May 12, 2022

I keep this on a sticky note on my desk.

____________________________________________

Lizard Brain noun:

The part of the brain to which primitive, nonrational, or self-interested behavior is attributed.

“Your lizard brain thinks the world is ending while your more rational side can see that you’re in no real danger”

____________________________________________

What a great moment and time for a mental check up as recent market declines are setting up another one of those very special buying opportunities. Will you be emotionally ready to be an investor when you need to be? It is officially time to banish the Lizard Brain!

Empathy for All Investors

Trust me when I say I feel your pain. Every professional money manager is also a human. Those who do not learn how to manage their emotions that go along with market volatility usually don’t last long in our business. I have learned to read and observe my emotions but work every day not to act on them. Instead, I rely on evidence, systems and a set of rules that has served us well over many years. Regardless, I want to acknowledge how hard it is to be an investor of any sort in times like these. It feels dark, hopeless and everything we read and hear speaks of more evil to come. We are almost relieved when we see that stocks are ONLY down 1% on the day. We stop looking at our accounts because we don’t want to see the new lower balances. We think about all the mistakes we have made or the money we spent frivolously in the last few years. Why didn’t we save more for this rainy day? There is also a bit of anger in the mix. Someone did this to me! Big guys are screwing the little guys again! In the end, we want out of this emotional state, we want to eliminate the pain and thus we find ourselves ultimately bowing to the Lizard Brain in some act of capitulation. Investing successfully over a full cycle of bull and bear market conditions is a challenge. Anyone who thinks otherwise, hasn’t been doing it for long enough yet.

Data

I am an evidence-based investor, or at least I like to tell myself that. Evidence can help us through tough emotional situations because it gives us better odds of success, if we are strong enough and have enough conviction to simply follow current trends as they unfold. I am going to give you a few important data points to consider surrounding the current condition of the US stock market. My hope is that you can push the Lizard Brain away to some degree.

% of Stocks Trading Above a 200 day Moving Average

This is one of the indicators we monitor to identify intermediate and long-term oversold conditions. Without boring you with the technical details or God forbid a chart, know that this indicator has fallen to 15 or below only 9 times in the last 35 years. Today the indicator hit 18 and it’s likely we are going to make history again when it tags 15 or less – this month, this quarter, this year? Literally, this means that only 15% of all stocks are NOT in bear markets and it takes a lot of price damage and a lot of time for the markets to get to this oversold level. Needless to say, all 9 times in the past have been the bottom of terrible bear markets, crashes and other Lizard Brain events. Now if we had an evidence based, high probability opportunity to invest at the bottom of every bear market, wouldn’t that be great! While there is still some work to go, we are getting to that place and time quickly and you should know that empirically speaking, much of the price damage for this bear market is already behind us! There will likely be lower lows and a period of base building before prices get up and start a new bull market. I won’t venture a guess on timing at this point, but we need to be ready when we see that very special headline – “Recession is Here”.

Bullish Sentiment Hit a Multi-Year Low Yesterday

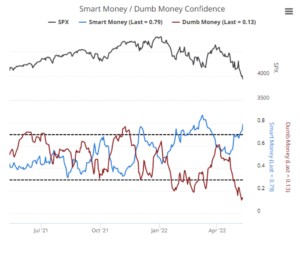

Again, the evidence is piling up that even in the short term, the probabilities favor at least a healthy and shockingly strong rebound rally over the next two months. Investor sentiment is one of the Lizard Brain indicators that seems to stand the test of time, according to the venerable Jason Goepfert of Sentiment Trader.com. Jason does outstanding work measuring the spread between “Smart” money and “Dumb” Lizard Brain money. Smart money gets bullish and aggressive at lows (good) while Dumb money sells at lows (bad). When the spread gets very wide as it is today, we typically see stocks bounce strongly within a few days. For what it’s worth, Jason notes that this is the 11th lowest reading in the Dumb money index since 1998. Of course, these are the same times and dates as our % of stocks trading above a 200-day moving average, indicator above.

Capitulation Panic Selling This Week

One more big one, perhaps the biggest one, to add to the pile. When the Lizards start panic selling in volume, we know that fear has turned to action. When all sellers are done selling, there is a vacuum of sellers, with deep price discounts and only buyers left. Today, sellers are still selling but they are almost exhausted in their efforts (nothing left to sell, 100% in cash? not worth selling something that is down 92% like Peloton?). This week, and last, we saw panic selling in volume. The crypto crowd that talks about HODLing (Holding On for Dear Life) is panic selling. Those who owned all the high-flying crazy valuation technology stocks, panic sold. And now we are finally seeing real selling in those safe technology names like Microsoft, Google and Apple as they race to catch up to Netflix, Tesla, Facebook and others already in bear markets. Bear markets take no prisoners. For the very aggressive investors who can sift through the wreckage and find good companies with strong revenues that are now trading at book values, there are some diamonds out there. We bought seven new positions in the New Power strategy today and added to several others that we purchased last week.

Don’t Forget Bonds

Bonds also appear to have found an intermediate term low in the last week which is contrary to what you might expect given all the inflation headlines and the Fed raising interest rates on May 6th. Treasury Bonds are now beginning to price in the realities of recession in 2023 as they always do 6-9 months before recession actually arrives. As you know, we have been (re) building our Treasury Bond position for the last couple of weeks and they are finally responding nicely (up 2-4% this week alone). Investors have been especially beat up this year since stocks and bonds have both moved in sync (down) as they will until inflation calms down. But for now, bonds are giving us the green light and offer investors a nice place to be outside of stocks. Commodities are still behaving well, up again today and yesterday while stocks are down down down. Diversification is another weapon to help fight the Lizard brain.

So, it is raining Lizards right now, they are crawling on the walls, in your car, on the radio, behind your pillow keeping you up at night. Banish them, get in the drivers’ seat of your own mind and try to recognize opportunities as they unfold.

I hope you are getting outside, it’s nice out finally!

Cheers

Sam Jones