March 15,2024

I talk to investors every day; some are clients, some are not. Inevitably, opinions and expectations are offered. I try to stay quiet, listen, and absorb the vibes. Why? Because the markets are really just a voting machine governed by investor sentiment driving prices in both directions. What I take away from the vast majority of conversations today is a strong sense that investors are not very Street Wise.

Ecuador

As a family, we traveled quite a bit with our young boys. In 2013, we went to Peru to see Machu Picchu, which is just an amazing adventure, by the way. We took the stunning Hiram Bingham glass-top train ride from Cuzco to Aguas Calientes, then climbed the ancient stone staircase for 2 hours through the jungle to the sacred city of Machu Picchu. The boys were 8 and 10 years old and gobbled it up. I highly recommend the trip and am happy to provide details for anyone considering the destination. Peru was, and continues to be, a very poor country, especially the further you get from Lima. Massive shanty towns, shoeless children, and a heavy-handed government that uses drinking water as a means of controlling the population (like shutting off your water). We made it a point to expose our boys to less developed parts of the world to gain perspective and appreciation for what we have as relatively wealthy Americans. After Peru, we traveled toward Ecuador to a small oceanside town where Ernest Hemmingway apparently spent his winters fishing and writing. From the airport, we arranged to have private transportation pick us up because, at the time, taxis were known to rob their passengers, especially gringos. As we entered a small dusty village along the way, we found that the road was blocked by trash can-size rocks. A shirtless man with a small orange flag tied to a stick waved us onto a side road. No bueno. Around the corner, it became clear that we were being robbed. Heated words between our driver and the bandits, a serious request for as much cash as we had on us, and we were allowed to pass without additionally losing our luggage, passports, and other valuables. The boys were wide awake, alert, scared as they should be. I was sweating bullets in full fight-or-flight mode.

We arrived at our destination, light by only a few hundred US dollars, but grateful not to be in a ditch face down. We were lucky. Conversations with the boys for the next week or so were about bad people and why they steal or what we could have done to prevent this from happening? I even remember a little pointed anger: “Why did you bring us to this place?”. To this day, the boys probably don’t remember much about Macho Picchu or Peru or Ecuador, but they could tell you in gross detail about that day on the trip from the airport and how it felt to be vulnerable, afraid, and at risk in a very visceral way.

During future trips to Argentina, Chile, Costa Rica, and Mexico, it was clear that the boys were much more aware of “other” people, how they looked at you, and how they acted. How are we going to get there, and is it safe? Should you wear an Apple watch and bright clothes with BIG AMERICAN brands? Probably not. Wallets and phones in the front pocket, out of sight. By yourself at night? Of course not. Lock the doors, yep. In short, they became street-wise, not afraid to travel but watchful with a simple and healthy survivor’s instinct for judicious risk-taking.

FOMO

For context, the sentiment I see today regarding housing and the financial markets is not surprising. The last time we had any event that invoked any sort of real fear was 2008, and before that, 2000. Since then, we have had mini bear markets and mini corrections of 10-20%, but nothing really lasting in time or of any magnitude that might shake your tree. 2008 was a long time ago and way past the zone of modern memory. So, let’s say that you are in your mid-30s and graduated college in 2010. Your memory and experience with everything from real estate to stocks is just up and to the right. Gains on top of gains, on top of compounding home equity with sub 3% mortgages. Frankly, you have never been “robbed” by the market in any way and, therefore, would naturally have no respect for what could happen or the fear that comes with dramatic loss. In other words, you simply have no set of experiences that would create any real sense of risk.

I thought this annotated chart from Bespoke might be appropriate to show within that context. Looking at a rolling 10-year percent change chart of the S&P can be a little shocking.

