April 10,2024

Life as we know it changed dramatically—socially, politically, and economically—with the global pandemic. Yet, investors have not adapted to many of the new realities created during this time. Frustrations will continue for those waiting, wanting, and hoping for a return to the good ‘ol days when inflation could be tamed with a few simple rate hikes.

Today’s Inflation is a Secular Thing

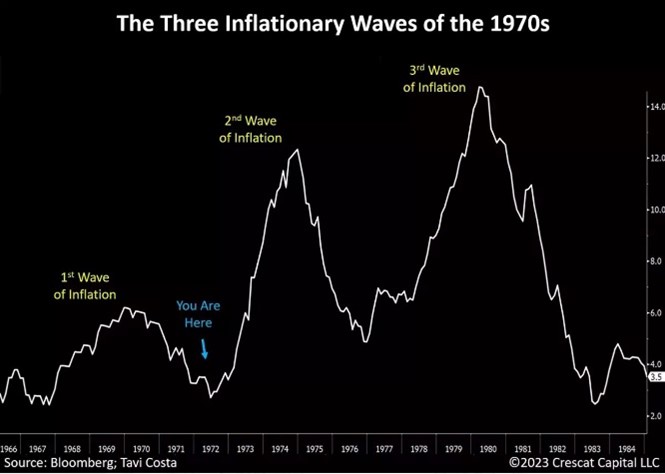

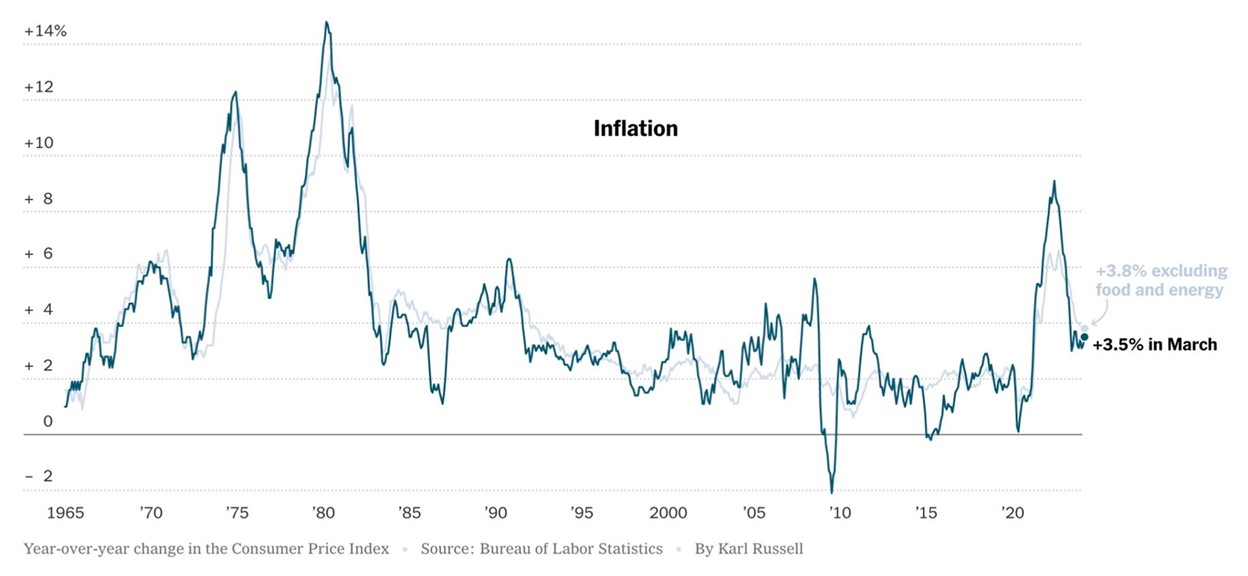

You might take a second to re-read our latest blog post, “Mission Accomplished” which was posted on January 22nd. In that post, we asked rhetorically if the mission of defeating inflation was indeed “accomplished,” as the Fed and the media seemed to suggest. Now, four months later, the Federal Reserve is inserting reasonable doubt daily as to their intentions to drop interest rates at all in June considering the recent rash of HIGHER inflationary reports. Today, employment is rising; wages are rising, and household wealth and company revenues are all rising. To be clear, the US economy is still doing fine in aggregate and especially fine for the very wealthy, who own 89% of all assets in the United States. ( *Seems almost strange to use the word “United” these days, doesn’t it?). Taylor Swift, as the Time Person of the Year represents peak Consumption and Spending. And $6 Billion spent chasing a 4-minute view of the total solar eclipse tells me we still have too much money chasing too few goods, The very definition of inflation. Investors and the financial media are marveling at the fact that the most extensive and shortest period of extreme rate hikes in the history of the Federal Reserve has not caused a recession. It will eventually! But today, in true 70’s style, it seems more likely that we are heading towards the next inflation leg higher (see chart below from Crescat Capital). Investors and the entire real estate industry, who are hoping for a big bond rally (lower rates), could be in for a longer wait.

