May 12, 2023

My apologies for posting this monthly report late. I wanted to get a better feel for earnings and hear what the Federal Reserve had to say last week before posting anything I would regret. There are a lot more positive developments in the markets than what we all feel and hear in the way of forecasts and consensus views on the future.

So Much Pessimism

I think regularly readers might have come to understand that I am most comfortable making recommendations and forecasts (please don’t make me) when I am in the minority of popular opinion.

Without boring you with stats and evidence, these are the very strong and broad views in the financial world today:

Stocks are still in a bear market, and they will finish lower on the year, perhaps by a lot.

Less than 20% of all investors expect a positive year in 2023.

Surveys show nearly 100% expectations for a recession to begin in late 2023 or early 2024.

Real Estate will remain in a deep freeze due to high mortgage rates.

The Fed is going to drop rates by either 3 or 4 times before the end of 2023.

The debt ceiling issue is likely to lead to a US Treasury default for the first time in history creating calamity in the market, a debasement of the US dollar and widespread panic.

We will see more and more bank failures and eventually regional banks may cease to exist.

Commercial real estate is going to drag down the entire banking system and leave our cities a ghost town.

So….. hmmmm

That is a tremendous amount of negativity. Our lizard brain (Amygdala) responsible for fight or flight responses is swollen, red and angry. And for good reason! There is plenty of compelling evidence suggesting these outcomes are possible, probable, even likely.

But meanwhile, today, what is happening in the markets, earnings and the economy is simply not telling the same story. This is what is happening, whether we want to believe it or not.

The US stock market just put together two of the best quarters in recent history (+7.04% and +7.42%). This does not tend to happen in a bear market.

Home builders are making all time new highs – not exactly a recessionary thing.

Consumer discretionary, biotech, technology and communications services are leading the markets higher – again not a typical thing to see if we are about to go over the cliff.

Growth and speculative stocks are charging higher while defensive, value and dividend payers are lagging and negative YTD.

Interest rates not controlled by the Fed are falling steadily and quietly stable.

Consumers? Out spending with healthy incomes.

International markets? Well hopefully you’ve heard me say they are the place to be with an overweight position. We are wildly overweight internationals for the record.

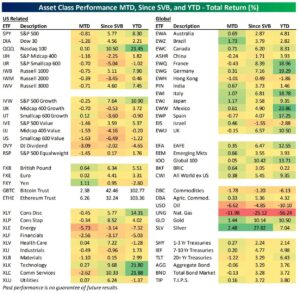

Every year, there are winners and losers in the financial markets, and I can certainly find a few negative sectors and asset classes in the Bespoke Report card below (small caps, dividend payers, natural gas, China, and financials). But I also see a lot of green YTD.

www.bespokepremium.com

The Coast is Not Clear

I don’t want to set the expectation or give the impression that I am long term bullish or suggest to anyone that this a great time to load up on stocks and swing for the fences. I am simply stating the obvious and considering the realities of what is actually happening today outside of our fear and emotional state. Specifically, there is so much negativity already baked into the markets that it’s actually going to be tough for any of the End-of-Days, Great Unwinding, Forth Turning, crowd to be vindicated, at least not now. This may be just a timing thing. It would make a great deal of sense for the markets to do what the fewest number of participants expect and that is to push all the way up to the old highs and suck in a lot more money before actually failing. Remember the S&P 500 is still nearly 14% below the peak set in early 2022 and many more individual names are still trading 50-60% below their highs.

In the short term, price patterns in many sectors and indices, both domestic and international, look very constructive toward higher prices. It simply is what it is. Our equity strategies remain 100% invested because there are plenty of investments in uptrends and we want to capitalize on opportunities as they present themselves. If prices roll over, or start to show a change of trend, we can become much more defensive. But for now….

Recession Still Looms

The Federal Reserve increased interest rates again last week and will now pause with any policy changes in the foreseeable future. A moment of your time for a brief history lesson.

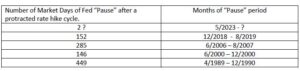

My database only goes back to 1989 but let’s look at the pattern of rate hike cycles since then.

We have seen four substantial rate hiking cycles beginning in 1989. Each of them varied from a minimum of nine rate hikes to as many as seventeen. In 2006, the hiking cycle didn’t end until rates were pushed up to 6.25%. In the year 2000, the same happened. Rate hikes did not end until we hit 6%. As of this week the Fed Funds rate is 5%. Is that enough to kill inflation in keeping with the history of the Fed? Maybe. But more to the point, after each of the last four rate hike cycles, the Federal Reserve has paused, made no changes to rates, for the following time periods (shown as market days, not calendar days)

Summary statement: We should be prepared for the Fed to “pause” for the next 7.25 months (218 calendar days/ 150 market days) because that is their shortest “pause” in modern history.

7 months is a long time. During these “pause” periods it the past, we didn’t exactly see prices run away higher with huge gains but neither did we see a lot of price damage. It wasn’t really until the Fed started to drop rates (2024?), that the aggregate US stock market ran into trouble. So again, our expectation remains for a recession, and we do expect stocks to pay the price when it happens.

