I was 32 years old in the year 2000, when I was invited to participate in the Denver Post Investment Roundtable talk alongside some industry heavy weights who had a lot more experience than me. I was nervous. This was the first time I had been recognized as an expert in anything having started in the business only 5 years earlier. After a two-hour long passionate and heated debate, I realized I was the only participant in the room voicing grave concerns about the overvalued condition of technology and the pile of new internet stocks. The elevator ride down from the meeting room was a bit like a cage match. The grey beards turned on me in a unified voice and said,

“You will not survive in this business if you say bearish things in public!”.

I think they were trying to provide some constructive career advice. It was a pivotal moment for me realizing that the old guard and the public really don’t want to believe or hear, that today’s (yesterday’s) big winners could fail or that returns might stop. I also understood clearly that the financial industry has a vested interest in feeding the machine of bullishness in order to keep investor money flowing, even in the face of damning evidence to the contrary.

3 months later, the technology heavy Nasdaq peaked and fell 80%+ over the next three years. I got lucky. We made a positive return in each of the next three years for our clients by simply investing in other areas of the market that were still very attractive including value, bonds, and small caps.

On January 6th, 2022, I posted a very clear update regarding “What’s Next”. I almost felt like that 32-year-old kid again saying the same words about the ridiculous valuations in mega cap technology and the top-heavy nature of the financial markets. Several readers suggested I am too bearish and negative. I’m having Déjà vu.

To be clear for all of my regular readers; I am rarely if ever bullish or bearish on “the market” as a whole. After all, there is always a bull market somewhere! It’s a bit like food for me. I like food, I eat it regularly. But sometimes I want to eat meat, other times I like to eat vegetables. Sometimes both! Putting your entire financial world in one food group or another is just about as silly as that sounds. My unapologetic promise to all.

I will always call it like I see it, with honesty and integrity.

I will point to evidence regarding risk and opportunity before offering my opinion.

The only thing I will remain bullish about is our value as a steward and manager of our client’s wealth in all market conditions.

Still Bullish on the Big Three Themes

For the last two years, we have been guiding toward significant opportunities in three areas of the market. These are working, unlike a lot of things in the market now. These are, and will, continue to be the focus of our actively managed strategies for our clients. But there are some subtle changes taking place in each. The Big Three are STILL as follows.

- Value

- Emerging Markets

- Commodities/ Inflation

Value Over Growth

Value has been outperforming growth since… November of 2020. There was a slight pause in this relative relationship last summer, but it wasn’t enough to change leadership. We remain dedicated to the value trade in all senses. Value companies are those who have high free cash flows, low debt, pay dividends and tend to occupy the cyclical side of the market like energy, industrials, transportation, materials, banking, and infrastructure. These tend to do well when GDP is growing (now 7%). These companies are making new highs regularly even during January’s sell off.

Nothing really subtle about it. Own Value and stick with it. Likewise, we are avoiding growth companies as they remain out of favor, overpriced, over-hyped and trending lower in price in a meaningful way.

Emerging Markets

This Big opportunity didn’t work well in 2021. In fact, the opportunity didn’t happen at all, and emerging markets actually showed a minor loss for the year (-0.61%). China makes up a large portion of the “emerging” market and China experienced some politically self – imposed destruction of wealth. Chinese mega cap technology companies like Alibaba, Tencent and Bidu were down almost 50% in 2021 as a group. However, like so many things this year, last year’s losers are becoming this year’s winners. I’m not ready to say that Chinese stocks have turned higher but they have stopped falling and that by itself is noteworthy. If the Chinese market can turn higher, we’ll see an explosive move in any of the broad-based emerging market funds. Latin America on the other hand is already booming, led by resource intensive countries like Peru (+9.7% YTD), Chile (+11.2% YTD) and Brazil (+9.8% YTD). We have initiated positions in emerging market stock and bond funds that are heavy in Latin America and intend to add to them in the weeks to come. Would you believe that Brazilian bonds are paying almost 12% in annual interest?

“How much is a Brazilian anyway?” George W. Bush

If you’re looking for a cheap (deeply discounted) side to the financial markets, stay focused on Emerging Markets.

