June 12, 2023

This seems like an important moment in time for a little investor education. We’re going to talk about Recency Bias and apply the principle to a growing list of extended trends (both highs and lows) in today’s financial landscape. I’ll finish with some evergreen recommendations to focus on the things you can control. Here we go.

But first, what is Recency Bias?

*Gratefully written by Chat GPT because I’m in the airport and a little jet lagged.

Recency bias is a cognitive bias that affects individuals’ decision-making processes, including those of investors. It refers to the tendency to give more weight or importance to recent events or information while disregarding or downplaying older or historical data. In other words, people tend to believe that what has happened recently is more relevant and representative of the future than what has happened in the past.

For investors, recency bias can lead to several risks:

Overemphasis on short-term trends: Investors influenced by recency bias may focus too much on the short-term performance of an investment, such as the stock market’s recent gains or losses. They might assume that these trends will continue indefinitely and base their investment decisions solely on recent performance, ignoring the long-term fundamentals of the investment.

Chasing performance: Recency bias can lead investors to chase after investments or asset classes that have recently performed well, assuming that the trend will continue. This behavior can result in buying at high prices, when assets may already be overvalued, and selling at low prices, when assets may be undervalued. Such performance chasing can lead to buying at the top and selling at the bottom, resulting in poor investment outcomes.

Failure to diversify: Recency bias can make investors overly focused on the most recent successful investments or sectors, causing them to neglect diversification. Diversification is an essential risk management strategy that involves spreading investments across different asset classes, sectors, and geographic regions. Neglecting diversification due to recency bias can expose investors to concentrated risks if a particular investment or sector experiences a downturn.

Me again.

Pretty ok commentary from Chat right? And as generic as we should expect (wink).

If seasoned investors know one thing about the markets, it is this; Change is the only constant. Trends that seem forever persistent, are never persistent. Investment strategies that have worked for years, ultimately stop working. Stocks that always go up, eventually stop going up. Nothing is forever, nothing is guaranteed in the world of finance.

So, let’s point to some obvious recency bias embedded in our financial psychology. Some of these are short term, some are longer term, but for this update, I’m going to concentrate only on areas that appear especially prone to reversal in the coming months.

Bonds

I know boring. Bear with me. Now that congress has pushed the debt ceiling issue out for another 24 months (applause), we can turn our attention to Treasury Bonds to look for opportunities. Recency bias wants us to believe that bonds will continue to do what they have done in recent history. We recognize that Treasury bonds, especially longer-term Treasury bonds, have been very poor performers over the last 18 months. In 2022, Treasury bonds lost roughly 16% and have continued to chop lower in 2023. Investor surveys confirm that bonds are expected to be the worst performing asset class for the next 12 months. And thus, in true contrarian fashion, the table is set for Treasury bonds to post impressive results, beginning on the next Fed meeting on June 14th. As the current pockets of recession (talk to your local retailer or restaurant owner) spread and expand to the US economy at large and real inflation dives below 3%, Treasury bonds will become very attractive again.

Real Estate

Recency bias in real estate is an amazing juggernaut now. I hear words like “unbelievable” and “Crazy.” Indeed! Toll Brothers, one of our nation’s largest home builders has been raising prices on their new homes for the last three months! Prices are seemingly steady and strong at historically high and unaffordable levels. This is happening as the 30-year fixed mortgage rate seems to be settling around 7% again. There are only two explanations for what’s happening. People have lost their minds or there is a lot more money out there than we think. The answer is probably both. My outsiders’ opinion is that the only people who can afford to buy homes at the moment are those who are economically insensitive (aka very wealthy), and most are paying with cash. Outside of these select high profile deals, the real estate market is frozen, like ice age frozen. High prices and high mortgage rates cannot coexist for any substantial length of time but sands in this hourglass are nearing the end. Keep an eye out for something to break here. Prices are quietly down double digits in 2023 in more than a few counties across the country with the West leading lower.

Technology

Well, here we are again. Technology seems to be the only game in town, literally the only thing up significantly in 2023. As a sector, it is also the most overvalued and overhyped focus of investor attention I have seen since the dot com days of 1999. Artificial intelligence is driving the frenzy. Anything AI gets a boost and an absurd valuation today. Nvidia is now a $Trillion company with a market enterprise value larger than the entire semiconductor industry in aggregate. Ridiculous. I’ve seen this movie before, several times actually. I won’t be that guy that tries to call a top, because these things can go further and higher than our imaginations. But I will say, buyer beware from this day forward. Recency bias says semiconductors of the Nvidia and AMD type are going to the moon. Recency bias gets angry when we see these gains and wonder why we don’t have huge exposure to this sure thing. Recency bias says this is just the beginning and we had better get on board. But recency bias will again be the root of investor pain, especially those who are late to this party.

