July 24, 2023

Let’s begin with our old friend Charles Darwin who famously said,

The New Environment

Regular readers know the high-level assumptions we are making regarding “The New Environment” . Specifically, we have highlighted almost exhaustively, about the Big Three Investment Themes (Value, Commodities and Emerging Markets) that emerged as new leadership beginning in October of 2020. These themes developed as a clear response to the New Environment we live in today. So far in 2023, just like the summer of 2021, we have witnessed a short counter trend move, where things like speculative tech and overvalued growth names take the lead. But, make no mistake, the primary trend leadership, dating back to 2020, remains with Value and Dividend Stocks, Commodities and Internationals. Let’s unpack the New Environment to help us understand the importance of adapting our portfolios with an eye toward “survival” and finding the right balance of risk and reward.

These are the clear features of the New Environment that began in late 2020:

- Rolling manias where investors are chasing the latest craze in order to make a quick buck. Rolling manias are indicative of a type of desperate and undisciplined investor who is struggling to make money and trades like a gambler. Manias always end badly and destroy wealth for the vast majority of those who choose to play in this sandbox. At the same time, manias can produce some lasting investment value if one is patient enough to find the real value these companies bring to the world. The short list in chronological order;

Bitcoin – still the domain of chaos investors, but Blockchain might be a lasting value.

Marijuana and Pot Stocks – Was very hot and now very dead

SPACs – Blank check Special Acquisition Companies – nothing left to see here.

COVID Unicorns – like Virgin Galactic, Peloton, Stitch Fix, Carvana, Chewy, etc.

Meme Stocks – Read all about it https://www.nerdwallet.com/article/investing/meme-stocks

And now Artificial Intelligence (AI) – Real AI is not what we see today. But it is coming.

- Labor Costs are Permanently Higher

This is a good thing and a long time coming. Nationalism trends are putting an end to the benefits of globalization (aka cheap labor overseas). Stuff we buy looking forward will cost more as labor costs to mine it, assemble it, serve it, deliver it, solve it, are not going back to $7/hr.

- Costs of Shelter are Higher for Longer

For those looking for Real Estate prices to collapse in hopes that they can afford something… anything, you’re going to be in for a long wait. Rental prices are falling thankfully but will not likely return to pre-2020 levels. Homeowners do not need to move, do not need to sell and have no interest in trading in their 2.7% mortgage for a 6.6% mortgage. Meanwhile, we have an entire generation of young people who want to buy real estate but still can’t afford it. Prices will therefore remain high unless and until we have a very serious economic contraction or an historic burst of supply.

- Costs of Capital are Higher for Longer

The Fed has been pretty clear about this, and they are likely to raise rates again on Wednesday. They are working to get inflation down, but they are swimming against a 25-year tide of massive money printing, unlimited stimulus, and uncontained debt spending. Our monetary system is going to be less friendly for the next 7-10 years if we are to find any form of sustainable balance again. Be prepared for the fact that mortgage and loan rates (still stuck at 6.5%) will stubbornly not fall with stated inflation (now 3%).

- Underinvestment in commodities and raw materials

This is a topic, maybe THE topic, that just doesn’t get enough press in my mind. Globally, we have not invested enough in the production of raw materials (think base metals, timber, oil and gas, silver, food commodities, etc.) to serve our global economies, even when they are barely growing as they are now. The world is in short supply of raw materials and commodities – I’ll provide more evidence in future updates. Commodities prices are also far below levels that reflect these worldwide shortages. Oil is moving back toward $80. Did you notice? Invest in Scarcity!

- Climate Adaptation is Inflationary

Our man-made climate problem is coming home to the bottom lines of corporations, homeowners, municipalities and our own Government (think FEMA). To be clear, the costs are coming fast and hard from our need to respond to the natural environment we made for ourselves – heat and cold extremes, drought, wildfire and flood extremes all at the same time. Select Insurance companies can’t afford to operate in entire states like California and Florida anymore. And of course, crumbling or inadequate infrastructure can’t handle most of what’s happening as we’ve seen in places like Texas. Adapting to climate change, is and will be, a very expensive and inflationary catalyst for the foreseeable future.

In summary, all that has happened since 2020 is not solely a response to and from COVID, but rather a culmination of variables that have been accruing since the late 80’s. The New Environment is one that is persistently and stubbornly inflationary interrupted by rounds of soft economic data, even short recessions. We are living this reality that folks in the 70’s would remember as a Stagflationary environment. This is when the economy and most asset classes become stagnant, while inflation roots in at higher than desirable levels.

