June 23, 2022

The second quarter of 2022 was one for the record books. There are a lot of obvious things happening today creating fear and anxiety among investors as the markets “price in” the reality that the US economy is heading into recession (perhaps already there). What lies beneath the surface is what interests me now as we look ahead to a market environment with a new set of opportunities.

The Obvious

Let’s get this out of the way. We are in a global bear market. Stock markets across the world put in long term price peaks between November of 2021 and Jan of 2022. Since then, the only things going up are commodities, energy and anxiety. Bear markets tend to create a lot of wealth destruction. Here in the US, estimates suggest that $2Trillion in market capitalization value (aka investor wealth) has been destroyed thus far in 2022. You might remember my warnings back in 2020 that stimulus in the $Trillions would eventually find its way into the stock market and be destroyed by the next bear market. Well, here we are! Not all of the $4.5 Trillion in stimulus was destroyed but let’s say half for easy math.

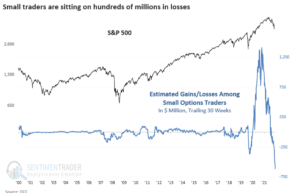

To illustrate the point, look at this chart of small options traders, specifically after 2020 when stimulus money was delivered during COVID. Yes, some of it went to covering lost incomes, paying for much needed food, etc. But, make no mistake, billions of dollars went into the stock market via investors who were day trading options at home. Obviously, they had no idea what they were doing and are now sitting on massive losses.

As of last Thursday, the S&P 500 was down 23%, and other indexes are worse, down 30% or more. The average bear market in the S&P 500 shows a standard loss of 28%. Remembering how we calculate averages; it would be wise for us to assume that the final low may not be in, but we could certainly be two-thirds of the way there.

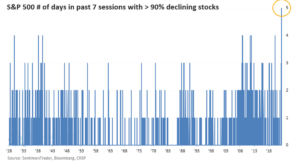

Last week rattled every investor’s cage. Statistically, according to the fine work of Sentiment Trader.com, the seven market days leading to the final low on June 16th marked the worst selling pressure since…. 1928. Extreme selling pressure is measured when more than 90% of stocks decline on any given day. The particularly good news is that these type of capitulation events where investors sell everything indiscriminately, tend to be exhaustive events that occur at, or very near, significant market lows. More on this in a minute.

Also, on the list of the obvious is losses in Treasury bonds. From the highs in the year 2020, long term Treasury bonds are down almost 40%. Wow! The Lehman Aggregate Bond index is down 12% in the last year and losing over 7% per year since 2020. We have not seen bonds and stocks lose together like this since our last bout with inflation in the 70’s. For the last 4 decades, bonds have moved inversely with stocks and buffered total portfolio losses to something tolerable. Investors who have no other form of risk management (outside of holding bonds) are feeling this bear market in full.

The Fed is inducing a recession. As we heard from Chairman Powell in his congressional testimony yesterday, this is the only way to contain the sharp rise in the rate of inflation. They are probably right about needing to induce recession as inflation becomes a greater worry, but they are OBVIOUSLY very late to the fight.

Inflation is still rising on many fronts including core inputs, COVID related industries and especially rents. The idea of too much money chasing too few goods (definition of inflation) is just now starting to revert to a healthier equation; Less money is now finding some or enough supply. And yet, there is still an obvious imbalance that needs to be resolved. Don’t expect the Feds to be your friend anytime soon.

Inflation is very tough to contain once it has been let out of the bottle. As I said in the last update, demand is obviously drying up daily for everything from housing and mortgages to consumer goods and services. Inflation numbers from here are not going to be as strong as what we have seen in the last few months and quarters. In fact, the rate of inflation may be peaking right now.

The obvious state of the financial markets and economy is pretty terrible today. Now let’s turn to what is not so obvious and see some of the new opportunities that are developing quickly.

