April 15, 2024

Copper is quickly becoming a critical metal in the transition towards renewable energy and electric vehicle infrastructure. While the industry projects tremendous growth in demand for copper, the supply of copper has faced challenges. Pricing dynamics and improving margins will create new production and opportunities for investors to capitalize on the current imbalance.

Projected Growth in the Copper Sector

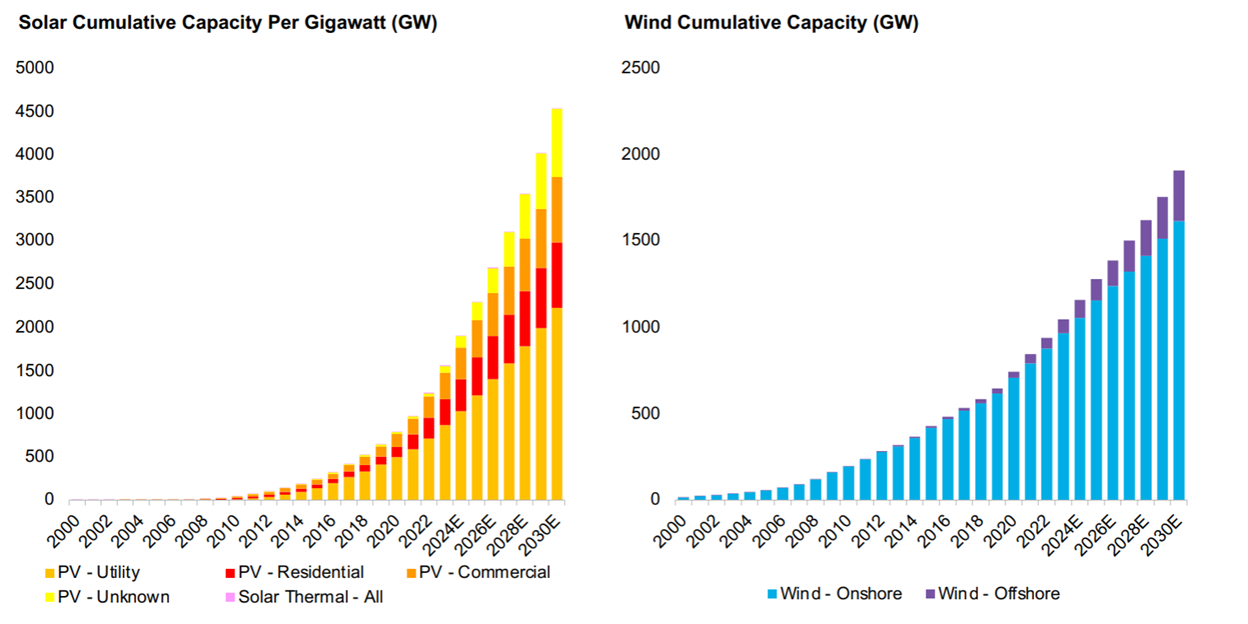

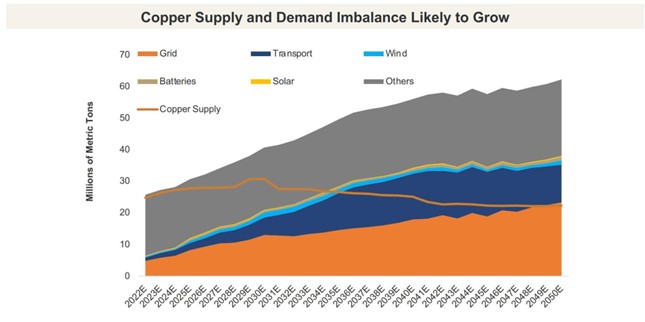

Recent projections indicate a robust expansion in the copper sector in the coming years. With the increasing adoption of renewable energy technologies such as solar panels, wind turbines, and electric vehicles, the demand for copper is expected to soar. Demand for copper is projected to surge, driven primarily by the rapid growth of renewable energy infrastructure and capacity.

BloombergNEF, March 2023

BloombergNEF, March 2023

Copper’s Crucial Role in Renewable Energy

Copper is the lifeblood of the renewable energy revolution and is vital in transmitting, distributing, and storing electricity generated from renewable sources. From conducting electricity in solar panels and wind turbines to facilitating energy storage in batteries, copper is indispensable to the functioning of clean energy systems. This also includes replacing existing inefficient grid infrastructure. The current grid runs inefficiently; according to a report done by Inside Energy, we lose between 2.2 and 13.3% of energy in transmission and distribution. The role copper will play is to enable material upgrades to a more innovative and efficient grid.

Moreover, as governments worldwide commit to ambitious climate targets and transition towards carbon-neutral economies, the demand for renewable energy technologies is set to skyrocket. This increased adoption of clean energy solutions will further fuel the demand for copper, making it a critical commodity in the fight against climate change.

Rising Production Likely to Meet Demand for Copper Over Time

We anticipate that industry leaders will invest in expanding their production capacities and improving operational efficiencies to meet the growing demand for copper. Today, the cost of producing copper ($2.41/ pound) is well below the Spot price ($4.34/ pound), implying an 80% profit margin. Despite current projections, increasing profit margins will likely spur more excellent production and discoveries across the industry. See below from Bloomberg New Energy Finance 9/1/2022.

As such, we believe they are well-positioned to capitalize on the opportunities presented by the burgeoning renewable energy sector.

Seizing the Opportunity in the New Power Fund

In light of the projected growth, current supply shortage, and significance of the copper sector in the renewable energy transition, we have added a copper position to our New Power Fund. On March 28th, we added a 4% position in the COPX exchange-traded fund (ETF) to the New Power Fund. This ETF owns some of the world’s most influential public copper mining companies, including Lundin Mining, Southern Copper Corp, Ivanhoe Mines, and Freeport McMoran. In addition, COPX is distinctive because it represents companies enabling a change to renewable energy and upholding ESG (environmental, social, and governance) standards. The addition of COPX represents another step in our reconstruction project with the New Power Fund to double down on climate solutions securities. Investing in copper now presents a timely opportunity to participate and benefit from transitioning towards a cleaner, more sustainable energy future.

Please feel free to contact us if you are considering an investment in the New Power Fund, which is open to new accounts of $100k or more.

Regards,

Cooper Jones

New Power Fund Analyst