September 5, 2023

Wealth Accumulation 101

Labor Day weekend marks the beginning of the school year for younger households so let’s take this moment to head back to the school of basic personal finance. It is important to understand the very purpose of wealth. For today’s report, I’m going to start by exploring the very purpose of wealth and then borrow heavily from the work of Scott Galloway (aka Prof G) and his newest book, The Algebra of Wealth, to provide a healthy framework for how to accumulate wealth inside and outside of the financial markets. Timeless wisdom for everyone to remember.

The Purpose of Wealth

I begin each of my semester high school classes posing this question; What do you think is the purpose of wealth in any capitalist society? Of course, there is no single answer. But most students quickly reply … So, we can buy stuff! Indeed! But let’s root down into that idea and really discover the very human need that is met when we accumulate wealth. The answer is choice.

Wealth = Personal Choice

When we think about a “rich” person, we think about someone who has everything, has nice things, can do what they want, when they want, how they want, where they want. Most rich people, not all, tend to signal their wealth through very public displays like luxury cars, houses, boats, clothes and other measures of consumption. They send their kids to elite colleges not because they are materially better (honest truth) but because these schools signal wealth and exclusivity. But really, rooting in, we find that such displays of wealth are displays of ultimate choice. Wealth brings optionality to every aspect of our lives in a good and desirable way. While seemingly wasteful spending is an unattractive behavior to some, it is simply an exercise in personal choice to another.

The choices we make each day generally to fall into three categories.

Things we MUST do

Things we SHOULD do

Things we WANT to do.

Sleep, spending, reading, personal fitness, working, vacationing, visiting with friends, etc. Everything fits nicely into one of these three boxes every day. Wealth has the effect of shifting more of our day into the WANT box and away from the MUST and SHOULD boxes. When we have no wealth, our WANT box is light and tends to be empty, meaning we are not doing things we want to do because we don’t have the financial freedom to do so.

Ok, so let’s get into best practices for wealth accumulation (hat tip to Scott Galloway’s fine work)

Focus

I had an interesting conversation with a remote worker this summer. He was bragging that he could surf all day and just come in every 30-40 minutes to check his phone tucked under a towel on the beach and still be credited with “working” all day. Personal opinion – remote work is not going to last much longer if this continues. Rest assured that employers know clearly who is working remotely and who is “remotely” working. When the time comes to cut the workforce, the decisions will be easy.

A person who is serious about wealth accumulation is going to work in a focused and non – distracted way for 8-10 hours a day. They will persistently grind for years especially in the time of early career development. Remember wealth brings choice but we must create lasting wealth first, right? I will address the issue of work/life balance in relation to time in a minute. Bear with me on this thread.

Following a personal talent or passion is great but be clear that we still need to focus that talent on an industry, company or market that will leverage those talents into wealth. I love to garden and have talent here, but this is not going to be a wealth accumulator for me and will remain forever in my hobby house.

Galloway says to focus on building your skills, degrees and personal certifications early in life. Get it done! I couldn’t agree more. You will not do it later I promise. Degrees matter, college matters, certifications open doors for you when employers are comparing candidates.

Finally, focus on sectors of the economy that have legitimate potential. Today, I still hear too many young people thinking they are going to make it big as an influencer on You Tube or some other nonsense. Influencers are not going to be a thing. Advertising as a business model, is already on life support and our digital media platforms (Facebook, Netflix, Disney and others) are absolutely saturated with content. But AI is going to be a thing. Technology solutions to climate change are going to be a thing. Caregivers to an aging world population are going to be a thing. Internet of Things (IOT), Biotech, Genetics, Cyber Security, Energy Transition and infrastructure engineers will all be BIG things. Career work is everywhere but not all pay well. Focus and apply your talents and interests toward relevant and growing industries that will naturally have high compensation potential. Be deliberate and thoughtful about your choices- Think about it, plan for it, execute it. My door is wide open to any young people struggling with career choices. Happy to chat any time… really any time.

Stoicism/ Discipline

I can already hear the screams of “Boomers!!!” I am factually not a Boomer as I was born in 1967 but I do share Professor Galloway’s belief in Stoicism as a standard of behavior. Personally, I would suggest that discipline is really the driving behavior we’re after, but stoicism and discipline are really twins when it comes to personal finance. Living within your means seems like a lost art as we all tend to get caught up in the war of outspending each other – whether we can afford it or not. Living within our means literally translates to spending less than you make every week and every month. The net result is savings, and those savings must be invested productively and working just as hard as you do every week and every month.

As a point of fact according to CNN in 2022, only 50.3% of Millennials are earning more than their parents on an inflation adjusted basis. This is a trend that has been steadily declining since the early 1940s when more than 90% of children earned more than their parents. But earnings are only part of wealth accumulation.

Stoicism in financial markets also takes the form of disciplined investing with a long-term strategy rather than repeatedly flaming out with a magical day trading strategy in your Robinhood account. Factually only 5% of day traders make money over any length of time.

Do you know how to make a small fortune trading options?

Start with a large one!

