There are times when we hear the same series of questions from clients during our review process. I thought this might be a great moment for an old-fashioned Q and A session so everyone can benefit. Buckle up for a speed round.

Question: Do you own GameStop or any of “Those” types of companies in our portfolios?

Answer: Of course not

Question: What is really happening with the whole GameStop thing?

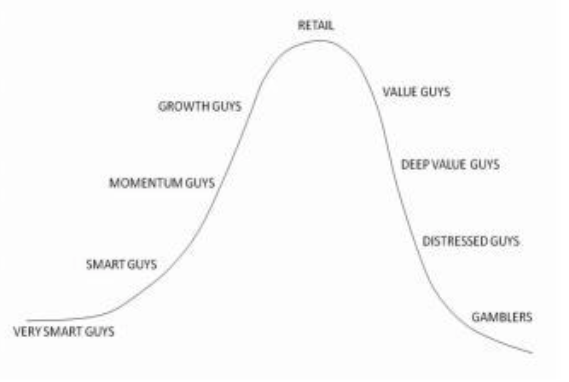

Answer: Too many retail investors with too much free money and free time on their hands blindly following a few social media celebrities. This is NOT a David and Goliath story. This is not about the people versus the machine or a financial coup or an effort to “stick it to the man”. This is the same old story of people trying to get rich quick, people who know nothing mostly. One of the great harbingers of the top of every bull market cycle in history is the strong presence of retail investors chasing what seems like easy money. The phenomenon is very sad and very well documented over time. This is a highly scientific chart of the cycle of investors and when they show up (nod to Jared Dillian of The Daily Dirtnap 😊)

Question: How long can the market go up like this?

Answer: The question is predicated on the belief that stock prices and the state of economy, fundamentals seem grossly out of sync. This has happened before, especially during 1999 through the first quarter of 2000 and then the great bull market of nearly two decades ended abruptly. We may be repeating the past with this rally as market conditions and price action is giving me some daily De’ Ja Vu. These lockout, runaway rallies are capitulation events of sorts on the buy-side when investors finally develop enough confidence to deploy some of their huge cash savings. FOMO (Fear of Missing Out) is driving prices, not much else. How long can this go on? For longer than you think possible, especially with a continuation of the $Trillion stimulus packages and all the cash sitting on the sidelines as well as massive underperforming bond assets. Stimulus at this point is going right into stock and commodity asset price inflation, soon to be main street inflation. It can also end at any time seemingly without reason. These are great times for investors but remember that making money during these periods is easy, keeping it on the other side is where we show real skill. Our advice; keep both hands on the wheel right here, right now.

Question: Is Janet Yellen (new Treasury Secretary) going to be good for the stock market?

Answer: Yes, at first, but too much easy money and her ultra–dovish stance regarding the purpose of the US Treasury will create very predictable problems with currency debasement, inflation, and some reckless behavior. It is already happening (i.e., GameStop, Real Estate prices, parabolic rise in the price of worthless companies coming to market as IPOs).

Question: Is it too late to invest new money now?

Answer: It is never too late to invest new money as personal conditions allow. You need to remember a few things. The stock markets of the world and corresponding index investments just represent a basket of stocks. Many of these are wildly overvalued and one could easily point to plenty of evidence that the market as a whole, has entered another bubble. However, within that same market, there is value and securities trading at deep discounts. There is a real opportunity if you know where to look. We discussed this at length in our 2021 Themes Webcast last week (view recording here ) This is a time to be very selective about what you own, revisit your predetermined asset allocation, rebalance as necessary, and consider owning some non-traditional asset classes. I could build an entire portfolio of investments with upside opportunities that have no correlation to the S&P 500. Actually, that is what we’re doing inside our managed accounts now. So yes, please invest, do so as you can financially, but simultaneously make sure your money is allocated where opportunity exists and avoid chasing yesterdays’ returns.

Question: Is Joe Biden going to raise taxes

Answer: Most likely in many forms but not without congressional approval. Tax changes will be aimed at high earners, owners of assets, and investments if he follows the playbook. This is a great time to review your taxable exposure to capital gains, income, and dividends. We can help!

Question: How is Will going to help us with Financial Planning? What is Financial Planning anyway?

Answer: Great Question! Will Brennan is our new Certified Financial Planner and Lead Advisor. Will is formalizing our financial planning offering to our clients in several ways. First, Will is a data gatherer. Having now met with at least a dozen households, one of the first things Will does is review what information we have on our clients’ entire financial picture. Then he works to fill in the gaps with things like last years’ tax returns, discussions about the very purpose of money in your life, discover if there are any problems with your beneficiary designations, looks at your gross incomes from multiple sources, your debt, and your spending behavior, gets copies of your wills, trust, or estate plans, etc. Finally, Will enters all information into E-Money, our newest comprehensive financial planning software platform, and builds projections for the rest of your life factoring in Inflation, investment returns, assets, income, withdrawals, and a ton of other variables. This is not a one and done thing but rather the birth of a live profile that will evolve over time and be updated regularly when we meet for reviews. Also, Will has built the financial planning shell with our current client information for about half of our entire client base in his first two weeks. When you first meet with Will, you will be surprised at how much he already knows about you but he will want to know more. The formality of conducting an actual financial plan for our clients is something we have not executed well in all honesty. We want to be able to give you solid, empirical answers and advice like how much you will need to retire in order to carry on with your current living standards for instance. Up to now, our planning process has been lacking. Now we have the right person with the right approach and tools to make it happen with confidence. You will be impressed.

Question: Are things still crazy or am I just getting crazy?

Answer: Probably a little of both. We all need to get beyond COVID.

That’s it for this week. Hope we answered some of your collective questions.

Sincerely

Sam Jones