Strategy Spotlight – Multi Asset Income (MASS Income)

I teach a capstone class at our local high school for a select group of seniors who are interested in finance, markets, and business. It is called Finding Benjamin. One of our tasks as a class was to create a podcast for young investors, delivered by young investors with guidance from an old fart in the industry (yours truly). The Podcast is also called Finding Benjamin, available on Sound Cloud, Apple Podcast, and Spotify https://allseasonfunds.libsyn.com/. We started the class last September introducing the most powerful force in the financial world, Compounding Interest. Our MASS Income strategy is our latest greatest creation born during a very rich pricing opportunity while grounded in the roots of compound interest.

Compound Interest 101

Why would anyone on their right mind start a blog post with a math formula?

Anyway…

By Definition:

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

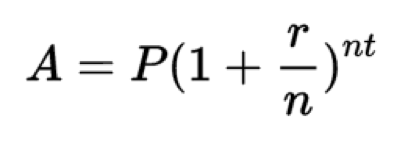

For the math geek it looks like this:

| A = | final amount | |

| P = | initial principal balance | |

| r = | interest rate | |

| n = | number of times interest applied per time period | |

| t = | number of time periods elapsed |

Any investment strategy that generates frequent high interest or dividends, reinvests those yields, and grows principal at the same time is going to be very productive. Easier said than done of course, but this is the root goal of MASS Income!

What is the MASS Income Investment Strategy?

Like all of our strategies, MASS income is an entire portfolio of investments selected through a well–defined process, based on solid research, and focused on a unique edge in generating high risk adjusted returns. Phew! That is a mouthful. Let me start with the portfolio holdings.

MASS Income attempts to remain fully invested in most markets keeping cash to a minimum. There will be times when we raise cash but only under very poor market conditions for stocks. The idea is to stay largely invested to generate high income by way of stock dividends and bond interest.

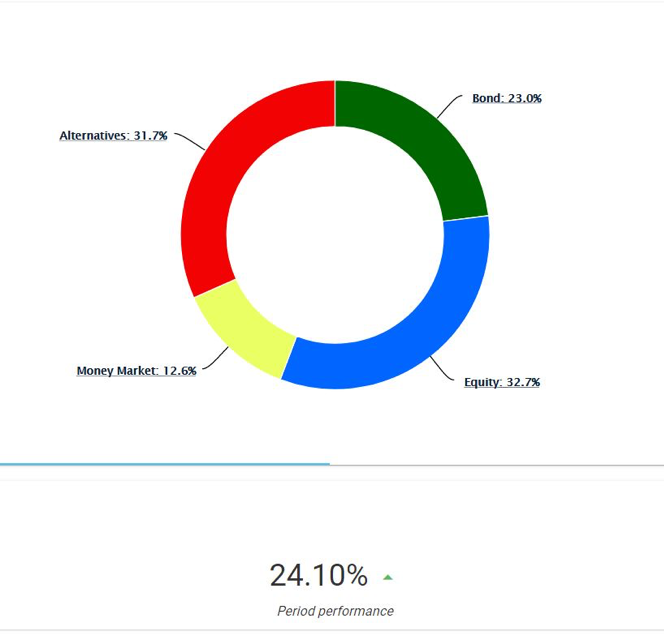

Holdings include REITS, Preferred securities, high yield credit, floating rate funds, bank loans, convertible securities, master limited partnership ETFs, and dividend paying stocks. We have preference for things that pay income monthly and dividends quarterly. We also work hard to identify securities with very high probability of continuing payments as well as those that are priced attractively, discounted in some way or below par. Securities are upgraded when there is new risk of dividend cuts or when yields fall to unattractive levels. The current asset allocation pie chart is shown below. Alternatives are REITs predominantly and yes we are currently carrying a high cash (money market) position as we are doing some tax loss harvesting and upgrading several positions as we come into year end.

Why Are We Excited About MASS Income?

Several reasons. First, all of our investment strategies offer investors something unique, something edgy and something risk managed. MASS income fits the mold. We are investing in a segment of the financial markets that is not widely owned, does not get a lot of press and yet offers one of the highest yields out there. Second, looking forward over the next 24-36 months, we believe the economy is heading into a sudden street fight with inflation and MASS Income is positioned to take advantage. Actually, we aren’t fighting inflation at all but rather welcoming it, beckoning it, hoping for it! We would say, be careful what you wish for. Inflation is not a good thing for most investors. However, REITS, hard assets, MLPs, preferred securities and stock dividend payers tend to be some of the best performers during periods of inflation while traditional bonds and growth stocks suffer. Third, MASS income is already showing its true colors as a strategy with very low correlation to the US stock market. It marches to its own beat. Given the fact that the US stock market is now fully valued and quite possibly the most overvalued relative to earnings in the last 100 years, we like strategies that have low correlation. Finally, MASS income is tax efficient as the strategy is designed to hold securities in excess of 12 months seeking long term cap gains. Furthermore, most dividends coming off securities are “qualified” meaning they are also taxed at long term cap gains rates. Of course, nothing beats the tax efficiency of a retirement account, but this strategy is also tax efficient for your taxable account registrations.

How Does This Fit into Your Portfolio?

Great question. Without offering any specific advice on this public platform, I will say that MASS Income is a great alternative to any stock strategy. MASS Income should not be confused with a bond strategy. It has stock market risk without a doubt, but the high dividends and income buffer downside losses and keep your money productive during corrections. As they say in the industry, “with dividend strategies, you are paid to wait”. MASS income is also appropriate for households looking for higher income than anything available in the bond world. The current annual estimated yield on the MASS income portfolio through yesterday is 6.52%. Beyond the dividends and Income, we believe there is significant growth potential as well. YTD, the strategy is up over 24% total return since inception in April, net of all fees. Please see our composite performance disclosures. One could make the case that MASS Income deserves some of your “bond” money but you need to expect much higher volatility in order to generate those higher returns (as usual). Some of your bond money? Maybe?

Why is the Timing Right for MASS Income?

Beyond all the timing issues discussed above, we must highlight the valuations of our core holdings which are far below intrinsic value of the underlying holdings and far below the over all US stock market valuations. REITS for instance have been slaughtered in 2020 – thus the opportunity! I have heard every reason why REITS will never recover, why COVID has changed the landscape of the office work, the mall shopper and hotel visitor forever. We would say bunk! In July and August of this year, you will see a great explosion of consumer behavior back to the way things were pre-COVID. Today, we are only lightly invested in REITS that own Malls or Leisure (We have a whopping 2% investment in Simon Property Group for instance). But that space is already catching the eye of Wall Street. This article just hit the headlines this AM from the WSJ;

https://www.wsj.com/articles/real-estates-biggest-losers-enjoy-a-one-month-bounce-11608028201

MASS Income is a post COVID trade very specifically. We are building our exposure to a segment of the market that has been left for dead. Today we will stick with the safety trades in Apartments, industrials space, storage until, 5G network towers, etc. Later in 2021, we will be in the retail, leisure, hotel space. The timing of initiating an investment in MASS Income is right despite the consensus blather on the street. As Jared Dillian of the Daily Dirtnap (one my favs) likes to say – Do the trade that gets you laughed off the set at CNB.

Personal Note: I am eating my own dog food here. Rarely do I make strategy changes with my own assets. This year, I have transitioned a significant portion of my investable capital into MASS Income from cash and other strategies. I believe!

We hope you have enjoyed this Strategy Spotlight, stay tuned as we roll into our 2021 Investment Forecasts.

Sincerely,

Sam Jones

President All Season Financial Advisors Inc.