October 30, 2023

Where Does Risk and Opportunity Exist in Your Life?

When I first started in this business in 1994, I honestly looked at wealth only through the lens of investments. As an asset manager, my thought process was singularly focused. If I could make big returns and keep them over time, then I would have wealth. Done! But 30 years later, I realize that wealth accumulation comes from risk management across many areas of your financial life. The condition of “the market” is a daily firehose of noise these days drawing our attention away from other variables in our lives where we can have larger control and positive impact on our financial futures. Let’s take a moment to look at the spectrum of where risk (and opportunities) exist in our lives.

Behavioral Economics

Ok, let’s get this out of the way. Market risk and opportunity are legitimately one of the primary tools used in our quest for wealth accumulation. Managing the balance between risk and opportunity in the financial markets by way of our 9 different investment strategies is one of the primary value propositions we offer our clients. Most of the financial services industry is made up of salespeople disguised as brokers or reps who sell products to investors and do little to no management of those assets once they are invested. “Set it and forget it” is an industry mantra. Sometimes that works, but in my 30 years of experience, when bear markets inevitably roll through, that strategy turns into Set it – lose it and sell out at the lows. We are witnessing capitulation selling in the markets now if you hadn’t noticed. Conversely, regular readers know that we became very defensive in our risk managed strategies in September by raising cash, buying gold, short positions, commodities, reducing our stock allocations and eliminating all corporate bonds. Please Re-read “The Last Dance” post on October 9th for more details. And now, after a waterfall 10% decline, many are hitting the panic button. Wealthy people rarely manage their own money because they know they are prone to making these behavioral errors. They hire someone who has the experience and knowledge to make tough decisions for them at the right times. Sometimes those decisions involve avoiding overhyped and overvalued sides of the market. Sometimes those decisions involve buying asset classes that everyone hates.

Humans are not designed for investing success. We are mentally programmed to seek safety/shelter and avoid pain/danger. However, the most successful investors over time are those that literally do the opposite of consensus opinion by actively allocating investment capital to unloved sectors, asset classes and stocks. Since it’s Halloween, let’s dress up as a contrarian and see what we can see. I’ll give you two ideas.

Small caps!

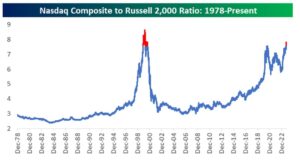

Small caps have been beaten down badly since 2021. Consequently, the market hates small caps. No surprise. Rising interest rates are tough on companies that tend to survive on borrowed money. But if we believe that rates are peaking now (as we do), then we might consider the potential in small caps. Valuations are less than 1/3 of their large cap growth brothers. In fact, according to Bespoke the ratio of small caps to the Nasdaq (home of large cap growth) has only been this extreme once in the last 40 years.

That time was the high peak in 1999. Those of us who were managing money then, remember clearly that small caps outperformed large caps and the Nasdaq by nearly 60% over the next few years. Today we have the same extreme situation that should serve as an early warning to sell large cap growth or buy small caps, maybe both. We’ll wait for those trends to emerge but we are clearly keeping an eye on this.

Treasury Bonds

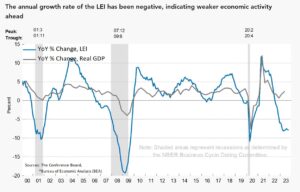

Today, you would find it difficult to find anyone recommending Treasury bonds. After all, they have lost 20-50% over a span of three years. With the gubbermint in disarray over the budget, a cumulative deficit of $1.7 Trillion and $34 Trillion of outstanding debt, who would want to effectively loan more money to the US of A? Treasury bonds are perhaps the most hated of all asset classes now. But value has returned in this space with rates now at 5% on a 10-year Treasury, especially as we slip closer toward recession when bonds tend to be the best performing asset class. If Treasury bond rates simply move DOWN to the current inflation rate of 3.5% over the course of the next 12 months, that move would represent a 25% gain in price. I like the sound of that especially knowing that we have a well-oiled printing press of the world’s reserve currency – the US dollar. Are we heading toward slower growth, or recession? Yes, at least according to 18 consecutive months of declines in the Leading Economic Index (LEI). GDP was just reported at north of 4% strangely but it should follow the LEI down into 2024 as it has done historically.

We are actively adding to our bond positions in our risk managed strategies. As I write today 10/27, bonds are up, commodities up, gold up, and stocks are down (again).

Investing against consensus opinion is very tough but very often the right way to make consistent, low risk, returns over time. The point is that most investors are prone to bad behavior like buying high and selling low. It’s human nature. Market risk and opportunity are always present but the difference between success and failure is how we respond to each with our investment capital. If you have the time, energy, knowledge and desire to make these choices, go for it. If not, hire someone with a proven long-term track record.

