November 30, 2023

We are moving on to review our flagship investment strategy called All Season, the brand of our firm and our longest standing investment program with an inception date of 12/13/1997 managed by yours truly. It’s my baby and everyone loves their baby. I’m going to describe the All Season strategy in the context of a solution to investor grievances, specifically one brought to me in full color by my eloquent college roommate back in May of 2021. He is very wealthy, is on a first name basis with powerful people in DC and was famed to be the speech writer for Al Gore as his first gig out of college. I keep an email from him on my desk as a reminder. The All Season strategy directly answers the question of “WHY” we do what we do for investors. Specifically, the strategy gives wealthy investors what they actually want from a wealth manager, not what they are sold.

My College Roommate’s Words of Wisdom

“I’ve worked with every kind of wealth manager over the years and have watched the industry pretty closely. Started with Fidelity in their managed funds program and have since used Merrill Lynch, Goldman Sachs, Credit Suisse, and UBS. My overall take is pretty dismal. My broadest view is that the industry of wealth management is one of the greatest marketing machines capitalism has ever created. My own experience is kind of silly from a distance but repeated all the time. The things I needed most – thoughtful financial planning and scenario planning has been really hard to find. I continue to search for smart investment management with a careful focus on the tax implications of the management; a sophisticated and active understanding of economic cycles and the willingness to crisply move to meet macro changes in the economy and the corresponding impact on types of assets. I promise you, this package is really, really hard to find.”

Enter the All Season Strategy…

We built “All Season” as a strategy that would adapt to all stages of the business cycle with dramatically lower costs, full transparency, and daily liquidity for individual investor accounts. I often describe “All Season” as a dynamic asset allocation strategy – like a hedge fund for individuals without all the high fees and illiquidity. The strategy offers investors a top down approach that “crisply moves to meet macro changes in the economy and corresponding impact on types of assets.” In short, the strategy goes where it needs to go, overweighting and underweighting asset classes based on our current position in the business cycle. These types of changes are not that frequent believe it or not. After all, the business cycle tends to move rather slowly over time.

Principles behind the methodology of All Season are simple and logical:

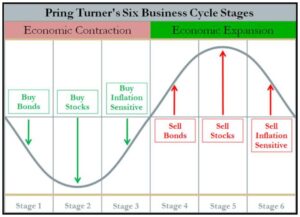

- The economy moves through a cycle of expansion and contraction (see below).

- Asset class performance is dramatically and persistently different in each stage of the business cycle.

- We can improve on both risk and returns by overweighting and underweighting our investment allocations if we properly align our holdings with the current stage of the business cycle.

Graphically, this is the business and market cycle (Pring Turner Six Business Cycle Stages) with oversimplified guidelines for when to overweight and underweight stocks, bonds, and commodities.

Easy right? Not really. In practice, each stage differs in duration and magnitude by variables that are considered non-systematic; The behavior of the Federal Reserve, global pandemics, war, politics, etc. Still, the methodology has solid roots and is well worth the effort in terms of the productivity of your investment capital over time.

Let’s look at Treasury bonds over the last 3 years as an example. Clearly, all evidence in early 2020 pointed to a rapidly growing economy on the back of $7 Trillion in Covid relief stimulus spending. Remember those days? Inflation was ripping higher, the Fed was queuing up to raise rates and US Treasury bonds had just gone parabolically higher in price with yields sitting at zero. At that moment in time, we didn’t need to be a genius to recognize that we were in Stage 4 above. The evidence was overwhelming. The model would suggest selling bonds or at least reduce exposure to short term maturities including cash and money markets. All Season carried almost no bond exposure from April of 2020 until October of 2023. During this time period, long term bonds fell 41%. Now, as we described in our October 9th, update “The Last Dance”, we have rebuilt our bond position as the business cycle is clearly moving back to Stage 1 (Buy Bonds!). We are heading into Economic Contraction and the evidence is again overwhelming. Long term bonds are already up strongly (+11.50%) since the October 19th low and outperforming the stock market.

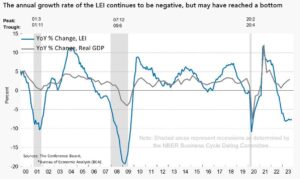

Again, the evidence is overwhelming if one is willing and able to look at the data objectively. The index of leading economic indicators (LEI) has been falling for 19 consecutive months. Note that the index tends to bottom just as the economy actually falls swiftly into recession. We are here!

The methodology behind All Season stands the test of time and will continue to generate very high risk adjusted results for as long as we have economic expansions and contractions.

