April 6, 2023

Since 2020, we’ve been banging the drum regarding The Big Three Investment Opportunities of the decade. Regular readers know what I’m talking about but you can read all about it HERE. They are all three playing out nicely now giving smart investors a full plate of investment options and a clear path to asset allocation. As we highlighted on November 9th of last year, international investments are taking flight as the 3rd of the Big Three. The trend is now accelerating relative to the US financial markets. This is that time to go big with your international allocations. Let me make a case now for why investors could now consider an outsized allocation to internationals as a longer-term core holding. Please note that any commentary hear is market based only focusing on opportunities and risk. Individual investors have different objectives, risk tolerance and situations so please take this for what it is.

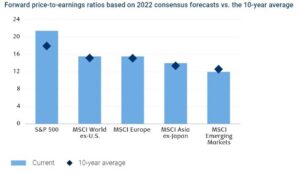

Non-US Valuations are Far More Attractive

There are a lot of messy charts and tables out there regarding this subject but the common summaries of all tell the same story. International valuations, especially developing and emerging markets are below their 10- year averages but the 10-year average itself is far below the current valuation of the US stock market. You might know that the last 10 years has been a blow-out for US securities. However, in decades past, international investments have produced very attractive returns relative to the US. See below from RBC Wealth Management.

Buffet and Shiller both offer their own studies surrounding these valuation differences using a similar methodology of market capitalization to current GDP (or GNP). They go further to project forward returns on these data which have historically been pretty accurate with an 8-10 year view. Again, the story is the same; Internationals are very inexpensive, absolutely and relatively speaking. Buffett’s analysis below is broken down by country. If we look at the projected returns below, we see a few important things. First, the US markets are not projected to earn more than 2% possibly for the rest of the decade using 1/2022 as the start date. So far, we’re down -14% from that date through yesterday. Meanwhile, outside the US, we see projected returns at the top of the list closer to 10% and well above in select cases. Am I going to rush into Russia, Pakistan or Egypt with client money? Of course not.

But Brazil, Indonesia, Mexico and China are certainly in the hunt. In the developed markets, we also see consistency of high projected returns in most of Europe as well as Australia, Singapore and Canada. Note- You’re going to see many of the same countries mentioned below as we move through the analysis.

With a Little Help from My Friends at Chat GPT

Wow, let me say quickly how powerful, awesome and terrifying it is to use Chat GPT. This is not a search tool; it is an analytical tool that is going to make research infinitely faster for those who are looking for more than just information. I used my tiny brain to ask Chat these questions in hopes of identifying which countries in the world are best positioned to benefit and sustain from obvious secular challenges. You’ll see a common thread in the line of questions.

Q: Which countries have the highest adoption rates of renewable energy?

I am only listing those with over 95% renewables or likely reaching 95% in the next 3-5 years. Hydro power is considered a renewable energy source here. Countries that have already shifted to non-fossil fuel-based energy sources are far in the lead. They are less prone to price swings in oil and gas, less prone to social impacts of petro dictators (Russia, Iraq, Saudi Arabia), and will have better control over their primary input costs from this day forward.

Iceland

Norway, Sweden and Denmark

Uruguay

Germany

Costa Rica

- Which countries have the highest output of agricultural products?

Food sourcing is increasingly becoming a thing in the global stage. Those who can produce food for themselves, and the world will continue to have the most influence in geopolitics, costs to consumers and the allocation of favorable trade terms. The top 6 listed in order.

Russia (sadly)

Brazil

Canada

Australia

Argentina

USA

- Which countries have the highest known deposits of rare earth metals?

Rare earth metals are critically important in almost all technology, especially energy storage, batteries and electrification of the transportation. If we are to continue on our current path, rare earth metals will again be one of those important differentiators between countries and who holds the power to the future. The worlds largest deposits of rare earth metals are found here.

China

Brazil

Australia

- Which countries are positioned to be least impacted by a protracted period of inflation and why?

This was a tough one for Chat because there are so many variables going into the comparisons. Preference was given to countries with:

- High levels of diversified exports

- High levels of domestic production of goods and services

- High consumption levels and growing middle class

- Strong monetary and fiscal controls through central banks

- High levels of commodity resources

…and the winners are:

Brazil

Canada

Australia

China

Germany

My line of questioning started with some assumptions about the future. These are that climate change, resource scarcity, a new and protracted period of nationalism (anti-globalization) and inflation are all going to have profound impacts on the welfare of different countries depending on what each brings to the table. We see from the output that a certain group of countries are all positioned well while many countries didn’t make the list and could be at greater risk.

Here’s the short list:

Brazil and Latin America, Australia, Canada, parts of Europe and Asia (including China).

What About Timing?

I’m glad you asked. The time is now. Internationals started outperforming the US markets last fall in November. We saw a bit of a pause in February but now the outperformance continues again and will likely for the foreseeable future. These changes in leadership between internationals and domestic markets tend to be notable, protracted and consistent once established. Take a look at this relative strength chart and note the change in trend in the bottom right corner. This is that time!

What does this mean for investment allocations?

Well for one, we need to catch this train because it is leaving the station and the longer we wait to get on board the greater the risk of an accident. Most asset allocation models with a 60% stock/ 40% bond mandate, might have 20% of equity exposure committed to internationals. Our own Wealth Beacon Conservative model has almost 30% as a slight overweighting. But our dynamic asset allocation strategies are more at liberty to take a bigger stake, as they have with over 50% of current equities invested, in internationals. I’m wondering out loud if this is enough considering the very wide differences in valuations, projected returns and the Chat factors listed above?

For our clients, rest assured that we are following the opportunities and trends as they present themselves. For those in the DIY camp, this is a great time and place to make some long-term investments (not trades) by increasing your international exposure now.

Timely updates and little education – requested and delivered in this Red Sky Report.

Best to all

Sam Jones