Cyber Security

Cyber security is as much of a threat to your financial future as anything out there. I wish we had the time and capacity to offer some much-needed home security training in password protocols, what to look for with email phishing attempts, and setting up multi factor authentication on all financial sites. I could finally put my masters in Information Technology to use! Every year we thwart a serious attempt from bad guys who have hacked into one of our client’s email accounts asking us to move money or change the address of record on accounts. We have protocols and cyber security procedures in place to identify and prevent these attempts. All Season uses Right Size Solutions as a real time technology partner who monitors all traffic to and from our organization and can provide threat response 24/7. No one can guarantee full security, but we can do our very best to minimize access and control damage if and when it happens. We would strongly recommend that you spend some time learning how to use a Password Manager – we like Lastpass.com ! We would strongly recommend that you avoid clicking on any hot links coming to you in email unless you are quite confident in the sender and have verified their “from” email address. And never, never, never give confidential information to someone who calls you and says your credit card or bank has been compromised – hackers love to pose as cyber security professionals!

Taxes

This is an area of financial opportunity that I have come to enjoy. They say there is nothing more certain than death and taxes. Bunk. Taxes are not certain and can be managed. This is a clear area of opportunity for most that is in your control and carries direct financial benefit. Here’s an example.

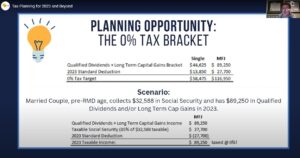

Did you know that if you can get your income below $116,950 year for MFJ filers, your long-term capital gains tax rate could be zero % (sounds like zeee row)? Here’s a scenario outlined in our January Solutions Series on the Secure Act 2.0.

How can you get your income below $116,950? Great question. You can get there by being retired of course, or perhaps doing some charitable giving at year end to slide under the line. You can use a deferred comp plan, profit sharing plan or cash balance plan to reduce your taxable income if that’s an option. You can maximize your deductions. You can chip away at your IRA account balance early so your required distributions (RMDs) post 70 years old aren’t huge. You can make sure that your taxable investment accounts are passively invested and not generating short term capital gains taxable as income (but do actively manage your retirement accounts!).

Again, if you don’t want to read tax code for fun on the weekends, feel free to work with our tax planning partners and software to help you minimize your taxes each and every year. This is in your control and directly helps build your wealth over time.

Financial Planning

For years, I didn’t really understand financial planning. It seemed like an overused label for financial services salespeople. But I have come to appreciate the real value behind regular planning. I’ll give you an example. If you are approaching Medicare, it’s important to pay attention to your income in the two years prior to avoid paying extra premiums. Medicare is means tested with a two year look back to income. MFJ filers making more than $206k will pay premiums. Again, careful income planning can help save money and build wealth.

Much of the opportunity and risk control in planning comes from projection work where we look into the future of your cash flows and balance sheet factoring in practically all aspects of your financial life. Those include, incomes, expenses, home values, debt, rates of return on your investments, inflation, taxes, even budgeting for things like a car, a second home or long-term care down the road. We can run your “plan” against all types of market conditions to see how much you are projected to have at death leading to discussion about legacy planning and gifting strategies. There is much to do here that can help answer critical questions like:

- Will I outlive my money?

- Can I afford to buy a vacation property?

- How should my assets be invested to make my plan work?

- To what extent can I help my adult children financially?

Most of all, clients who go through the planning process and have a clear idea of what they can and can’t do from a spending perspective, find themselves much more at peace about the future. The process of building your plan is manageable but does take some effort on your side. We need to gather a lot of information from you, put it all in one digital space, ask questions, evaluate, ask more questions and then put together your financial plan. It’s a real thing that lives and breathes and needs to be updated annually. I have found the whole process to be useful, valuable, and it ultimately helps build wealth as well as any of the issues above.

As always, we’re here to help you solve these puzzles with our team of wealth management professionals, working in collaboration toward your benefit. Today, I see a lot of energy focused on things that are largely out of our control like the markets, the Federal Reserve, wars and politics. How about spending more time on the things that we can directly control to help manage risk and find opportunities.

Wealth Transfer Solution Series Coming in 2024

This seems like an opportune moment to announce our upcoming Solution Series starting in 2024. The series is targeted to families that need help, organization, education and training on how to pass wealth efficiently from one generation to the next. Naturally, this will appeal to those designated as Executors for parents’ estates and/or those designated with a Power of Attorney. The series will be hosted by each of our Wealth Management Partners offering advice and guidance from their respective fields and delivered quarterly. Stay tuned for more detail.

Have a great week!

Sam Jones