July 01, 2024

This seems like an obvious place and time to revisit one of the very basic rules and tenets of investing. To start the new quarter, I’m going to reach back into the Investing 101 textbooks and unpack several issues and realities behind diversification. Why must we stay diversified? What does diversification look like today? And what is the hardest part of owning a diversified portfolio? Diversification and discipline are cornerstones of successful investing for the long term, but the 1st half of 2024 has been anything but rewarding for such good behavior. I have little doubt that diversification will matter a great deal again in the 2nd half.

Why Diversify Our Investments?

I’m sure any high school student could answer this question easily. The answer is to avoid the risk of intolerable and, in most cases, unrecoverable losses that tend to come with a highly concentrated portfolio. Today, it is common to see portfolios that are highly concentrated in a few mega-cap technology names like Amazon, Apple, Google, TSLA, Microsoft, or Nvidia. This concentration has happened almost purely through growth and compounding over the last 4-5 years. Now, it seems that most are also aware that the S&P 500 index has subsequently become a large-cap growth fund as less than 4 names account for 45% of the capitalization weight of the index. Nvidia (NVDA), the new icon of the artificial intelligence megatrend, is the world’s largest company by market cap, now exceeding $3 Trillion in “value.” Nvidia, by itself, is largely driving the daily price trend of most large-cap funds and indexes. In client meetings with individuals who are still working for public companies, it is also common to see enormous, concentrated positions in company stock that have been granted as Restricted Stock Awards (Units) or Stock Options. The compensation cycle has shifted quickly and quietly back to share-based compensation packages that are quite gracious. This is a good thing in terms of wealth accumulation quickly, but make no mistake, these situations also lead to a high concentration in just one stock.

Having a portfolio that is highly concentrated in stock or even a few stocks that experience exponential gains year after year can be a life-changing event, but only if prudently managed with a net of tax considerations. Warren Buffet notoriously leans into the concentration of assets as a means of generating outsized gains over time. But Buffett and Berkshire Hathaway have something that most don’t, and that is billions in cash sitting on the sidelines, ready to deploy as opportunities present themselves. Buffett also has extraordinary staying power, patience, and a willingness to stick with a stock that is down 40-50 or 60% and wait for a decade for that stock to recover (as long as it’s paying a healthy dividend). But Buffett and Berkshire Hathaway are not like the rest of us. He (they) has very deep pockets and a risk capacity that rivals a sovereign nation or something that is multigenerational.

For most of us humans, living with a concentrated stock position is great on the way up but almost impossible to carry when the price trend becomes adverse, and we see our portfolios get cut in half or more. The hard fact is that most humans simply cannot psychologically tolerate the deep losses and eventually they sell after that concentrated stock position is down 70-90%.

The darlings of today have all experienced losses of that magnitude. Consider these drawdowns over time in some of the big names of today:

- From 2000-2002, Amazon (AMZN) lost -92% and did not make a new high for over 10 years.

- In 2001 alone, Nvidia (NVDA), lost -86%, the stock recovered back to the highs by 2007 and then lost -84% again. NVDA did not make an all time new high until mid-2016.

- Tesla (TSLA) stock has been in a steep decline since the last peak in November of 2021. At the lows the price was down -70% and is still trading near the lows.

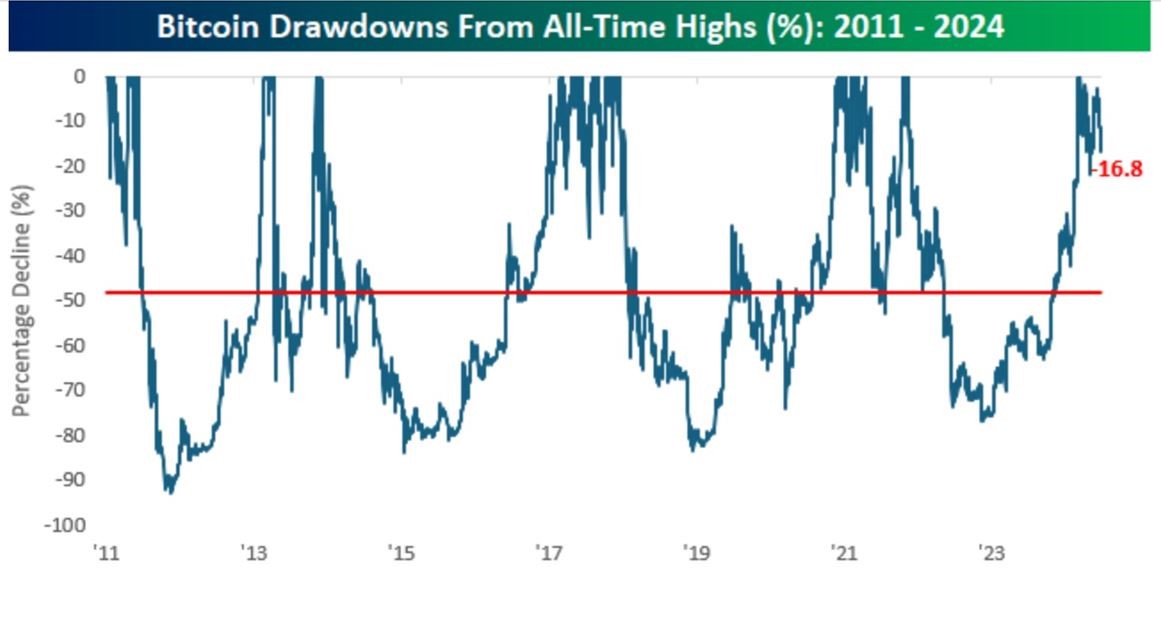

- Bitcoin and most of the cryptocurrency space have complete wipeout type losses every 2-3 years (see below courtesy of Bespoke Institutional)

