June 13, 2022

As of this morning, the S&P 500 has officially entered into bear market (down 20+%) territory. Inflation is still with us, economic growth is (maybe?) slowing, the entire crypto complex is imploding, corporate credit is back to levels not seen since the early days of the pandemic and I had to arm wrestle three other dads this morning at Target to secure the right to buy baby formula. The tide is going out in a hurry, and we are quickly finding out who’s been swimming naked.

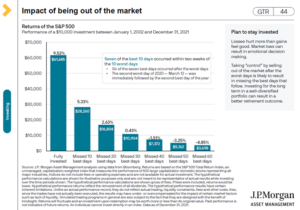

So, what is an investor to do on a day like today? In the midst of so much negativity and pessimism, let’s step back and remember that 7 of the 10 BEST days in the stock market over the last 20 years have occurred within two weeks of the 10 WORST days in the stock market. Said another way: taking “control” of your portfolio by selling out on or after the worst days is likely to result in missing the best days that tend to follow. Missing the 10 best days in the stock market could cost you close to 50% of your annual returns over the course of 20 years (see the chart below from JP Morgan).

*Source: JP Morgan Asset Management

I hate to break it to you, times like these in the markets never get any easier. That said, making rash decisions in times of turmoil can lead to negative and/or catastrophic long-term outcomes. If you are feeling stressed or anxious about your situation and would like to revisit your financial plan, please give us a call or use our Calendly Link to schedule time for us to talk. If nothing else, we are here just to listen.

Hang in there, we will get through this.

Will

,