October 24, 2022

Last Friday’s market action offered investors a clue as to how the market will react when the Federal Reserve begins walking back their uber aggressive policy of raising interest rates. We would be wise to let history be our guide as we are indeed still playing this game right from the 70’s playbook. In the short term, there is a reasonable chance that a very strong relief rally, in stocks and bonds, has just begun.

What just happened?

Well, it was inevitable that the Fed would begin its choreographed chatter about how they might consider, maybe, sort of, potentially begin talking about reducing the size of their rate hikes after the November meeting. As we have said for the last several years, this Fed and specifically Jerome Powell is driven by the path of least embarrassment. They will pursue a relentless policy until it is almost absurd for them to continue and then they will change 180 degrees on a dime. Today, we have overwhelming current and forward-looking evidence that the US and global economies are either in recession or heading swiftly in that direction. It would be very embarrassing for them to continue raising rates much beyond 2022 if the data continues as such. On Friday, Mary Daly of the SF Fed, casually slipped a comment to the WSJ that they “should start planning for smaller rate hikes”. Following her comments, in a hot second, the US stock market moved from -0.80% on the day to +2.3%.

What a “relief”!

This is the same Mary Daly who said earlier in the week that rates will push higher for the foreseeable future and Fed Feds will reach at least 4.65%. The Daly show indeed. Enough Fed shaming for this update… but they do deserve it.

Just The Data Please

Robert Berone contributed a terrific article to Forbes on Saturday entitled, “Did the Fed Just Blink? The Markets Think So”. Google that and read it if you can (Forbes articles are tough to read without subscriptions). Berone compiled behind the scenes evidence showing just how quickly our economy, housing, and employment are all slipping into the red. His point was that the Fed needs to stop now given the evidence. I’ll give you a few highlights in case you cannot read the article.

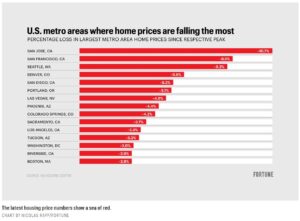

- The Housing market is already in decline. Home sales are down for the last 8 consecutive months by -23.8%. Regardless of what you might hear today, prices tend to track sales. 65% of the population owns a home and price declines will have a negative wealth effect on spending. Mortgage applications are down -38% year over year (record declines). This chart was also offered in a separate Fortune article supporting Berone’s comments. Albeit slight, home prices have started falling predictably.

- On the employment front, there is a discrepancy of more than one million jobs between the Seasonally Adjusted and Non-Seasonally Adjusted data as reported by the BLS. This will be reconciled by the end of the year and the November 4th report is very likely to show a much weaker labor mark t than what was previously reported. Does the Fed have eyes on this report?

Big employers have already announced either smaller holiday hires or outright layoffs between now and the end of the year including Walmart, Macys, Fed Ex, Microsoft, Meta , Twitter! And Netflix. Berone also highlights reporting issues in the BLS related to part time versus full time measures as well as the exclusion of small business labor in their data, all having the impact of overstating employment figures in the last 6 months.

- Inflation measures are mostly showing disinflation now. The Fed is choosing to only look at things going up in price while the majority of “things” are actually falling in price. Retail sales are down 3% in the last month. Other things falling in price since the spring: Furniture, appliances, moving expenses, used car prices, gas at the pump, natural gas, prescriptions, theater tickets, hotels, sports events, apparel, and IT services. Even rents are starting to fall in several major metro areas. Food is flat year over year. Tesla just announced a 9% drop in prices for their vehicles sold in China in order to compete with BYD. We are past peak inflation for sure and CPI is very likely to begin falling from here, perhaps dramatically.

The Fed has been working to fix and correct their last error (not raising rates in 2020 and 2021). Now they are at risk of making another policy error. Given the public shaming and overwhelming recessionary evidence pressing on them every day, it shouldn’t be a surprise to hear them start to back pedal on their stance.

The 70’s Playbook

Regular readers and those attending our annual meeting know that we have been expecting a relief rally in both stocks and bonds to begin in October. At present the marginal lows of the year appear to be October 14th for stocks. Bonds may be bottoming now. Relief rallies can be the start of new multiyear bull markets which is still possible if we somehow avoid a deep recession in 2023. For now, any rally is simply a response to a change in the central bank policy as we discussed above, and is literally just a relief that the worst of the tightening cycle may be behind us. Relief rallies can take prices of both stocks and bonds all the way back up to the old highs in a very short time period. Wouldn’t that be nice! It happened in the 70’s. The 70’s play book lasted for the better part of 10 years and stocks (and bonds) moved within a 30-40% trading range during that entire period.

It would seem quite possible that we are just now carving out the lower end of the playbook trading range if history is repeating.

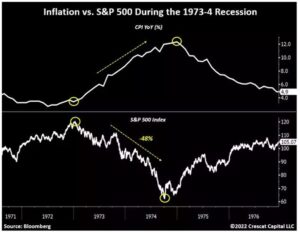

As inflation peaks and the Fed becomes more accommodative, stocks and bonds tend to bottom. Here’s what that looked like in the 70’s at least for the first round of peak inflation! In the 24 months following the 1974 low, prices recovered almost back up to the previous highs.

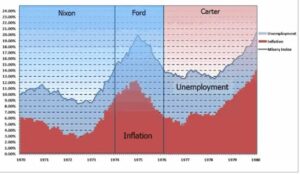

Of course, that was not the end of inflation in the 70s, and the cycle of stocks, bonds and employment and moving inversely with inflation continued until 1982. The next chart shows the pattern of inflation and unemployment during the 70’s.

Investor Action Items

We like to offer some relevant advice in our updates so here it is. Investors might use this time and place to consider the following:

- Make your IRA contributions for 2022 now if you haven’t already – check on your eligibility and limits for deductible contributions here.

- Consider conversions from IRA to Roth IRA – please consult with us first!

- Deploy sideline cash to taxable investment accounts – This is likely to be the last good window to get this done in 2022.

- Add to 529 plans for children’s education accounts for 2022.

- Help your kids open a Roth IRA if they had summer income.

- Fund your Health Savings Accounts for 2022 if needed. Details and limits here.

- There are plenty of investment opportunities here including tax loss harvesting, rebalancing asset allocations, shifting from short term to long term and high yield bonds, etc. We do all of this for our clients in their managed accounts as needed.

As always, we’re here to help our clients with all the messiness. Please reach out to us if you have questions or need assistance.

We are excited with the technical bottoming pattern that has been developing since the lows in June. The timing of a relief rally starting now is very good. As we said in our annual meeting this is a time to banish that fight or flight impulse. Stay opportunistic, stay in the game, life is long!

Cheers

Sam Jones