The Durable Investment Portfolio – Investing 101

Sometimes it takes a waterfall, flash crash, stock market event like this to begin to appreciate what we mean by a “durable” portfolio. Our clients know that we have a unique method to our investment approach. As a quick update, I’ll illustrate what we’re doing inside our flagship All Season strategy which houses the majority of our client’s assets. My hope is that you’ll begin to understand what goes into a portfolio that is designed to survive and thrive in all markets… or create wealth and defend it as we like to say in our shop.

What does durable mean?

We all know what durable means but I’m going to answer this question in financially relevant terms for this discussion. A durable investment portfolio is one that is constructed such that the owner (investor) feels no need to panic and sell all after devastating losses. The durable portfolio is not free of losses, but it does keep them to a tolerable and easily recoverable level. The durable portfolio will not impress your friends or be the subject of a cocktail party banter. It is purposely constructed to avoid high volatility either up or down so you will never feel extremely happy nor extremely sad. What you will do is give yourself a place to put your hard–earned capital knowing that the returns will be consistent, stable, and positive in almost all market conditions. Others, meaning most investors, have very little discipline. They need to win, and they need to put their money into non-durable investment portfolios. They believe that they will be able to “buy and hold” through tough markets but find themselves selling in wholesale fashion after losses become unbearable. In fact, the sheer act of selling out of an investment strategy is an admission that you are investing in something that can break or is not durable.

All Season – A Durable investment strategy

For those who attended our last Solution Series in January, or viewed the video broadcast https://allseasonfunds.com/events-and-resources/solution-series, you know that we have been reiterating the value of owning a non-conventional portfolio, especially now. Let me explain with a few examples.

The All-Season strategy operates with six investment sleeves. A sleeve is functionally an asset class, but can also serve as a unique driver of returns. I will describe each of them and provide our current exposure to each sleeve ({1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654}) so you get an idea of how we are invested today.

#1 13{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} Domestic Stock Index ETFs – just like it sounds, domestic stock ETF index funds

#2 12{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} International Stock index ETFs – Again, cheap international stock exposure

#3 15{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} BOC Managers – Best of Class fund managers. We own Berkshire Hathaway as an example.

#4 6{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} Alternatives – These are things like Real estate or funds that use trading strategies

#5 12{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} Gold and Hard Assets – Here we can own gold, silver or commodities

#6 11{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} Bonds – Treasury bonds, corporate bonds, emerging market bonds, and many more

Cash – 26{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} Cash held in money market funds yielding about 1.2{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} annually.

This is what a durable investment portfolio looks like.

How Does All Season Respond During a Market Meltdown?

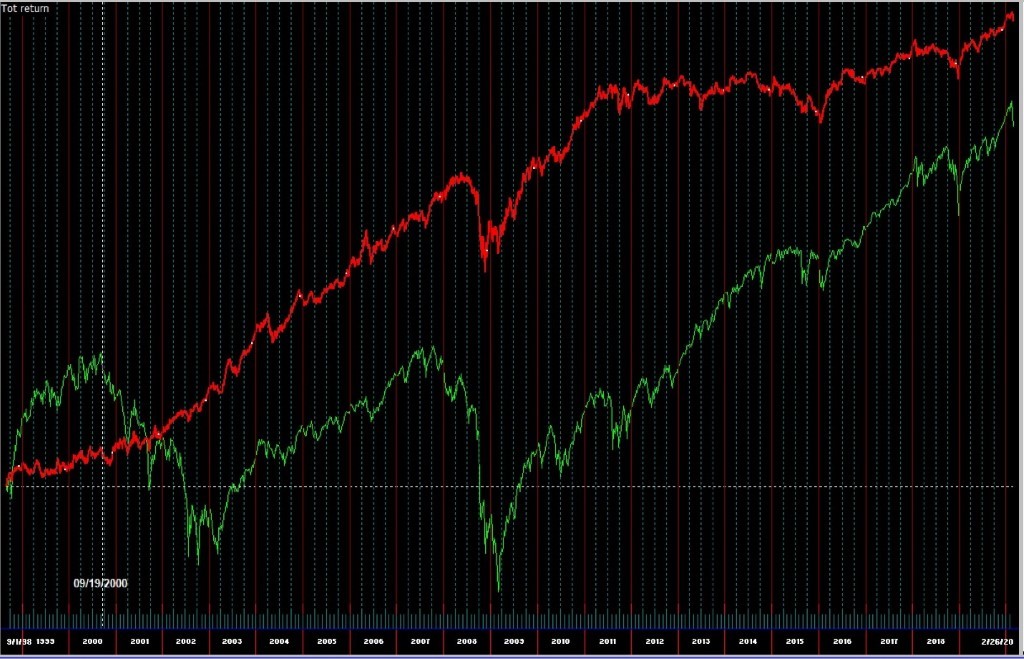

First of all, let me be clear. This is not a static portfolio. Each sleeve has an allocation parameter shown as a percentage of total assets. For instance, our Gold and Hard Assets sleeve have a guideline allocation of up to 10{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} of assets in the strategy. Today we have 11{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} allocated there so we’re close but a little overweight. Here’s an example of one of our gold and hard asset investments; The Permanent Fund (PRPFX). You can see how this fund (in Red) marches to its own beat but is still in a nice steady uptrend. We can only hope that it does again what it did in the early part of the decade relative to the market (S&P 500 in Green)

When we design our durable portfolio, we set our desired size of the various sleeves based on our perceptions about risk and return for that group. These changes over time but very slowly. However, under the hood of each sleeve, we try to maintain the target allocation but importantly give ourselves the latitude to cut exposure and upgrade positions as needed. Ultimately, we want to keep those sleeves full! But, in times like these, we can help ourselves and control our volatility even further by turning the dial a bit (cutting some exposure). Our #6 sleeve is specifically a trading strategy where we move between quality US treasury bonds where we are invested today or swing all the way out to high yield corporate bonds. The #6 sleeve target allocation is 20{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} so we are currently about half invested there.

When the markets do the free fall thing, we will often use that event as an opportunity to cut exposure in some under-performers in each sleeve and begin scanning for new leadership to replace those holdings. While most of our non–stock allocations haven’t changed, we have eliminated several positions and plan to upgrade them to new holdings once the selling ends.

Again, it is our goal to keep each sleeve fully invested up to its target allocation but there is the flexibility to make adjustments as conditions warrant and new leadership emerges.

What’s in Your Wallet?

To borrow from the Capital One credit card ad, it’s important to know where your money is invested. We look at 401k and outside account statement every day now. Most have the same market exposure which from our view is far too heavy in stocks (75-80{1de7caaf0b891e8de3ff5bef940389bb3ad66cfa642e6e11bdb96925e6e15654} stock funds). What we don’t usually see are portfolios that have durability as described above. Building in that durability can and should happen at any time. We can help you build it yourself or do it for you in our All Season strategy.

Let us help you.

Sam Jones