Today, we are constantly tempted to deviate from our plans, to chase the latest, hottest theme, reaching for a faster, bigger, better return on our capital. In the last 5 years, we have serially witnessed investment frenzies in marijuana stocks, crypto currencies, Special Purpose Acquisition Companies (SPACs), and now we find ourselves in the grips of the Artificial Intelligence (AI) frenzy. Each of these themes has sucked in a great deal of investor capital… and destroyed it. Will AI buck the trend and prove to be the game changer that everyone believes? It seems possible, even likely, but be clear that at this moment, we are witnessing another frenzy and very little money is actually made and retained once the frenzy becomes obvious.

Anecdotally, clients have recently asked why our risk managed investment strategies have lagged the markets in 2023, specifically select indices like the Nasdaq 100 or any other technology only benchmarks. They lag because we remain stoic and disciplined in our risk management methodologies and we’re proud of it. These strategies maintain an appropriate mix of asset classes including stocks, bonds and now a full-size position in commodities and internationals.

In today’s market, a stoic and disciplined investor would have only a modest, even minimal exposure, to most of the mega cap technology companies found in the Nasdaq 100 despite very recent performance. But wise investors would remember that these names are still down the most since the peak in late 2021 when we said goodbye to our last positions held in the mega cap technology trend. Risk management is a practice of allocating capital to areas of the market with the most attractive risk to reward characteristics and most of these lagged big techs in the first half of 2023. However, value-oriented investments are already coming back now in the second half of the year, and we remain quite confident that our risk managed strategies will continue to generate high risk adjusted returns for our clients especially in 2024. This is a critical time and place to avoid temptation and stick with your discipline.

Stoic and disciplined wealth accumulators also remain diversified not just with their investment portfolios but in all financial decisions. As an in-house rule of thumb, we coach our clients not to have more than 10% of their investment capital exposed to any one company or stock. If you are lucky enough to have one of those lottery type wins with a 3000% gain, do yourself a favor and work to trim that thing back to 10% over time, taking gains off the table, even it means paying some of your growing long term capital gains tax bill annually. But diversification is not just about investments. Think about your career and where you invest your savings. If you are a real estate agent and you invest only in real estate with your savings, then you are not diversified. Your income and the fate of your real estate investment results rise and fall together with real estate cycles.

Personally, I love the idea of diversifying income streams across non-related sectors of the economy, but that is pretty tough as we tend to be good at just one thing at a time. When I was 24 years old, a good neighbor invited me to participate in his new coffee shop and co-working space in downtown Longmont Colorado. He only needed another $5,000 to get it started and I happened to have saved about $5,000 at the time. I thought this was a great idea to get involved in a small business outside of my own work. We wrote up a promissory note where he would pay me 20% of profits for 5 years and then repay the $5,000 at that time. By his estimates, I would double my money in five years. Sounded great! In year two, the coffee shop closed permanently, and my neighbor sheepishly tried to pay back the note counting out small stacks of 10 and 20 dollar bills on my porch every month. A painful experience all around. He returned about $2000 in total if I remember right. At that point in my life, I did not even remotely have enough capital available to consider such a thing. Stay diversified and avoid concentrated financial bets on anything. As Scott G says, this is your personal Kevlar against the high probability of unfavorable outcomes.

Time

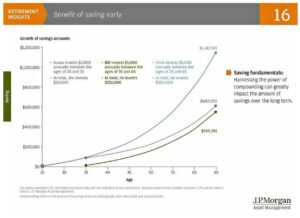

Time is a powerful wealth accumulating tool if we really understand the incredible power of compounding. I won’t beat the dead horse here but let’s all remember that starting early with our saving and investing has a far greater impact on our wealth than trying to catch up later with a higher savings rate. Consider this handy chart from JP Morgan’s Guide to Retirement.

We should all strive to be Susan who smartly saves a total of $50,000 in the first ten years of her working life and ends up with more than twice the wealth of her peers who started later and tried to catch up with higher savings amounts. Compounding works incredibly well when time is on your side.

Earlier I mentioned the issue of Work/ Life Balance. Let’s say that maintaining a work/life balance is important to us. I completely but conditionally, respect that choice for the benefits of mental health, relationships, life experiences and happiness. But there is a consequence to every decision. In most cases, those who choose a career with a healthy work/life balance often forego higher incomes in earlier career years. Having more savings and investments at an early age allows compounding to work to your advantage as the chart above illustrates. Again, no judgement but be aware that the ultimate wealth accumulation is directly a function of time. Starting to save later with less capital really just creates bigger challenges down the road when you really want to pursue some life balance (aka retirement).

Last thought on time and wealth accumulation. Dividend paying investment strategies with reinvestment of dividends to additional shares, provides an automated way to embrace compounding to its fullest. Cash dividends paid monthly or quarterly, form a drip of new investments back into additional shares of the very thing that is creating the dividends. Our shares pay dividends that become more shares that create more dividends and so forth as the great compounding machine winds up our wealth. Our MASS (Multi-Asset Income) strategy currently has an incredibly high dividend rate of 11%/ year. These dividends are reinvested in shares of securities that are also trading at a steep and discounted level thanks to the Federal Reserve smashing prices with 11 rate hikes. Think of the dividends, the reinvestment potential into discounted shares and the compounding that is happening with that dividend yield over a 20-year time frame. I apologize for the infomercial but oh my, we believe this is an exciting opportunity for wealth accumulation. We’ll be covering this and other unique opportunities in the current market environment at our upcoming annual dinner on October 4th. Please RSVP soon if you plan to attend!

Happy September to all , my favorite month of the year.

Cheers

Sam Jones