Value is Not Dead

Last month, I suggested we banish our Lizard Brains and consider the real possibility that stocks could move higher in aggregate against a backdrop of very sour investor perspectives. Well, now we see it happening (finally). Style and size investments in small-caps, mid-caps, value, dividend payers and internationals, which dominate our risk managed strategies have been sitting on the bench for most of 2023. Now they are waking up in a big way. Recency bias thinks value investing styles, in the intrinsic sense of the word, is dead. Value is a long way from dead and now offers investors another overdue opportunity.

Cash is Calling

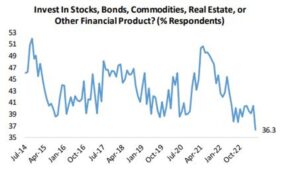

Cash earning a free and easy 5%/ year is probably the greatest recency bias appeal of the year. I certainly can’t argue that everyone’s cash should be earning 4-5% at this point. That means your bank savings or any other form of cash that must be available on short notice. But let’s unpack the idea that one should sit in cash instead of stocks, or bonds or any other form of investment right now. First, this is the top of the cycle for rates – the Fed is done raising rates and thus the interest earned in money markets and short-term bonds is also at the top. These rates will drop back toward 2-3% in the next 6-9 months. Also, when we choose cash as an investment, we have timing considerations. When do we sell to cash, when will be buy back in? Not so easy. Sitting in cash with “investment” dollars also assumes that one knows the future of the markets and the economy and has determined with clairvoyance that cash is going to be the best option. Maybe, but history has proven otherwise. Alternatively, why not consider any number of stocks or funds paying 4-5% in dividends – best of both worlds, right? How about buying some bonds trading at a discount and paying 4-5% interest as we head into a recession? How about we just stick to our program and long-term investment strategies and let the markets, diversification and our tactical strategies handle those pesky risk and reward decisions. Cash looks great right now, I get it. But never, in my career have I been happy sitting in cash with my investment dollars for any period of time. Bespoke offered this data point over the weekend. Interest in buying investment securities is almost at an all time low!

I suspect the competition from higher yielding cash must have something to do with this but low interest in financial products has typically been an excellent longer term buy signal for everything outside of cash. We will see!

Control What You Can

I’ll keep this brief and to the point:

A rational person who is free of recency bias would be doing the following:

- Looking for ways to cut costs and unnecessary expenses in a world that is still under inflationary pressure.

- Continue adding to investment portfolios on regular intervals and resist the urge to sit on piles of cash.

- Consider spending some time, money and energy getting comfortable in your home. You’re going to be there for a long time. Start budgeting for a remodel, landscaping, new deck, furniture, or super energy efficient appliances?

- Reach out to your favorite friends and family. Stay connected and make plans. Relationships are the only things that we remember in the end.

- Remain patient with investments. You do not need to make money every day, every week, and every quarter. The dominant direction for stocks throughout time is sideways with brief periods of time pushing out to new highs. You will be hard pressed to find a stock index trading above where it was in January of 2021. Patience is something in your control.

- Become the MVP in your workplace. Employment is not a right, it is earned. Stay in control of your income by staying employed as we head into recession.

Bonus commentary – Europe is Thriving

I’m writing this commentary on a return flight from Spain where I just spent a wonderful week with my wife Sarah, celebrating our 30 years together. San Sebastián on the northern coast of Basque country is amazing with long sandy beaches, rich food, amazing history, and kind people. We walked and biked everywhere, stayed in a beautiful hotel for a few days and a charming Air BnB apartment in old town. We hadn’t been to Europe in a while and I found myself amazed.

Europe is thriving and cheap, at least Spain is cheap. If you read the daily headlines in the US, you might think that Europe is in trouble, at risk with a Russian led energy crisis, struggling with leadership and immigration problems. I found just the opposite. Europeans, especially in Spain have completely recovered from COVID and don’t seem impacted by the war in Ukraine. By my estimates, outside of petrol, the cost of living are about 40% lower than the US even after the exchange rate. The best cup of coffee is 1.75 Euros versus $6 at Starbucks. Dinner for two at a very nice restaurant – 60 Euros. A super cute, two bedroom, centrally located Airbnb with all new everything, 160 Euros/ night. People are very healthy, fit and find time every day to enjoy each other attending local futbol or having a glass of Rioja (or three). The work culture is strong and vibrant, people are busy. Taxis arrive on time with chatty drivers. The brick and cobbled streets which are wet cleaned each and every night, are filled with children going to school, learning to ride bikes, laughing. Recycling is like an Olympic sport and a point of pride. Most of the locals seem happy and calm, at peace with one another and welcoming of tourists. Comparatively, I don’t feel that in the US these days, especially our cities. You know what I’m talking about. There is friction everywhere; socially, economically, politically with a flagging sense of hope. If quality of life is important, we would be wise to follow the lead of our brothers and sisters across the pond. They certainly have what we desperately need; peace and prosperity for all.

Happy Summer!

Sam Jones