Unfortunately, a new round of inflation would also be quite bad for stocks as expectations for a continuation of the bull market are squarely relying on lower prices and lower rates. Barrons notoriously pins the tail on the bull with their magazine covers in true contrarian fashion. 2024 is setting up to be the transition year where we see peak spending, consumer and investor confidence, peak earnings and peak economic growth. In short, not bullish for future stock returns.

Let’s unpack the sources of inflation as evidence that the new environment is here to stay.

We must understand that the sources of inflation today are not something that can be controlled by monetary policy (i.e. lowering interest rates and/or reducing the Federal balance sheet). Inflation of the type we have now comes from five sources most of which have accumulated over the last three to four decades. They are as follows in no particular order.

- Deglobalization and Nationalization Themes

Countries are putting up walls, tariffs, and barriers to trade as a sense of nationalism emerges aimed at labor protection. This is a relatively new phenomenon that is politically and racially motivated with very little economic basis. Recent wars over territory and resources are also destabilizing and bad for business. Deglobalization is inflationary by nature, but thankfully, this is the least sticky of the inflationary sources. Strong and healthy leadership would reach across borders to find cost efficiencies wherever and whenever. I was encouraged to see Janet Yellen make a recent trip to Chile to help secure favorable trade with its Lithium producers. The article is here.

- Out of-control Global Fiscal Spending, Stimulus, Debt, and Deficits

Many have described the last 16 years as the most undisciplined period of monetary and fiscal spending in history. Since 2008, the annual federal budget for spending has increased from a little over $1 Trillion to over $7 Trillion as of last month. All of this spending has come from borrowing. Consequently, the level of public debt has also ballooned to over $34 Trillion with net interest payments projected to exceed the total costs of Social Security and Medicare by 2030 and defense spending by 2028. In plain speak, our Federal Government is spending far more than it receives in tax revenue (called a Deficit) using debt and freshly printed US dollars to fill the gap. There is no Republican or Democrat willing or able to actually reduce Federal Spending because to do so would threaten over 15% of our country’s GDP! It’s totally out of control, totally unsustainable, and yes, totally inflationary.

- Wages are Permanently Higher

While avoiding the hot political buttons, I think this is a good thing and a long time coming. Wages have historically not kept pace with underreported increases in the costs of living, and we have now embarked on a journey to find that rare and almost extinct animal called The Livable Wage. Right or wrong, it’s happening. California recently increased the minimum wage for fast food workers from $16 to $20/ hour, up from $7/ hr. just 10 years ago. Like it or not, trends in California work their way from west to east over time. Only the poorest states with the highest unemployment rates will keep their non-competitive wages in the years to come. Eventually, labor will migrate to higher-pay states when a recession hits, but wages will not come down. It’s important to note that wage increases can stabilize, leading to lower inflation as a rate of change, but make no mistake, this still leaves us with permanently higher costs for all things labor intensive.

- Climate Adaptation

We posted a recent article on our New Power Fund page about the rising costs of homeowners’ insurance in areas of the country that are now regularly battered by hurricanes, wildfires, floods, and other “extreme” weather events. After more than a few years, insurers are now pricing in the true risks or simply dropping coverage altogether. Here’s the article. Climate change is now being priced into our economy and it ain’t cheap. Utility costs are up nearly 20% year over year, most of which comes from climate adaptation efforts. Again, this is not a variable that can be solved by the Federal Reserve lowering interest rates by a few basis points. This is a lifetime challenge that will bring a lifetime of higher costs.

