July 17, 2023

The Alternative to Being a Landlord

It seems that everyone I speak to these days is looking for passive income, usually in the form of a rental property. Of course, real estate of any kind is now in short supply, with historically high prices and heavy carrying costs. Let’s peel back the shell of owning hard asset real estate for investment purposes and consider the alternatives.

My Personal Disaster

Scott met me at our newly purchased Sherman Street office building in a vintage yellow Mercedes Benz. It looked like something his grandmother gave him. I was working to rent the office before moving All Season Financial Advisors into the space in 1999. Scott needed some short-term office space for his new thriving business on the world wide web. We signed a quick lease for 6 months and it didn’t take long for me to discover that “Scott” also needed a place to live and had a very healthy on-line gambling habit. Scott paid the first month’s rent but that was the last of it. I tried to evict him with attorneys but alas Colorado state law favors the tenant, and he stayed rent free for over a year. He trashed the place and vanished in the end. My total rent for a year was one month’s rent and his damage deposit. Costs to me all in were over $8000 with attorneys, replacing the carpet, and deductibles for a water damage claim. In addition, my taxes doubled that year as new owner of the property as did my homeowners insurance after making the claim. It was an amazingly poor experience with a negative “return” on my investment and a year of high blood pressure. I felt trapped in a losing situation with an expensive asset and that is a bad feeling. I’m sure others who are better at this than I, know how to find good tenants and keep a rental property spinning profitably. Personally, I’m a bit scarred from my landlord experience and probably won’t ever do it again.

Real estate also has a growing Total Cost of Ownership (TCO). After nearly 30 years of historically low carrying costs like mortgage rates in the 2’s (%), utility costs that are lower than your weekly coffee budget, and taxes that don’t seem significant, we have been conditioned to just focus on the purchase price of any real estate. But those days are really over now. Tax assessments in 2023 were shockingly high after the run up in prices over the last few years. Homeowners insurance is also ramping up 20-30% over the last couple years as they attempt to socialize the rising costs of climate disasters in vulnerable areas.

This happened on Thursday if you hadn’t heard:

(The Hill) – Farmers Insurance will end its home, auto and umbrella coverage in Florida and curtail coverage offerings in California due to ongoing risks from environmental disaster, the insurer announced Tuesday.

If you happen to need a new roof, or some work done on your house this summer, you know that finding a contractor is nearly impossible and then the cost to get anything is truly unbelievable.

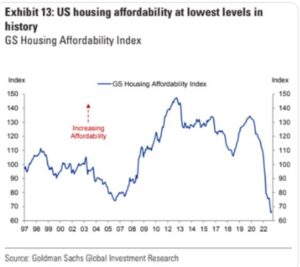

All things considered, when we look at the affordability index (below),

and combine this with the rising Total Costs of Ownership, it seems pretty obvious that investment property and rentals are not going to generate much passive income for investors until the situation changes rather dramatically. To be clear, we’re not talking about your primary residence or other personal use property but rather the prospect of buying property in order to generate rental income.

A Real Alternative

Now, if only there were a way to buy a commission free, diversified pool of income producing real estate with daily liquidity, positive and dependable income, and no troublesome tenants, taxes or insurance.

Wait there is such a thing! Real Estate Investment Trusts (REITS!)

REITS Offer High Total Returns and Staying Power

Let’s look backwards for a minute noting that past performance is not guarantee of future results. REITS have outperformed stocks for at least the last 20 years. Certainly, we have to consider the strong tailwind of falling interest rates over this time period and temper our future expectations. But the facts are what they are.

I want to present this information using the Dalbar study on real investor returns. First consider that over the last 20 years, REITS have outperformed nearly all other asset classes (ex-Gold). Who knew? REITS generate a total return that is a combination of price change and dividend payments. Today, we are finding REITS in many forms that are paying 7-10% dividends despite the trend of prices. If you look at the Dalbar chart above, you might notice the yellow “Average Investor” bar that shows a relatively poor 20-year return of only 2.9%. Remember this is a study of actual investor portfolios conducted by Dalbar every year with a 20 year look back. Now I want to explain why owning a REIT paying 7-10% interest can help investors avoid the negative behavioral effect we see so often.

Behaviorally speaking, the reason why investors do so poorly is that they have a strong and repeat tendency to buy high and sell low. Buying high isn’t as much of a problem as selling low. But why does our silly lizard brain ultimately drive us to sell low? Well because the human brain is preprogrammed to avoid pain and the pain of loss at bear market lows simply becomes “unbearable” (unable to withstand a bear – Ha!). But, but, but, if we were getting paid 7-10% in dividends on our holdings, despite the prices of these securities being down 15-25%, we have much better staying power. That is why I have over 50% of my personal net worth in our MASS Income model which has an estimated dividend yield of 8.8%. If I focus on price alone, I might get sad. But then I see multiple dividends of $500-$800 + come to me in waves around the end of each month and I think “ at least I’m getting paid really well to wait for prices to move higher again”. Emotionally, when we are receiving regular high income on our investments, we are much less prone to reacting to our fears.

REITS: Why Now?

After a bloody 2022 on the price side, REITS are now very attractively priced again and paying historically high dividend rates. Several of our positions like AGNC Investment Co (AGNC) and Annaly Capital (NLY) already cut their dividends by over 20% in the last couple years as cash flows from operations fell. But they are still paying over 13% in annual dividends with improving balance sheets and rising revenues. Price trends also appear to have bottomed with the market in October of 2022, but gains have been somewhat muted against continued pressure and chatter from the Fed. REITS are highly reactive to changes in interest rates and the Fed has not been a friend since March of 2022. But with inflation having completed a full return to pre-pandemic levels, the Fed is likely done with their rate hike cycle. Historically speaking, when the Federal Reserve ends their rate hiking cycles, it tends to be a very good environment for interest sensitive sectors like REITS, banks, financials, etc. REITS look good now, especially compared to the risks and rising costs of purchasing hard asset real estate now. REITS importantly offer incredibly high liquidity especially when we can purchase them using closed end funds and ETFs. They pay very high dividends, and most are now trading at 10-12% discounts. The second half of 2023 should be an excellent environment.

For those invested in our Multi-ASSet Income strategy (MASS Income), REITs represent a little more than 40% of our 42 holdings. The remainder is held in credit funds, preferred securities, bank loans, business loans (BDCs), fixed income and select high dividend paying stocks. I think of MASS Income as a REIT strategy but really it’s far more diversified than just that asset class. Our goal is to remain fully invested in all markets in order to generate secure annual dividends and income in the 7-10% range. As our investors know, there is plenty of price volatility in this strategy, but the income keeps rolling in, month after month after month.

As always, my intention with these updates is to set expectations, guide good behavior as investors, and present timely solutions for you to consider. Stay tuned as there are new opportunities (and new risks) as this relief rally in the stock market matures. I’ll be guiding you through the changes in the economy and the markets more frequently now, moving toward weekly updates.

I hope everyone is enjoying the very belly button of summer!

Cheers,

Sam Jones