March 30. 2024

The landscape of global investment is undergoing a significant transformation, with a growing emphasis on sustainable and environmentally responsible practices.

Clean Energy: A Sector in Transition

The clean energy sector is gaining momentum, driven by a combination of technological advancements, regulatory support, and shifting consumer preferences. Renewable technologies such as solar, wind, and hydroelectric power have emerged as viable alternatives to traditional fossil fuels, offering cleaner and more sustainable solutions to meet energy needs.

The clean energy sector operates within a complex market environment, characterized by fluctuating prices, regulatory uncertainties, and technological disruptions. Despite some of the volatility in this sector, there are common trends that can be taken advantage of.

Price Dynamics in the Clean Energy Market

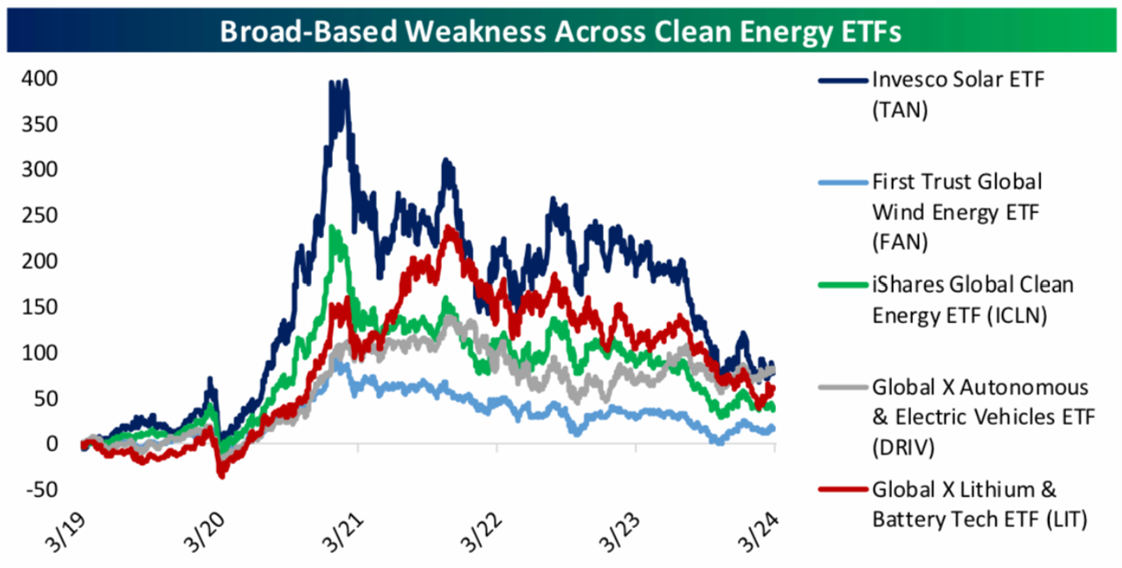

One notable aspect of the clean energy sector is how closely the pricing dynamics reflect the diverse competitive landscapes and challenges faced by various renewable technologies. Solar, wind, electric vehicles (EVs), and batteries each encounter distinct hurdles, yet despite these differences, many securities within this sector exhibit commensurate price changes. This indicates that the sector responds to common factors, despite the individual nuances of each technology.

For instance, fluctuations in government policies, technological advancements, and global economic conditions can impact the competitiveness and profitability of companies across different clean energy subsectors. While the challenges may vary – from intermittency issues in wind and solar to supply chain constraints in EV batteries – the overarching trends in the market often influence the performance of clean energy securities.

Understanding these interconnected dynamics is crucial for investors seeking to navigate the clean energy market effectively. By recognizing the commonalities in price movements and the underlying factors driving them, investors can make more informed decisions and capitalize on opportunities for long-term growth and value creation within this rapidly evolving sector. Below, we have included a chart showing a variety of clean energy ETFs. The important aspect of this chart is looking at how, although the ETFs represent different technologies, price changes move similarly. It should also be noted that the sector has pulled back over 80% since the end of 2020.

The Bespoke Report, May 15, 2024

Riding the Wave of Growth

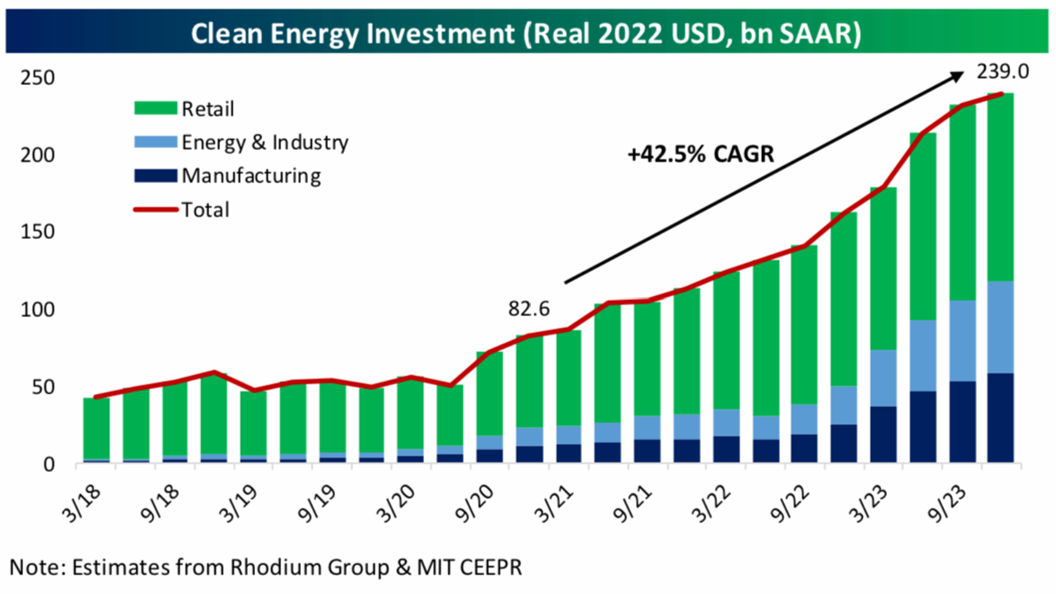

Despite the inherent volatility and uncertainties among investments, engagement in the clean energy sector has demonstrated remarkable resilience and growth. In fact, data reveals that investment in renewable energy has grown at an annualized rate of 42.5% in real terms since 2020, underscoring the increasing investor confidence and market momentum in this space.

The Bespoke Report, May 15, 2024

This impressive growth trajectory is driven by several factors, including the declining costs of renewable technologies, supportive government policies (think of the Inflation Reduction Act), and growing public and corporate awareness of climate change. As the world shifts towards a low-carbon economy, opportunities abound for savvy investors to capitalize on the transition to clean energy.

Seizing Opportunities in the Market

We believe now is an opportune time to consider allocating investment capital to the clean energy sector. Growth in overall engagement and sector investment, with a pullback in prices, offers a compelling entry point. Despite some of the inherent risks, the sector offers high-growth investment prospects with low price barriers to entry. Moreover, the strong market fundamentals, coupled with ongoing demand for renewable technologies, provide a solid foundation for long-term growth and sustainability. The New Power Fund is a separately managed account dedicated to investing in clean energy, climate solutions, and transformational technologies. We are seizing the current opportunity by deploying cash to new positions in this sector. Please feel free to contact us to discuss your interest or current situation.

Best Regards,

Cooper Jones

New Power Fund Analyst