October 9, 2023

The Last Dance

Last week was big for the financial markets. An event, or series of events, occurred all in one week, that one could accurately describe as a true change of seasons. These things do not just happen out of the blue. They build slowly, discretely, often in the face of widely held beliefs. And then, the moment arrives when it becomes clear to those of us who are domain experts in cycle work, that a turn is upon us. For most of the last 6 months, investors convinced themselves and financial media spread the word that a recession was not in the cards, not possible, soft landing and so forth. With the cumulative events of last week, there is now little doubt that the US economy will be solidly in recession in the first half of 2024. Consequently, for investment strategies with a dynamic methodology, we have the next few weeks, maybe a month, to make a few changes to your asset allocations. This is the time to prepare for new asset class leadership and a relatively swift rotation among winners and losers as we head fast into 2024.

Annual Meeting Presentation Key Points

It was a pleasure to see so many of our clients and our complete Denver area wealth management team at the Wellshire Golf Course for dinner and entertainment this week. Zoom meetings are never an adequate substitute for in person events and we are always glad to host this 22-year-old event. Thank you to everyone who made it special.

Much of the content of our presentation is especially relevant to this update so I’d like to highlight a few key points made in the session.

*If you would like to receive a copy of the 2023 Annual Meeting presentation please reach out to Kris Dickey at kris@allseasonfunds.com or by calling us at (303) 837-1187.

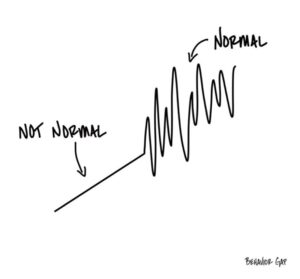

#1. Higher volatility is the new norm.

This picture pretty much says it all. What has become obvious to all is that portfolio volatility, both up and down, is increasing and has been since 2018. In the last five years, we have experienced three bear markets in stocks in excess of 20%. We have also witnessed the US Treasury bond market fall for three consecutive years losing an average of -7.65% per year from the peak in August of 2020 to last Friday. The 20-year Treasury bond has flat out crashed and yes that word is appropriate considering the loss of 46% (-17%/ year of the last three years). Retail investors probably don’t feel the outright pain of those bond market losses as much as larger institutions, but they do feel the increase in portfolio volatility when the “safe” side of your portfolio (bonds) loses more than your stocks. It would be smart for all of us to remember this moment because this is the direct result of the Federal Reserve’s multi year period of near zero interest rates while simultaneously spraying $Trillions into the economy as “stimulus”.

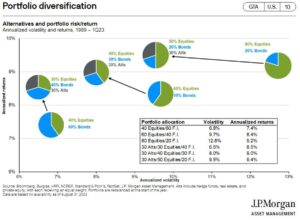

#2. Add Alternatives for Higher Returns and Lower Risk

We talked through the benefits of carrying alternatives in a portfolio in order to increase returns and lower risk (or control volatility). Alternatives are traditionally things that have little to no correlation to stocks or bonds; Things like commodities, gold, hedging and tactical strategies, even real estate when the time is right. We described this as Asset Allocation 2.0, but this concept is not new. The same thing occurred in the 70’s and early 80’s. During these years, investors learned how to hedge and clearly recognized the value of risk management and a more dynamic approach to portfolio management. But sadly, that recognition takes years to settle into the mass of investor psychology and for good reason. Simply owning a standard blend of stocks and bonds has been a rewarding and carefree experience for most of the last decade.

If history repeats, then alternatives should earn a rather permanent place in your portfolio. Today, our Flagship All Season strategy has reduced our stock exposure to 50%, reduced our Bond exposure to 20% and increased our “Alternatives” exposure to 30%. Over time and especially as we move closer toward a true Stagflationary environment (Inflation with a Stagnant Economy), we expect the results of this allocation to speak for themselves. Statistically speaking, owning alternatives in any portfolio throughout history has actually produced impressive results. Consider this study from JP Morgan from 1989- Q1 of 2023.

Notice the recommended asset allocation mix in the very top pie chart for higher returns and lower risk (volatility).

50% stocks

20% bonds

30% Alternatives

Sound familiar?

#3 Inflation is sticky – The Stagflation Playbook

This is the last but most important takeaway from our annual meeting presentation. The headline goes with a tag line that reads Inflation is sticky…. And the Fed can’t do much about it by raising rates. These are the real drivers of inflation across the globe.

As you walk through these self-explanatory catalysts behind secular inflation, ask yourself which of these will be solved by the Fed raising interest rates? I’ll save you the analysis. None. Here’s the important take away. Inflation of the type we have today, is likely to remain high and higher than desired even when we slip into recession in 2024 (hint). This again is called Stagflation and it’s a condition we have experience here in the mighty U S of A in the late 40’s and again in the 70’s.