For example, if one were to have made significant investments in the basic S&P 500 index anywhere from 1998 to 2000, one would have seen a total return of negative -50% through the middle of 2009 (10 years). The same thing happened between 1960 and 1974, but the rolling 10-year return was only -20%. These things happen. These are long, painful periods of time with cumulative negative returns, and they tend to change attitudes about risk rather permanently. It seems somewhat obvious that the rolling 10-year performance of the S&P 500 peaked in 2019 and is now headed back toward the zero line, setting us up for another one of those true generational buying opportunities.

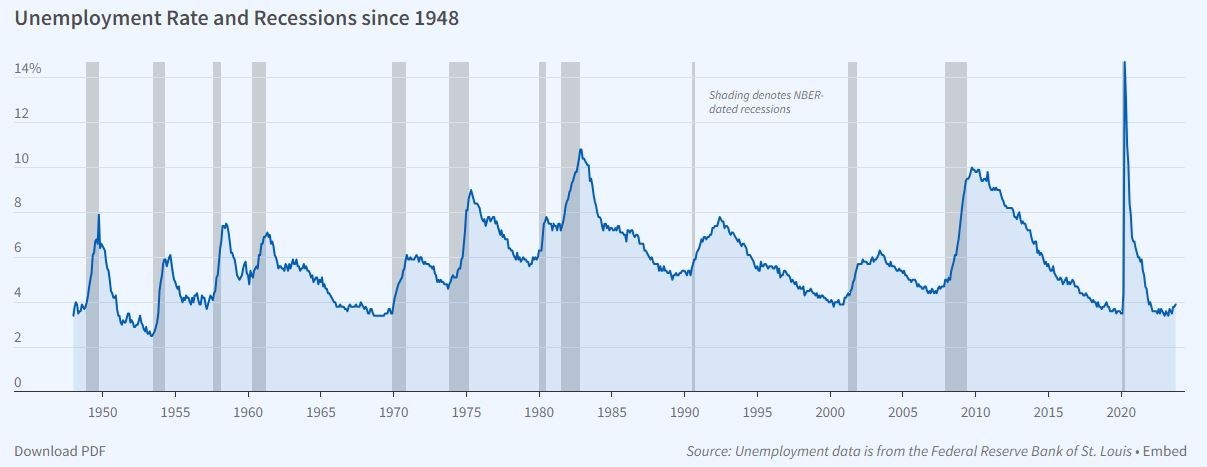

Since 2008, we have had exactly one micro recession in the US economy in the year 2020 following the pandemic that was so short, many didn’t even know it happened. Unemployment rocketed higher during that time amid COVID lockdowns, but we returned almost immediately to sub 4% about thirty months later with pockets full of “stimi” checks and bulging household savings.

So, we’re pushing 16 years since the US economy has given us any reason to be Street Wise – Wall Street Wise, Real Estate Wise, Anything Wise. Quite honestly, street-wise investors would be stashing cash right now and cheerleading for a much-needed deep correction to buy great companies at discounted prices, especially younger investors with a long-term horizon. Want to buy Nvidia? Be my guest, but how about at a price that starts with a 5, not a 9? (The current price is $926/ share). Factually, our greatest returns are generated not following periods where stocks are trading at all-time highs but from those deep lows where fear of losing, despair, and doubt dominate the headlines.

Today, we are at the opposite end of the psychology pendulum. Among those who have enough choice and dollars to invest, roughly half of the country’s sentiment is predominantly one of FOMO – Fear of Missing Out. Where is the next rocket ship? Why didn’t I put everything into Bitcoin or Nvidia? Damn it! Next time, I’m going to get a ride… to the moon! There is unbridled confidence behind putting a majority of your net worth in the S&P 500 as an investible index with an embedded expectation of 12-15% annualized returns. Maybe revisit that Rolling 10-year performance chart above? S&P 500 total return since 12/31/2021 is now just a bit over 5% or the same as any money market fund.

Real estate has also been incredibly rewarding for nearly 30 years – on the back of falling interest rates. This was the topic of our recent Finding Benjamin podcast- What they won’t tell you about housing.

Anyone who has owned a home, over the last 20 years, has built up incredible wealth and equity. Why would we not feel the urge to own even more real estate with the purchase of a second home when our experience has been nothing but green lights and a higher net worth. Perception is reality of course.

