This is an important update for any and all investors. We offer this advice in the vein of financial literacy such that we can make smart, productive, and rational decisions when adverse market conditions compel us to do just the opposite.

Focus on the Things You Can Control

Risk management in the investing world attempts to control a lot of things including portfolio volatility and absolute downside losses when the financial markets experience deep corrections or bear markets. The practice is both art and science. But there are limits to what any form of risk management can accomplish. To be clear, risk management does not eliminate risk, nor does it try to sidestep every down week or negative giggle in the markets. It is about reducing volatility and reducing downside losses to a tolerable level such that recovery periods are shorter in both time and magnitude. Risk management cannot control what the market does of course, we can only respond to what the markets present us in both risk and opportunity. To the point, as investors, we can only control our behavior. “The market” is never wrong, just our assumptions about what it should do and our reactions to real price action.

Now with that said…

Will Brennan, CFP Advice- Best Practices for Investors Following a Market Correction

I asked Will to write up a specific piece of advice for our clients. The question I posed to him was this.

Will, from a financial planning perspective, what should investors do after a deep market correction or even a bear market?

Here’s what he had to say.

Will Brennan, CFA, CFP

Following-up on our recent piece concerning return expectations, we are publishing a roadmap or checklist of action items to pursue in the event of a market selloff or correction. Market corrections, defined as drops of more than 10% from recent highs, have occurred in 11 of the last 21 years (source: Charles Schwab). Going back even further to 1980, the S&P 500 has seen an average intra-year decline of 14.3% despite annual returns being positive in 31 of those 41 years (Source: JPMorgan Guide to the Markets). That said, corrections are normal market events that, while scary, present good long-term financial planning and buying opportunities. While we cannot predict when a market correction might occur, we want you to understand the ideas and logistics of how to react during a selloff or correction:

1.) Harvest Tax Losses

- a)A selloff or correction might provide an opportunity to realize (harvest) taxable losses.

- We can simultaneously reposition the portfolio to catch the subsequent market rebound.

- Realized or harvested taxable losses can be used to offset future capital gains OR to reduce ordinary income by $3,000 per year.

- Unused losses may be carried forward in perpetuity.

2.) Stay Invested but Rebalance

- Similar to number 1, a sell-off or correction may afford the opportunity to reposition an individual’s portfolio by asset class as well as by strategy type (active to passive).

3.) Ante Up

- While staying invested during market selloffs or corrections is paramount, it also presents opportunities to buy risk assets at cheaper or distressed prices.

4.) Accelerate or Bunch Retirement Plan and/or College Savings Plan Contributions

- Selloffs or corrections provide great entry points for retirement plan and/or college savings plan contributions.

- If you find yourself in a correction, it may be wise to accelerate or bunch planned contributions into these accounts.

5.) Consider Roth IRA conversions

- Selloffs or corrections may allow for opportunities to convert dollars from pre-tax IRA accounts to after tax Roth IRA accounts.

- This would require taxes to be paid up front.

- Future growth on converted dollars is TAX FREE and not subject to required minimum distributions.

- Before recommending Roth IRA conversions, we encourage a careful examination of your tax situation today and in future years.

6.) Consider withdrawing cost basis from Annuities or Variable Insurance Products

- Selloffs or corrections may allow for tax free opportunities to withdraw the cost basis on Annuities and/or Variable Insurance Products.

- Before recommending withdrawals from Annuities or other Insurance Products, we encourage a careful examination of your tax situation.

Great Advice!

Of course, we’re here to help all our clients navigate these decisions when the time comes, and the time will come. Think about these things and get yourself ready to act when the time comes. Let’s turn a market discount into the opportunity that it is!

