May 20, 2022

We have returned to an era that is going to be quite different from anything we have seen in the last four decades. For the last forty years, the US markets and economy have increasingly focused on one primary theme: Growth. When I say growth, I’m really talking about technology and innovation aimed at consumers. Looking backward, our economic and market cycles were either growth, or not growth (aka recession) all measured by consumption and GDP. Clearly now, we are embarking on a different game of winners and losers with a different set of rules, and it seems investors are still struggling to adapt their attention and capital allocations. I am hopeful that this update might help to reframe investor focus and for our clients, provide a better understanding of why we are allocating your investment assets as we are.

The Big Three Revisited

Regular readers know that we have been focusing our clients’ investment capital across three themes for almost exactly two years (since April of 2020). In short, these are:

Value over Growth

Commodities Bull Market

International Outperformance

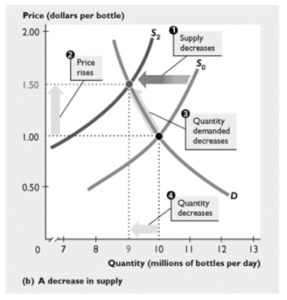

I’ve a talked about these in several ways including Reflation, Reversion and Recovery themes which you can find HERE. Another way we might answer the question “Why These Three?” can be seen through the lens of scarcity. Scarcity is something we are all becoming familiar with when we think about all the things we want to buy, but cannot get (That special car, bike, building materials, windows, employees or even more fundamentally certain foods). Supply shortages are a common topic of conversation usually beginning with the phrase, “I can’t believe I can’t get……”. And the affect of supply shortages and scarcity are also becoming engrained in our day to day lives in the form of higher prices for everything (aka inflation). Scarcity is by definition, a decrease of supply and good econ students know that when supply falls, prices rise. Eventually, rising prices lead to a fall in demand (aka recession) as the market is always working to find “equilibrium”.

Please forgive the econ lesson but there is an important principal here for all to understand. Eventually at some point in time, demand will fall. You have heard that the Federal Reserve is raising interest rates. They are doing so to increase the costs of borrowing, thereby increasing pricing even further, hoping that demand will respond lower. The Federal Reserve wants to SLOW DOWN demand without putting the US economy into recession (two consecutive quarters of negative GDP). Personally, I don’t think the Feds need to raise rates as much as projected. Consumers are already feeling the squeeze of near hyper inflation and at the tipping point of cutting back on their spending habits as much as they can. Demand will fall all on its own from here forward with or without the Fed.

Ok enough Econ and back to the point.

Looking at the investment environment through the lens of scarcity provides us with some clear guidelines and preferences when considering where we should park our capital. I’ll present the framework of Scarcity from different perspectives with investment implications. Of course, any advice given should be considered within your personal situation, portfolio, tolerance for risk and so forth.

Scarcity of Natural Resources/ Commodities

I think some of the absolute best work done in this space has been produced by Crescat Capital, here in Denver through the research of Tavi Costa and Kevin Smith – www.crescat.net . We know that commodity prices entered a new bull market almost exactly two years ago in May of 2020. The COVID decline in prices at that time set the stage for commodities in aggregate to put in a final low after declining 75% in value over the previous 12 years. 24 months later, commodity funds are up 160% in the aggregate. This new bull market in commodities is in the early stages contrary to what you might hear. Inflation as stated by CPI will go through cyclical ups and downs but the fundamentals and backdrop for commodity prices to run higher for years is likely to persist. The backdrop is again about scarcity. There are a couple charts available at Crescat Capital showing that the commodity cycle relative to equities expressed a ratio is just now turning up from a multi-year low and has a long way to go. Commodities are highly likely to outperform equities for years to come.

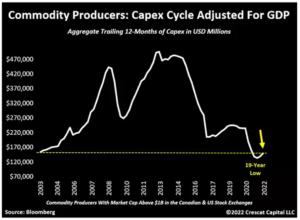

Unlike all other areas of the market like finance, technology, healthcare, etc., we have also witnessed a dramatic drop in capital expenditure (Capex) in commodity producers in the last 10 years (see below). In simple terms, this means, globally, we have not invested in capacity (potential supply) among commodity producers, and it will take years to rebuild that capacity to meet current demand. Even if we see a drop in demand via a recession, commodity producers are still unlikely to be able to produce enough raw materials (metals, basic materials, oil and gas, wheat, corn, soybeans, etc.). This does not even account for disruptions from wars, climate change, nationalism, etc. Scarcity among commodities will drive prices higher.

Investment implications should be pretty clear; For those with capacity and willingness to invest in a truly diversified portfolio, you would want to keep a healthy allocation in your portfolio to:

- Broad based commodities funds and ETFs

- Metals and Mining stocks or funds including gold, lithium, rare earth metals, aluminum, steel

- Agriculture producers and soft commodities funds

- Energy distribution companies

Thankfully, there are many to choose from that do not issue annual k-1’s to shareholders! We are maintaining an overweight allocation to commodities and commodity producers for our clients in all investment strategies outside of our pure income models.

