January 22, 2024

Every new year in the markets tends to bring a new set of leaders, laggards, and themes. I always find it helpful to just observe any changes as they unfold in the first 30 days to help guide my thoughts, challenge my assumptions, and shed my own backwards looking biases as needed. Portfolio management is an art and a science that mandates a certain level of flexibility, humility, and a constant reminder that our emotions are our worst enemy. For this update, let’s look at what has changed in terms of intermarket action from late 2023 and perhaps more importantly, what relationships have stayed the same.

The Three Horseman?

Bespoke Institutional Research has highlighted the importance of the Three Horseman in the financial markets. These three variables have arguably been the most important influences on which sectors, asset classes and themes dominate the markets. They are as follows:

The trend of the US dollar

The trend of the yield on 10-year US Treasury bonds

The price of Oil

Now if you hadn’t noticed, the vast majority of gains generated from stocks in 2023, happened in the last 60 days of the year. We were all grateful of course to finish strong. But it’s important to recognize that these gains occurred because the condition of all Three Horseman simultaneously reversed course in a favorable direction. Specifically, from late October through the end of the year we saw:

The US dollar fall -4.5%

The yield on the 10-year US Treasury bond fall -23.9%

The price of Oil fall – 22.4%

Taken together as a team, these three variables effectively reflected an expectation of falling inflation. When all three fall in unison, we understand that inflation expectations are falling. Conversely, when all three rise in unison, we understand that inflation expectations are rising – and are still a threat to the economy.

Unfortunately, in the first 20 days of 2024, all three seem to be forming a new higher base and are starting to trend higher again. Quickly, our mind begins to ask that hard question.

Is inflation coming back in earnest or did the market simply get ahead of itself in late 2023? Honestly, we don’t have a clear answer yet. For now, we are assuming the later case but remain watchful of the former.

Sectors, like Real Estate were clearly the best performers from the lows of late October, ripping higher by 27% in less than 60 days; but so far, the market is “digesting” these gains and real estate is down over 7% in 2024. Similarly, internationals had a fantastic run in late 2023 but like real estate, they are digesting those gains now as the US dollar is trending higher again. Oil is marginally higher so far in 2024, so of course we see the Dow Jones Industrial Index and Dow Transportation Index falling.

In short, the market ecosystem is responding to the trends in the Three Horseman again: All up in 2024 so far. But we are approaching a critical moment for these trends with important ramifications for investors.

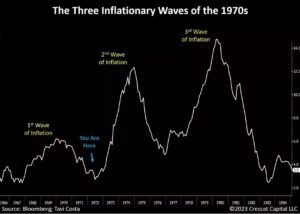

I have shown this chart in the past and will bring it forward again, courtesy of Crescat Capital, who has very high conviction that we are nearly approaching a second wave of inflation, like the pattern from the 70’s. Our conviction is not so high, and we will let the data guide us. But the risk is real, and we’ll be watching the Three Horseman closely in the next several weeks.

Crescat suggests that the primary forces and drivers of inflation are still present and persistently out of the Federal Reserve’s control. We presented these non-monetary drivers of inflation at our annual meeting last October:

-

- Deglobalization/ Nationalism/ Geopolitical instability

- Climate adaptation and mitigation

- Long term underinvestment in raw materials and commodities.

- Unsustainable levels of global government debt and fiscal deficits.

*I would probably add one more – persistently high costs of housing which account for over 40% of the Consumer Price Index in the US now.

It seems the market and the Fed have proclaimed victory over inflation. I am not yet convinced, neither is the bond market and they say bond money is the smart money.

I am reminded of young president George Bush standing on the deck of the USS Abraham Lincoln Aircraft Carrier declaring victory over his 3 month old war in Iraq on May 2nd, 2003, with his infamous “Mission Accomplished” speech. Oh my.

The War in Iraq was not over by a long shot and raged on until the official end on December 15th, 2011 – 8 years later!

Bonds and Stocks; Friends or Frenemies?

From 1982 until early 2021, stocks and bonds moved in opposite directions which gave birth to the magic of the 60/40 portfolio (60% stocks/ 40% bonds). Make no mistake, this condition was all a fabrication of our own Federal Reserve who have used the Federal Funds rate and monetary policy to effectively support the financial markets, and the economy to a lesser degree, when times get tough. Historically, when stock prices fell, the Fed dropped interest rates and bond prices rose. Consequently, the mix of the 60/40 portfolio created a smooth ride for investors: Up and to the right, no real volatility, no worries, investor bliss. But history shows that this 40-year cycle is an unnatural and unsustainable condition. Discerning investors are beginning to recognize that the relationship between stocks and bonds changed in 2021.

