July 3, 2023

It’s been a wild first 6 months of the year with big winners and big losers inside all asset classes. As I look across the landscape at all market indices, as well as our own strategies, looking back to the top of the bull market in December of 2021, I see that nearly everything has arrived at the same place in terms of performance. This is the yin and yang of market cycles where we recognize that adding risk to one’s portfolio often just leads to adding volatility and not necessarily long-term returns. Of course, timing is everything. Let’s dive into the details and some performance numbers and I’ll finish with some opportunities developing for the second half of 2023.

My First Investment

My first investment was a total loss, nearly 100%. When my girlfriend (now wife, Sarah) and I got out of college, her parents gave us an unthinkable amount of “starter” money – $10,000. We were working day jobs and didn’t need it immediately. My smart 22-year-old self, called a broker friend from Wachovia bank and asked what I should invest in that will make big returns! At the time, 1990, Trimble Navigation (TRMB) was a company on fire; satellites were big business, and they were going to the moon. I put all $10,000 into TRMB and paid a $280 commission for the shares. The stock topped out a month later and fell 83%. I panicked and sold right at the lows and lost the majority of our nest egg. My broker friend waived the sale commission because he felt bad. I never told my wife but felt the utter shame and frustration of my first catastrophic investment failure including the consequential loss of confidence and financial freedom. But that wasn’t the end of my pain. TRMB went to climb to new highs the next year and has made 15%/ year on average for the last three decades through last week, without me. I learned that timing matters. I learned that I am human and prone to making bad decisions even with good companies. I learned that there must be a better way to balance risk and return. I learned about true diversification. Today, I hope to bring 30 years of experience to the management of our client’s assets, always working to find that right balance and avoid catastrophic, unrecoverable losses. This is what we do for all clients of All Season Financial in all forms.

See You on the Other Side!

It was October 5th, 2022, when we stood in front of our clients at our annual meeting at the Wellshire Country Club and offered this summary slide. We called the pending rally in stocks and bonds, a “Relief Rally”.

Few in the room believed it. After all, the S&P 500 was down -26% at that meeting.

Five days after our meeting, global stock and bond markets bottomed. Good call!

But let’s look a little deeper into the market to understand what has happened since those lows.

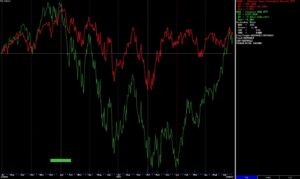

As we would expect, the biggest winners on our relief rally since last October, have come from the same side of the market that was decimated in 2022. Mega cap technology companies like Netflix, Meta (Facebook), Google and Amazon were down 30-75% at their worst in 2022. But they have recovered a majority of those losses thus far in 2023. Comparatively, other areas of the market like Value and Dividend payers which lost almost nothing in 2022, have gained almost nothing in 2023 but remain steady just below the all-time highs. Looking back at a two-year chart (below) we see two paths to the same destination. The red line is the iShares Dividend Growth ETF (DGRO), and the green line is the Nasdaq 100 ETF (QQQ) or mega cap growth index. Obviously the two worlds have come together in terms of performance with the Nasdaq 100 simply going about it the hard way. I’ll see you on the other side! As I said in the introduction, adding risk has simply added volatility to your portfolio, not returns, if you are willing to look beyond the last 6 months.

Of course, what happens next matters a great deal in terms of comparative performance. Stay tuned as we are very likely at an important inflection point for market leadership.

From the Top

Looking back at the last two years, a similar comparison can be made looking at different investment strategies and methods. Our passive strategies called Wealth Beacon represent different mixes of stock and bond indices. As we would expect, these strategies fell harder in 2022, but have recovered stronger in 2023, just like the green line above. Our active, risk management strategies like our flagship All Season strategy, experienced mild losses in 2022 but have not gained much ground thus far in 2023, just like the red line above. In the end, after a full market cycle, we see the two coming together in total returns.

From the top of the market on 12/31/21 to present we see the losses (or total returns) are very similar for all strategies as well as the broad market averages over the period. Strategy performance numbers presented below are preliminary, unaudited and based on model accounts net of all fees as of the writing of this update (6/26/2023).

Returns (losses) from the top of the market 12/31/21 – 6/26/2023.

S&P 500 Index -9.18%

Wealth Beacon Aggressive (passive) -10.14%

Wealth Beacon Moderate (passive) -9.70%

Wealth Beacon Conservative (passive) -9.59%

All Season (Risk Managed) -9.88%

Again, what happens in the second half of 2023 will provide more clarity on leadership and strategy advantages. But as of this midyear checkup, it’s all the same.

Opportunities and Risks for the Second Half

If I had to pick just one thing that represents the greatest systematic risk to investors today, it is the overwhelming concentration of wealth in just a few names, 8 of them to be exact. These are names that you hear every day in the media.

Microsoft

Apple

Meta (Facebook)

Netflix

Nvidia

Amazon

Tesla

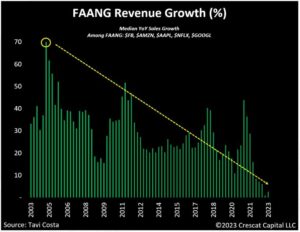

These are great companies make no mistake, but from a valuation, revenue growth, free cash flow, price to book and price to earnings basis, they are now some of the most expensive, overpriced securities in the world today. Crescat Capital does some incredible work on the state of Mega cap technology stocks. They point to the fact that the median Year over Year sales growth among “FAANG” names has just gone negative for the first time in two decades. Focus on the last 5 years of the chart below.

