September 27, 2023

As we work through our fall client reviews, I often hear the same set of questions and have the same or similar discussions. With that in mind, it seems appropriate to use this update as a means of daylighting these conversations, concerns, questions for everyone’s benefit. This is a highly emotional time for all investors and I hope we can help guide and set expectations a bit. We will be discussing and presenting more detailed information on these subjects at our upcoming annual client meeting on October 4th in Denver.

Q and A

Question #1:

Help me understand – Are we going to avoid a recession like I seem to hear on the media? Will we have a soft landing?

Answer:

There is some good news and some bad news on this front. Bad news first.

We are seeing growing evidence that inflation is actually bottoming now and heading higher again after falling from the high of 9% one year ago . One of the better sources of inflationary data comes from www.truflation.com.

They show that inflation has successfully fallen from over 9% to as low as 2.3% but the rate appears to be climbing again from the lows in July and August.

While we might applaud the Federal Reserve for aggressively fighting inflation, albeit terribly late to that war, we also need to recognize that ultimately, the sources of inflation are not something the Fed has control over through monetary policy. These sources of inflation are very sticky, durable and quite difficult to reverse directionally. Many are still creating great concern at the Federal Reserve.

I will be talking specifically about these sources of inflation at the upcoming Annual Client meeting at the Wellshire Country Club on October 4th.

The concern of course is that we are beginning our next stair step higher on what continues to look like the long and formidable decade of the 70’s. Stocks remained range bound from 1965 – 1982 including four bear markets of 20-40% each. Today, we have seen three bear markets in stocks of at least 20% each since 2018 (3 of the last 5 years). It seems somewhat obvious that we are repeating the 70’s style inflation cycle.

The good news is that we may not have a formal recession or at least not something that impacts the entire economy in widespread fashion. Employment is still strong, wages are high, commodity prices are high, real estate prices are high, and the cost of my breakfast burrito is insanely high!

$18! Seriously?

$18! Seriously?

What I see with strong evidence is that the more cyclical segments of the economy are already in recession like luxury goods, technology hardware, sporting goods, discretionary items, consumer retail, and travel. Other areas that command our steady payments like energy, streaming services, insurance, food, housing, rents, services, are still strong almost riding the wave of higher prices. The strong sides of the economy are really inflation beneficiaries while the weak sides of the economy are suffering badly from inflationary pressures. So, it depends on who you ask whether we are going to have a recession or not. Some would say “Yes, my company is already deeply in recession!” Others would say, “Absolutely not, we can’t keep up with demand”. Inflation can be worse than any recession for many.

In sum, in true 70’s style, there is a tug of war between inflation, which is winning at the moment, and recession, which could still become a bigger force as we move through time. If history repeats, we end up with a draw of sorts, called Stagflation (Inflation AND recession). I believe we are getting there quickly.

Question #2:

They say inflation is running at 3.67%. Why does it still feel like everything is still so expensive?

Answer:

As I indicated in Question #1, the things we need are still rising at almost double-digit rates on a year over year basis. Things we want, that fall into the discretionary pool, are seeing modest falling prices year over year. Stagflation! Take a look at the breakdown of August CPI numbers. The areas in Blue are showing rising prices while those in Green are showing falling prices. Very interesting! Spend some time with this.

As I’ve said for the last decade, our measures of inflation are highly skewed toward consumer goods and literally exclude things like housing (+7.8%) and food (+ 6%) and energy (actually up 11% year over year now). So yes, our current and rising cost of living is not represented well by current inflation numbers reported as the Consumer Price Index. Our advice: Control the things you can control, like your spending, saving, incomes, debt and taxes. We’ll work hard every day to make sure your money is as productive as possible given market conditions.

Question #3:

Where are you (ASFA) looking for investment opportunities now? What is working?

The answer comes back to the 70’s playbook for what made money and what did not. As I’ve told regular readers in the past, I keep a list of the sectors, asset classes and themes that did the best in the 70’s period of persistent high inflation with bouts of recession mixed in. Here’s the list (and I’m sure you’re tired of seeing it).

- Commodities – A new super cycle of commodities began in late 2020. Since then, commodities are up 87% versus stocks, up 19% and bonds DOWN -14%. We have full exposure to commodities across multiple investment strategies. Buy the dips for the foreseeable future.