Consider the correlations between stocks and bonds in different time periods.

1968-1981 (70’s Inflationary period) Positive .42

This means that stocks and bonds were positively correlated, both moving in the same direction during inflationary periods. There is no diversification benefit when correlations are positive.

1982 – 2021 (40 years of investor bliss) Negative .32

This means that stocks and bonds moved in opposite directions providing excellent diversification benefits. Enjoy the 60/40 magic carpet ride!

2021-2024 Positive .35

Back to no diversification benefit

Last 12 months Positive .42

Back to the 70’s??????

Stock prices and bond prices are still moving in the same direction. Mission Accomplished? Not yet. What’s the point? The point is that investors now have a few uncomfortable realities to contend with.

-

- Bonds are no longer a safety net for stocks. They do not yet add value to a portfolio in terms of dampening volatility and they don’t yet pay enough income beyond cash or a money market to justify a permanent or normal size allocation.

- We need to consider other asset classes or portfolio strategies that can replace the traditional role of bonds (more on this in a minute).

- Higher portfolio volatility is expected and normal until we have a formal economic recession.

- A 100% stock portfolio is not a tolerable option for most, especially considering today’s very high valuations.

Big Opportunities

Despite what you might feel and hear, there are still very rich opportunities for investors in this environment. A few thoughts on this front.

-

- Stocks are factually trending higher, pushing out to new highs in some cases, so we need to remain invested in stocks and avoid the temptation to hide in cash with our stock money. In fact, the first 20 days of 2024, has provided an orderly pullback for those interested in adding to their equity positions.

- Small caps are still far more attractive than large caps and tend to perform better when inflation is falling, as it is now.

- Relative valuations and growth rates strongly favor these countries looking forward:

- Brazil/Latin America

- Hong Kong

- India

- Spain

- UK

*The United States and Japan remain the most overvalued countries in the world by a wide margin.

-

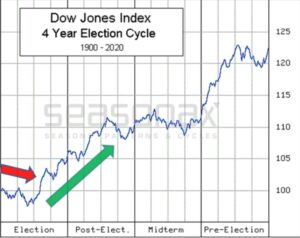

- The Presidential cycle still seems to be in force. “Election years” (2024) tend to be a little weak in the first half but finish strong, followed by a healthy “Post election year” (2025). So, while volatility is to be expected now, it is rare to see more than a garden variety correction in the broad US stock market in the next 24 months. Given the stakes of our pending election, we should all give this pattern much more room for error!

Alternatives to Treasury Bonds

This gets tricky and honestly falls outside the domain of most investors’ knowledge and comfort zone. Our firm has expertise and experience with strategies that do not depend on Treasury Bonds or falling interest rates to generate reasonable portfolio total returns over time. Here are five ideas without getting too deep in the weeds.

-

- Tactical trading strategies – These strategies can trade away stock market risk either through dynamic asset allocation or relative strength analysis as a means of controlling portfolio volatility.

- Alternative asset classes – These are things that have low or negative correlation to stocks and bonds. Things like precious metals, perhaps Bitcoin (now that the SEC has approved public consumption), hard assets and commodities or specialty strategies like covered calls, mergers and acquisition funds.

- High dividend paying securities, preferred securities, REITS, credit funds and other hybrid income producers.

- Stock picking strategies – Believe it or not, stock picking is back! Select value managers are earning their keep offering both high returns with limited downside volatility. Think Berkshire Hathaway.

- Cash and Money Market funds paying 5% – Yes, this is still a viable option to bonds for as long as cash rates are higher than bond rates!

I’ll close with one critical observation looking back at the last two years, since the highs in late 2021. Lots of investors got excited about the market action in 2023. Yes, the markets were up in 2023 but can we say Mission Accomplished? We mostly saw a healthy recovery from the losses in 2022. A 60/40 portfolio is still down a little over 5% in total return from January of 2021 to present. My sense is that we are in a different market environment now. One in which we need to work a little harder and be a little less complacent with our assumptions about what has worked well in the past in terms of portfolio allocations. Remember, the Mission of creating wealth and defending it is never accomplished.

Stay tuned!

Sam Jones