Why So Many Investors are Losing Money in a Rising Market

I can’t say that any of this is a surprise. Today, the side of the markets that have been left for dead, is up almost 20%. Meanwhile, the mass bulk of investor capital is exactly in the wrong place; in the sectors and asset classes that are beginning new downtrends. Investment portfolios need to be reallocated now. Move it or lose it as they say.

Game Plan Revisited

In our last post entitled, the “Game Plan for the Remainder of 2020”, we covered the change in leadership and the likely surge coming from sectors that are grossly under-owned by investors.

Here’s the post if you want to read it again https://allseasonfunds.com/game-plan-for-the-remainder-of-2020/

I’ll provide a few highlights.

We suggested buying the Value side of the market like Financials, Energy, Commodity producers, cyclical stocks, REITs, MLPs, Emerging markets, companies that save you money. We recommended holding your inflation trades including Gold and other things that benefit from currency debasement.

We also suggested staying away from Facebook, AAPL, Netflix, Amazon, TSLA, and all the stocks that dominate every mutual fund, index, and investor portfolios. We recommended reducing Treasury bond exposure and all COVID trades.

Today, we wake up to our screens and we see a lot of dark red and a lot of bright green, all in the same day. These moves are exactly following the game plan outlined above. Take a look

This is a screenshot taking at 10:00 AM MST of the COVID stocks that everyone seems to think are bulletproof. Look through the list! You’ll also find Amazon, Costco, Netflix, FedEx, etc. Peloton is a fun thing to ride but I wouldn’t put a dime into that company. Even after their enormous blow out in earnings, the company is still showing 1-year trailing earnings of -$71M. Chewy? It’s pet food delivered. Why are investors in love with pet food? 12-month trailing earnings – $220M! No thanks. There was a time to own the COVID trades, but only as a trade. That time is past.

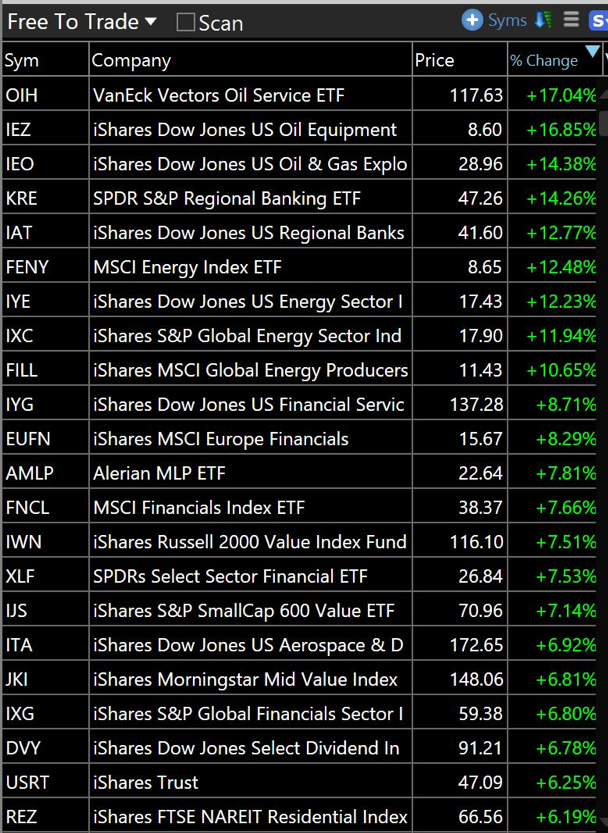

Now here’s a quick snapshot of the broad market winners for the day represented by ETFs. These aren’t even the individual stocks which are up much higher on the day.

Again, take a minute to actually walk down the list. You’ll see Energy in all forms, Banking, and financials, commodity producers, MLPs, REITs, internationals, small-cap value.

Our technical market system went on a “Buy Signal” on November 3rd. We took that opportunity to do a lot of buying in the sectors above. All households that have joined us recently and were waiting for a good entry point into the markets, were allocated on 11/4 and 11/5.

Now I want to tell you something that should get you excited.

There are only two things that make stocks go up over time. They are…

1.) The available money supply (aka cash available to invest)

2.) Investors’ willingness to deploy that cash.

Believe it or not, stock price action deviates from earnings wildly and for years on end. They are almost unrelated statistically.