Priced to perfection is an understatement. Beyond valuations, there are significant headwinds coming now from changes in privacy regulations, diminishing dollar volume of on-line advertising, anti- trust regulations, global tensions, and competition. The AI frenzy offered a nice boost in recent months, but I’m not convinced these same names will be the leaders in the end. Fun fact from Seeking Alpha last week with data as of 6/23/23; the 8 names listed above account for slightly more than 100% of the gain YTD in the S&P 500. The other 492 stocks in the index have an average return of -1%. Wow!

Most investors don’t realize how much exposure and concentration of their wealth is in these names by way of simple mutual fund or ETF index ownership. Factually, these mega cap names are in the top ten holdings of nearly every fund and ETF within these investment categories:

Large Cap Growth

Large Cap Value!

Mid Cap Growth

S&P 500 Index funds

Total Stock Market funds

Every 401k plan and every standard asset allocation portfolio seems to own the same mix of the funds above. Is this a diversified portfolio when all funds own the same securities in bulk? Hardly.

What’s the point?

As your asset manager, our job is to allocate your money into securities, sectors, countries and asset classes that offer favorable characteristics in terms of risk and reward. Conversely, our job is not to pile your hard-earned money into overbought, overvalued, overhyped investments just because they are winning the popularity contest (Trimble Navigation!). The time to buy mega cap technology was October of 2022. Now, may very well prove to be the time to take profits.

What do we find attractive now?

Now that we have clearly identified where risk lives, let’s put our fingers on three real opportunities for the second half of 2023.

#1 Small Cap Value

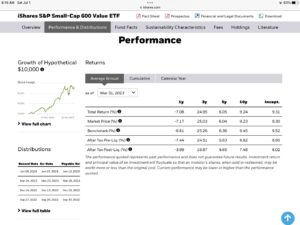

I’m intrigued by this style and size category for future investment. Take a look at the returns of the basic I Shares Small Cap Value ETF (IJS).

While the 1-year numbers are still negative (-7.08%), look at the 3 yr. numbers of +24.95% annualized. IJS also posts an average P/E of 10.5 and Price/ Book ratio of 1.25 which is less than ½ the very rich valuation of your basic S&P 500 index fund and 1/3 the valuation of the Nasdaq 100. And under the hood of Small Cap Value, you will not find any mega cap tech – wink! Today we have significant allocations to small cap value which are only up +4.95% YTD. We remain disciplined and patient as we expect this style box investment to begin outperforming in the second half of 2023.

#2 Internationals/ Emerging Markets

No need to wait for performance here. Internationals have been outperforming the US stock market since the lows last October. Consider the following total returns from 10/11/2022 – 6/26/2023:

Dow Jones Industrial Average (DIA) +17.61%

S&P 500 (SPY) +23.48%

Europe/Far East/ Asia (EFA) +31.21%

All Country Word Index ex US (ACWX) +25.67%

Regular readers know that internationals, like small cap value, are priced at less than 1/3 of the valuations we see in the broad US large caps today. Stronger performance at 1/3 the price. Sounds good! We remain fully allocated to internationals and emerging markets.

#3 REITS, High Dividend and High-Income securities

Admittedly, it’s been a rough go for this group of investments in the last 6-12 months. The Fed pushing up short term interest rates by 5% in the shortest time period in history, has been a headwind to say the least. Now it appears they are done raising rates and are likely to pause for the better part of the next 6 months (TBD). Inflation is sticky and inflation is still real, but they have done a tremendous amount of damage to the banking system, real estate, credit markets and lending since March of last year. The Fed has poured gallons of water into the gas tank of our economic engine and now they are waiting to see if and when our car will stop. It will stop.

IF, and this is a big IF, the Fed is actually done raising rates, we will see the market begin to accumulate and bid UP the prices of securities that are highly impacted by interest rates. Since the last Fed meeting on June 14th, I have witnessed a new level of buying interest in this space, so we see the opportunity developing now. As time goes on and we move into the second half of 2023, this could become a huge total return opportunity especially if recessionary pressure continues to build.

Our Multi-Asset Income strategy is still down over 19% since the all-time highs in 2021 on a total return, net of fee basis. I know it and feel it, because this strategy remains my personal largest holding by a long shot. It is frustrating to see growth investments with no dividends and crazy valuations rocketing higher while REITS, preferred securities, Bank loans, credit funds and direct lending securities paying over 8% in aggregate, sit on the sidelines of the performance charts. Maybe Warren Buffett and I are the last investors who like their investments to pay high income. I like income because it pays rain or shine and lets the magic of compounding work to our advantage. 8% annual income is very attractive to me and when the price trends turn higher, we get into double digit total returns in a hurry.

Our Value to You

The main points we want you to take away from this update are simply this; You have entrusted us to manage your money by allocating your assets appropriately to sectors, countries and asset classes that offer attractive risk and return characteristics. We do this across all investment strategies in our company. Today the markets are rewarding only a very thin slice of the investment landscape that now has poor risk reward characteristics looking forward. We understand that it’s difficult to watch the market run up as it has while your portfolio seems to be lagging. This is one of those times when emotions get in the way of rational, disciplined, needs based, investment decisions. Fear of Missing Out (FOMO) is loud, we get it. Please excuse us while we choose to stay disciplined and follow our system as we have done for the last 30 years. Patience now is critical as the second half of 2023 is queuing up to be very different than the first half.

Beyond allocating your assets appropriately, our other main value as your advisor is to set expectations and offer you a clear and honest assessment of conditions whether it is popular or not. Our fiduciary loyalty is to our clients and meeting your long-term objectives for cash flow and financial independence as identified in the financial planning process. Hopefully, this type of communication helps set those expectations and guides your understanding of what we are doing with your investment assets toward that end.

As always, we appreciate your continued trust and confidence in our firm, and we look forward to serving you to the greatest extent possible.

Sincerely,

Sam Jones

President, Chief Investment Officer