March 11, 2024

The New Power Fund (NPF) is currently undergoing a remodeling process, and this transition is happening at the perfect time. Please read on to learn about the future plans for NPF and to discover how we are enhancing its appeal to clients who are eager to invest in a genuine climate solutions strategy.

The Last 20 years

The New Power Fund is celebrating its 20th anniversary and has been consistently outperforming its benchmark, the Powershares Clean Energy Index (PBW), by a significant margin. However, the fund’s original strategy of investing in pure plays in the renewable energy sector has proven to be financially speculative, volatile, and subject to resistance from the fossil fuel industry. To minimize the risk of the strategy, the fund started including companies that fit with ESG (Environmental, Social, and Governance) metrics in 2013. The belief was that ESG metrics would provide a broader framework for investing towards a climate solutions objective. But the water was murky surrounding the collective standards of the many “ESG ratings” and the fund found itself uncomfortably far from its original objectives. Thankfully, in recent months, the SEC and several other regulatory bodies are moving strongly to mandate that public companies provide full disclosures and quantify of all known climate risks as well as expected carbon emissions. Subsequently, the fund decided to reconstruct its strategy in late 2023 with the aim of maintaining performance while focusing exclusively on companies that have a clear objective of climate responsibility. We are grateful that the new regulatory metrics will give us more clarity and breadth of opportunity in our security selection process.

The NEW New Power Fund

The New Power Fund has recently made a strategic decision to concentrate its investments solely on climate solutions. In line with this objective, the fund has also introduced a new logo to represent its new direction. To ensure its stability and returns, the fund will no longer rely on investments outside of this objective. Instead, it will allocate investments across three sleeves, with the exact proportions yet to be determined.

- Transformers

- Innovators

- Players

Let’s start by discussing the Transformers sleeve. This sleeve comprises companies that are shifting towards sustainable business practices, products, or services, and those that provide technologies to facilitate this transition for others. For instance, consider one of our latest investments, Waste Management (WM). WM is a well-established company that has witnessed significant growth, both financially and as a business model. However, it’s no longer solely focused on waste diversion but has emerged as a leader in methane capture from their landfills that fuel their Compressed Natural Gas (CNG trucks) and is now installing solar arrays over mature landfills. You can read all about it HERE. This is the perfect example of a Transformer; this is a company that is shifting their business model to become a closed loop ecosystem as well as move the needle away from fossil fuel energy sources.

Looking at the second sleeve: Innovators. These are companies that have been publicly traded for 2-4 years, targeting emerging technologies and potential “game changers”. Aris Water Solutions (ARIS) is a wonderful example of a company that has recently been added to the New Power Fund. Aris is a relatively new company but is already exhibiting solid financials. As of this quarter, Aris has 22% year-over-year revenue growth, 142% growth in earnings per share, generates $183M in free cash flow and is still trading at a 40% discount to the market’s current valuation. As a business, Aris is responsible for the recycling and reuse of wastewater generated from oil and gas drilling operations. Aris is working to eliminate the need for freshwater resources from the oil and gas industry! In our minds (and on paper), this is the kind of company we could see having incredible returns while maintaining an “eco-friendly” business model, providing a real solution to an otherwise dirty business.

Moving on, let discuss the final sleeve which is called Players. This section will focus solely on companies that are directly involved in renewable energy, electrification of transportation, building efficiency, as well as broad, clean energy-focused ETFs. One company that we are particularly excited about is First Solar (FSLR). It is a top-tier manufacturer and global installer of Solar PV for utilities, commercial and industrial customers. Moreover, it is currently trading at a deep discount.

