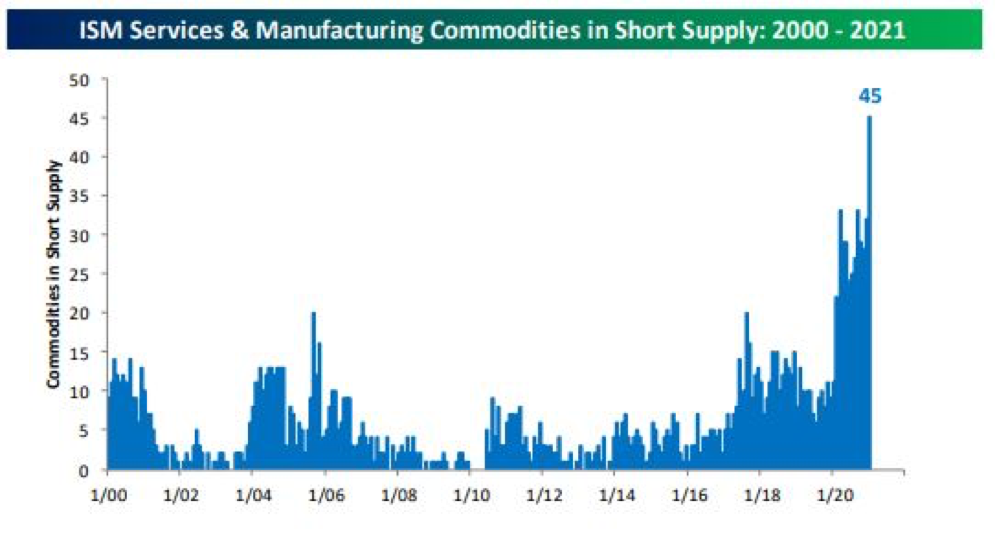

Commodities are also set to become a productive trend for investors who know how to invest in this space. We have a lot of commodities in our strategies if you care to look. Commodities do well in inflationary environments and this Trend has just barely begun. Furthermore, we are seeing some serious scarcity of commodity assets after years of oversupply. This again from Bespoke.

Short supply with a global economy that is emerging from an economic shut down for a year? This is the big bang; 45 commodities groups are showing supply shortages! Commodities are part of the inflation trend and not a trade. Hold em if you got em or buy pullbacks until further notice.

To be clear, the TREND is Inflation (and higher interest rates), and the Trade is deflation for the foreseeable future. Those who want Treasury bonds will have a chance to buy very soon as a Trade. But most will ultimately want to reduce their exposure to this unproductive asset class.

Understanding what is TRENDING is critical and investors need to stick with these primary longer-term themes. Conversely, a TRADE can be productive but is generally something held short term. We are here to help if you have questions about anything you own in your outside accounts.

Thanks for reading.

Sam Jones