Scarcity of Good Income-Bearing Investments

This is a sore subject for any retiree who is feeling the pain of rising costs of living (8-9%) while secure Treasury bonds are paying at best 3%. What are they to do? A heavy stock allocation is not particularly appealing considering the risks and volatility involved but Treasury bonds are also down 10% and only paying 3% annual interest.

This situation has evolved from 40 years of an accommodative Federal Reserve who remains committed to dropping rates to near zero every time we get a hiccup in economic growth. The chart below is of the interest rate on a 10-year US Treasury bond.

Now, with real rates (interest rate minus inflation) solidly negative, we have come to a hard place and time. Again, we want to reframe the discussion and invest in scarcity. In this situation, we need to call on a diversified portfolio of dividend, preferred, fixed and variable income producers in order to push up our annual income without taking on full stock market risks.

Our investment solution to this form of scarcity is our Multi-Asset Income (MASS Income) strategy designed exactly to solve this challenge. To date, the strategy has generated a little over 3% in dividends and income paid monthly to our clients’ accounts. This is an annualized rate of over 6%, not quite the current rate of inflation but very attractive! We have set the default for income and dividends to be paid to cash rather than reinvested in additional shares. Cash dividends and income in hand give you a lot of options. The strategy attempts to remain fully invested and as such there is price volatility in the underlying holdings (39). Investors in MASS Income need to be prepared for their balances to fall in environments like these. BUT, we are ultimately focused on these securities continuing ability to pay their monthly dividends and interest to shareholders. Think of it like a rental property we intend to own for a long time. We do not really care about the market price of our rental property from month to month, but we do, and should, care about keeping our properties occupied and paying regular rent. So far, so good. All “tenants” are paying full and rising rents in our portfolio!

Scarcity of Value

Just as it sounds, the current investment environment is short on real value (valuable) investment options. What is value? Value is something that appreciates over time or has current utility for us today. Back in 2010, there was a surplus of value to be found as prices of mega cap growth names were trading at very attractive levels. After 11 years of massive price appreciation, these same stocks became value(less) despite the fact that the companies themselves continue to provide great value to their users (Tesla, Amazon, Apple, Meta, Netflix, etc.). In fact, the vast majority of stocks on the growth side of the market moved higher in sync to outrageous valuation levels. Now, 18 months after the peak, we see what happens to overpriced securities when the tide turns against them with prices down 30-90%. But here’s the important thing to understand. Real value is still scarce. Growth names are still unattractive, do not pay dividends or interest and are in the wrong type of business for the new era. If you think about it, do we have scarcity of mobile phones (Apple)? Is there a scarcity of streaming content to watch (Netflix)? How about Electric Vehicles (Telsa)? Or Cloud based service providers (Microsoft, Google, Amazon)? Is there a scarcity of social media outlets (Meta)? Meanwhile, there are companies out there who are directly in the business of providing scarce resources that everyone needs (not wants) and offering investors great values with stocks at attractive prices, paying regular income and dividends today. The current environment offers discriminating stock pickers an opportunity to remain invested in “Value” as we do inside our Worldwide Sectors strategy.

I cannot provide individual names here but generally speaking, our Worldwide Sectors individual stock holdings (18) have valuations that are 40% less than the S&P 500 in aggregate, are outperforming the markets over the last 3-6 months in price action and paying 2-5% annual dividend income.

I have to throw in the potential of Internationals and Emerging markets here as well. Admittedly, outperformance by international investments has been hard to spot. The war in Ukraine might have created a delayed game here. Rising interest rates are also tough on emerging markets and less developed countries who rely heavier on debt spending. And above all, a very stiff rise in the value of the US dollar by 13% in less than 12 months has made it even tougher on performance. And yet, despite all the headwinds, global indices are actually performing better than the US markets YTD and especially since the last FOMC meeting on May 6th. In fact, Brazil (keeper of global raw materials and natural commodity resources!) is up almost 18% YTD. Mexico is also slightly positive YTD, and others like Australia, Canada, Spain and the UK are not far behind. There is something brewing here. By all signs, it seems likely the headwinds facing internationals are on the tipping point of reversing. But the most important thing to remember is that internationals are trading at nearly 50% of the valuation of the broad US stock market. Invest in scarcity and real value is scarce!

Looking the Wrong Way

I love this image. I feel like investors these days are like the whale watchers on this boat, peeling their eyes for a return of the WHALEs (like Amazon, Meta, Netflix, Apple and TESLA). Meanwhile, new whales are breaching regularly on the other side of the boat. It’s time to turn our heads and recognize the new leadership. Scarcity is driving opportunity for those willing and able.

We’re here to help as always.

Have a great weekend and know that you are in good hands.

Sam Jones