Changing our Asset Allocation Mix in Response to Market Conditions

What a perfect time to provide a quick update on a change in our dynamic asset allocation model made effective last Friday. Again, we’re not forecasting, nor trying to control the markets, just our response to conditions as they unfold. These changes are happening in our flagship All Season and Gain Keeper annuity strategies which by design actively overweight and underweight investments into (and out of) various asset classes based on empirical evidence and price trends. Other equity only strategies like Worldwide Sectors and New Power are making adjustments as well mostly by raising some cash and selection criteria. Our passive programs like MASS income and Wealth Beacon strategies remain fully invested- as they should.

The market environment today is beginning to respond to several key factors in terms of strength and weakness in sectors and asset classes. The key factors are as follows in no particular order:

- Increasing recognition that inflation is not temporary – Latest PPI number was shocking, inflation now running at 8.3% year over year.

- Likelihood that the Fed is going to be forced to respond to inflation sooner than they suggested.

- Recognition that we will continue to see BOTH labor shortages and persistently high unemployment (we have spoken of this phenomenon several times in the past few months).

- The post Covid economic recovery is showing clear signs of weakness now.

- Treasury bonds and interest are more focused on inflationary pressures than economic weakness (Treasury bonds).

- Inflation trades are showing new signs of resurgent strength after a very weak summer.

- Housing prices are flattening – lower growth and increasing supply but not price declines.

- Transportation sector is under fire – this is one of the economically sensitive sectors to watch for early signs of economic weakness.

- Earnings season has been very strong but year over year comparisons are going to be much tougher in the 4thquarter as we push past the depth of COVID data in 2020.

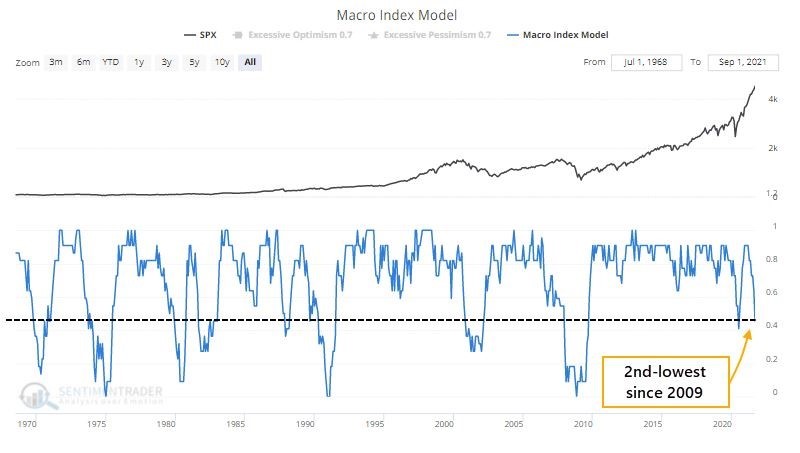

Jason Goepfert of Sentiment Trader, maintains a Macro Index Model that effectively mashes all this stuff together and plots the aggregate against the stock market. As a thesis, the markets tend to have a very high correlation to trend in the Macro Model, give or take a few months. Last week, Jason made note that their Macro model just hit the 2nd lowest level since the last bear market in 2008. In other words, the economy is not nearly as strong as the markets would suggest.

At the same time, we are seeing very clear evidence that inflation is still running much higher than expected or desired. The possibility of 70’s style stagflation is increasing every week … and so, without guessing at the future, our asset allocation mix will follow the evidence of what is happening with these key economic and market trends. This is never a one and done thing but rather a slow-moving evolution through ever changing conditions.

Specifically, we have made the following changes to our Asset Allocation mix as of last Friday.

- Reduced our World Stock Index exposure by 10% (from 60% to 50%).

- Increased our Alternatives and Volatility Controls by 5% (from 15% to 20%).

- Increased our Inflation/ Commodities allocations by 5% (from 10% to 15%).

- Bond and Credit allocations remain the same at 15%.

Thanks for reading and stay tuned as we have a lot of great financial planning opportunities as we angle closer to the end of the year.

Sincerely,

Sam Jones – President

Will Brennan – CFP