November 9, 2022

Regular readers might recall the rollout of our Big Three investment themes in April of 2020. Two of the three are now well entrenched and we’re about to see the third and final big opportunity unfold as the markets and economy slide deeper into recession. Dynamic asset allocators should be on the move here, reorienting portfolios for the Next Big Thing.

The Big Three

You might want to take a few minutes to brush up on the Big Three by reading our Dec 30th 2020 post HERE. For the reluctant, I’ll summarize the themes and bring you up to date with the state of these trends.

1. Commodities and Inflation Hedges – Entrenched uptrend since April of 2020.

Now in its third year, the commodity/ inflation trade is still one of the only investment themes that has actually made money in 2022. Energy is up over 60%, broad commodity funds are up 24%, inflation beneficiaries like steel, copper and materials are flattish YTD. And just this week, Gold, Silver and associated miners have just bottomed in a clear and decisive way after falling a surprising 30% (blame = super strong US dollar). Gold miners are up 17.5% in the last three days. We bought gold miners in several strategies on October 3rd. From a cycle standpoint, we should expect to see commodities top out around here as the economy slides deeper into recession. We might continue to move pure commodity positions more into gold and gold miners as a safety measure in the weeks ahead.

2. Value Over Growth – Entrenched since December 2021

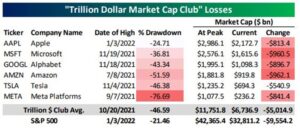

Wow did we get this right! Even this week, growth investments are still plumbing new lows led lower by mega cap tech names like Tesla, Meta (Facebook), Alphabet (Google), Microsoft and Amazon. Take a look at the losses in both stock prices as well as market cap, courtesy of Bespoke.

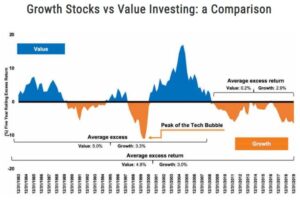

I have said many times that the concentration of investor dollars in these six names represents the greatest risk to investor wealth in a generation. This risk extends to the US stock market as well, given their dominant weight in the broad market indices. As these names go, so goes the market. These six alone have collectively lost over $5 Trillion in market cap in the last 12 months. The entire S&P 500 has lost over $9.5 Trillion by comparison. That is a lot of wealth destruction and I feel badly for those who still maintain concentrated positions here. I see no sign of a price bottom in growth at this point. Meanwhile value is trading very well and higher in most cases. “Value” represents those companies that have high free cash flows, pay dividends, are profitable and carry relatively little debt. This environment rewards those types of companies and punishes over-priced growth names, especially those without profits and burn cash to stay warm. Outside of New Power, our investment strategies remain piled high in value, dividend payers and virtually zero growth or technology names. At this point, the benefits of owning value over growth have manifested as (much) smaller losses but losses, nonetheless.

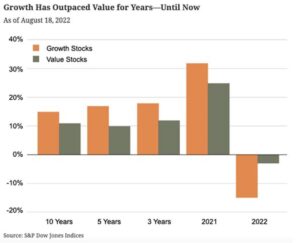

This chart is only updated through mid-August. The only thing different to date is that the orange bar in 2022 is now – 33% while the green bar is down around -8%.

If history repeats, we’ll see these relatively small losses in value turn into absolute gains as the stock market finds its footing and develops more sustained price recoveries. How long can the Value over Growth theme last? Again, with history as our teacher, each dance partner tends to maintain the lead for 5-6 years before handing off to the other. We are in year two of this value leadership so yes there is much further to go especially considering how long growth previously held the lead (from 2004 to 2020!).

3. Internationals over Domestic – The Next BIG Thing!

This theme has been a bugger as the Federal Reserve has been driving up the US dollar for almost two years in conjunction with runaway inflation. A rising US dollar creates headwinds for US dollar denominated international investments.

But this is about to change in a big way. How do I know? Two main reasons.

The first is that we are already in a quiet recession, but that fact is about to become very loud and pronounced in the next 30-60 days (rising inventories and unemployment, falling real estate prices, falling demand, falling PMIs, falling prices, lower CPI, etc.). The US dollar falls when recession is finally recognized. Again, a falling US dollar acts as a tailwind to international investments.

The second reason is this:

This was the cover image of Barrons on October 4th, 2022. The Barrons record of highlighting the very last gasp of any long trend is nearly flawless. If you’re on the cover of Barrons, the trend is over, your days are numbered. The same goes for Time Magazine Person of the Year.

Elon Musk 2021

Now the king of chaos and volatility in 2022.

The US dollar peaked on October 12th and has yet to make a higher high for the record.

Select internationals, especially non-China based emerging market funds and stocks, are already outperforming the US market. Brazil is up 21% YTD (we own it), Latin America in general is up 17% (we own it), Mexico is up 11% (we own it) and I see compelling evidence that Europe is bottoming now (buying now). 27 of 42 foreign country ETFs are now outperforming the US stock market and that number is growing daily. This is happening while the US dollar is still sitting at its highs of the year. Imagine what will happen when the US dollar starts a new downtrend!

Finally, remember that the valuations of the international world are almost 50% of those in the US. We are no longer the best-looking horse in the glue factory. In addition, most international stock and bond funds are paying dividends in the 5-6% range. This is a compelling moment in time to rebuild or initiate a solid international position in your portfolio as we have done for our clients.

Other stuff – Bonus thoughts in brief

• Mid term elections will not make a difference to this market. A very health year end rally into early 2023 is a high probability even as recession headlines hit the press.

• Real estate is in trouble – long term. More on this in future updates.

• Inflation has peaked – this will become more and more obvious. In 6 months, Year over Year CPI measures will be close to zero.

• Feel free to book and PAY FOR your international adventure of choice. After exchange rates, your trip is 20-30% off.

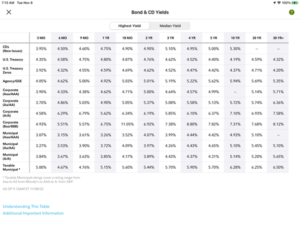

• There are lots of juicy short-term interest-bearing securities out there. I clipped this from Fidelity yesterday AM. Wow! We are beginning to reinvest our Income models now after carrying nearly 60% cash for most of 2022. Look at the 18-month column.

Lots of new opportunities developing for investors who are awake, aware and care to make some money in 2023.

That’s it for today. Big snow coming to Steamboat Springs, CO. We already have over 25”.

Sam Jones