Commodities/ Inflation

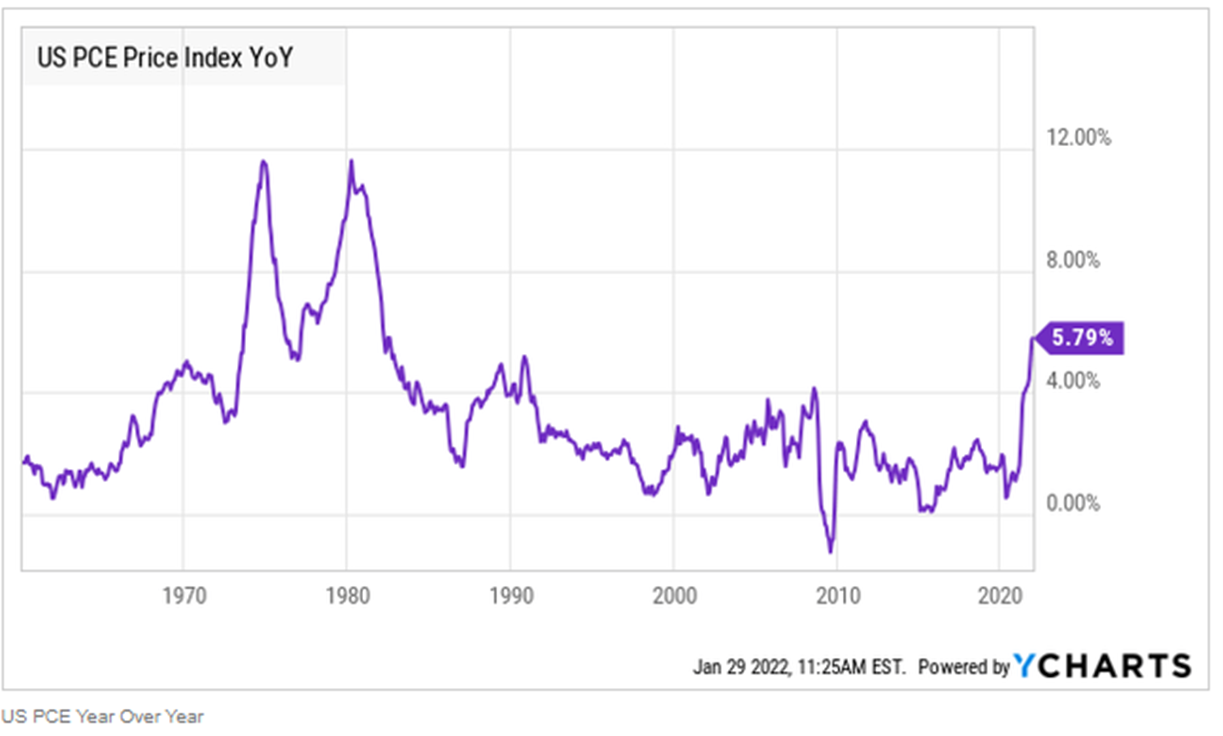

I’m really struggling to not say “I told you so”. Commodities continue to move higher in price to all-time new highs in the face of a sharply falling US stock market. This is the only source of diversification in any asset allocation portfolio and will remain so for the foreseeable future. Bonds have stopped falling but are still positively correlated to stocks. That means that bonds are no longer serving their purpose in providing ballast or stability to a stock portfolio. Commodities, however, are doing exactly that. There are subtle changes emerging in this space that might require some adjusting of your commodity exposure. Crude Oil may be approaching the upper end of it’s historic price range in the upper $80’s. Yes, it could go to $100+ easily but this would likely to be an outside and an exhaustive move (good place to lighten up on oil and gas if you own them). Oil and gas still dominate most broad-based commodity funds and ETFs by weighting, so there will be a time and place to reduce exposure to commodity funds soon. At the same time, we’re seeing some amazing opportunities in metals and miners both in gold, silver, platinum, palladium, even uranium. We are likely to shift assets from broad based commodities funds and into more specific metal’s investments in the days and weeks to come. Agriculture and food commodities are up, up and away. As a firm, we took a stand with commodities in September of 2020, adding to those positions in early 2021. Our allocation to commodities in our dynamic asset allocation strategies like All Season remains firmly at 25-30%. Commodities and hard assets will continue to rise in value for as long as inflation is with us. Now I’ve heard a lot of talk about the end of inflation in 2022. I will leave you with one chart. Look on the right side and I want you to ask yourself if the recent move in PCE (Personal Consumption Expenditures), the Federal Reserves’ favorite measure of inflation, looks like the beginning or the end of inflation. I know my answer.

There are a lot of things to be excited about in this market. There are also a lot of new risks. Our job as investors is to allocate our money properly in sync with the current economic and financial environment. As usual we are handling all of this for our clients so you can focus on the things YOU can control.

Happy February!

Cheers

Sam Jones