Personally, I’ve had my financial teeth kicked in enough times to have that survivor’s sense of when current risk and future reward just don’t match up. On the contrary, I feel like a great many investors are unfortunately destined to learn some Street Wisdom that will no doubt shape their perspectives about risk-taking, perhaps for the remainder of their lives, just like that van ride in Ecuador.

To be clear, I have no idea if we are heading into a bear market, recession, or something nasty in real estate. I am simply calling out when I see too much false confidence and reckless spending among investors and consumers at large, and I mean too much, like on a Great Gatsby scale.

I don’t know; maybe it was that woman coming out of the restaurant last night.

Oh my God, Oh my God, Oh my God, did I tell you I’m going to Vienna to see Taylor Swift!!!!!!!

Screams of joy…. And fade to black.

Becoming Street Wise

Let’s end on a constructive note.

Investing is actually pretty easy most of the time. We can and should have anchor positions in any of the broad-based low-cost Index ETFs using simple rebalancing and periodic tax loss harvesting disciplines. Roughly 30% of our client’s investment dollars are invested this way.

But there are clearly times when investors should balance out their index market exposure and expectations with a different strategic approach. This is one of those times. We use the term “Strategies” a lot in our shop because we believe that your money should be diversified not only by your holdings but by your very approach to building wealth. Our clients should have confidence knowing that we are making these changes across portfolios now.

Lean Into Shareholder Yield and Value

Consider how you measure success with investing. For most, it’s really a simple measuring stick of your investment balance. A rising balance equals success, right? Fair enough. But there are other ways that our investment dollars can help support you financially. Think about what your stocks or funds provide you in the way of shareholder yield, which is a combination of share buybacks and dividends. The vast majority of stocks and stock index funds out there provide almost no shareholder yield; it’s all a game focused on price appreciation – aka growth. The yield on the S&P 500 as an index is 1.45% currently, close to the all-time lows.

Alternatively, our Multi-Asset Income model kicks out 9.3% annualized dividends, which are paid monthly in most cases. This week, we will receive 14 dividend checks as free cash flow from our 42 positions, regardless of what happens to the markets. If you are looking for a Street Wise strategy that cares less about growth and more about consistent, near-double-digit income replacement, this is an option. To be clear, your balance may not move up as much or be in sync with growth-type investments, but that’s not the objective. The objective of this approach is to lean into a strategy that does not depend on rising prices as much as consistency of income. When prices also turn higher, as they did in 2020 and 2021, the total returns compound quite nicely, just like a rental property but without property taxes, broken toilets, and troublesome tenants! Sorry for the shameless advertising.