- Commodity and Natural Resource Shortages

Finally, for those of us who have kept a watchful eye on the imbalances between supply of and demand for commodities, we have arrived at a tipping point. Commodities have notoriously long lead times to pull the raw materials from the earth and craft them into a usable resource for energy, building, infrastructure, technology, transportation, etc. Today, we have enormous demand for raw materials and energy, but we have also massively underinvested in the production of commodities for the last two decades. Lowering interest rates will not magically solve the global shortage of raw copper ore for instance. In recent months, commodities of all types, including oil, base metals, precious metals, rare earth metals, uranium, agriculture, timber, and especially copper, have all shot higher, in many cases out to new highs. These are input costs for nearly every tangible item in the world and these costs are not yet reflected in any current inflation numbers. We can also add housing to the list of shortages and of course, persistently high costs of shelter are over 40% of the Consumer Price Index, our inflation index du jour. Shortages of any sort create inflationary pressure, and more are on the way from commodities.

All in, the stage is set for inflation to remain sticky, strong, and persistent despite what you might hear about “Mission Accomplished” by the Fed and the Financial media. While there are plenty of differences between now and the 70s in terms of the drivers of inflation, the same stair-step pattern seems to be playing out. Today’s “higher than expected” CPI report confirms (again).

The 70’s pattern

and now

Investor Implications

There are important implications for investors. Where do we put our hard-earned capital such that it will continue to work as hard as we do and hopefully stay ahead of real inflation – let’s call it 5% just to be conservative.

Since 2021, regular readers have heard me talk about The Big Three investment themes and these should really be the foundation of any portfolio until further notice.

The Big Three are:

True Value – Lean into true value like stable incumbent companies paying higher dividends and conducting share buybacks, as well as those trading at subpar industry prices with high free cash flows, strong revenues, and healthy profit margins. There are many that fit this description, but you won’t find them in the technology or financial sectors. Small caps are very cheap relative to large caps, but selection is key as small caps, in aggregate, still have poor cash flows and high debt.

Internationals/ Emerging Markets—Lean into Japan, European value, Latin America, Mexico, and India. All are far cheaper than the US stock market and offer compelling growth stories. Their economies are just now recovering from recessions or very high inflationary cycles, making emerging markets look especially compelling as a group.

Commodities (including Gold and Silver) – See above! Supply and demand imbalances have created a new multi-year commodity bull market which started in November of 2020. 2023 and into early 2024 were pullback years for commodities offering us one of the most attractive (re) entry points I have seen in many years. Little known fact: Commodities have outperformed the S&P 500 by almost 2:1 since November 2020, even with the correction of the last 12 months! Commodity bull markets in the 1910s, ’40s, and ’70s each lasted a decade or more.

A couple of rules and guardrails on these themes. First, they do not all work together at the same time. Be patient and buy pullbacks within each theme. And second, it’s not wrong to diversify away from these themes to some degree. It’s fine to hold some mega-cap tech or your favorite AI stock. It’s fine to carry a few tiny bond or Bitcoin positions to dampen portfolio volatility. It’s also fine to do a little stock picking if you are so inclined. But the core of your entire investment portfolio should be anchored in the big three above.

In addition, investors at large are still expecting a normal business cycle to occur, and the current environment is likely to challenge those assumptions. In a normal expansion phase of the business cycle, the economy grows, stocks and commodities rise, and bonds give way. That’s where we are today. In a contractionary phase, demand dries up, the economy begins to shrink, stocks and commodities fail, and bonds take the lead. However, during persistently high inflationary cycles, the business cycle is highly skewed. Specifically, during the contractionary phase, inflation beneficiaries, like commodities, continue higher, stocks experience bear markets, and bonds do very little to provide safety. There is evidence that we are approaching this phase. Wise and aware investors would consequently skew portfolio allocations towards inflation beneficiaries or hard assets and away from financial securities like large-cap stocks and Treasury bonds. In this scenario, many investors could be caught off-side with their current allocations.

Other implications are more in the warning camp. Today, I still see far too much concentration in mega-cap technology, too much money sitting in non-interest-bearing checking and savings accounts, and too much hope regarding the future of the bond market and associated securities. I also see a great deal of complacency in simply owning the S&P 500 or the Nasdaq 100 as investible indices (SPY or QQQ). These indices have had an incredible run, but these are not the times or places to get complacent, given record-high valuations and pending risks. Picking up nickels in front of a steamroller is a phrase that comes to mind.

Thank you for reading. I honestly wish the best to all as we move through this new investor environment. Clients of All Season should rest assured that we have already made the necessary changes to their portfolios. Please do reach out if you need help. We are happy to evaluate your personal situation and help you get aligned properly if necessary.

Regards,

Sam Jones

President, All Season Financial Advisors.