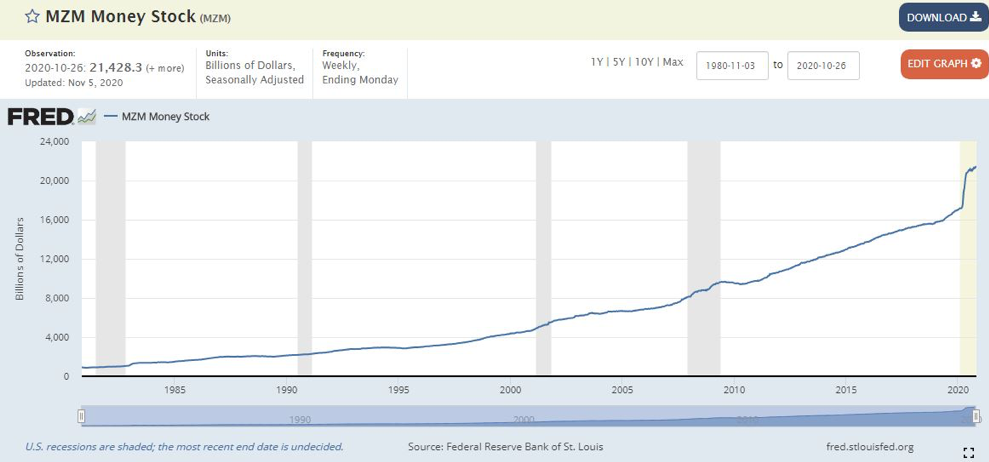

Today we have over $21 Trillion sitting in cash (MZM) as measured by the Federal Reserve Bank of St. Louis.

So, we have a lot of “Available money”

Now, investors have a reason and a place to invest it. Please reread the Game Plan if you need to.

The point is that we could very easily see a robust move higher in the new leadership sectors and asset classes as investors across the globe begin to deploy any portion of the cash sitting in money markets. There is also a record amount of investment in Treasury Bonds which are near worthless and continue to lose ground. That money will also redirect to stocks once the downtrends become more pronounced.

So, this is an exciting moment for investors who are willing to embrace change. Unfortunately, old habits are hard to break and many investors will likely stick with the old leadership rather than taking profits and moving on.

One last thought

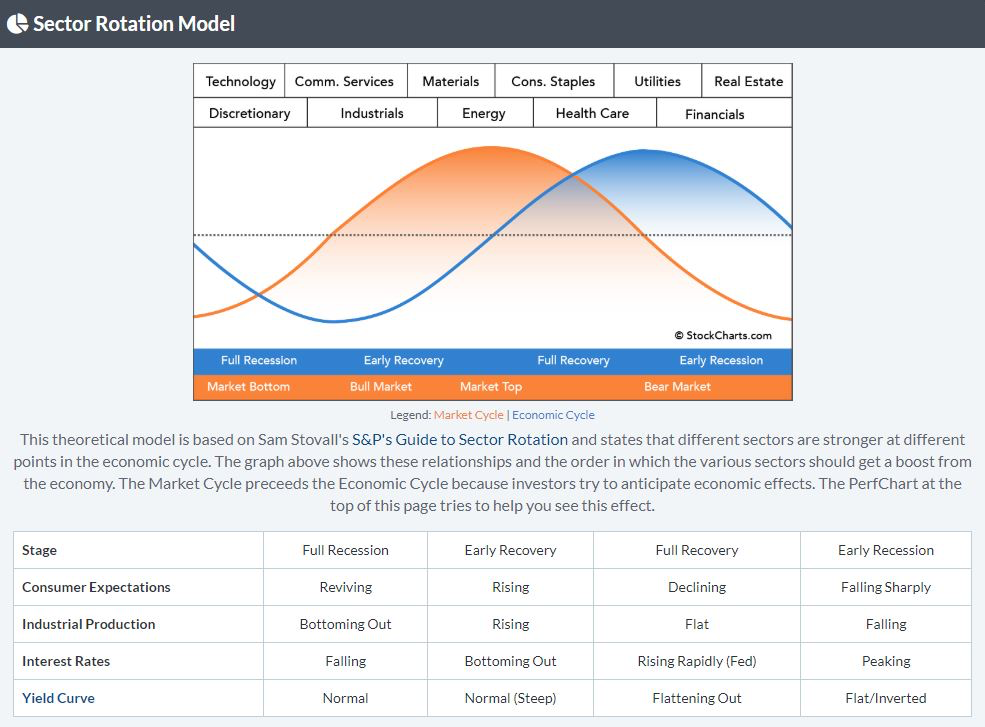

The markets and the economy march to a very well-defined pattern of cycles. They are related to each other but they typically operate out of sync in terms of timing. Understanding these cycles is our specialty and the very namesake of our firm, All Season Financial Advisors. Cycles are Seasons.

This is a theoretic model of how the financial markets move in relationship to economic conditions.

At the top of the graphic, you can identify which sectors should be leaders in the various stages of the economic and market cycle. Clearly based on the rotation in market leadership recently, we are moving quickly from the left side (Tech, consumer discretionary, communication service, and industrials) to the right side where Energy, materials, consumer staples, healthcare, utilities, and financials do best.

Often this change in leadership marks a “Market Top” in the broad stock market and the “full recovery” stage of the economy. So, while we’re excited about the prospects of new investment opportunities, we’re also acutely aware that the broad market, especially among large-cap indexes, may still be carving out a bigger top. Selection and timing are everything and investors need to get it right if they want to continue generating positive and consistent returns from here on out.

We are shamelessly bullish toward the prospects of our various investment strategies and our clients who are enjoying the new trends in leadership.

Happy Monday!

Sam Jones