May 9, 2022

As promised, we will be talking about housing and real estate trends in this update. That discussion will segue towards the one investment approach that continues to shine in this “no where to hide” market environment.

Highlights of the Last Two Updates

I would like to take a second to review, in bullet form, the highlights of the last two posts because I’m hearing some bad interpretations of what I clearly said. I will simply cut and paste select exact words for your review.

Calling All Cars #1 – Red Sky Report May 2nd

- Investors have the opportunity to add to stock or bond allocations, preferably at once.

- It is our expectation that the stock market will remain under pressure and choppy until midterm elections in November.

- If you are more on the conservative side, there should be other opportunities to add to passive accounts throughout the summer and into the fall of this year.

- I plan to allocate any new money across all assets held in these investment accounts in order to maintain a desired diversified mix of securities. (The current mix in my kids’ 529 education accounts are 36% stocks and 64% bonds which represents the “conservative growth” strategy suggested by College Invest for students of their age -18 and 20).

This is the confirmation of me adding to my kids’ 529 plan accounts today – 5/9/2022

The Gravity of the Situation – Red Sky Report April 29th

- Gravity is real and valuations ultimately do matter.

- The condition of the economy is also clearly moving from full recovery to early recession.

- Stage 6 is also the time when we see the most wealth destruction as stocks (all stocks including value) can enter the realm of real bear market losses. (We are entering Stage 6 quickly)

- #1 Start reducing your stock exposure all together

- #2 Consider reducing, but not eliminating, inflation hedges, commodities, and hard assets

- #3 Use the proceeds from #1 and #2 to rebuild your bond position

Hopefully, that is pretty clear advice and might help our clients understand our perspective on the markets and the changes we are making now to accommodate current conditions in our active risk managed strategies. Ok, now on to Housing and Real Estate trends.

Real Estate Trends

I’ve changed my mind on real estate. Historically, real estate has done well or at least stayed stable during periods of high inflation. Real estate is after all, a hard asset and hard assets tend to retain their value during inflation. In recent weeks and months, we are starting to see the primary drivers of price gains in real estate reverse course. At this point, I think real estate will follow the path of the US stock market with a 6–9-month lag. Let’s go back in time and review the perfect confluence of four variables that drove real estate prices exponentially higher in the last 36 months.

Free money – Stimulus from the Federal government following the Covid shut down, put $Trillions into the hands of consumers and artificially increased the US savings rate to over 12% in a very short period. Let’s go shopping for a new house now that we have a larger down payment!

Work from Home – Covid also drove workers and students to spend more time in their homes. We need more room! In addition, Covid offered some a chance to relocate to more desirable locations especially as remote work became more permanent in certain industries. YOLO! (You Only Live Once).

Interest Rates Held at 0.25% for way too long – The Federal Reserve dropped interest rates to near zero on March 16th of 2020. Mortgages followed and remained artificially low for almost two full years. This was happening even while inflation was ripping higher at 6-8%. Logically, home buyers jumped at the opportunity to bid up homes that were rising at 15-20%/ year in price using borrowed money that was still stuck at 2-3%.

Supply of Homes for Sale Stuck at Historic Lows – This is a tired story but true, nonetheless. The available stock of homes for sale, compared to the demand for homes in the US, was historically imbalanced for the last two years for a variety of reasons. Mostly, there was a shortage of new construction that dated back to 2018 when rates were actually much higher. COVID shut down building and the availability of building materials for about 18 months even while demand was exploding.

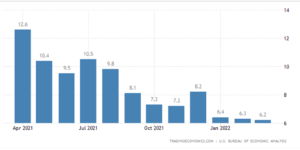

Now fast forward to today. All four variables have almost completely reversed, and yet home prices are still suspiciously hovering at the highs. As a reminder, I do believe in gravity. Good consumers in the US have done what they always do when provided with cash stimulus payments from the government; They spend it all. The year over year, US saving rate shown below, is now back down to 6% which was the pre-pandemic low from a high of 12%. We smart investors should not expect demand for housing (or anything else) to continue at the current pace now that the savings rate in the US is back to “normal.”