Technology Revaluation is Still a Problem for The Markets

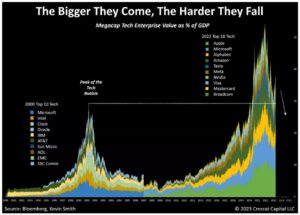

Simply put, the US stock market is going to follow the path of large cap technology because technology represents over 40% of the US stock market (if we include communications services companies like Meta and Google). No mystery here. Technology is up, so the US stock market is up. When technology fails, the US stock market fails. Let’s not make this complicated.

If we back out a bit and look at the big picture, the US stock market is still in a phase of revaluation, especially in the large cap technology world. Crescat Capital offered this chart again in April. It’s pretty self-explanatory. The revaluation process for mega caps relative to current GDP is a lumpy and bumpy affair. Today, it appears that these companies are back, leading, charging, bullet proof. But history would argue that large cap technology will ultimately become a smaller part of the market and the economy. Large cap technology stocks are very likely experiencing a rebound rally within a longer term downtrend. It’s still going to be a good idea to sell into this rally in my opinion especially if you still have a high concentration of your portfolio here.

The Debt Ceiling Thing is Real

Looking ahead by only 30 days, the Debt Ceiling debate also has the capacity to be highly disruptive. We clearly have a bipolar congress with a heavy dose of crazy in the House that seems very willing to push us over the edge in June just to flex and be in the spotlight. Default on Treasuries is a net zero probability this time. They will expand the debt ceiling, make no mistake as they have for the last 100 years without fail, but the markets may not like the uncertainty and time it takes to get there. What if congress and the white house can come to an agreement – tomorrow? Stocks would rip higher by 5% in a hot second.

Big opportunities now and themes that are still working!

I want to spend a little more time giving you some opportunistic thoughts and provide a backdrop for where we are seeing positive spending across global economies. There are many investments, sectors, countries, and asset classes moving higher now, certainly enough for us to remain 100% invested and well diversified.

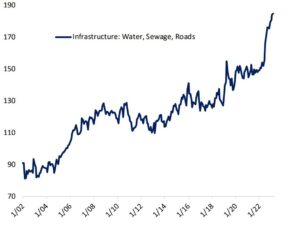

Thematic investing is getting good traction. Thematic investing focuses on a style of investing or a trend that incorporates players from multiples sectors of the economy. I’ll give you a few examples. If we follow the money, we begin to see enduring positive trends, regardless of where we are in the economic cycle. Infrastructure spending is a big one that includes machinery, raw materials, water, utilities, and manufacturing. Obviously, the growing reality of crumbling and dysfunctional infrastructure after decades of neglect and deferred maintenance is forcing spending, investment, and profits in this sector. You’ll never see such political harmony, cooperation, and bipartisan behavior as when the water turns off, sewer lines break, or the room goes dark. Yes, yes let’s fix that stat, all in favor.

Speaking of infrastructure spending…

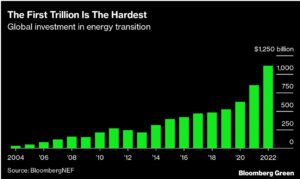

Investment in energy Transition just exceeded $1 Trillion in 2022 surpassing all investment in fossil fuels. Regardless of your politics, ignore this mega shift toward clean energy at your own financial peril.

Raw materials, especially rare earth metals that are in very high demand from energy transition technologies for batteries, storage and electrification of power are poised for a significant move higher. At this magical moment, we have the perfect investor trifecta (High Demand, High Scarcity and Low prices).

Worldwide Sectors and New Power are our primary strategies for direct thematic investing, but these ideas find their way into most of our other strategies indirectly through our investment selection process.

The Best Buy in over a decade is coming.

As you might have guessed, it seems likely now that we have more volatility ahead in the markets before we might find a more lasting and durable bottom to this bear market. These are the tough times, when we are psychologically weak, we have suffered some losses and wonder when (and if) the good times will ever return. Volatility is the price we pay for higher returns. If one wants to avoid volatility all together than necessarily, you will also avoid significant returns in the future. Today, we can focus on areas of the market with more opportunity, leadership, and relative strength. Tomorrow, in our risk managed strategies, we could find ourselves positioned much more defensively as the markets actually give way to recession. Once we see prices wash out and valuations reset to more attractive levels, perhaps in 2024, we will be faced with another one of those generational opportunities to dramatically improve the wealth and lifestyle of your family. Many will miss it. Many will not have their emotional or physical capital intact enough to add to their investments at the lows. The vast majority will wait until prices are up 100% or more before feeling like the coast is clear. Our job as your wealth manager is to take all of this off of your plate and to allocate your investments according to what is happening today, not what our lizard brain tells us should happen in the future.

Please trust that you are in good hands. We see the risks; we see the opportunities and have decades of experience allocating investor money appropriately.

My best to all.

Sam Jones