Asset allocation 2.0 would therefore dictate that we “stick” with some inflation beneficiaries among our alternative allocations. At the same time, we should prepare our investment portfolios for what is now becoming inevitable and that is a recession in the first half of 2024.

Change of Seasons

As I mentioned in the preamble, there are certain moments in market history when we become aware that the tide has turned or on a more timely basis, when the season has changed. Last week was all about brilliant colors, long sleeve t-shirts and shorts, sunny, awesome. My wife Sarah in fall Camo last weekend here in Steamboat Springs, CO.

This week, all leaves are down, temps fall below 30, break out the winter jackets. And just like that the season turns, gradually, slowly , then all at once.

Last week, several important events occurred that are consistent with a top in the economic and market cycle.

- We saw a potential top in the energy sector (not necessarily all commodities).

- We saw the defensive sectors like Utilities and Healthcare suddenly rise from the ashes. Consumer Staples should be next.

- We saw the bond market complete an exhaustive, waterfall decline in price and spike in yields. This is a natural event that occurs at the top of every economic cycle paving the way for recession.

- We saw a jobs report that was anything BUT strong considering it showed a LOSS of 22,000 full-time jobs and a rise of 126,000 part-time jobs.

- We continue to see the stream of economically sensitive reports like factory orders, shipping rates, credit card and auto payment delinquencies, consumer confidence, falling new home sales, corporate bankruptcies, all pointing to an economy that is simply contracting. The evidence is overwhelming.

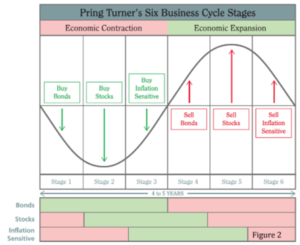

Martin Pring, the author of The All Season Investor, and the name sake of our firm, offers this clear chart to illustrate my point.

One can read this chart from left to right showing when we should overweight/ underweight stocks bonds and inflation sensitives in our portfolios depending on where we are in the economic business cycle. Each stage of a real business cycle varies in length and magnitude but the sequence of events repeats.

The US bond market topped in April of 2020 – Stage 4

The US stock market topped in December of 2021 – Stage 5

Inflation sensitives (like energy) may have just topped – End of Stage 6

Today, there is a high likelihood that we are shifting from Stage 6 on the very right-hand side all the way back to the beginning which is Stage 1. Stage 1 marks the beginning of economic contractions (aka Recessions). So, what does that mean practically speaking for investors. Darn it Sam, get to the point!

- This is that time when we want to reduce, but not eliminate, inflation beneficiaries.

- This is the time to reduce stocks to an amount that we can hold through a complete recession.

- This is the time when we want to rebuild our Bond positions, yes that means US Treasuries.

- This is the time when we want to shift to internationals expecting the US dollar to fall.

- This is the time to start bottom fishing for stocks among oversold financials, REITS, banks, utilities, healthcare, and consumer staples sectors.

- This is a great time to rebalance your passive index portfolio which is no doubt light on bonds and heavy on stocks.

All Season Clients* – We do all of this for you of course.

The Last Dance

I named this update the Last Dance for a reason. October and the last quarter of the year tend to be good for stocks. During the 4th quarter, I expect we will see the following:

- A quick recovery in stocks from the July-Sept sell off that ultimately gives way to the longer-term bear market in place since December of 2021.

- Bonds should form a bottom here and begin rising stronger than most would expect.

- Commodities and inflation beneficiaries should participate in the year-end rally but lag, especially as we close in on January.

- Internationals should rip higher if the dollar begins to sell off.

- Economic reports will continue to come in weaker than expected this quarter.

- We will see a peak in corporate earnings this quarter.

- We will see a peak in employment and wages.

- We will see real estate prices fall as supply finally arrives.

- There is a high probability that the Fed is done raising rates.

This is the last dance.

I’ll leave you with a note of optimism for the future. Every multiyear bull market is born out of a recessionary environment. Stocks tend to bottom almost exactly halfway through a recognized recession and the returns from those lows are robust in the neighborhood of 20-30% in the first 6-9 months. Since 2018, we have not been able to sustain back-to-back years of gains without a great deal of price drama and massive support from the Fed. A complete recession will give our markets a real chance to rise dramatically over multiple years, with real value at every turn. Our job between now and then is to preserve principle, keep our risk management goggles firmly in place and make a move to the other side with our emotional and physical capital intact.

I realize this has been a frustrating year for all investors with diversified, risk managed investment strategies. I do wish we had been able to capitalize on more of the relief rally over the last 12 months, but we stick to our disciplined methods, rain, or shine. From the highs in 2021, we are no better and no worse than the best of the US stock index – down about 10%. But what happens next as we complete the full economic cycle, is what separates the field. As our company tag line says, Create Wealth, Defend It.

Best of luck to all investors!

Sam Jones