- Value and high dividend paying stocks – Till I’m blue in the face. Let’s highlight Berkshire Hathaway (BRKB), our largest holding in the All Season strategy. Berkshire Hathaway represents the essence of value and dividends for those who understand Buffett’s discipline. The markets began favoring value over growth styles in November 2021. From that time Berkshire Hathaway is up over 26%, while most “Growth” funds like the I shares S&P Growth ETF (IVW) are down -15% to date.

- Natural resource ETFS, Closed End Funds and MLPs – MLP are Master Limited Partnerships that invest in natural resources and raw materials. Like most of the inflation trades, these funds and stocks are up over 70% since 2021. MLPs in ETF form like ALERIAN MLP ETF (AMLP) are also up 40% since late 2021 but pay out over 9% in annual dividend interest. Buy em, hold em and collect $200 as you pass GO.

- Cash – Yes, a higher than average cash position is also fine as long as that money is earning a high yield. High yield in today’s market is around 5%/ year and available via any money market mutual fund, T-Bill or short term Treasury bond. Cash can be an investment, but usually not a long-term investment.

- Treasury Bonds – But only for a trade. I believe we are approaching that time and place where there is a reasonable opportunity to buy basic 10-year Treasury bonds. They are unnaturally oversold and paying nearly 4.5% interest with growing recessionary threats out there. Again, US Treasury Bonds are only a trade and not to be bought and held through this whole cycle.

- Internationals – Critical investors might have noticed that international stocks have been marginally outperforming the US stock market since late 2021. Again, this comes down to value as International markets are priced at less than ½ of the US market by almost all metrics. I expect the performance difference to widen dramatically in 2024.

We will cover this topic at our annual meeting at the Wellshire Country Club on October 4th!

Question #4

If the government shuts down at the end of September, will that have a negative impact on the markets?

No, we have had 20 government shutdowns in modern history and the impact on the S&P 500 from beginning to end has been 0.0%.

Question #5:

Are real estate prices going to crash if rates stay this high (or higher) and people can’t afford a mortgage?

Answer:

My sense of gravity and belief in mean reversion says yes, but crash is a harsh word. I would suggest that a more reasonable description is Deep Freeze. You have heard and felt the hard facts surrounding real estate and mortgages since the Fed embarked on the most dramatic increase in rates in history (fact). The impact has been a cliff drop in sales but not so much in price, at least not yet. Falling sales are tough on one set of our economy and those are real estate agents, mortgage brokers, title companies and everyone associated with a real estate transaction. I am interested to find out how much of our economy and wealth is tied up in the real estate transaction industry. I’ll bet it’s a large number considering the National Association of Realtors is the largest lobbying group in DC, spending $84 Billion in grease money in 2022 alone according to Zippia.com. In the 70’s, real estate prices basically flatlined for almost 14 years while mortgage rates climbed into the teens by 1982. No one is going to move unless they have to, especially if they need a bigger house and another mortgage. We will see more supply come on the market as those who failed to lock in long term mortgages are forced to sell or foreclose when their notes are due. They will be frozen out of the housing market and go back to renting. Other housing supply will come from aging baby boomers looking to downsize with no mortgage but will have to accept less than they want to attract a buyer – possibly much less. Most will opt to stay frozen in their great big homes, with lots of empty rooms. Finally, home builders will work to meet the demand for homes but building costs are still on the rise making them ultimately unaffordable for most.

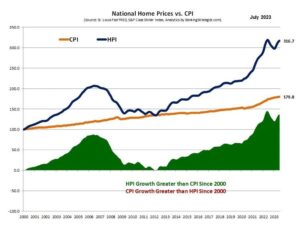

It seems pretty obvious that we’re in for a long period of no growth, sideways at best, deep freeze trends in residential real estate. National home prices over the long term tend to track back to the Consumer Price Index just as they did from 2006 through 2012.

I expect the same this time without the dramatic drop in prices of 2008/09. How long will it take for the CPI and HPI lines to converge? Glacially long. Our best advice? Get comfortable. Learn how to fix up your own home to save money. Settle in for the deep freeze. Enjoy the process and the joy of learning how your house works. I installed all new porch lights on our house last weekend. Super fun.

That’s it for this Q and A session. Again, we’ll be covering a lot of this type of information at our upcoming meeting on October 4th. There will be dinner, drinks, the company of your peers and our entire Denver area based wealth management team!

Keynote Speaker – David Hansen, Senior Economist for the Colorado Legislative Council.

We hope to see you there!

Sam Jones