Darwinize Your Portfolio

Adjusting one’s investment portfolio regardless of the time frame, is necessary. There is no such thing as set it and forget it as much as our industry would love for you to do that (good for fee revenue and no work for them!). Our constant exposure/ passive investment strategies, called Wealth Beacon, do make changes but on long-term time horizons. These adjustments take the form of rebalancing, tax loss harvesting, possible upgrades to positions with lower costs and/ or tilting the portfolio toward asset classes and styles with better long term risk reward properties. We do remain fully invested in all market conditions, however. Ultimately, with our passive strategies, we are working to keep client assets earning a market return with very high tax efficiency. This is not a paired objective as many of our clients simply want a portion of their portfolio earning the full market’s return and are willing to accept the associated volatility. Others are more focused on generating long term capital gains, so it works for them too. The point is that nothing is truly passive, changes are necessary.

If we consider our dynamic asset allocation strategies, our New Environment offers investors some very attractive opportunities that will increase returns, increase true diversification, and reduce risk of large losses with only a few minor changes.

Adding Full Exposure to Commodities to our Dynamic Asset Allocation Strategies

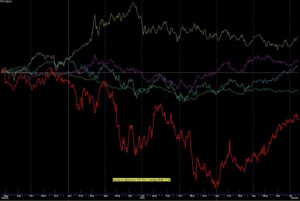

A picture (chart) is worth a thousand words so consider this two-year chart ending 7/21/2023.

Yellow line – (PDBC), A complete Commodities ETF with no k-1

Purple line – (GLD), A gold bullion ETF

Light Blue line – (SPY) The S&P 500 Index

Green line – (AGG) Ishares Aggregate Bond ETF

Red Line – (AMZN) Amazon Stock

What do we see?

We see that over the last 24 months, in the New Environment, Commodities and Gold are the best performers compared to stocks, bonds and the mother of all investments owned by all, Amazon.

Perhaps this is just an anomaly and one of those cycles that favors a bizarre asset class like commodities or gold. Or dare I say these dangerous words; This time is different. If we are willing to open our eyes to what is happening, we see that stocks in general are again approaching one of the highest valuation levels in history. Bonds are caught between the Fed and the hard place. Amazon and company is becoming a low profit consumer staple stock. Meanwhile commodities and gold are in short supply with very high demand with extremely low empirical valuations and paying out attractive dividends to shareholders. We are bound only by our imaginations to consider a somewhat permanent allocation to both commodities and gold now.

Let’s do some quick math for a traditional 60% stock/ 40% bond portfolio since the end of 2021 when the New Environment was first recognized. I’ll even use the Dow Jones Industrial Average as the best performing index as the “stock” proxy. For bonds, let’s use the AGG bond index.

Total returns since 12/31/2021 – 7/21/2023 for different asset mixes

60/40 -4.32%

What if we had more stocks and less bonds, say 80% stocks and 20% bonds

80/20 -2.16% (OK but could be better!)

Now what if we added 15% Commodities and 5% gold to the mix?

60 (stock)/ 15% (commodities)/ 5% (Gold)/ 20% (bonds)

The results are a positive 0.62%

But importantly the very worst portfolio drawdown you would have experienced in 2022 was approximately -2.5% in late September.

I can see the future with perfect hindsight! Kidding. Of course, this begins to look like an exercise in building the perfect portfolio with past performance. Also note that the same mix of stocks, commodities, gold and bonds would only be up 5% YTD versus the Dow which is up 8%. What we are not trying to accomplish is a manic race to generate high returns or even beat one index versus another.

What we are after is the following:

- A Darwinian portfolio that is adapting to the New Environment.

- A portfolio designed to survive in a stagflationary environment that doesn’t have 20-30% periodic losses every year or two.

- A positive return that doesn’t depend on the Fed coming to the rescue.

- A portfolio that allows us to sleep at night regardless of the headlines we wake up to every morning.

Why Should Our Clients Care?

Please excuse the shameless promotion but this is the type of analysis and portfolio management that we provide to our clients in their managed accounts. We make adjustments as needed, when needed within each strategy. Every client has a mix of strategies that is designed to meet their financial planning goals, cash flow needs, tax considerations and general expectations. Our clients should not feel the need to call with questions like – What do you think of AI stocks, or Should I just put everything into a high yielding savings account? Our investment strategies adjust to both risk and return opportunities as environments dictate. Some move very slowly, others move faster. We relieve you of the need to wonder if you’re in the right place with your hard-earned investment dollars.

I offer this commentary as an example of the type of adaptations we are making on your behalf. This is why you pay us, and this is part of our value as your holistic wealth manager.

Enough with the infomercial!

I hope you are well and enjoying the HOT, HOT summer. Wow, hot.

Regards,

Sam Jones