August 5, 2024

Dynamic Asset Allocation is, and has been, our investment specialty since inception. It shapes the very name of our firm, as we manage assets for “All Seasons” of the financial markets. In July, we spoke of the profound and immediate need to diversify (https://allseasonfunds.com/why-diversify/ ) as investors, in mass, are still far too concentrated in mega-cap technology and proxy index funds like the S&P 500. That proved to be timely advice as mega-cap technology is now leading the markets lower into a “surprising” correction. It’s not surprising to us in the least! Since 2022, we haven’t had reason or evidence enough to make significant changes in our dynamic asset allocation strategies. Now we do. We’re on the move, setting our new allocations for the next cycle in the economy and the stock market.

Angling Toward Recession

No doubt you have heard ad nauseam how big tech is the only game in town. More broadly, investors have been drawn into large-cap growth stocks at the expense of nearly all other asset classes for the better part of the last 4 years. Money chases performance, and to be fair, performance outside of large-cap stocks has been poor to terrible. But in the process, the collective “we” of investors has seen their portfolios migrate, by choice, into a more concentrated and bloated allocation to stocks. I believe July will mark the top of the market cycle for large-cap growth stocks, and this period is already being tagged as the “Great Rotation!” *The media loves that word, don’t they? The GREAT Financial Crisis (2008), the GREAT Resignation (2021) and now the GREAT Rotation (2024). Silly. The rotation of which they speak is not just TO one thing but TO all things outside of large-cap growth. For instance, in July, we saw a long overdue bounce in small caps, value, dividend payers, gold, and most notably, all things interest-sensitive like bonds, utilities, and real estate. We also saw the recession trades receive a great deal of buying enthusiasm, including healthcare and consumer staples – all at the expense of your favorite large-cap growth names like Amazon, Nvidia, Google, and the S&P 500. As you might have guessed from the July update, we have been moving to a more defensive and diversified orientation in our dynamic asset allocation strategies since April, and this includes rebuilding our bond and income allocations for the first time in nearly four years. What’s going on? I’m glad you asked!

High-quality bonds, including investment grade corporates and municipal bonds, are an asset class that serves as our guide for future economic growth or contractions. They say bond money is smart money, and that is true. Since the final price peak in April 2020, bonds have been pricing in very high inflation and an expanding economy. And now, four years later, in April of 2024, Bonds bottomed and began pricing in an economic contraction (aka a pending recession). Yes, that’s right ladies and gentlemen, the bond market has been telling us clearly since April that the US economy is weakening, employment conditions are softer, and inflation is back to pre-pandemic levels. From the market side, we are seeing softer absolute corporate earnings to match despite the fact that they are still marginally beating lower expectations.

This is all a nice healthy macro econ word salad, so let me break it down for you. We are heading toward a recession. Regular readers know, based on our study of lag times after rate hike cycles, that June of 2024 was the most likely month to see a top in the stock market with a recession headline in January of 2025. Markets typically peak out ~340 days after the last rate hike. The last rate hike was in July of 2023, so we’re right on target if this proves to be a meaningful peak in stocks. Consequently, it’s time to add bonds back into any diversified investment portfolio. Of course, we are already well on our way to doing so on behalf of our clients and sit now with a 25% allocation, up from 5% less than a year ago. Ultimately, we are aiming for a 30-40% allocation as the recession unfolds. At the same time, as we enter Stage 4 of the business cycle, this is also the time to reduce stock allocations. Today, we are down to 50% from a high of 75% in May and will reduce that exposure to nearly 40% in the end. The remainder of our available funds (15-20%) stick to our alternative allocations in low volatility and low correlation securities, including specialty funds, like the Permanent Fund (PRPFX), Berkshire Hathaway (BRKB), and Gold (GLD). We are on the move, making appropriate and timely changes to keep our clients’ assets invested in the asset classes and securities that offer the best risk-adjusted returns. This is what we do in our dynamic asset allocation strategies and one of our unique value propositions as a wealth management firm.