These are intolerable losses for almost every retail investor. We say and think we can stick with a name that we love through bear market losses because we build loyalty to names that have rewarded us in the past. But the hard fact, confirmed by heavy selling volumes at the lows, is that most simply can’t watch their net worth evaporate day after day after day without ultimately capitulating. So, the concentration of wealth in a non-diversified portfolio feels like a blessing on paper, but for many, it regularly becomes an emotional and financial curse in practice.

What Does Diversification Look Like Today

Honestly, a well-diversified portfolio today feels relatively bad, judging from the first 6 months of 2024. Diversification and discipline have been a recipe for underperformance and lackluster returns. A highly concentrated portfolio of technology stocks or simply owning the Nasdaq 100 (QQQ) has been a winner. So, what does a well-diversified portfolio look like today?

To answer the question, we need to understand the ingredients of diversification. By definition, we need to own things that are not alike or, more specifically, do not behave the same at the same time. In the investing world, we call this non-correlation. When two asset classes move inversely with each other, they are said to have a negative correlation. When they move together, they are said to be positively correlated. Correlation is measured on a scale of +1 to -1. Zero (0) correlation is also diversification, meaning there is simply no correlation between securities. So, when we seek true diversification, we need to take care of owning a pool of investments that are non-correlated to each other first and second. We want to own different asset classes that might not be correlated to the US stock market. Historically, prior to the end of 2021, we had safe and trusty US Treasury Bonds as the go-to asset class for near-perfect diversification to stocks. Prior to 2021, when stocks fell, bonds would rise. This condition lasted for years, consistently giving birth to the magic of the 60% (stock)/ 40% (bond) portfolio, which earned outsized risk-adjusted returns.

But those days are over until further notice.

Now, bonds and stocks are positively correlated and have become even more highly correlated in recent months. Since late 2021, stocks and bonds have fallen and risen together day to day, offering little to no diversification benefit either in returns or downside volatility control. Bonds are a real problem asset class as intermediate-term Treasuries have lost nearly 5.5% annually on average since late 2021. Long-term Treasury bonds have lost 15% annually on average over the same period. Nevertheless, the timing of price moves between stocks and bonds remains highly correlated.

So, where might we look to find true non-correlated diversification?

Gold bullion (GLD) continues to serve its role as near perfect diversifier against stock holdings. Here are a few stats for you to consider.

Since the inception of the Gold bullion ETF (GLD), on Jan 28th of, 2005:

Average annual returns: +8.69% (S&P 500 index has produced 8.28% comparatively)

Correlation to the S&P 500 index:

Since inception 0.11

Last 5 years 0.25

Last 3 years 0.16

Last 12 months 0.15

Looking at these numbers, critical thinkers could reasonably say that owning GLD in combination with and S&P 500 Index fund, enhances returns and reduces risk substantially.

Other investment options that could be considered in a portfolio seeking diversification are currency-related investments. These include the US dollar. Here, we want to be very careful and tread lightly with position sizes, and I am intentionally not offering any security symbols to avoid any notion of “advice” surrounding currency holdings. But again, looking at the statistics, the US Dollar is less correlation to the US Stock market than US Treasuries and offers investors a positive average return.

Finally, there are specialty ETFs that are tactically managed, as well as true old school stock picking managed mutual funds that have been quietly keeping pace with the US stock market with very low correlation to any of the benchmark indices. Our clients invested in the “All Season” strategy might recognize exemplary names like.

Third Avenue Value (TAFVX)

Berkshire Hathaway (BRKB)

Permanent Fund (PRPFX)

JP Morgan Equity Premium (JEPI)

Pacer US Cash Cows (COWZ)

I have heard the media talking about why the S&P 500 is a diversified index. This is simply false information. The S&P 500 is controlled by 4 stocks (see above). In 2022, the S&P 500 fell more than 25% in the first three quarters, weighed down by losses in mega-cap technology, while more broadly weighted indexes fell only 6-7% over the same time period. The S&P 500 should be called the S&P 4 and is purely a non-diversified growth index by the nature of its cap-weighted construction. For the record, I am concerned that so many investors have accumulated a highly concentrated position in the S&P 500 through basic index fund investing and believe that they are diversified and somewhat protected from downside losses. The next down cycle for the S&P 500 will be larger than 25% with little doubt. My advice to any and all is to consider your personal weight to this index now and have an honest conversation with yourself about your tolerance for portfolio losses in light of your personal financial planning, cash flow needs, age, and goals.