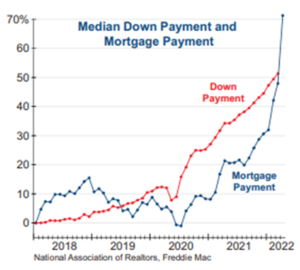

Interest rates are obviously on the rise now as well putting affordability into reverse. Look at the chart below and understand that even before rates went vertically higher this year, affordability based on mortgage payments has been falling since 2020 as prices for homes rose commensurately. A 30-year fixed mortgage was 3.11% in January of 2022. Now that rate is 5.2%.

Finally, the supply of homes for sale is likely to rise dramatically between now and next fall. If all the real estate (single family, multi-unit, commercial) currently under construction are completed over the summer, we will have more supply than any time in modern history.

Without trying to forecast, and just observing current trends, we can make a logical assumption that real estate prices should fall to reflect a reversal in all of the drivers of recent price gains over the last several years. I’m not smart enough to know how the remote worker thing is going to resolve but that by itself is probably the least influential variable to current housing prices.

What To Do About Your Real Estate Holdings?

For most, the answer is do nothing. Your primary residence is your home and not some commodity to be traded. You need to live somewhere, and rents are quickly rising to reflect current housing prices paid. This commentary should not inspire you to sell your primary residence by any stretch. However, from a financial planning perspective, we can and should admit a few things looking forward:

- You will be in your current home for a while. The music has stopped, prices will fall, and you should get comfortable where you are – maybe a suitable time to do some DIY home upgrades.

- If you are overstretched and own more real estate than you want, need, or can afford, you might consider reducing your real estate inventory. Get this done quickly.

- Rental properties should be held! As I said rents are rising and these properties generate much needed additional income while inflation is chewing away at your earned income or assets. Rentals are GOLD in these environments as long as you do not look at or care about the values of these properties. Keep your long-term goggles firmly in place and work to keep your rentals occupied.

- Falling real estate prices can have a negative wealth effect. Be aware that if we all feel less wealthy because our homes have seen some price decay, this can impact our other spending behavior and general optimism toward the economy and investing just as it did in 2007-2009. Real estate has become another investment for most, often quoted regularly in net worth conversations. Be aware of your psychology here; best to emotionally unhook from the value of your home if you can.

Investing in High Dividends/ Income

You have heard me beat the drum on this for a while now. Dividend paying stocks, funds, closed end funds, ETFs, preferred securities, and master limited partnerships are a lot like rental properties. They are currently and historically the inflation fighter of choice, outside of pure inflation hedges. My benchmark for security selection is a minimum of 3-5% in annual dividends. Yes, there are many securities out there paying those annual rates as regular monthly or quarterly dividends. Our job is to identify them and research their continued ability to maintain or grow their dividend payouts to shareholders.

Our Multi-Asset Income strategy (MASS Income), established near the lows in April of 2020, does exactly that and boasts a 6.2% annual dividend stream across all securities held in the strategy including our current 10% cash position. Comparatively, the rate of inflation is still running above 8% but that number should drop in the months to come as year over year comparisons will become more reasonable. There is compelling evidence to suggest that inflation will stabilize between 4-5% as we get closer to the end of the year which is still more than twice the historic rate of inflation for the last couple decades!

Dividend payers are naturally those companies with high free cash flow, very little debt on their balance sheets, and are STILL trading at much more attractive valuations than the growth side of the market. Dividend payers are a big part of the “Value” trade we have spoken of for the last year or two. I’ve heard some recent chatter about valuations becoming more attractive in technology and growth type investments now that prices are down 70-90% from the highs. Sadly, there is still a long way to go before growth actually becomes attractive relative to Value. Technology for instance still represents over 27% of the S&P 500 as of last Friday where a normal weighting is closer to 16%. Meanwhile dividend payers found in the Energy, Utilities and Consumer staples sectors are still well below their historic weights in the broad market indices. There is a long way to go on the Dividend/ Value trade, perhaps years.

Performance in the High Dividend ETF space has been excellent YTD in both relative and absolute terms.

Please fee free to contact us if you are looking for high dividend payers for your own portfolio. We’d be happy to help you with some suggestions after reviewing your situation.

That’s it for this week, enjoy the spring.

Sam Jones