Highlights

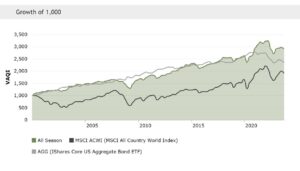

All Season is providing our investors with stability and growth over time net of all fees – See the green shaded area below with unfortunate benchmarks for comparison.

At a high level, All Season has delivered the following:

At a high level, All Season has delivered the following:

Positive returns in 71% of all quarters

Returns with less than 50% of the volatility of our stock benchmark (ACWI)

A correlation coefficient of .079 to the bond market (AGG) meaning the strategy DOES NOT DEPEND on a falling interest rate environment to generate returns like so many investment solutions out there.

Consistent, healthy, and boring. Just what we want with our investment capital!

How Does All Season Fit Into Your Portfolio?

All Season can be a core holding representing a majority of your portfolio for select types of investors and investor accounts:

- More conservative investors who are not comfortable with market volatility (bonds or stocks).

- Investors with tax deferred accounts where trading does not create short term taxable gains.

- Investors who are looking for a compliment to a more passive index model or concentrated stock positions.

- Most importantly, investors who do not feel compelled to beat a designated benchmark.

The Comfort of Tribalism

I want to expand on the last bullet point above for a moment. A benchmark is really just a measuring tool used by our industry as a means for investors to judge their investment portfolio performance. We feel like we have failed if we don’t beat the benchmark on the way up but we never seem to feel any sense of success when we beat the benchmark on the way down (by losing less). Why is that? The reason is tied to an unfortunate emotional reality; Our need to belong to a tribe. The tribe is the benchmark which theoretically represents our peers. If the tribe is suffering, we’re ok suffering too. Misery loves company after all. If the tribe is thriving, we want to be thriving too. Emotionally, it’s incredibly challenging to feel different, alone, outside the comfort of the tribe. The very top performing investment managers over time, (Warren Buffet, George Soros, Sir John Templeton, Peter Lynch, John Neff) know that the greatest investing success regularly comes from opportunity outside the tribal walls.

Unfortunately, every psychologist would agree that the vast majority of individuals would rather fail spectacularly within a crowd, than try to succeed all on our own. Consequently, you begin to see why the financial services industry preys on this human emotion and need to belong.

Unfortunately, every psychologist would agree that the vast majority of individuals would rather fail spectacularly within a crowd, than try to succeed all on our own. Consequently, you begin to see why the financial services industry preys on this human emotion and need to belong.

In reality, your benchmark should be your own personal financial needs for growth, income, stability. The planning process identifies your personal target rate of return over time, not any benchmark. Your investments returns are there to support your lifestyle and provide financial freedom. Benchmarking and tribalism do not serve you, especially when they reduce your financial freedom. The All Season strategy does not play the tribal comfort game. If benchmark performance is important to you, we have passive index strategies that will impress you.

The Solution

In my many years in this business, I do see the merit of diversifying an investment portfolio not by holdings but by methodology. We can and should certainly have a portion of our portfolio in a strategy like All Season. This strategy will keep you in the game, keep your emotional and physical capital intact when the tribe is suffering! Likewise, we can and should have exposure to the tribe and own market indexes passively. We want to feel like we are thriving when the tribe is thriving. The magic is in the mix between the two worlds and our individual blend can be dialed to our needs. In our shop, we have 9 investment strategies, four of them are tied to the passive index investing methodologies. The other 5, like All Season, are there to satisfy your proud individualism.

Looking Forward

The table is certainly set to benefit investors who have a healthy allocation to more dynamic asset allocation strategies in 2024. All Season has lagged the US stock market in 2023 which is why I will be personally adding to my All Season strategy account balance at year end with my annual retirement contributions. Sadly, I suspect most investors will be looking for ways to add to their large cap growth (aka Technology) investment strategies because this has been the source, the only source of gains in 2023. From a rebalancing, financial planning, valuation, and logic perspective, this is of course exactly the wrong thing to do now. Buy low, sell high right?

Please stay tuned for our next Strategy Insights update as we complete the line up throughout December.

P.S. Charlie Munger R.I.P.

Charlie Munger was a brilliant investor and will be missed by all. My lasting memory of Charlie will always be his dismissive attitude toward everything that Wall Street seemed to love at any given moment. He was the essence of discipline and always true to the value based, Berkshire methodology. He leaves our world and investors in Berkshire Hathaway with a cool $160B sitting in cash waiting for something big enough and “valuable” enough to deserve their investment. Take note. I will miss Charlie as a lighthouse of common sense.

Sincerely,

Sam Jones