The Hardest Part of Diversification

As always, behavioral economics is the weakest link in the chain of any investment experience. In a perfect world, all of our investments would move consistently higher every year, and we would never experience losses. Of course, this never happens, certainly not within any 20-year period of time. They say that short-term volatility is the price we pay for long-term returns, and that is certainly a fact. Something in your well-diversified portfolio will always underperform or even be held at a loss. Conversationally, I hear a lot of questions from friends, family, and clients, and they regularly surround an investment that is “not doing well.”

Should I just get rid of it?

Should I hold? And how long should I stick it out?

What do you think I should do with XYZ?

What you hear in these questions is anxiety about holding an investment that is not generating an expected return, usually over a relatively short period of time.

I have a couple of things to share that might help with this type of anxiety.

- If you have something in your investment portfolio (A strategy, security, an asset class) that is underperforming or even held at a loss, this is likely to be your best performer in the next cycle. Market leadership changes every 18-24 months. Investments that perform well in different cycles are evidence of good diversification. Congratulations! Stick with it!

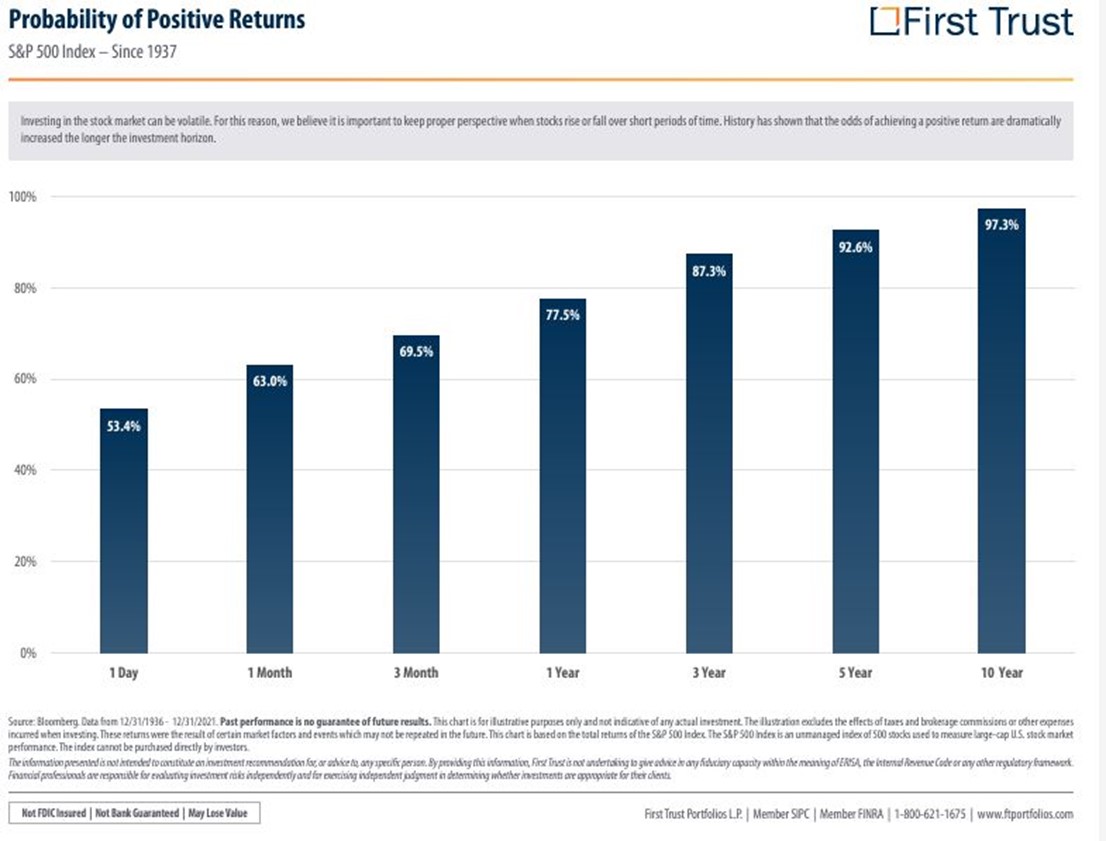

- Positive returns come with time. I’ll leave you with this chart regarding the probability of returns offered by First Trust

Investments held beyond 3 years have a very high probably (87.3%) of generating positive returns. This stat does not speak to magnitude because a 1% total return is a still a positive return, but it does highlight the importance of patience and a long-term view. This logic and statistics apply to almost all types of investments in my experience including stocks, bonds, gold, commodities, real estate, etc.

In the first 6 months of 2024, returns for things like pure value, speculative growth, bonds, dividend payers, interest-sensitive securities, emerging markets, Europe, China, or any form of risk-managed investment strategies have been underwhelming. In the next cycle, these could be the market leaders. Time is your friend; impatience is your enemy. As we head into the summer months in a pre-election year, this is a critically important moment to seek true diversification in your holdings.

As always, we are here to help with any of your non-managed accounts or portfolios.

Thank you to all of our clients for your continued trust and confidence our firm. We look forward to serving you as your trusted advisor.

Sincerely,

Sam Jones

President, All Season Financial Advisors.