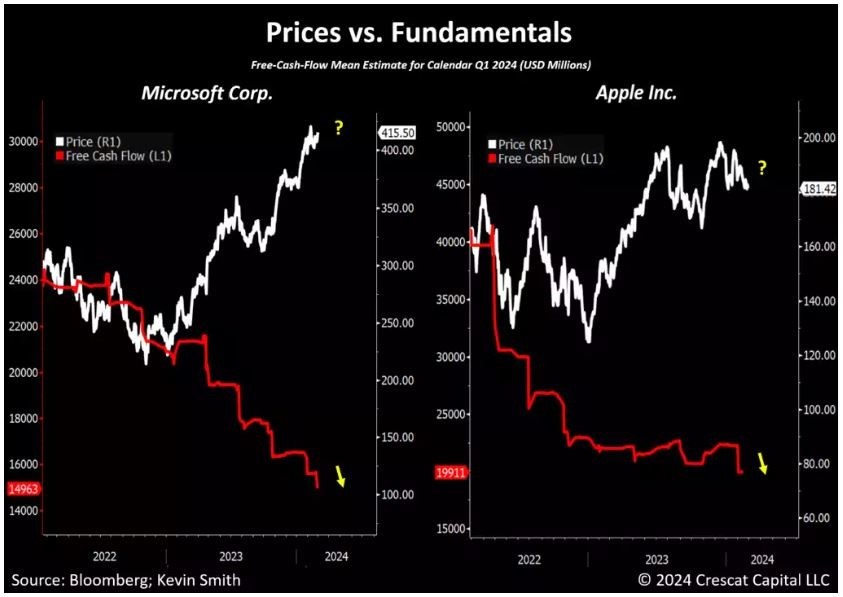

Generally, this would be the time to also lean toward value managers who can compile a pool of companies generating high free cash flow, profit margins of over 15% and price to sales ratios well below 10. Most investor money is now highly concentrated in companies that have almost no “value” if one is using these metrics. Have you seen the free cash flow from Microsoft and Apple?

Here’s another Street Wise idea.

Consider The Alternatives

I think the last time I felt this way was 1999. Alternative asset classes like real estate, gold, commodities, emerging markets and tactical trading strategies were clearly the most hated of all things at that time, just like today. Of course, these very groups went on to earn double digit, even triple digit returns while the broad US stock indexes plummeted over 50% through March of 2003.

The table certainly seems set here for alternatives in many forms to begin outperforming any of your basic stock index ETFs. Last week, gold bullion (GLD) decisively broke out of a trading range dating back to 2011. This is perhaps the most meaningful macroeconomic event of the last decade, and it received almost no press over the weekend. Amazing. We own gold and gold miners and have started accumulating positions in silver. Speaking of… Tactical trading strategies are also a good addition now. They can be found in ETF form or generally through separate account management, like our All Season, Worldwide Sectors, and Gain Keeper strategies. Know when to hold ‘em, know when to fold ‘em.

Consider Future Climate Change Impacts

I thought this was a fascinating article from Forbes, and I encourage you to read it.

Climate Change is a Financial Threat to Your Retirement

Real estate in select coastal areas in states like Florida, S. Carolina, and California is approaching the status of “uninsurable.” They have been hit by hurricanes, floods, and mudslides so often that insurers simply will not carry them any longer. How marketable is your house when you go to sell if you can’t get home insurance or the premium cost is so high that it swamps your monthly payment, no pun intended? Insurance providers are suddenly huge profit centers as premiums are sharply on the rise. They are very good at quantifying the risk of loss and charging customers commensurately. We bought KIE (insurance ETF) as a new theme position in our Worldwide Sectors strategy last September.

Climate change is factually and quantifiably adding risk to select companies, asset classes, and industries that are heavy carbon polluters. Others are beneficiaries of these changes. The SEC is forcing all public companies to disclose and quantify their known climate and carbon risks in their quarterly earnings reports. Make no mistake, shareholders recognize these risks now, just like any other, and are quickly moving toward industries and sectors that are less exposed. Should we be surprised that traditional fossil fuel companies are struggling again despite their attractive valuations and healthy dividends? I’m not. Investment strategies like our New Power fund are clear beneficiaries of these changes toward a cleaner, carbon-neutral world while strictly avoiding companies subject to climate change risk.

Control the Things You Can Control

like spending, OMG, OMG!

It would be wise to consider your financial situation if you suddenly lose your $250k job. How much debt are you carrying? Multiple car payments? Who will pay your mortgage and your kid’s private school education? What kind of reserves do you have for THAT rainy day? Controlled spending, limiting debt, and positive day-to-day savings habits are, quite honestly, the most impactful things you can do to improve your financial independence. It is not how much you make but how much you save that creates wealth over time. The markets are largely out of your control. Your income is also largely out of your control whether you are self-made or work for the man. Personal finance is difficult if you tend to be an undisciplined person, so perhaps the first step is to do a little self-reflection and get help if you need it. Discipline is a learned habit, and it must be nurtured, reinforced, rewarded, and practiced daily. Make your bed every day, right?

That’s it for this week. Let’s keep it real.

Good chat

Sam Jones

President, CIO – All Season Financial Advisors