The Fed is Late (Again)

This Federal Reserve tends to be directionally right but woefully late in their changes to monetary policy. Consider this: The Fed did not raise interest rates until March of 2022 after finally capitulating to the idea that inflation was not transitory at all. Inflation had already been ripping higher for a full year. By June of 2022, only 2 months later, inflation actually peaked at 9.1% on CPI. THEN, they proceeded to raise rates 11 times to 5.50% into September of 2023, even as inflation was falling dramatically. Amazing. Now, they sit while the rest of the central banks in the world are already dropping rates sequentially to help support their own flagging economies. But not here, not in the US. We’re going to wait until it’s too late (again). For reference, inflation today is at the same level as in June of 2018. The Federal Fund interest rate then was 2.25%. Today, we are at 5.50%. Late! Tardy! Again! What’s the point? The point is that the Federal Reserve is now going to have to cut rates more aggressively in a short period of time to get back in sync with current inflation as well as the real recessionary pressure that rolls in with every report (manufacturing, unemployment, retail sales, you name it).

Again, this is one more reason to rebuild your bond allocations now before the next September meeting. I am already hearing that the bond market has already priced in a rate cut. Bunk. The bond market is just now responding to a pending recession with 225 interest rates points of runway. Intermediate term bonds can move up 30-40% in price if rates were to fall that much.

The other point is that this Federal Reserve is adding volatility to your life, your mortgage options, the real estate market, and your investment portfolio. I can only hope that Powell will be replaced by the next administration. He should not be replaced on the basis of a recession; after all, these are regular and necessary events. But talk about unforced errors! The bond market clearly thinks we’re going to be in recession rather soon; Powell says we will have a soft landing. I’ll stick with the bond market prediction, thank you very much. Remember, an economic recession is just another market condition, not the end of the world. Quite the opposite. The recession brings new and outsized opportunities for stocks, new company creation, and some long-overdue changes in market leadership.