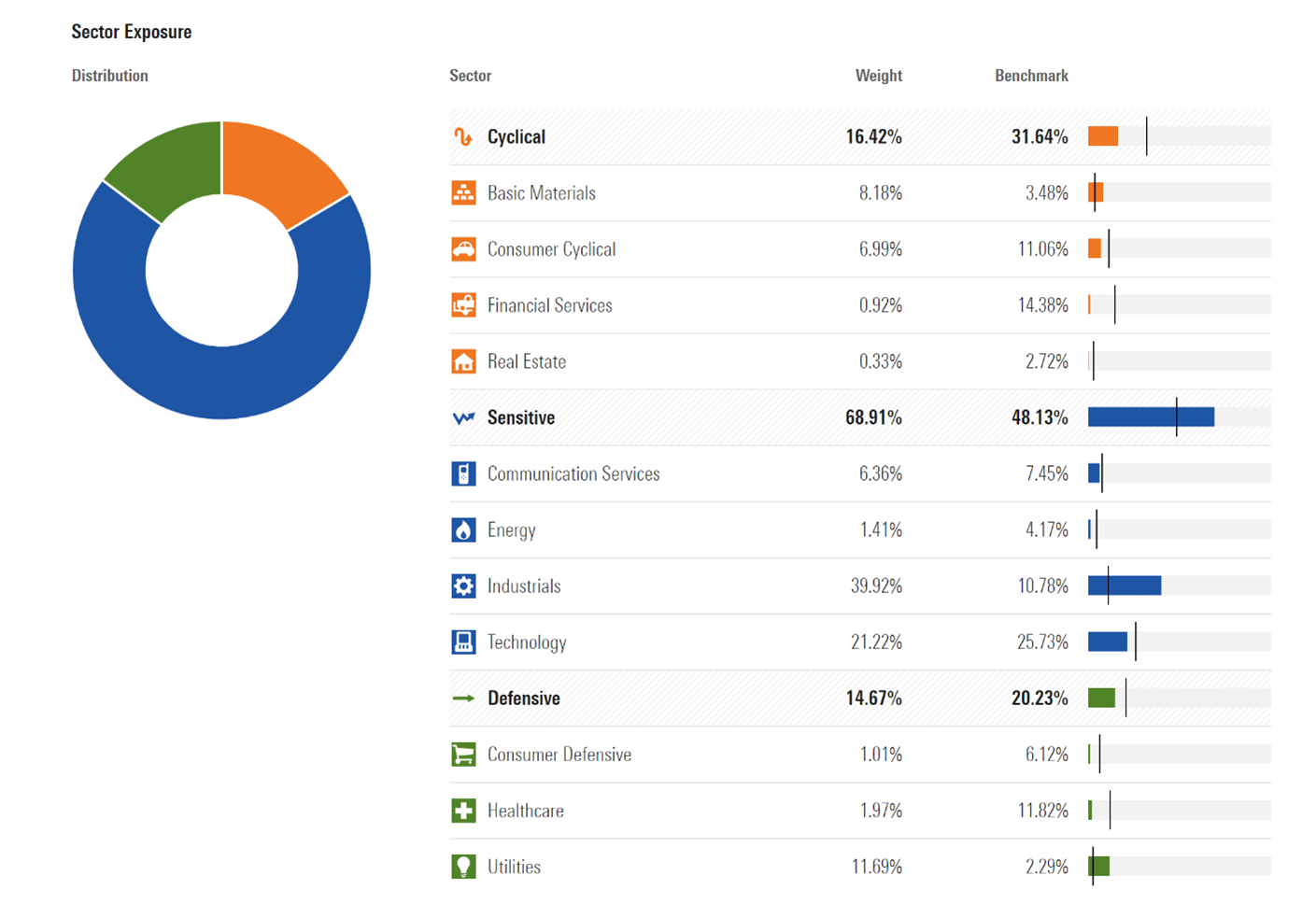

We believe that the allocation of assets across the three sleeves is optimal for several reasons. Firstly, the objective of this investment strategy is not only to outperform the benchmark, but also to keep the portfolio’s risk level within the boundaries of the broad US stock market. Secondly, this allocation can be effective because our new holdings are predominantly non-cyclical. Below is an illustration of the current sector distribution, where we have almost 70% of this fund invested in non-cyclical sectors (sensitive) companies. Non-cyclicals, just like they sound, tend to be less sensitive to the directional trends in economic cycles. As you can see, we are heavy in industrials and technology which are quite necessary now for everyday needs.

Finally, our three sleeves provide us with the chance to invest in climate solutions from different perspectives. Some of our companies are incumbents, established stable companies that are transitioning towards becoming environmentally friendly. Others are on the cutting edge of emerging technologies, while some are purely dedicated to climate solutions. With this range, we can ensure that we have all our bases covered!

Why Are We Doing This Now?

Fact: The Clean Energy sector has experienced a decline of approximately 80% since its peak in 2021. However, this presents an opportunity to invest at a low point in a sector with immense growth potential. As awareness of the need for climate solutions increases, companies across various industries, including oil and gas, chemical, and manufacturing, are realizing the importance of adapting and committing to environmentally responsible practices. Stakeholders are pressuring them to transform and be more sustainable, leading to significant changes in their operations. What an awesome opportunity to double down on our own commitment with our investment dollars!

What’s Next?

We are currently in the process of reorganizing our investments in the New Power Fund. This involves selling off our previous holdings and replacing them with new ones. The process is expected to take several months to complete, but so far, we are making good progress. Since November 2023, our results have been excellent. The architectural planning for the Fund is complete, and we are excited to finish the remodel. Looking forward, we will provide further updates as progress is made. Stay tuned and feel free to contact us directly if you have any questions or are interested in the New Power Fund. Visit www.NewPowerFund.com for more information.

Regards,

Cooper Jones

New Power Fund Analyst