Beyond the Obvious

Looking across the spectrum of technical market research that we follow, I see between 3 and 5 other instances of oversold extremes in history that match the current environment. In all cases, the markets were higher by a minimum of 24% and as much as 48% over the course of the next 12 months. Those are high odds. Most investors who don’t understand cycles and markets might see a headline about pending recession and think, “OMG, I’ve got to get defensive or run to cash”. Counterintuitively, markets tend to carve out long term BOTTOMS within 2-3 months of the first headlines recognizing the arrival of a Recession. Remember, the markets are an excellent discounting mechanism and have been selling off dramatically for over 12 months in anticipation of today’s condition. Aggressive and opportunistic investors are now allowed to start looking for new leadership and bottoming patterns in their favorite stocks, sectors and indices with an eye toward long-term buying opportunities. To be clear, we are not buying the dip, we are looking for a window to start gradually buying into the bottom of a devastating bear market! This window is not a small window but could take weeks or months. No need to rush as the economy is just now slipping into formal recession.

Thoughts on Bonds

This is the time and place for the Treasury bond market to find a lasting bottom. Here we have some urgency as bonds are already outperforming stocks by almost 8% in the last 30 days. As I said in the last update, bonds are now behaving well and offering investors some much needed diversification juice in our portfolios. Bonds tend to be the best performing asset class during recession. Now that Treasury bonds have sold off by double digits and are paying reasonable interest rates again, we can and should consider allocations here. Again, this might not seem intuitive or obvious as the Fed is headlining with the big fight against inflation as we speak. This Federal Reserve board is so late in their habits that I won’t be surprised to hear them plan to cut interest rates just as the economy is emerging from recession.

Top in Energy and Commodities

We have heard for the last year that oil is going to the moon. We have heard that the war in Ukraine will never end and that investors should be overweight in energy for the foreseeable future. This week we sold the last of our commodities and energy positions across all strategies and we’re happy to be taking profits in something! Russia has largely accomplished what they set out to do – destroy Ukraine. Russia has also earned it’s spot as global bad guys for the next several decades. They will suffer for it just as Germany did post WWII. Given that the war could end quickly and quietly any day now, we think it’s a grand time and place to take profits in energy. Gas prices will also find a top in the next 30 days if the patterns follow, just as President Biden comes to the rescue with a national holiday on gas taxes which are projected to save good Americans a total of $13 over the course of the holiday.

It has been an incredible run in energy and commodities but enough is enough and the set up for future gains from here are pretty poor as the cycle moves very quickly toward contraction and favors non-cyclical sectors and asset classes.

New Opportunities

From a cycle standpoint, the market is beginning to look across the chasm of recession and toward recovery. The first sectors to find traction and lead the charge out of any bear market are financials, consumer groups and technology. All three have been beaten to dust in the last year. Nevertheless, our focus should be on these not so obvious sectors looking for strength and leadership in the months to come.

Yesterday, I did my own study on different investment themes that have been outperforming the S&P 500 over the last 30 days. Several of these groups did not even make a new low last while the broad market plunged to new lows by 5-6%.

These are the results:

Select technology- cloud computing, software, internet, fintech, clean energy, and telecom

Select consumer – consumer staples, consumer discretionary, and retail groups

Healthcare – Pharma, biotech and healthcare services

China – all

Emerging markets – all

Bonds – corporate bonds, municipal bonds, treasury bonds, investment grade bonds

Dividend growth funds

Large cap and mid cap growth funds

Preferred stock funds

With the exception of financials, looking at this list, I see the market quietly starting to accumulate new investment in sectors and asset classes that should perform well during recession and early recovery.

As we close out this quarter, try to remember that the markets are just one very large cycle. There are up cycles and down cycles. This is not the end of days nor time to hide. These are the times to look for discounts and long-term entry points for your hard-earned investment dollars. Honestly, I don’t expect to convince anyone of the pending opportunity now any more than I could convince someone to sell their Tesla stock above $1200 in 2021 (You know I tried). Investing is anything but obvious which makes it so difficult. As always, we are here to help and guide you. Please reach out if you would like to talk through any anxiety, concerns or need help with your outside investments.

Happy Summer Solstice and Go Colorado Avs!

Regards,

Sam Jones