Cash Considerations

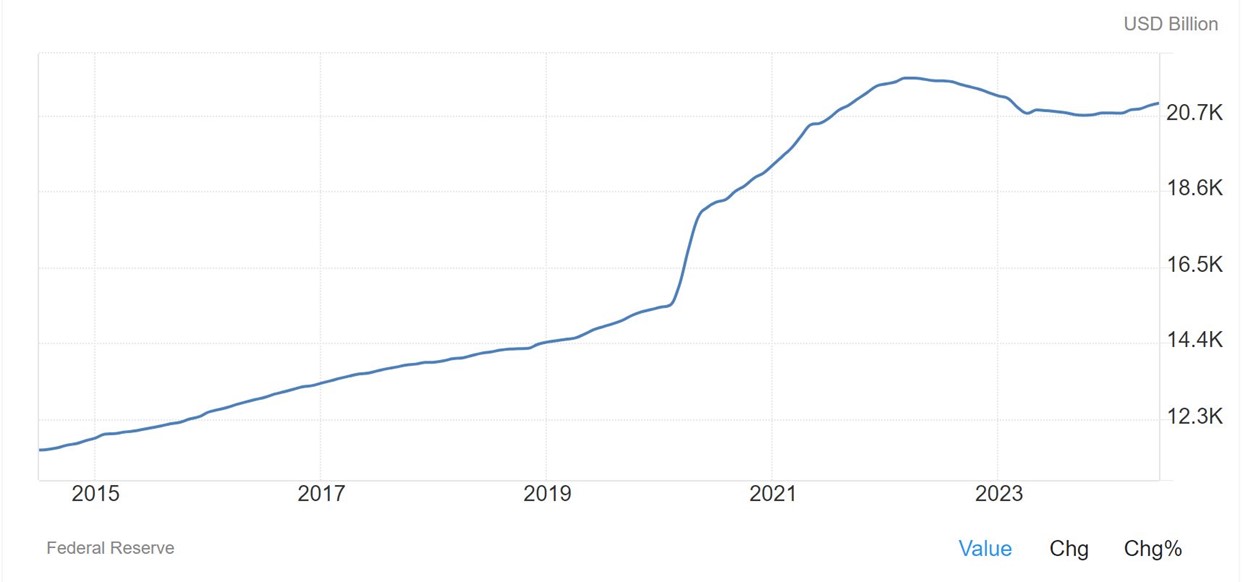

I’ve had a lot of discussions with clients about their cash holdings in the last several weeks. This is a great time to consider your options. Today, there is a lot of cash, deposits, and CDs, as measured by M2. Here’s a chart. You can see the jump of $7 trillion during the Covid years, which has yet to be absorbed (or lost or inflated away). Yes, that number is in Billions, so we’re talking about $20 Trillion in cash-earning interest largely paid by the US Government.

This is a tremendous amount of cash in aggregate, but you have to understand that this pile is not equally distributed. As of June, $4.11 Trillion of the total was held by corporations alone. The rest is spread across money market funds, bank deposits, CDs and actual cash held by 100’s of millions of individuals, small businesses and non-profits.

Here are some important ramifications.

The interest earned on your cash is going to begin to drop in September. How fast? As fast as the Fed drops rates for all but fixed rate instruments like CDs. I suspect, they may drop rates as much as .50% in September with one or two more rate drops in 2024. Trust me they are highly motivated if you consider the next chart.

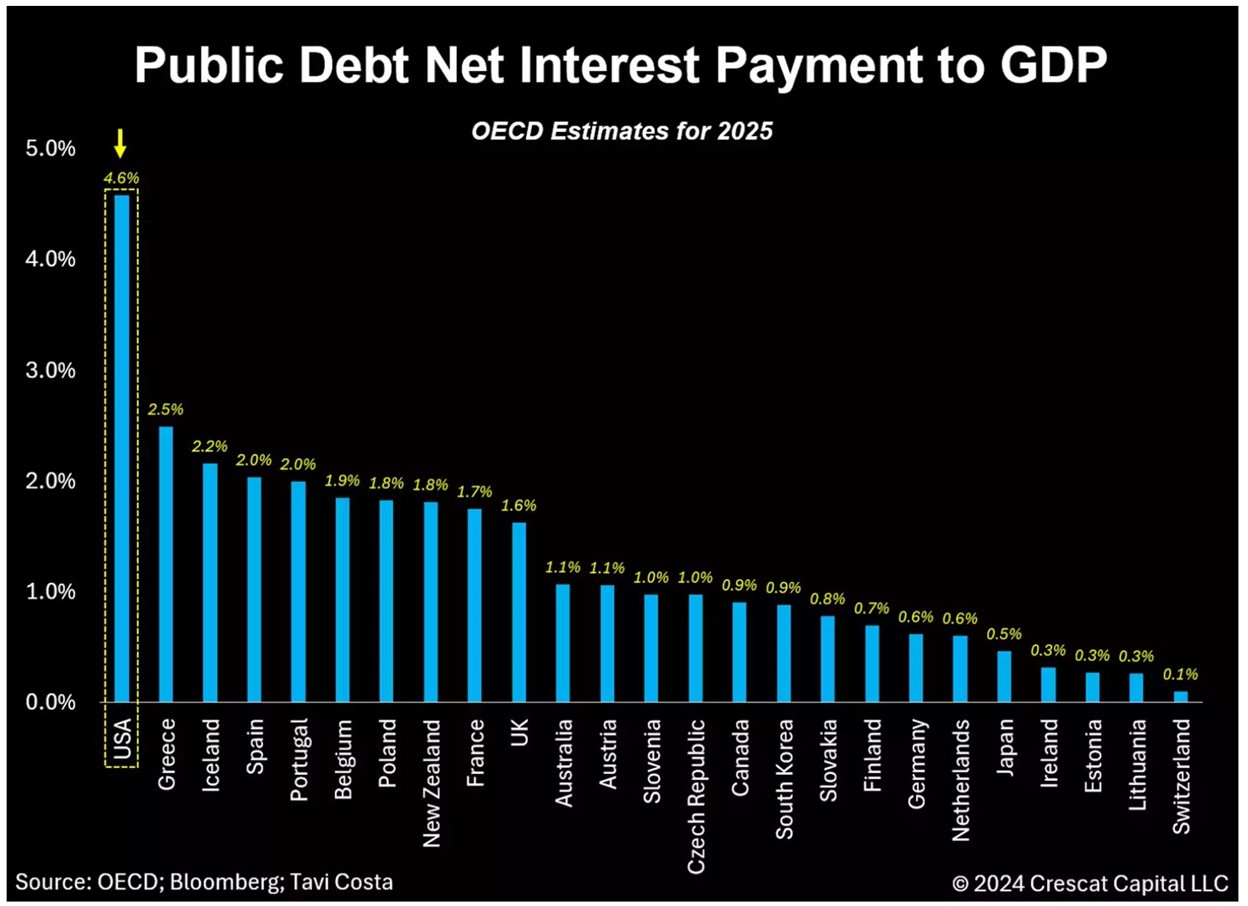

The US has the largest public debt net interest payment as a percentage of GDP in the World. A Dubious honor and one that will drive the US dollar lower until this is resolved (Take Note!). A falling US dollar provides a strong tailwind for Gold, foreign currencies and international investments. Perhaps these should be on your shopping list for your cash?

There is nothing wrong with keeping your cash in something earning 5% or even less, especially if the economy is slipping into recession. But, if trends continue, you will get a much better bang for your buck in any of these interest-sensitive sectors of the financial markets. These include:

Real Estate funds and REITS

Mortgage-backed securities

Intermediate-term Treasury Bonds

International sovereign Bonds

Investment Grade Corporate Bonds

Utilities

Dividend-paying stocks

Today, all of the above are paying interest and dividend rates that are competitive with cash but now offer real price appreciation as well. Your basic Core US Aggregate Bond ETF (AGG) is now earning an annualize rate of total return (interest plus price gains) of 22% since April. The new bull market in bonds has just begun. Cash can be used to buy into the interest sensitive sectors now.

Cash can also pay down high-interest loans and mortgages, specifically those loans with rates higher than 5%! I’m always a little shocked to see people sit with oversized cash in the bank earning 5% while carrying a credit card balance that accrues interest at 25%, a mortgage at 7%, a car loan at 8%, or student loans at 7%. What a great time to pay down some high-interest debt if it makes sense.

Cash can buy stocks as well, but I would be very slow and methodical with this plan. Volatility has been sharply on the rise since mid-July, and with elections pending in November, I wouldn’t be in a hurry. At the same time, there are deeply discounted opportunities right now in select stocks. You might revisit our 40% Off Rack Part I and Part II discussions for some ideas. Again, the best deals are not in tech or semiconductors (yet) but in stocks currently trading at 12-year lows, paying huge dividends, many of which operate outside the US. We’re here to help and have investment strategies that focus purely on value, multi-asset Income, and risk-managed solutions. Please call us if you need help.

I’ll leave it there for this month. There are very suddenly a lot of new opportunities, risks, and reasons to make changes to your investments. We’re doing so for our clients, so rest easy and know that you are in good hands.

Things I’m grateful for in August:

Water– phew hot!

Summer Olympics – including surfing, women’s soccer, and handball

Kris, John, Matthew, and our awesome team of wealth partners Kristi, Dan, Dustin, and Scott

Quality time with my two boys’ home from college

Sarah, my wife of 31 years who is simply amazing always, a willing adventurer, family cheerleader, and my best friend.

Cheers

Sam Jones